How to Discover Stocks Using the FinViz Screener

For educational and information purposes only; not investment advice. Any Spartan Trading Service offered is for educational and informational purposes only and should not be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice.

Stock screening is a pivotal tool that refines the stock market into a narrow set of investment opportunities. Among these tools, the FinViz Screener stands out, offering investors inclusive filters to sift through penny stocks, evaluate market cap, and assess volatility with precision. This screener adapts to the diverse needs of traders and provides various investing strategies, whether the focus is on valuation, beta (volatility measure), or earnings per share (EPS).

At Spartan Trading, we extensively leverage the FinViz Screener in our online stock and option idea generation service. We have successfully used it in evaluating trades with the right mix of risk and return, focusing on stocks that align with our strategic goals. Our approach combines this powerful tool with our in-depth market knowledge to identify opportunities in investing, especially when market volatility and EPS figures play critical roles.

Building on our proven strategies, we’ve crafted this guide to delve into the FinViz tools and features, from understanding its interface to utilizing filters for discovering high-potential stocks. As you read through, you’ll learn how to use the FinViz stock screener and explore its benefits to be confident with your investment endeavors and trading decisions.

Let’s dive in!

What is the FinViz Screener?

The FinViz Screener, short for financial visualizations, is an online tool that provides extensive data filtering options to sift through thousands of stocks. Its comprehensive database simplifies market analysis, enabling investors to quickly identify investment opportunities based on their preferred criteria and risk preferences.

Here are the use cases of FinViz Screener:

- Identify undervalued stocks – stocks priced below their true market value.

- Simplifies finding high-potential stocks.

- Track market trends to see which sectors and industries perform well.

- Create charts and patterns to predict future movements via technical analysis.

- Help investors diversify their portfolios by finding stocks from different sectors to spread investment risks.

- Let users receive real-time alerts or updates on stocks that meet their criteria.

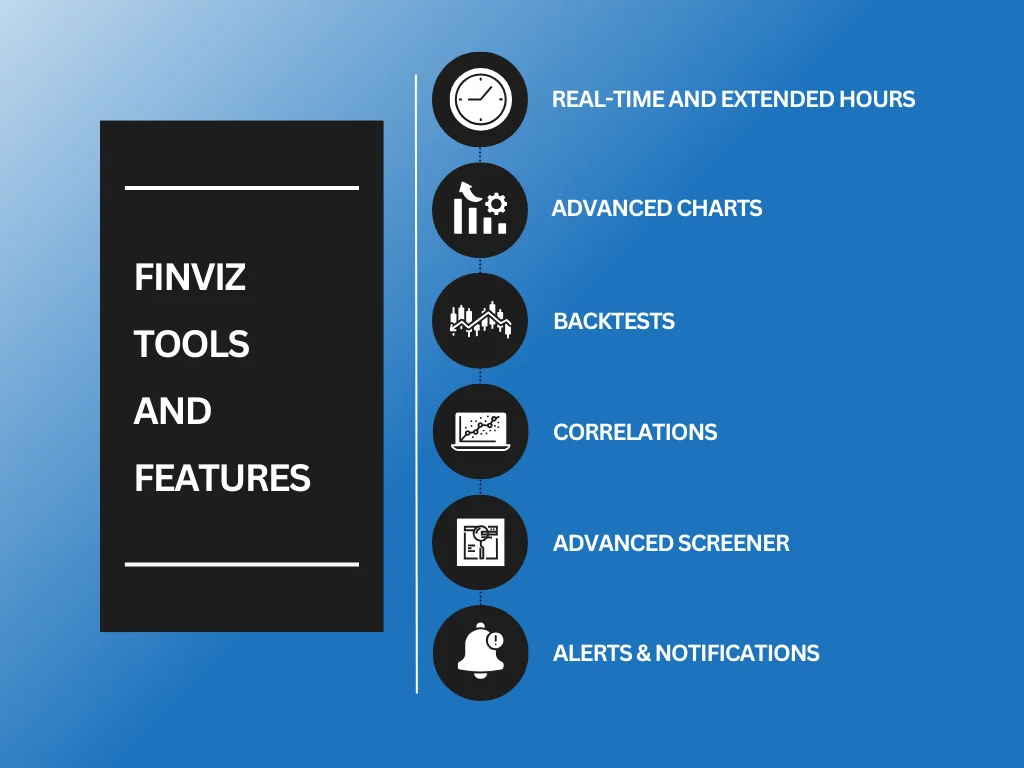

FinViz Tools and Features

Discovering high-potential stocks becomes straightforward with the FinViz Screener. Its comprehensive tools and features ensure investors and traders have everything they need to make informed decisions. Here, we delve into six key functionalities that set the tool apart.

