Trading for Beginners: Start with Confidence and Success

The stock market offers vast opportunities for financial growth, making it an attractive option for many. However, trading for beginners presents unique challenges. While the profit potential is immense, the path to success often requires intense focus and a deep understanding of trading strategies. New traders must navigate market volatility, risk management, and technical analysis to achieve their goals in financial markets.

At Spartan Trading, we provide an online service for stock and option idea generation. We focus on technical indicators and real-time data to enhance success rates in active trading. Our insights help traders manage transaction costs, optimize buying power, and understand a stock’s price movements. Our team focuses on equipping you with the knowledge to handle real money, transaction costs, and psychological pressure.

Building on proven trading strategies, we’ve put together this guide on trading for beginners. You’ll learn the different types of trading and strategies for successful trading. At the end of this blog, you will feel more prepared to embark on your stock trading journey, armed with strategies to increase your success rate.

Let’s get started!

What Is Trading? An Overview for Beginners

Trading is a process where individuals buy and sell financial instruments like stocks, bonds, or commodities to make a profit. Unlike long-term investment strategies, trading focuses on short-term gains and often involves quick decisions within a trading account. For those new to trading, understanding the basics, such as using a trading platform and selecting a brokerage firm, is crucial.

Different Types of Trading for Beginners

For beginners, there are several trading styles to explore, each with its own unique characteristics and challenges:

- Day Trading: It involves making multiple trades within a single day, focusing on real-time price movements. Day trading strategies rely on tools like the relative strength index and momentum trading to capitalize on intraday trading opportunities. Successful day traders must manage their margin accounts carefully, as day trading requires a minimum balance due to the pattern day trader rule.

- Swing Trading: Unlike day trading, swing trading aims to capture price swings in the market and involves holding positions for several days or weeks. While less intense than day trading, swing trading requires careful stock price analysis and investment strategies.

- Position Trading: Position trading involves holding trades for long-term gains, often ignoring short-term market fluctuations and focusing on the broader price of the stock over time.

- Algorithmic (or Automated) Trading: Algorithmic trading uses software to execute trades based on pre-set conditions. This method appeals to professional day traders and those looking to automate their day trade strategies.

- Scalping: Scalping targets small profits from numerous trades throughout the day. Scalpers operate quickly, reacting to changes in stock price and making swift decisions on market orders and limit orders.

Trading for beginners involves understanding these various methods and selecting the one that aligns with their financial goals. The only way to gain confidence before committing real money is to start with a well-structured trading plan and practice with paper trading.

Trading Tools and Resources Every Beginner Must Know

Trading for beginners involves learning and adapting. Tools like a trading journal, technical analysis platforms, and economic calendars provide the structure needed for growth. Each tool plays a role in shaping a successful trading strategy. Start with these essentials to build a solid foundation in your trading journey.

1. Trading Journal

A trading journal is a must-have tool for traders. It lets them track every trade, noting strategies, emotions, and outcomes. For trading for beginners, maintaining a journal helps identify patterns, avoid repeating mistakes, and refine strategies. Successful traders often credit their trading journal as a key factor in their growth. Start logging every trade to build better habits and improve decision-making.

2. Trading Platforms

Choosing the right trading platform is crucial. Trading for beginners often involves exploring various platforms to find the best fit. Platforms like TradingView stock heatmap offer excellent tools for visualizing market data. These platforms provide real-time charts, indicators, and a FinViz screener to filter stocks based on specific criteria. A good platform should be user-friendly, especially for beginners, ensuring a smooth trading experience.

3. Technical Analysis Tools

Understanding technical analysis is essential in trading for beginners. Tools that provide insights into market trends and patterns can guide trading decisions. The spinning top candlestick and cup and handle pattern are common indicators of potential market reversals and continuations. These tools allow traders to interpret market data and make informed trades. Incorporating technical analysis into your trading routine increases the chances of success.

4. Risk Management Tools

Risk management is vital in trading, especially for beginners. Tools designed to manage risk can prevent significant losses. A reliable trading journal often includes sections dedicated to risk management strategies. Platforms like Barchart compare stocks and allow traders to evaluate and diversify portfolios, minimizing risk. Proper risk management ensures longevity in trading and protects investments, making it an essential focus for new traders.

5. Economic Calendars

Economic events impact market movements. An economic calendar lists essential dates like 2024 stock market holidays, earnings releases, and economic indicators. For beginner traders, keeping track of these events is crucial. It helps traders anticipate market volatility and make timely decisions. Understanding the broader economic landscape aids in predicting market behavior, making economic calendars an invaluable resource.

Strategic Guide to Getting Started in Trading for Beginners

Starting your journey in trading for beginners requires careful planning and a strategic approach. Equipping yourself with the knowledge and tools needed for confidence ensures successful trading. Here are the steps to help you build a strong foundation, make informed decisions, and develop a confident, disciplined trading approach.

