Quad Witching Overview: What it Means and How to Prepare

For educational and information purposes only; not investment advice. Any Spartan Trading Service offered is for educational and informational purposes only and should not be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice.

In financial markets, the third Friday of the third month of each quarter is notable for quadruple witching, when four types of financial derivatives expire simultaneously. This phenomenon typically leads to a spike of activity as traders and market participants adjust their positions, increasing trading volume and market volatility. Quad witching occurs quarterly, adding to the already significant volatility of the stock market.

Spartan Trading, an online stock and option idea generation service, provides insights into trading strategies and market fluctuations. We offer guidance on navigating quadruple witching and other derivative contracts, helping traders understand the implications of simultaneous expiration on their portfolios. Our insights help manage these critical trading periods, ensuring our strategies adapt to the unique conditions of triple and double witching days.

Employing our best practices, we’ve compiled this guide exploring the intricacies of quad witching day. We’ll delve into the types of contracts, the significance of the third Friday of every third month of a quarter, and the impact on trading activity during the last hours. Afterward, you’ll thoroughly gauge quadruple witching and how to navigate the market volatility it brings.

Let’s get started!

What Is a Quad Witching Day?

A quad witching day, or quadruple witching, refers to the third Friday of March, June, September, and December when stock options, index futures, stock futures, and stock index options expire simultaneously. This convergence often results in heightened trading activity, increased volume, and greater market volatility.

To prepare for this market event, traders can consider adjusting their positions, staying updated on market trends and news, and employing risk management strategies to handle potential fluctuations effectively. Traders can better position themselves to capitalize on opportunities and minimize risks associated with such volatile trading periods by understanding the implications of quad witching.

Significance of Quad Witching

Quad witching profoundly affects both the stock market and trading volumes. This event occurs four times a year and marks the simultaneous expiration of various derivatives contracts. Let’s explore five critical aspects of quad witching and how it influences the markets:

Increased Market Volatility

Quad witching increases volatility as traders and institutional investors adjust their positions. As the expiration date approaches, the urgency to close or roll over positions intensifies. This urgency affects stock prices and can lead to more significant fluctuations throughout the trading day. The alignment of multiple expirations amplifies these effects, making the quadruple witching hour a period of heightened activity.

Higher Trading Volume

Trading volumes surge during quad witching due to many expiring contracts. Equity index futures, stock options contracts, and other types of derivative contracts all converge on this single day. As a result, traders execute a high volume of transactions to rebalance portfolios or mitigate risk, significantly increasing liquidity.

Impact on Stock Prices

The convergence of expiring options and futures often leads to unusual price movements. For instance, if a large number of call option contracts at a specific strike price are set to expire, institutional investors might manipulate the underlying stock price to favor their positions. This manipulation can result in temporary price discrepancies, affecting the overall market.

Strategic Trading Opportunities

Quad witching presents unique opportunities for traders who are aware of its dynamics. Understanding the potential for price swings and increased liquidity, savvy traders can take positions that capitalize on these short-term movements. Options trading becomes particularly strategic during this time, as traders can exploit the volatility to enter or exit positions at advantageous prices.

Renewed Focus on Expiry Strategies

During quadruple witching, the focus on expiration strategies intensifies among traders. Those holding futures or stock futures contracts must decide whether to let them expire worthless or take action. Decisions about executing, rolling over, or closing positions can significantly impact the derivative markets and underlying asset prices.

Key Dates for Quad Witching

Understanding the key dates for quad witching helps traders and investors prepare for potential market volatility. Typically, it occurs on the third Friday of March, June, September, and December. Here’s why these dates matter:

- March 15, 2024: Caters to potential for price fluctuations when traders adjust their positions as they respond to the expirations. This adjustment is often seen in increased trading volumes and could affect stock prices.

- June 21, 2024: As the financial quarter closes, investors might witness significant liquidity and market dynamics changes, making it a critical date for those looking to rebalance or modify their portfolios.

- September 20, 2024: This date often marks a period of heightened activity as traders return from summer vacations and re-engage with the markets, potentially leading to increased volatility.

- December 20, 2024: Typically sees some of the year’s highest trading volumes as investors close out positions and prepare for the new year. This quad witching day can impact market prices and investor strategies.

Each of these dates represents a strategic point for market participants. They provide opportunities to capitalize on or hedge against the increased market movements driven by the expirations of futures and options. As such, staying informed and prepared for these quad witching days is essential for effective market participation.

Four Types of Financial Instruments Involved in Quadruple Witching

Quadruple witching days shake up the markets, involving the simultaneous expiration of four types of financial derivatives. This event intensifies market activities and affects investors’ strategies. Understanding the instruments involved helps traders manage risks and capitalize on potential opportunities.

Stock Index Futures

Stock index futures are contracts to buy or sell a specific stock index at a predetermined price on a future date. Investors use these futures to hedge against potential market risks or to speculate on future market movements. During quadruple witching, the expiration of these contracts can cause large-scale adjustments in portfolio positions, affecting market prices.