Real-Time and Extended Hours

FinViz provides real-time stock quotes, ensuring investors access to the most current market data. This feature extends beyond the standard trading hours, covering premarket and aftermarket sessions starting from 7:00 AM. It integrates this data across various sections, including the homepage, charts, and the stock screener, offering a comprehensive view of market dynamics.

Advanced Charts

The tool offers advanced charting capabilities for those looking to conduct in-depth technical analysis. Users can leverage intraday charts, overlays, indicators, and drawing tools to examine stock performance meticulously. Fullscreen layouts and performance comparison charts further enrich the analysis, allowing for a detailed assessment of stock trends and patterns.

Backtests

FinViz’s backtest feature empowers users to research the profitability of technical indicators before applying them in real-world scenarios. With access to 100 technical indicators and 24 years of historical data, investors can rigorously test their trading strategies against the SPY benchmark to enhance their strategy execution.

Correlations

Navigating stock correlations is crucial for diversifying risk and optimizing portfolio performance. FinViz offers proprietary correlation algorithms tailored for financial markets, enabling users to identify stocks that move in tandem or inversely. This feature assists investors in making informed decisions on position alternation and risk management.

Advanced Screener

The advanced screener of FinViz extends beyond basic filtering, offering statistics, data export capabilities, and customized filters. This enables a deeper analysis of filtered stocks, providing a granular view of investment opportunities through advanced charts and a statistical viewpoint, catering to the nuanced needs of advanced users.

Alerts and Notifications

Staying abreast of critical market events is simplified with its alerts and notifications. Users can set up email notifications for individual stocks or portfolios triggered by news, price changes, or new ticker matches to screener criteria. This feature ensures investors remain informed of significant market movements, allowing for timely decision-making.

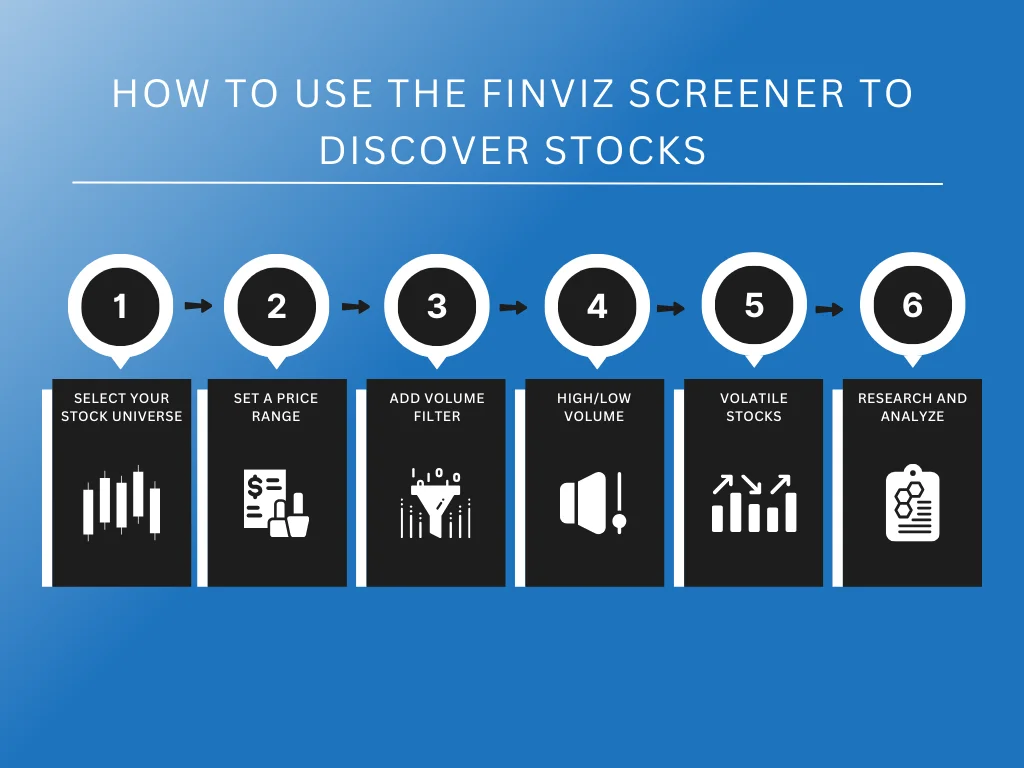

How to Use the FinViz Screener to Discover Stocks

Effectively using FinViz provides specific stocks that meet certain criteria. Whether you’re a day trader, swing trader, or long-term investor, this tool can help you filter thousands of stocks to find the ones that fit your investment needs. Here’s a step-by-step guide on how to use it:

Step 1: Select Your Stock Universe

The initial step in utilizing the FinViz Screener involves defining the scope of stocks you’re interested in exploring. This decision narrows the vast market into a manageable segment to match your investment profile. Remember, stocks are typically classified into various categories based on market capitalization: small, mid, and large-cap. Each of these categories comes with its distinct set of risks and rewards.

