Bear Trap 101: What Is Bear Trap and How to Avoid Them

A bear trap is a common pitfall in financial trading, often ensnaring even experienced traders who fall victim to false market signals. Bear trap stock trading happens when short sellers anticipate a market decline, only for the market to reverse unexpectedly, driving prices up and catching them off guard. This scenario plays out frequently in volatile markets, leading to significant losses for those expecting a prolonged downturn.

At Spartan Trading, we focus on helping traders navigate the complexities of stock and option markets. We know how crucial it is to avoid stock market traps, especially when short sellers risk a sharp reversal. Our platform delivers actionable ideas and insights, keeping traders informed and prepared for market shifts. We’re committed to empowering our community with the knowledge to succeed, even when the market seems stacked against them.

Building on proven strategies, we’ve compiled this guide that explores what a bear trap is, how to identify it, and the best strategies for avoiding it. At the end of this blog, you will be better equipped to navigate bear markets, spot potential reversals, and protect your investments from the risks that trap many traders.

Let’s get started!

What is a Bear Trap?

A bear trap is a deceptive pattern in financial markets that lures traders into believing that a market is turning bearish, only for prices to reverse and rise. This false signal tricks traders into short-selling or selling assets, resulting in losses when the market rebounds unexpectedly.

A bear trap typically unfolds through the following:

- False Breakout: The market experiences a brief drop below a support level, convincing traders that it is headed downwards.

- Low Volume: The decline appears during low trading volume, making the downward move seem less credible.

- Quick Reversal: Prices rapidly reverse direction, catching traders off guard and leading to losses.

- Market Sentiment: It leverages negative market sentiment, pushing traders to make hasty decisions based on false signals.

- Technical Indicators: Misleading technical signals contribute to deceptive patterns, adding confusion.

A bear trap can devastate traders who misinterpret market signals. Understanding how it works and recognizing the signs can protect traders from significant losses. Technical analysis and awareness of market sentiment can help avoid these deceptive market moves.

