What is a Liquidity Sweep? Identifiers and Next Steps

For educational and information purposes only; not investment advice. Any Spartan Trading Service offered is for educational and informational purposes only and should not be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice.

Understanding the role of a liquidity sweep in the financial market reveals much about the complexity of Forex trading and the need for advanced strategies. It can dramatically affect market dynamics by quickly executing large orders seeking the best price across different liquidity pools. This technique helps maintain stable prices even during significant price fluctuations, underscoring its importance in risk management and market stability.

At Spartan Trading, we specialize in providing an online stock and option idea generation service that harnesses the power of liquidity sweeps to optimize trading strategies. We use technical analysis, economic indicators, and advanced algorithms for our trading decisions, letting our clients and community members leverage high liquidity for the best execution price.

Based on our experience and insights, we’ve thoroughly explored how liquidity sweep functions within the forex market and their impact on market conditions. Our blog delves into benefits, practical execution tips, and ways to identify its occurrence. By the end, you’ll better understand how they contribute to diversifying trading strategies and minimizing volatility-related risks.

Let’s get started!

What is a Liquidity Sweep?

A liquidity sweep is a strategic trading action that clears out available liquidity at certain price levels. Traders execute this to minimize slippage, capitalize on favorable prices, and enhance transaction efficiency. This method proves essential in fast-paced markets, optimizing entry and exit points during volatile conditions.

Traders often use it to quickly execute large orders without significantly impacting the market price. This technique involves identifying liquidity pools where large orders accumulate and strategically placing orders to ‘sweep’ through these pools. This allows traders to secure large volumes of assets at predictable prices, providing a crucial advantage in dynamic trading environments.

In this video, we explore what a liquidity sweep is and how you can effectively use this strategy to enhance your trading performance.

How To Perform Liquidity Sweep in Forex

Performing a liquidity sweep in foreign exchange (ForEx) involves optimizing trading strategies to execute large orders efficiently without significantly impacting market prices. Here’s a five-step guide:

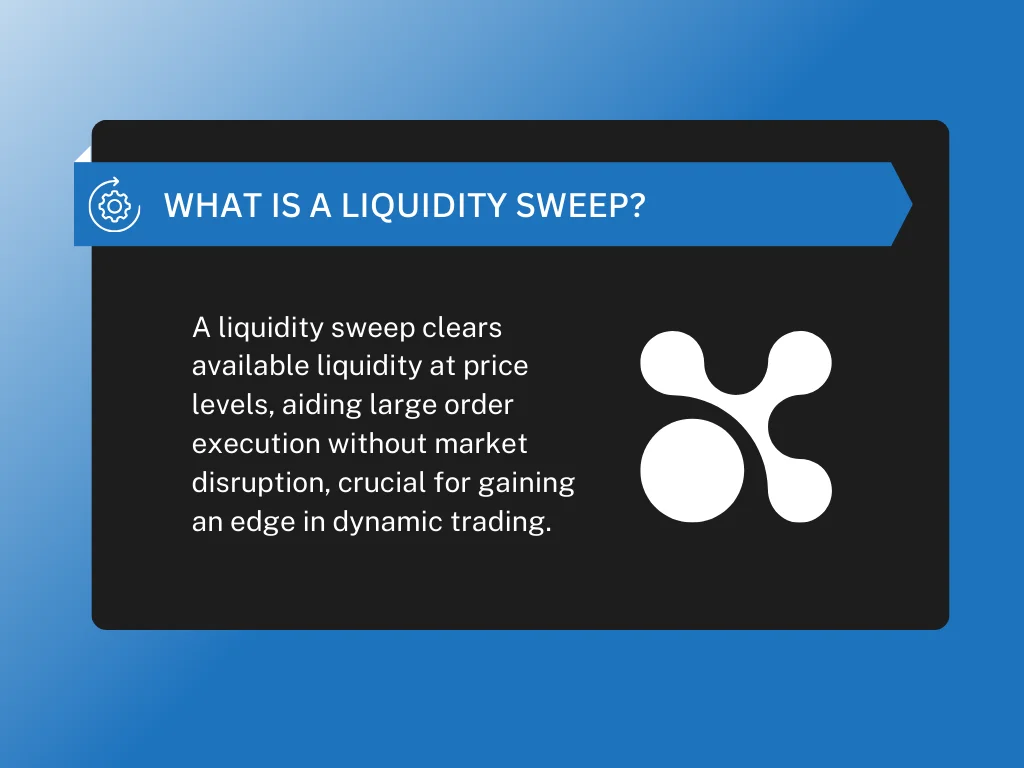

Step 1: Find the Right Trading Partner

Performing a successful liquidity sweep in Forex starts with choosing the right trading partner. This partner is crucial in enabling the efficient execution of large-volume trades. Here’s how to ensure you choose the best trading partner:

- Assess Broker Reliability: Ensure the broker has a robust platform to handle high-frequency trading and substantial trade volumes without system lags or failures.

