What is a Small Stock Dividend and How Do They Work?

Understanding the stock dividend in corporate finance and investments proves crucial for investors aiming to navigate the complexities of market dynamics. A small stock dividend involves the distribution of additional shares of a company’s common stock to its shareholders without significantly depleting its retained earnings. This strategic move influences a company’s market value and share price, making it vital for managing capital stock and outstanding shares.

Spartan Trading, an online stock and option idea generation service, specializes in providing insights into market dynamics. We meticulously analyze corporate actions to offer informed investment strategies. Through our research, we’ve observed how small stock dividends influence share prices and dividend yield. Our experts ensure that investors gain holistic insights into how these dividends work and their significance in the long term.

Leveraging our trading experience and insights, we’ve compiled this comprehensive guide on small stock dividends. Our exploration covers the essentials, from defining a small stock dividend to formulating strategic implications for companies and investors. We’ll highlight their roles in your investment strategies and portfolios, empowering you to make informed decisions.

Let’s dive in!

What Is a Small Stock Dividend?

A small stock dividend is a distribution of additional shares to shareholders proportional to their current holdings. Companies usually issue these dividends to reward investors without depleting cash reserves. The amount distributed is typically less than 25% of the total shares currently owned by the shareholders.

This approach benefits shareholders through potential tax advantages and supports the company’s financial health by preserving cash. It balances between encouraging investor loyalty and ensuring the company’s growth potential remains strong.

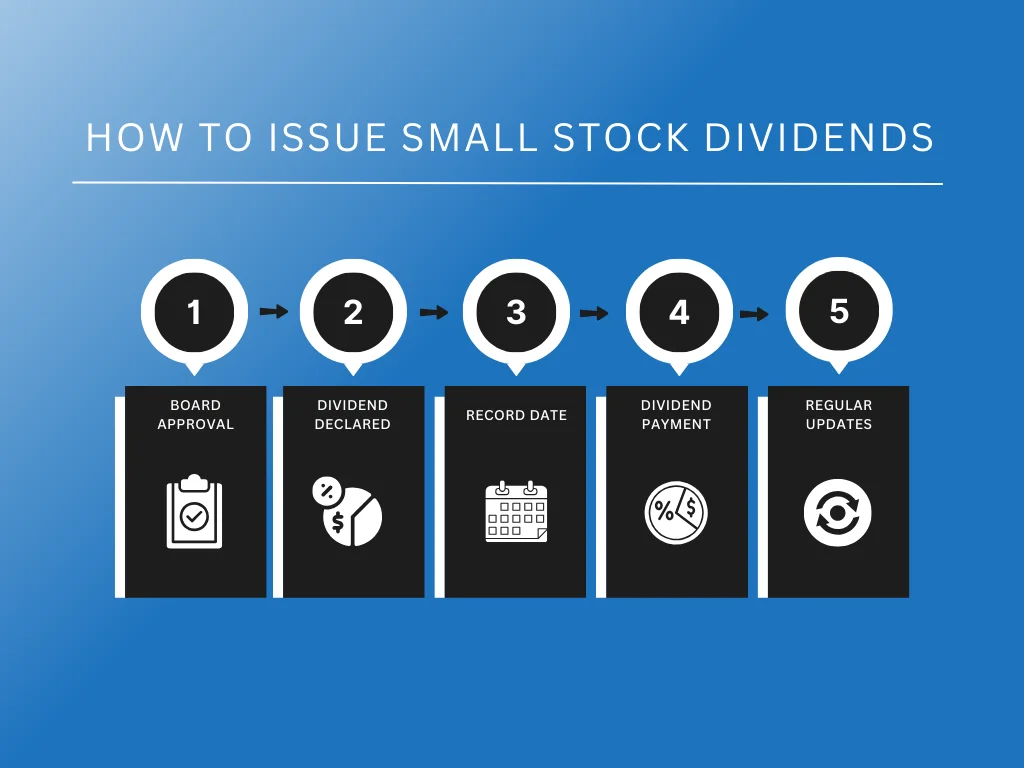

How to Issue Small Stock Dividends

Issuing small stock dividends is a nuanced process that can enhance shareholder value without depleting a company’s cash reserves. Here’s a breakdown of the six essential steps involved in the process:

Step 1: Board of Directors Approval

The process of issuing a small stock dividend is intricate and primarily involves a company’s board of directors approval. It begins with this governing body assessing the company’s financial stability and strategic position. They consider how distributing stock dividends might influence investors’ views of the company upon declaring the dividend distribution.