Step 1: Set Clear Goals and Define Your Trading Style

Every successful trading journey begins with setting clear goals. Your goals determine your approach, whether you aim for quick gains through day trading or prefer long-term investments. Understanding your goal helps create a focused and disciplined trading plan. This clarity guides your decisions and keeps you motivated and aligned with your financial objectives.

Consider these key questions for this step:

- What are your financial goals? Define whether you want to generate income, grow your capital, or save for a specific purpose.

- What is your risk tolerance? Assessing how much risk you are willing to take influences your trades and investments.

- How much time can you dedicate to trading? Determine whether you can actively monitor the markets daily or prefer a less time-intensive approach.

- What is your trading style preference? Choose between day, swing, or position trading based on your goals and risk tolerance.

- What is your experience level? Be honest about your trading knowledge to select a style that matches your skills and learning curve.

Defining your goals and trading style sets the foundation for success in trading for beginners. Clear goals guide your trading journey, keeping you focused and disciplined. Understanding your trading style ensures you adopt strategies that align with your objectives, leading to more informed and confident decisions in the market.

Step 2: Choose the Right Broker and Trading Platform

Selecting the right broker and trading platform is a crucial step in trading for beginners. The broker you choose can significantly impact your trading experience. Look for a broker that offers competitive fees, strong customer support, and a wide range of tools tailored to beginners. A good broker will provide educational resources and easy access to market data, helping you make informed decisions from the start.

The trading platform itself plays a vital role in your success. Beginners need a platform that is intuitive and user-friendly. The right platform should offer essential features like real-time charts, indicators, and customizable layouts. It should also integrate seamlessly with your trading strategy. For those new to trading, a platform with a demo account option allows for practice without financial risk, building confidence before transitioning to live trading.

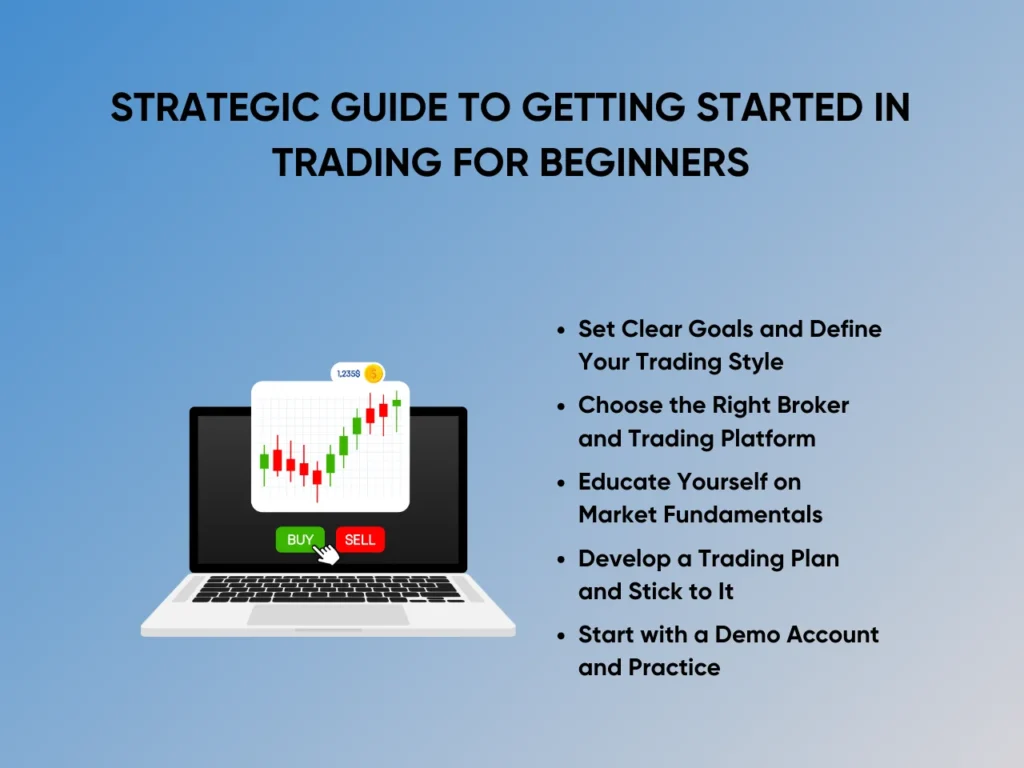

Step 3: Educate Yourself on Market Fundamentals

Beginners often need a solid grasp of markets, which can lead to costly mistakes. A deep understanding of market principles helps you make informed decisions and reduces the likelihood of impulsive trades. Knowledge empowers you to navigate market fluctuations confidently and strategically.