- Evaluate Market Access: Select a broker that offers direct market access (DMA). This feature is essential as it allows you to trade directly with liquidity providers, bypassing intermediaries.

- Check for Competitive Fees: Consider the transaction costs associated with trading. Competitive fees can significantly affect net profitability, especially when executing large orders.

- Review Execution Speed: Speed is critical in a liquidity sweep. Your broker should provide fast execution to capitalize on market conditions that make liquidity sweeps profitable.

- Verify Regulatory Compliance: Work with a broker that adheres to regulatory standards. This compliance protects your transactions and ensures fair trading practices.

Following these steps in choosing the right trading partner is fundamental to performing effective liquidity sweeps in the Forex market. A reliable partner facilitates smoother transactions and enhances your trading strategy’s efficiency and success.

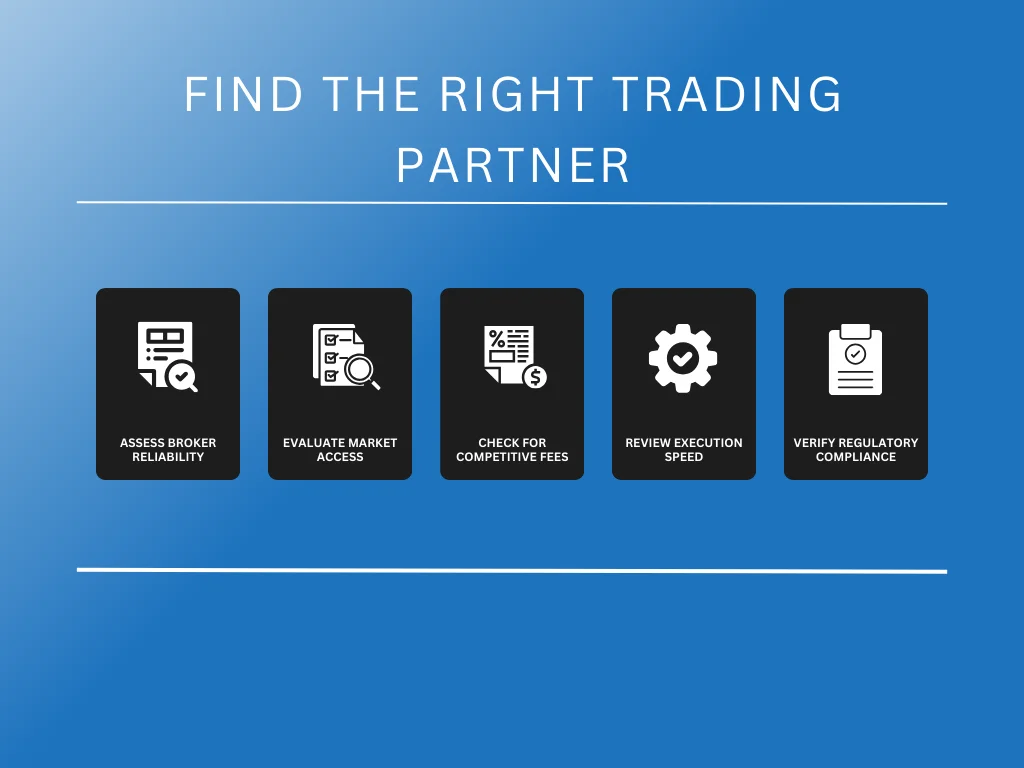

Step 2: Analyze the Market Before Execution

Before executing a liquidity sweep in Forex, a thorough analysis of the market is crucial. This analysis helps traders understand current conditions and anticipate possible price movements. Here’s how to effectively analyze the market:

- Assess Market Volatility: Determine the current level of market volatility. High volatility often presents more opportunities for liquidity sweeps as prices move more drastically.