Here are things the board usually consider:

- Financial Health: The board scrutinizes the company’s financial statements to ensure they can afford to issue dividends without harming their financial standing.

- Market Impact: They assess the potential reactions from the market, predicting whether the dividends will be seen as a sign of strength or a cause for concern.

- Strategic Positioning: Understanding the company’s place in the industry helps decide the right time for such a move.

- Approval is Key: The process can commence with the board’s green light. Their decision is based on a thorough analysis of various factors.

Issuing small stock dividends is a decision that rests heavily on the company’s board of directors. They must carefully analyze the financial implications, market reactions, and strategic timing before approval. This step is fundamental in the dividend distribution, setting the stage for all subsequent actions.

Step 2: Declaration of the Dividend

After receiving approval from the board of directors, the next step in issuing a small stock dividend involves making an official announcement. This announcement is a critical communication with shareholders, detailing the size of the dividend, the record date, and the distribution date. It is a formal pledge to distribute dividends, marking a significant moment in the company’s engagement with its investors.

Consider these aspects when declaring the dividend:

- Detailing the Dividend Size: The announcement specifies the size of the dividends, offering clarity to shareholders about what they can expect.

- Setting the Record Date: It establishes the record date, which is crucial for determining which shareholders are eligible to receive the dividend.

- Announcing the Distribution Date: The company also announces when the dividends will be distributed, allowing shareholders to know when they will receive their shares.

- A Formal Commitment: This step represents the company’s official commitment to its dividend policy and dedication to rewarding shareholders.

The formal announcement of the dividend following the board’s approval is a decisive step in the process of issuing small stock dividends. It communicates essential details to shareholders and solidifies the company’s commitment to distributing dividends. This official declaration is pivotal in maintaining transparency and trust between the company and its investors.

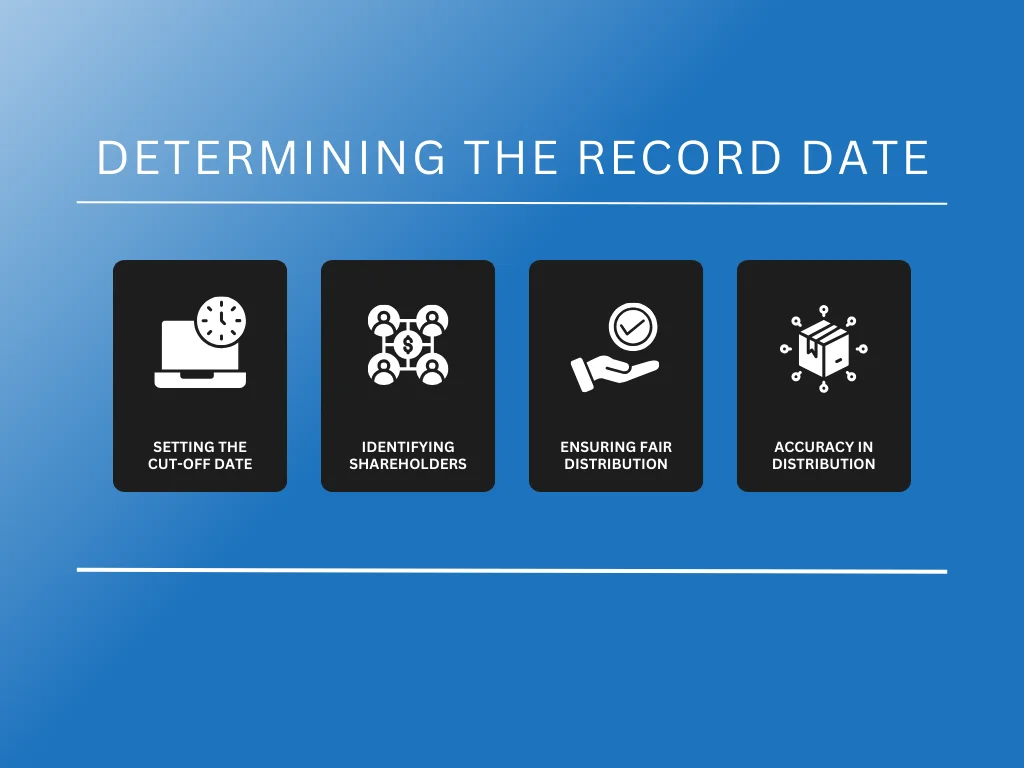

Step 3: Determining the Record Date

The third step in issuing small stock dividends involves determining the record date, which is essential for identifying eligible shareholders. This date acts as a cut-off point for the company to identify who owns the stock and who is entitled to receive the dividend. Considering this phase demands precise record-keeping to guarantee that the dividend distribution is executed accurately and fairly:

- Setting the Cut-off Date: The company establishes the record date to determine the shareholder eligibility for the dividend.