Stock Index Options

Stock index options grant the holder the right, but not the obligation, to buy or sell a stock index at a specified price before the contract expires. Like futures, these options are tools for hedging and speculation. The expiry of stock index options during quadruple witching contributes to heightened market activity and potential price swings.

Single Stock Futures

Single stock futures are similar to stock index futures but are contracts based on single stocks rather than an index. These futures allow traders to leverage their positions in specific stocks. Their expiration during quadruple witching can lead to significant price movements in the underlying stocks.

Single Stock Options

Single stock options operate on the same principle as stock index options but apply to individual stocks. They provide traders flexibility in managing their stock holdings without requiring full upfront purchase. The simultaneous expiration of single stock options with other instruments during quadruple witching amplifies trading volume and volatility.

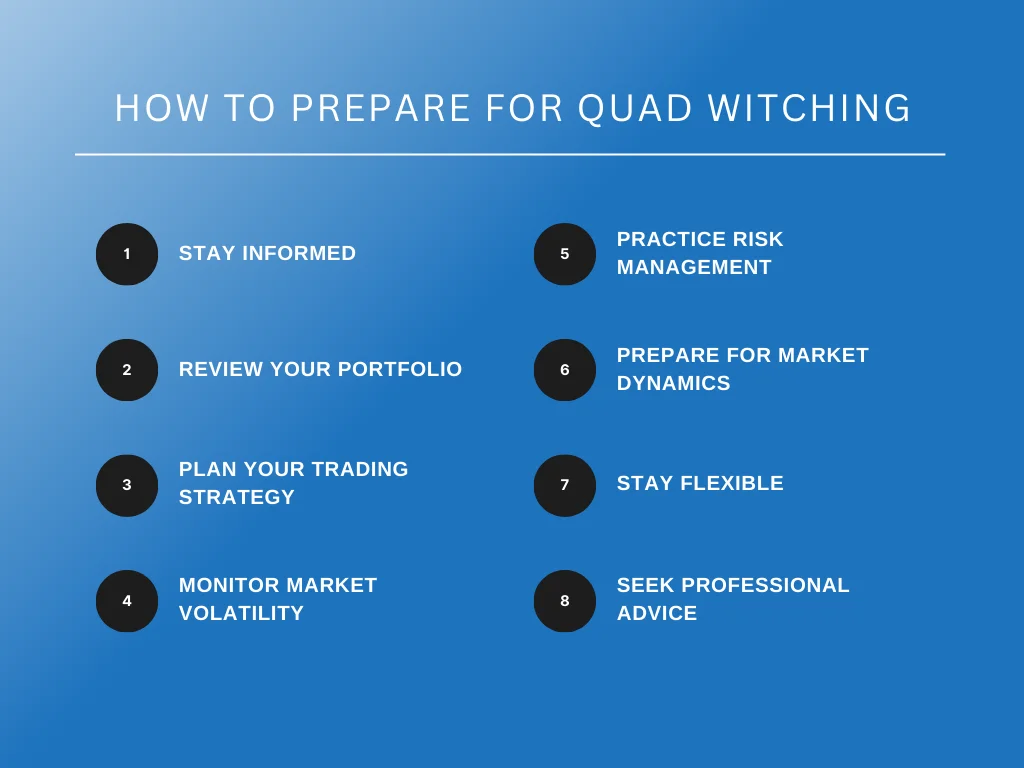

How To Prepare for Quad Witching

Preparing for quad witching is crucial for traders to manage the increased volatility and volume that characterize these days. Effective preparation involves a multifaceted approach focusing on staying informed, reviewing portfolio strategies, and managing risks. Here’s how you can gear up for these critical trading days.

1. Stay Informed

Staying informed entails conducting thorough research on prevailing market trends and keeping abreast of pertinent financial news and expert analyses. This proactive approach ensures a comprehensive understanding of the factors influencing market dynamics. Here’s how to ensure you’re up to trend:

- Market Research: Employ diligent research methods to enable an in-depth comprehension of market trends leading up to significant dates.

- News and Analysis: Regularly access reliable financial news sources and expert analyses for valuable insights into potential impacts on various sectors and assets.

Maintaining well-informed through meticulous market research and staying updated with expert analyses equips investors with the knowledge to navigate market fluctuations effectively.

2. Review Your Portfolio

Portfolio review involves evaluating asset allocation and risk tolerance to optimize investment positions. This proactive measure ensures portfolio resilience in the face of market volatility. Here are the factors to consider:

- Asset Allocation: Analyze asset distribution within a portfolio and make necessary adjustments aligned with anticipated market fluctuations.

- Risk Assessment: Evaluate risk tolerance to determine the suitability of investment positions and mitigate potential losses.