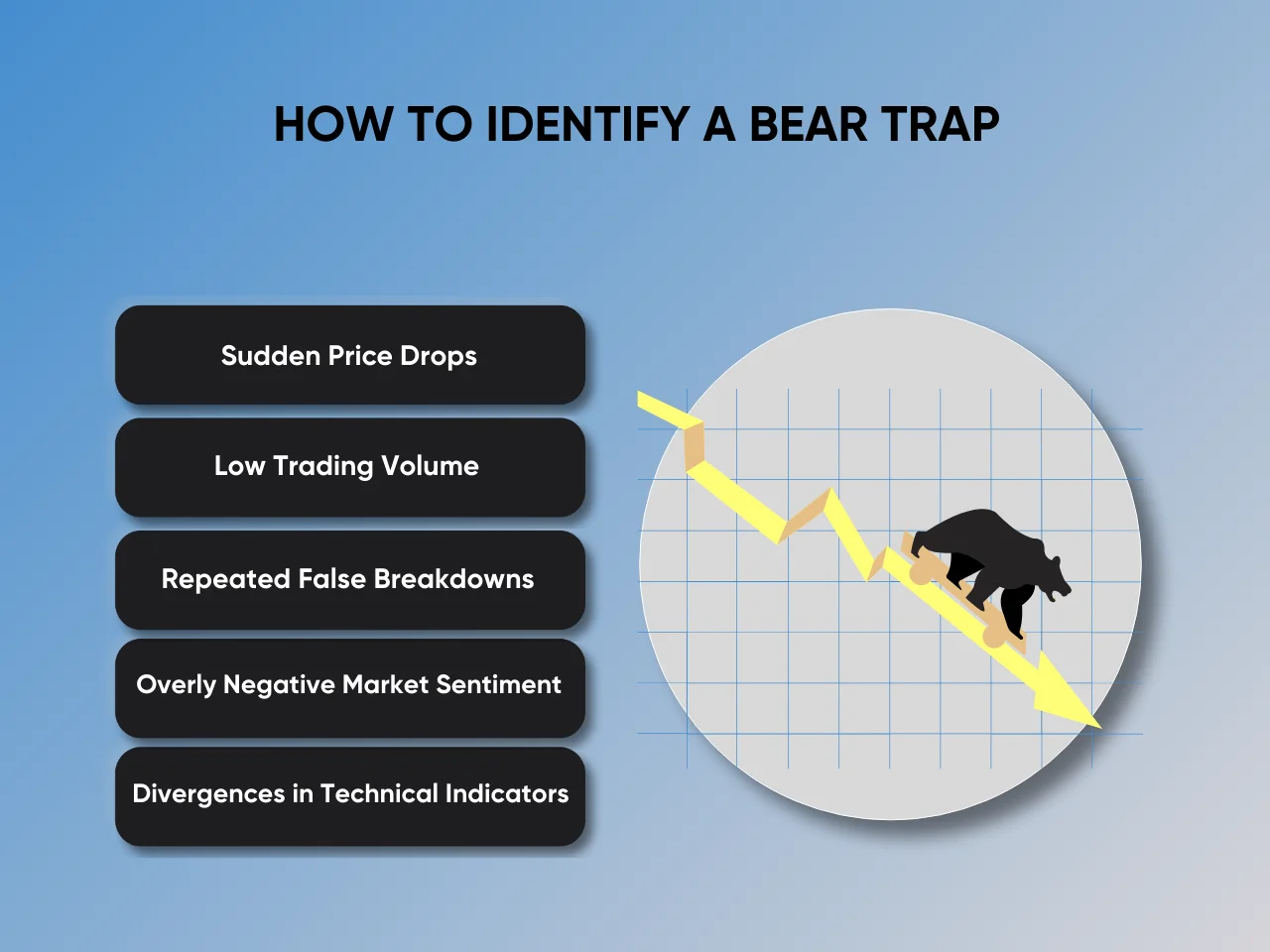

How to Identify a Bear Trap

Recognizing a bear trap can help traders avoid significant financial losses and this common pitfall. Watch out for these five key indicators for assessing potential false sell signals:

1. Sudden Price Drops

A sharp decline in price often signals a bear trap, especially if it occurs without strong confirmation. Traders who act quickly on these sudden drops risk getting caught when the market rebounds. Instead, patience and further analysis are needed to confirm whether the decline is genuine or a trap.

2. Low Trading Volume

A significant price drop occurring during low trading volume should raise red flags. Genuine downtrends typically come with high trading volume as investors rush to sell. In contrast, it usually occurs in a low-volume environment where the selling pressure lacks conviction. This low volume indicates that the market might not fully support the price drop, increasing the likelihood of a reversal.

3. Repeated False Breakdowns

When an asset’s price repeatedly breaks below key support levels but fails to sustain these lows, it may signal a bear trap. These false signals can lure traders into short positions, only for the price to recover and rise again. Identifying this pattern of false breakdowns helps traders avoid falling into the trap.

4. Overly Negative Market Sentiment

When market participants become excessively bearish, they may overreact to negative news or trends, leading to panic selling. This collective negativity can create the illusion of a continuing downtrend, but it often marks the bottom of the market, with a rebound likely to follow. Recognizing the impact of market sentiment is key to avoiding it.

5. Divergences in Technical Indicators

Divergences between price movements and technical indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can signal a bear trap. For instance, if prices decline while momentum indicators suggest bullish strength, a reversal may be imminent. Monitoring technical indicators for such divergences can help traders avoid it.

Strategies to Avoid Bear Traps

Bear traps are deceptive and can lead to significant losses for traders. Understanding how to avoid them is crucial for protecting investments and maintaining a successful trading strategy. Implement these five effective strategies:

1. Conduct Thorough Market Research

Market research is essential for avoiding a bear trap. Traders should always gather and analyze relevant market data before making any decisions. Understanding market trends, economic indicators, and company performance helps identify genuine market movements from false signals that often lead to market deception. Staying informed on news and events that can influence the market also provides valuable context that helps traders make better decisions.