- Identifying Shareholders: Only those holding shares on the record date are eligible to receive the dividend, making accurate records vital.

- Ensuring Fair Distribution: Precise record-keeping is necessary to ensure all eligible shareholders are fairly recognized and receive their due dividends.

- Accuracy in Distribution: This step is fundamental to maintaining the integrity of the dividend distribution process and avoiding errors and disputes.

Setting the ex-dividend date is critical in issuing a small stock dividend. It ensures a transparent and equitable trading environment by adjusting the stock price to account for the dividend payout. This helps maintain market integrity and fairness, preventing confusion and ensuring all parties know their rights and expectations concerning dividend payments.

Step 4: Distribution of the Dividends

On the designated payment date, the company finalizes the distribution of a small stock dividend to the shareholders listed in the records. Such distribution entails giving shareholders with the shares based on their existing holdings. Although it increases the total number of shares in circulation, it doesn’t reduce the overall value of each shareholder’s investment. Instead, it’s a method to reward investors without drawing on the company’s cash reserves.

Following the distribution, each shareholder finds their ownership slightly diluted but not devalued, which benefited both the company and its investors. For the company, it’s a way to acknowledge and reward shareholder loyalty without impacting its liquidity. In turn, shareholders see an increase in their share count, reflecting their continued commitment to the company. This approach balances rewarding investors and ensuring the company’s financial stability.

Step 5: Ongoing Communication

Continuous communication with shareholders before, during, and after the issuance of stock dividends is vital. It ensures clarity, maintains trust, and helps shareholders understand the implications of the dividend on their investments. Regular updates and transparent communication channels are instrumental in managing shareholder expectations and reinforcing the company’s commitment to shareholder value.

This strategy ensures that shareholders remain well-informed about the company’s financial decisions and their impact on investments. Effective communication fosters a strong relationship between the company and its investors, reinforcing solid shareholder engagement and loyalty. Moreover, it highlights the company’s commitment to transparency and its investors’ well-being.