Focus on these key areas:

- Asset Classes: Learn about different asset classes, including stocks, bonds, commodities, and currencies, to understand where your trades will occur.

- Market Indicators: Familiarize yourself with indicators like GDP, inflation rates, and employment data, which impact market movements.

- Technical Analysis: Study chart patterns, trends, and technical indicators that help predict future market behavior.

- Fundamental Analysis: Understand how to assess a company’s financial health through earnings reports, balance sheets, and other financial statements.

- Economic Factors: Stay updated on global economic events that influence market conditions, such as central bank policies and geopolitical developments.

A well-rounded education in these areas forms the backbone of successful trading. The more you learn, the better equipped you become to anticipate market changes, manage risks, and confidently achieve your trading goals.

Step 4: Develop a Trading Plan and Stick to It

Creating a trading plan serves as a roadmap for beginners. The plan should outline your financial goals, risk tolerance, and strategies for entering and exiting trades. This structured approach helps maintain focus and discipline, preventing impulsive decisions from derailing progress.

Following your trading plan consistently builds confidence and promotes long-term success. Adjustments can be made based on performance, but sticking to the core principles of your plan is crucial. Discipline in following your plan helps you stay aligned with your goals and ensures steady growth in your trading journey.

Step 5: Start with a Demo Account and Practice

Beginning with a demo account allows beginners to experience trading without the risk of losing real money. This step is crucial in trading for beginners because it provides a safe environment to test strategies, understand market dynamics, and get comfortable with the trading platform. Practicing with a demo account helps refine your techniques and build confidence before transitioning to live trading.

Consistency in practice reinforces your skills and prepares you for the challenges of the real market. Treat the demo account seriously, as if you were trading real money. This mindset will better prepare you for actual trading situations and ensure a smooth and successful transition to live trading.

Common Trading Mistakes Beginners Should Avoid

Trading offers incredible opportunities, but beginners often need help with common pitfalls that can hinder progress. Understanding these mistakes helps traders start on the right foot. Knowing what to avoid is just as crucial as learning the right strategies. Here are five common mistakes beginners make when trading.

1. Overtrading

The thrill of quick profits leads beginners to overtrade by placing an excessive number of trades within a short period. This impulsive behavior often results in losses rather than gains. Successful trading requires patience and discipline. Instead of seizing every opportunity, beginners should prioritize quality trades. Overtrading can quickly deplete an account and demoralize new traders.

2. Ignore Risk Management

Many beginners underestimate the importance of risk management, presuming they can address risks later. This approach leads to significant losses. Every trade should include a risk management strategy, such as setting stop-loss orders and determining the proper position sizes. Ignoring risk management in trading for beginners can lead to substantial financial setbacks.

3. Chasing Losses

The urge to recover losses immediately often drives beginners to make impulsive trades. This mistake, known as chasing losses, usually results in further losses. Traders should stick to their plan instead of trying to win back money quickly. Chasing losses often leads to irrational decisions and increased risks. Maintaining discipline and following a well-thought-out strategy in trading for beginners proves far more effective than making emotional trades.

4. Lack of a Trading Plan

A well-defined trading plan serves as a roadmap for success. Many beginners start trading without a clear plan, which leads to inconsistent results. A trading plan should include specific goals, strategies, and risk management rules. This plan provides structure and prevents emotional decision-making. Without a plan, beginners often make haphazard trades that do not align with their financial goals. For beginners trading, having a plan is essential for long-term success.

5. Neglect Education and Research

The desire to start trading quickly often causes beginners to skip necessary education and research. This mistake leaves traders unprepared for the complexities of the market. Continuous learning and staying informed about market trends are crucial in trading for beginners. Relying solely on intuition or external tips often results in poor trading decisions. Beginners should prioritize learning about market analysis, trading strategies, and available tools. Education serves as the foundation for successful trading.

Key Takeaway

Preparation, education, and strategy form the backbone of trading for beginners. Beginners often need to pay more attention to the value of thorough preparation, but success in trading requires a solid foundation. Educating oneself on market trends, trading tools, and different strategies can dramatically increase the chances of making informed decisions. A well-thought-out strategy helps navigate the complexities of the trading world and ensures a disciplined approach to each trade.

Building confidence in trading for beginners requires continuous learning and practice. Every trade, win or loss, offers valuable lessons that contribute to growth. Practicing regularly hones skills and helps traders understand market behaviors better, leading to more confident and successful trading decisions over time.

Ready to start your journey in trading for beginners? At Spartan Trading, we guide beginners every step of the way. Our experts provide the knowledge and tools you need to succeed. Subscribe to our newsletter to stay updated on the latest trends, strategies, and tips tailored for beginners. Let us help you turn your trading aspirations into reality.