2. Use Technical Analysis Tools

Technical analysis tools offer insights into market behavior and help spot potential market reversal. Tools such as cup and handle, moving averages, trend lines, and candlestick patterns visually represent market trends and signals. Traders should focus on indicators like relative strength index (RSI) and moving average convergence divergence (MACD) to gauge market momentum and identify possible reversals that could indicate a bullish reversal. Incorporating these tools into regular analysis reduces the chances of falling into false technical indications.

3. Implement Stop-Loss Orders

Setting a stop-loss order at a predetermined price level automatically triggers the sale of a security if the market moves against the trader. This strategy limits potential losses and prevents emotional decision-making during market volatility. Traders should set their stop-loss levels based on risk tolerance and market conditions to effectively minimize exposure to false sell signals.

4. Diversify Investments

Diversification is a powerful strategy for reducing the risk associated with market reversal. By spreading investments across different asset classes, sectors, and geographical regions, traders reduce the impact of any single market movement. Diversification ensures that if one part of the portfolio is caught in a bear trap, the overall impact on the trader’s wealth is minimized. This approach also provides exposure to various market opportunities, enhancing the potential for gains.

5. Stay Calm and Avoid Herd Mentality

Traders should avoid making decisions based on fear, greed, or the actions of others. Herd mentality often leads traders into this stock market trap, as they follow the crowd without fully understanding the market conditions. Staying calm, sticking to a well-thought-out trading plan, and resisting the urge to follow the majority help avoid the pitfalls of market deception. Traders should trust their analysis and strategies, even when market sentiment appears overwhelming.

What to Do If You Fall into a Bear Trap

Falling into a bear trap can be stressful, but there are ways to manage the situation and minimize losses. Taking quick and strategic actions will help you navigate through this financial pitfall.

Step 1: Assess the Situation

Falling into a bear trap can be unsettling, but staying calm is crucial. Assess the situation quickly to understand what triggered it. Analyze the market conditions and review your trades to identify mistakes or external factors that led to the trap.

Implement these key steps to assess the situation effectively:

- Review Market Trends: Look at current market trends to see if external factors influenced the bear trap.

- Analyze Your Trades: Check your trade entries and exits to pinpoint where things went wrong.

- Evaluate Market Sentiment: Understand how market sentiment shifted, leading to false signals.

Assessing the situation thoroughly lets you make informed decisions and plan your next moves. This initial assessment sets the foundation for effectively managing the stock market trap and preventing future occurrences.

Step 2: Limit Your Losses

Once you have assessed the situation, the next step is to limit your losses. If you haven’t already, implement stop-loss orders immediately. Stop-loss orders automatically sell your position at a predetermined price, preventing further losses. Another strategy is to reevaluate your positions. Consider closing out losing trades to prevent further financial damage. Remember, accepting a small loss now is better than risking a later one.

Step 3: Develop a Recovery Plan

After addressing immediate losses, focus on developing a solid recovery plan. You must quickly regroup and focus on strategies to bounce back. Reviewing what went wrong, adapting your trading tactics, and staying vigilant against future stock market traps will strengthen your position.

Developing an effective recovery plan includes the following steps:

- Reassess Your Trading Strategy: Analyze your previous approach and identify flaws. Adjust your strategy to recognize the stock market traps.

- Diversify Your Portfolio: Spreading investments across different assets reduces the risk of falling into another bear trap. Diversification provides a safety net during volatile market conditions.

- Use Advanced Tools: Incorporate advanced trading tools with real-time alerts and data analysis. These tools help detect false technical indications early, giving you an edge.

Staying informed and proactive ensures you’re better prepared for future challenges. Every experience adds to your trading wisdom, helping you become more resilient and savvy. With the right recovery plan, you can turn setbacks into valuable lessons and continue to grow in your trading journey.

Advanced Tools and Software for Detecting a Bear Trap

Advanced software and trading platforms offer powerful features that help traders identify potential market deception and make informed decisions. Take note of some of the most effective tools and software for detecting a bear trap:

1. Finviz – Best for Comprehensive Screening and Market Visualization

Finviz is a leading tool for traders looking to avoid a bear trap in the market. Known for its user-friendly interface and extensive screening capabilities, Finviz helps traders quickly identify potential risks and opportunities. Finviz’s detailed filters and real-time data allow traders to make informed decisions to protect their investments.