- Identify Key Price Levels: Look for significant support and resistance levels. These are typically where large orders accumulate, creating potential targets for liquidity sweeps.

- Evaluate Economic Indicators: Consider the impact of upcoming economic reports or news events that could influence market conditions and liquidity.

- Monitor Order Flows: Monitor order flows to gauge the strength behind price movements. This can indicate whether a liquidity pocket is forming.

- Use Technical Analysis: Use tools like Fibonacci retracements or moving averages to pinpoint precise entry and exit points.

Understanding these factors provides a solid foundation for effectively timing and executing liquidity sweeps. This preparation ensures traders can act swiftly and confidently when the right conditions arise. Carefully considering the various market factors to take advantage of liquidity opportunities further leads to potentially profitable outcomes in the volatile Forex market.

Step 3: Utilize Advanced Technology

To effectively execute a liquidity sweep, it is essential to harness the power of advanced trading technologies. These tools help traders identify opportunities and execute trades at optimal speeds. Here are key considerations when utilizing technology for liquidity sweeps:

- Choose Reliable Trading Platforms: Opt for real-time data and superior execution speeds to ensure timely trades.

- Automated Trading Systems: Employ systems capable of automatically setting up and executing trades based on predefined market conditions.

- High-Frequency Trading (HFT) Algorithms: These can be incredibly useful for executing rapid trades to maximize available liquidity.

- Risk Management Software: Use tools that help monitor and manage the risks associated with high-volume trading.

- Backtesting Tools: Before going live, test your liquidity sweep strategies using historical data to gauge potential effectiveness.

- Integration Capabilities: Ensure your technology seamlessly integrates with other systems and data feeds for comprehensive market analysis.

Leveraging such technologies, traders can effectively enhance their ability to perform liquidity sweeps. These tools help analyze market conditions quickly, make decisions based on accurate data, and execute trades at the best possible prices. Additionally, they increase the efficiency and speed of trades and optimize various trading strategies.

Step 4: Test the Strategy

Testing the strategy under various market conditions is crucial before fully implementing a liquidity sweep in the Forex market. This preliminary step ensures the strategy aligns with your trading goals and performs effectively across different scenarios.

Start by applying the liquidity sweep strategy in a simulated trading environment. This approach allows you to observe how the strategy manages risk and captures opportunities without the financial exposure of real trading. Testing in a simulation helps refine the tactics used during liquidity sweeps, ensuring they are responsive to rapid market changes.

Consider the following when testing your strategy:

- Volatility Response: How does the strategy perform during unexpected market volatility?

- Order Execution: Are the orders executed at the desired price levels?

- Risk Management: Does the strategy effectively limit potential losses?

- Adaptability: How well can you modify the strategy in response to feedback from the testing phase?

- Outcome Consistency: Are the strategy results consistent across different test scenarios?

After thorough testing, analyze the results to identify any necessary adjustments. Fine-tuning the strategy based on test outcomes helps improve its reliability and effectiveness. This step is essential to ensure the liquidity sweep can be executed smoothly when real money is at stake.

Rigorously examining the strategy’s performance in a controlled setting allows you to make informed adjustments that enhance its effectiveness in live trading. This careful preparation paves the way for successful application in the volatile Forex market.

Step 5: Adapt and Update

Once you initiate a liquidity sweep in the Forex market, staying adaptive and responsive to market changes is crucial. This final step involves continuous monitoring and adjustments to ensure the strategy remains effective and aligns with market dynamics.

After executing the liquidity sweep, traders must closely observe the market’s reaction. This monitoring helps understand whether the sweep is performing as expected. If the market moves against your position, prompt action is necessary to mitigate risks and protect your investment.

Considerations for adapting and updating your strategy include:

- Market Feedback: Analyze how the market responds to your sweep. Look for increased volatility or unexpected price movements that might affect your positions.

- Risk Assessment: Continually reassess the risks associated with your current positions. Adjust your stop-loss orders to protect against potential losses.

- Profit Targets: If the market moves favorably, consider adjusting your profit targets to maximize gains while protecting your investment from reversal.

- Economic Indicators: Monitor economic reports and indicators influencing currency values and market liquidity.

Adapting and updating your strategy as market conditions evolve is key to successfully implementing liquidity sweeps in Forex trading. This proactive approach enhances the effectiveness of your trades and helps you manage risks more efficiently.