Through diligent portfolio review and risk assessment, investors can tailor their portfolios to withstand market uncertainties and capitalize on opportunities presented during volatile periods.

3. Plan Your Trading Strategy

Crafting a trading strategy involves setting clear objectives and developing a comprehensive plan encompassing entry and exit strategies, stop-loss orders, and profit targets. This structured approach enhances decision-making during volatile market conditions. Here’s how to craft one:

- Define Objectives: Establish specific trading objectives to achieve clarity and direction for decision-making processes.

- Create Trading Plan: Craft a detailed trading plan to execute strategies effectively amidst market fluctuations.

A meticulously crafted trading strategy, underpinned by clear objectives and disciplined execution, empowers investors to navigate market volatility confidently. Adhering to a well-defined plan can navigate the complexities of trading with resilience and adaptability.

4. Monitor Market Volatility

Monitoring market volatility entails observing volatility indicators and employing technical analysis tools to gauge market sentiment and identify trends. This proactive approach facilitates informed decision-making in response to changing market conditions. Consider these key factors to stay on top of it:

- Volatility Indicators: Tracking indicators such as the VIX aids in assessing market sentiment and anticipating potential price movements.

- Technical Analysis: Utilizing technical analysis tools helps identify essential support and resistance levels and informs strategic trading decisions.

Investors can navigate market fluctuations with precision and foresight by monitoring market volatility and employing technical analysis. Informed decision-making, rooted in comprehensive analysis, positions investors to capitalize on opportunities amidst market volatility.

5. Practice Risk Management

Effective risk management involves determining appropriate position sizes and diversifying investments across asset classes and sectors. This prudent approach mitigates exposure to market fluctuations and safeguards against potential losses. Here are key points to implement:

- Position Sizing: Calculating optimal position sizes based on risk tolerance minimizes the impact of adverse market movements.

- Diversification: Spreading investments across diverse assets reduces vulnerability to sector-specific risks, enhancing portfolio resilience.

Prudent risk management practices, including appropriate position sizing and diversification, are crucial for safeguarding investments against market volatility. Sound risk management practices protect portfolios from undue volatility and position themselves for long-term success in dynamic market environments.

6. Prepare for Market Dynamics

Preparation for market dynamics encompasses anticipating changes in liquidity and maintaining discipline in adherence to trading plans. This proactive stance ensures readiness to capitalize on opportunities and navigate challenges effectively. Here’s how to prepare:

- Consider Liquidity: Adjusting trading strategies in response to fluctuations in market liquidity facilitates efficient order execution.

- Stay Disciplined: Adhering to predetermined trading plans mitigates the influence of impulsive decisions driven by short-term market movements.

Through proactive preparation and disciplined adherence to trading plans, investors can explore market dynamics with resilience and composure, optimizing outcomes amidst uncertainty.

7. Stay Flexible

Flexibility entails adaptability to changing market conditions and managing emotions effectively. This agile approach enables investors to respond promptly to emerging opportunities and challenges. Here’s how to remain adaptable:

- Adapt to Market Conditions: Adjusting trading strategies in response to evolving market dynamics facilitates optimal decision-making and capitalizes on emerging trends.

- Manage Emotions: Maintaining emotional discipline fosters rational decision-making and prevents impulsive actions driven by fear or greed.

Cultivating flexibility and emotional resilience, investors can navigate market fluctuations with confidence and agility, positioning themselves for sustained success in dynamic environments.

8. Seek Professional Advice

Seeking professional advice involves consulting with financial advisors and utilizing educational resources to enhance trading knowledge and decision-making capabilities. This proactive approach augments investor expertise and fosters informed decision-making. Options include:

- Consulting with Experts: Leveraging the insights of financial advisors and experienced traders provides valuable perspectives and guidance in navigating complex market scenarios.

- Utilizing Educational Resources: Accessing seminars, webinars, and online courses enhances understanding of trading strategies and market dynamics, empowering investors to make informed decisions.

Guided by expert insights, investors can augment their decision-making capabilities and navigate financial markets confidently. With enough know-how in trading activities, they can easily achieve success amidst market fluctuations.

Key Takeaway

Quad witching significantly influences market dynamics, demanding careful preparation from traders. To navigate these turbulent periods, one should thoroughly understand the financial instruments and their potential impact on the market. Reviewing and adjusting your portfolio becomes crucial as quad witching approaches, allowing you to manage risks effectively and capitalize on potential opportunities.

Traders must develop a solid strategy that includes staying updated with market news, understanding technical indicators, and setting precise entry and exit points. Maintaining a disciplined and well-considered plan enhances your ability to maneuver through market volatility and make more informed decisions aligning with your trading objectives.

Looking to refine your day trading skills or are searching for innovative investment ideas? Join our community of experts or explore our trading resources to empower your trading strategies when quad witching approaches. At Spartan Trading, we provide real-time insights and guidance to help you excel in the fast-paced trading world. Fill out this form to connect!