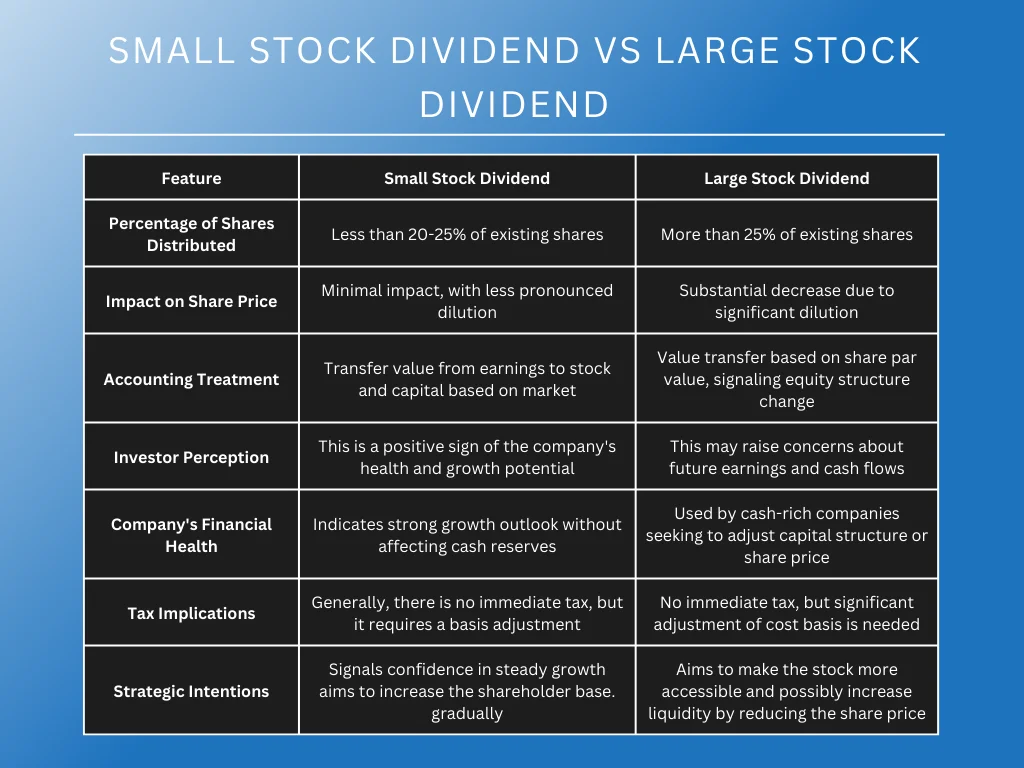

Small Stock Dividend vs Large Stock Dividend

When rewarding shareholders, companies often choose between issuing a small stock dividend and large stock dividends. Both serve as a way to distribute wealth but differ significantly in their execution and impact on the company and its investors. Understanding these differences is crucial for investors aiming to make informed decisions and for companies considering which dividend policy best aligns with their strategic goals.

Impact on Share Price

Small stock dividends often have a minimal impact on the share price. Since the increase in the number of shares is relatively modest, the dilution of share value is less pronounced. On the other hand, large stock dividends can lead to a substantial decrease in the per-share price due to the significant increase in the total number of shares, which dilutes the value of existing shares.

Accounting Treatment

For small stock dividends, the accounting treatment involves transferring the value from retained earnings to common stock and additional paid-in capital based on the fair market value of the shares distributed. Meanwhile, for large stock dividends, companies transfer the value based solely on the shares’ par value, reflecting a considerable shift in the company’s equity structure.

Investor Perception

Investors may perceive a small stock dividend as a positive signal that the company is doing well but prefers to reinvest its profits to fuel growth rather than distribute cash. Large stock dividends, while still a sign of prosperity, might raise concerns about the company’s future cash flows and ability to generate earnings, as they substantially alter the share structure.

Company’s Financial Health

Issuing a small stock dividend allows a company to reward its shareholders without significantly affecting its cash reserves. It’s often seen as a strategy that companies with a strong growth outlook employ. In contrast, companies with ample cash might employ large stock dividends but seek to adjust their capital structure or share price without altering their liquidity.

Tax Implications

For shareholders, small stock dividends typically do not result in immediate tax consequences, as the overall value of their investment does not change significantly. However, they must adjust the cost based on their holdings. Large stock dividends can also be non-taxable at the time of distribution. Still, the significant change in the number of shares requires careful adjustment of the cost basis to avoid future capital gains tax discrepancies.

Strategic Intentions

A small stock dividend might be part of a company’s ongoing strategy to gradually increase its shareholder base while maintaining a stable share price. They reflect confidence in the company’s growth trajectory. Conversely, large stock dividends can be a tool for companies aiming to make their stock more accessible to a broader base of investors by reducing the share price, thus potentially increasing liquidity.