How to Identify Liquidity Sweeps

Liquidity sweeps play a crucial role in trading, particularly in volatile markets. They help traders identify instances when large orders move the market significantly. Recognizing these scenarios provides strategic advantages in trading. Let’s explore how to spot liquidity sweeps effectively.

Option 1: Analyze Trading Volume and Price Fluctuations

Trading volume and price are closely linked in identifying liquidity sweeps. A sudden increase in trading volume and sharp price movements indicate a liquidity sweep. Traders should monitor volume levels alongside price charts to spot these rapid changes. Such patterns suggest big players enter or exit their holdings, causing significant market movements.

Option 2: Interpret Market Sentiment

Market sentiment offers clues about potential liquidity sweeps. Tools like sentiment indicators or news feeds help gauge the market’s swing. A sudden shift in sentiment, whether positive or negative, can precede a liquidity sweep. Traders must stay updated with news and market trends to anticipate these moves.

Option 3: Observe Order Flow Dynamics

Order flow, the real-time list of buy and sell orders in the market, is a direct way to spot liquidity sweeps. Anomalies in order flows, such as many orders at unusual price points, often indicate a sweep. Traders can use order flow analysis tools to visualize these patterns and react swiftly.

Option 4: Utilize Technical Indicators

Technical indicators are vital for spotting liquidity sweeps. Tools like the Relative Strength Index (RSI) or Bollinger Bands can indicate overbought or oversold conditions. A sudden exit from these conditions may signify a liquidity sweep as large volumes are traded to capitalize on these market states. However, technical indicators should not be relied upon solely, as they are lagging indicators and can sometimes generate false signals.

Option 5: Monitor Breakouts and Breakdowns

Breakouts or breakdowns from established price ranges can signal liquidity sweeps. These movements are typically accompanied by high volume, confirming a sweep. Traders must set alerts for such price levels and monitor them closely to act promptly when a breakout or breakdown occurs.

Benefits Of Liquidity Sweeps in Forex Trading

Liquidity sweeps are crucial in Forex trading, offering numerous advantages for retail and institutional investors. These strategies improve the execution speed and help secure the best possible price for large orders without significantly impacting the market.

Let’s explore five key benefits of implementing a liquidity sweep strategy in Forex trading.

Enhanced Execution Speed

Liquidity sweeps increase the speed at which large orders execute. Instead of placing a single order that could affect the market price, it breaks the order into smaller parts. This method ensures faster fulfillment as it taps into available liquidity at multiple price levels. For traders, swift execution means less exposure to price movements in a volatile market.

Improved Price Discovery

When traders use liquidity sweeps, they can often secure a better average price for their trades. Distributing a buy order across several liquidity providers in the order book avoids large slippage and minimizes the impact on the price level. This approach is particularly beneficial in markets like crypto and Forex, where price fluctuations can be rapid and unpredictable.

Risk Management

Employing liquidity sweeps helps manage risks associated with large transactions. Spreading out the execution of a market order reduces the likelihood of triggering stop losses prematurely due to sudden price movements. This is crucial for traders who must maintain precise control over their trades and limit potential losses.

Market Impact Reduction

Liquidity sweeps mitigate the market impact of large orders. Dispersing the order throughout the market structure, the sweep hides the trader’s true intentions and prevents other market participants from taking advantage of the trade. This tactic is vital in maintaining a stable trading environment, especially for institutional investors who move large volumes of dollars, euros, or even bitcoin.

Strategic Trading Advantage

Traders gain a strategic advantage by using liquidity sweep. This technique allows them to execute large orders during breakout moments without significantly alerting the entire market. Such an advantage helps traders avoid tipping off other market participants from front-running the order or exploiting anticipated price movements.

Key Takeaway

Traders utilizing liquidity sweep strategies offer significant benefits in Forex trading. These tactics help enhance traders’ ability to manage risks and capitalize on market volatility. With proper execution, traders can achieve more efficient use of capital and improve profitability through better entry and exit points.

However, traders looking to implement liquidity sweep should focus on identifying market conditions conducive to these strategies. This knowledge ensures they can execute sweeps effectively, maximizing their strategic advantage in the fast-paced Forex market. Continuous education and practical application form the cornerstone of success in using this strategy.

Contact Spartan Trading to expand your expertise and develop long-term investment strategies. At Spartan Trading, we provide insights and resources to help you harness the full potential of liquidity sweep. Engaging with our expertise offers valuable trading resources and guidance to advance your trading skills and financial goals.