Using Finviz, traders can customize their screens to target specific indicators. Whether you’re focusing on price movements, volume changes, or technical patterns, Finviz provides the tools needed to stay ahead of market fluctuations. This level of customization ensures that you catch early warning signs and avoid costly mistakes.

Notable Features of Using Finviz

- Heatmaps: Visualize market sectors to identify potential false technical indications across different industries.

- Real-time Data: Access up-to-the-minute information to avoid false technical indications during volatile trading sessions.

- Technical Filters: Apply specific technical indicators like moving averages and candlestick patterns to detect short squeezes.

- Alerts: Set custom alerts to notify you of potential market deception based on your criteria.

Finviz’s powerful visualization tools and comprehensive screening options allow users to identify potential reversal traps before they occur. This proactive approach makes Finviz an essential tool for any trader focused on risk management and market analysis.

2. TradingView – Best for Comprehensive Analysis

TradingView is known for its advanced charting capabilities and various technical indicators. TradingView helps traders analyze market trends and spot a potential bear trap early. This platform integrates real-time data and social networking features, enhancing the trader’s ability to make informed decisions.

TradingView can leverage detailed charts and custom scripts to identify false sell signals. The platform supports various asset classes, including stocks, forex, and cryptocurrencies. This versatility allows traders to apply consistent analysis techniques across different markets.

Notable Features of Using TradingView

- Advanced Charting: Offers extensive charting tools with numerous indicators to detect market anomalies.

- Real-time Data: Provides real-time market data essential for timely decision-making.

- Custom Scripts: Allows creation and use of custom indicators through Pine Script for tailored analysis.

- Community Insights: Access to a community of traders sharing ideas and strategies for spotting bullish reversal.

TradingView’s comprehensive analysis tools, real-time data, and community-driven insights make it a valuable platform for staying ahead of market fluctuations and avoiding costly mistakes. For traders seeking a reliable tool to navigate the complexities of the market, TradingView is one of the top choices.

3. Barchart – Best for Integrated Screening and Charting

Barchart provides a comprehensive platform combining advanced charting with powerful stock screening. Traders benefit from its intuitive interface, which integrates real-time data and customizable alerts. This dual functionality helps identify potential stock market traps, making Barchart an essential tool for proactive market analysis.

Traders can seamlessly switch between screening and charting to spot early signs of a reversal trap using Barchart. The platform’s detailed fundamental and technical analysis features enable traders to set specific criteria to catch potential pitfalls. This integrated approach streamlines the detection process, reducing the risk of being caught in a bear trap.

Notable Features of Using Barchart

- Real-Time Data: Access up-to-date market information to make timely decisions.

- Custom Alerts: Set personalized alerts for market movements that could indicate a market reversal.

- Comprehensive Screeners: Utilize advanced filters for both technical and fundamental analysis.

- Interactive Charts: Analyze stock performance with detailed, customizable charting tools.

Barchart’s advanced screening, real-time data, and customizable alerts make it a reliable platform for staying ahead of market trends. For traders seeking to protect their investments from sudden downturns, Barchart offers the tools needed to navigate the complexities of the financial markets.

Key Takeaway

Avoiding the bear trap in stock trading requires vigilance, discipline, and knowledge. Traders who understand the signals and patterns can avoid significant losses. Keeping a trading journal helps document experiences and decisions, making it easier to recognize similar scenarios in the future. Consistency in learning and adapting remains key to staying ahead.

Risk management strategies are crucial when navigating volatile markets and unpredictable market movements. Traders must remain prepared to duke out challenging situations by using stop-loss orders, diversifying portfolios, and staying informed. Combined with the right software tools, these strategies can prevent traders from getting caught in false signals or deceptive market patterns.Have you ever been caught in a bear trap in August? At Spartan Trading, we will guide you through the complexities of the market. Join our live stock trading chat room and gain confidence and insights from experienced traders. Let us help you stay ahead of the curve and protect your investments from the risks of bear traps.