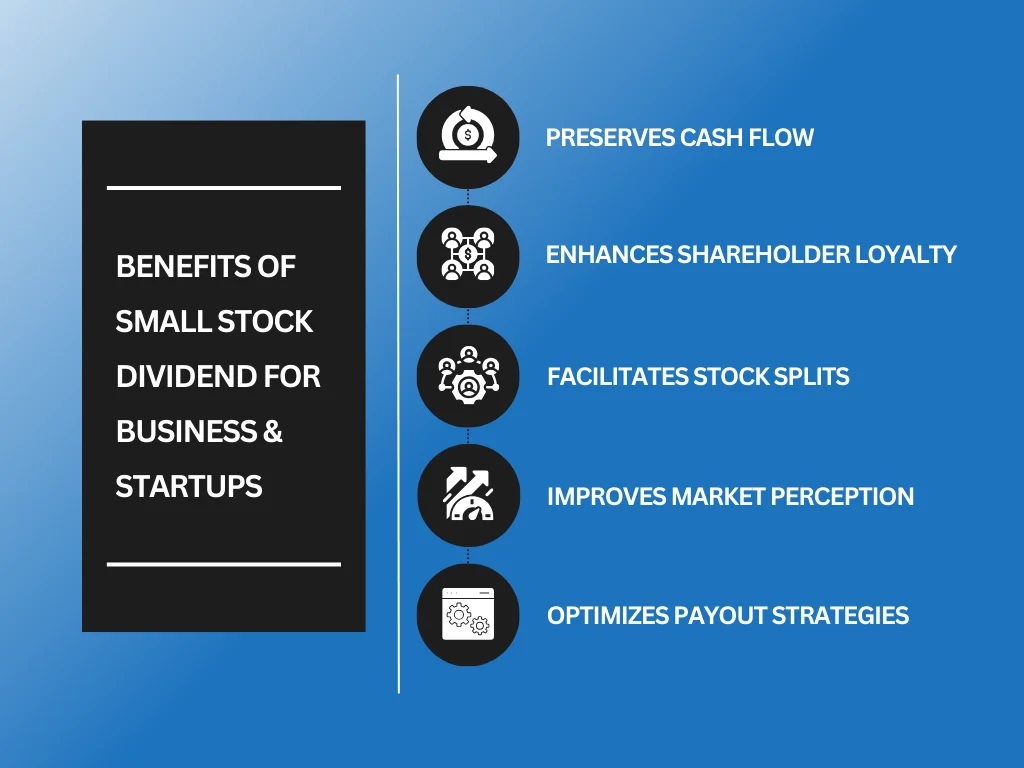

Benefits of Small Stock Dividend for Business and Startups

Small stock dividends offer a range of advantages for businesses and startups looking to grow and maintain a strong relationship with their investors. From enhancing capitalization to optimizing payout strategies, these dividends represent a strategic tool for managing finances and shareholder value. Let’s delve into five key benefits:

Preserves Cash Flow

Cash flow is vital for businesses, especially startups. Companies can retain more cash by issuing small stock dividends instead of cash dividends. This approach supports operations, funds expansion projects, and maintains liquidity without impacting the company’s financial stability. A small stock dividend allows companies to reward shareholders without depleting the cash necessary for day-to-day operations or unexpected expenses.

Enhances Shareholder Loyalty

When a company issues new shares to its shareholders as a form of dividend, it strengthens the shareholders’ commitment to the business. Since receiving more shares of stock can increase a shareholder’s stake in the company over time, it encourages long-term investment and loyalty. This practice can benefit startups looking to build and maintain a strong investor base.

Facilitates Stock Splits

Implementing a small stock dividend is a straightforward process, often preceding a stock split. It increases the total number of shares in circulation without altering the company’s market capitalization, making the stock more accessible and potentially boosting the stock price. This can be a significant advantage for businesses listed on exchanges like Nasdaq, where visibility and stock performance can attract more investors.

Improves Market Perception

Declaring dividends, including small stock dividends, sends a positive signal about the company’s net income and financial health. It can enhance the company’s reputation and increase the confidence of investors and the board of directors in the business’s management and prospects. Over the short term, this positive market perception can contribute to a higher stock price relative to the company’s performance.

Optimizes Payout Strategies

For companies, the flexibility in dividend rate declaration offers strategic benefits. By adjusting the number of new shares given out as dividends, businesses can align their payout strategies with current financial performance and future goals. This method allows for adjusting the payout without the rigid cash outflow commitments that cash dividends entail. Additionally, maintaining accurate journal entries for these transactions ensures transparency and compliance, which are critical for investor trust and financial reporting.

Key Takeaway

Learning what a stock dividend is and how it is being issued is crucial for making informed investment decisions. A small stock dividend enables companies to reward shareholders without spending cash. Instead, they issue additional shares, which leads to slight dilution while maintaining their overall value. Investors appreciate these dividends for the potential to gradually increase their stake in the company, making it perfect for long-term investment growth without cash outlays.

However, investors and companies still need to consider several considerations with stock dividends. For investors, it’s crucial to assess its impact on their portfolio’s value and the tax implications. Companies, on the other hand, should weigh the benefits of retaining cash against the dilution of shares. While stock dividends can signal confidence from management, companies must communicate effectively to ensure shareholders understand their implications.

Looking for more insights to make the most of your small stock dividend? Contact Spartan Trading today to gain valuable insights via our exclusive trading masterclasses. Whether day trading or swing trading, our expert advice will help maximize your returns from stock dividends, propelling your investment strategy to new heights in 2024 and beyond!