For instance, while small-cap stocks are known for their potential for significant growth, they also carry a higher risk due to increased volatility. For this reason, this step requires you to align your selection with investment goals, risk tolerance, and trading style. Opting for a particular category at this stage enables a more targeted approach in the subsequent steps, paving the way for a refined and efficient stock selection process.

Step 2: Set a Price Range

Once you’ve defined your stock universe, the next step is establishing a price range that fits your budget and investment criteria. This is crucial for selecting stocks that align with your financial capacity, strategy, and expected return for price appreciation or stability. Setting a price range is also useful when combined with the market capitalization filter.

For example, selecting mid-cap stocks between $10 and $50 might be strategic if you aim for a blend of stability and growth potential. This pricing criterion helps eliminate stocks that are either too speculative or too rich for your budget, thus further refining your search for suitable investment opportunities.

Step 3: Look for Sufficient Stock Volume

A key indicator of a stock’s health and suitability for trading is its volume. Volume represents the number of shares traded within a specific timeframe and reflects a stock’s liquidity. A higher trading volume signifies that a stock can be bought or sold quickly without causing significant price movements, which is crucial for traders who need to execute quick trades.

Applying a filter for stocks with a trading volume exceeding 200,000 ensures that the selected stocks have enough market interest and activity to facilitate smooth entry and exit. This step is crucial for those looking to engage in active trading, as it helps identify liquid stocks to handle sudden trades without the risk of slippage.

Step 4: Check the Relative Volume

Understanding a stock’s relative volume provides insight into its current trading activity compared to its average. A relative volume filter set at 1.5 or higher pinpoint stocks with unusual trading activity, possibly indicative of upcoming moves or news to attract attention.

Stocks exhibiting such volumes signal a higher-than-normal trading interest, potentially making them ripe for trading opportunities. This metric is invaluable for traders looking for momentum or those aiming to capitalize on recent developments that could drive stock prices up or down.

Incorporating relative volume into your screening process aids in identifying stocks that are not just actively traded but also possibly at the threshold of significant price movements.

Step 5: Screen for Movement Potential

After narrowing down your options using the previous filters, the focus shifts to analyzing the selected stocks for potential movement. This involves examining technical patterns and indicators that suggest imminent price action. Whether it’s a breakout from a downtrend signaling an upward or a continuation of an uptrend, identifying these patterns is crucial for timing your trades effectively.

The aim is to sift through the screened stocks to find those that exhibit clear signs of momentum, breakout, or reversal, which could lead to profitable trading opportunities. This step is about merging theoretical knowledge with practical market movements, looking beyond numbers to understand the pattern or implication the stock tells through its charts.

Step 6: Research and Analyze

With a refined list of stocks, the final step is comprehensive research and analysis. This includes examining the latest news impacting the stocks, analyzing financial statements for their underlying health, and anticipating upcoming events that could influence stock prices. At this stage, fundamental and technical analysis provides a holistic view of each stock’s potential.

Fundamental analysis reveals a company’s growth potential or financial stability, while technical indicators suggest the stock’s short-term price direction. This rigorous examination ensures that the selected stocks meet your initial screening criteria and stand up to closer scrutiny, aligning with your broader investment strategy and goals.

Tips for Using the FinViz Screener

The FinViz Screener’s comprehensive set of descriptive, fundamental, and technical filters allows users to sift through thousands of stocks to identify those that meet their unique investment strategies. Whether you are a seasoned investor looking for growth opportunities or a day trader seeking volatility, this tool can be invaluable.

Here are some tips to effectively use this powerful platform to its fullest potential:

- Use Custom Filters: FinViz allows users to create custom filters beyond the basic ones. These include more nuanced criteria such as P/E ratios, dividend yields, or specific technical indicators. Tailoring these filters to match your unique strategy can help discover stocks others might overlook.

- Save and Revisit Your Screens: Once you’ve created a screen that works for you, save it. Market conditions change, and a screen that yields promising stocks today might do so again in the future. Regularly revisiting and adjusting your screens can align your trading strategy with market dynamics.

- Integrate Screen Results With Other Research: While the tool can significantly narrow potential stocks, integrating these findings with additional research tools and sources can provide a more rounded view. Use financial news websites, analyst reports, and investment research platforms to supplement your FinViz Screener results.

- Stay Updated With Alerts: FinViz offers alerts and notifications for specific stocks or criteria. Setting up alerts for your screened stocks can inform you of critical movements or news, allowing for timely decision-making.

The FinViz Screener is an invaluable tool for traders and investors aiming to navigate the complex stock market efficiently. Users can uncover high-potential trading and investment opportunities by following a systematic approach to select, analyze, and research stocks.

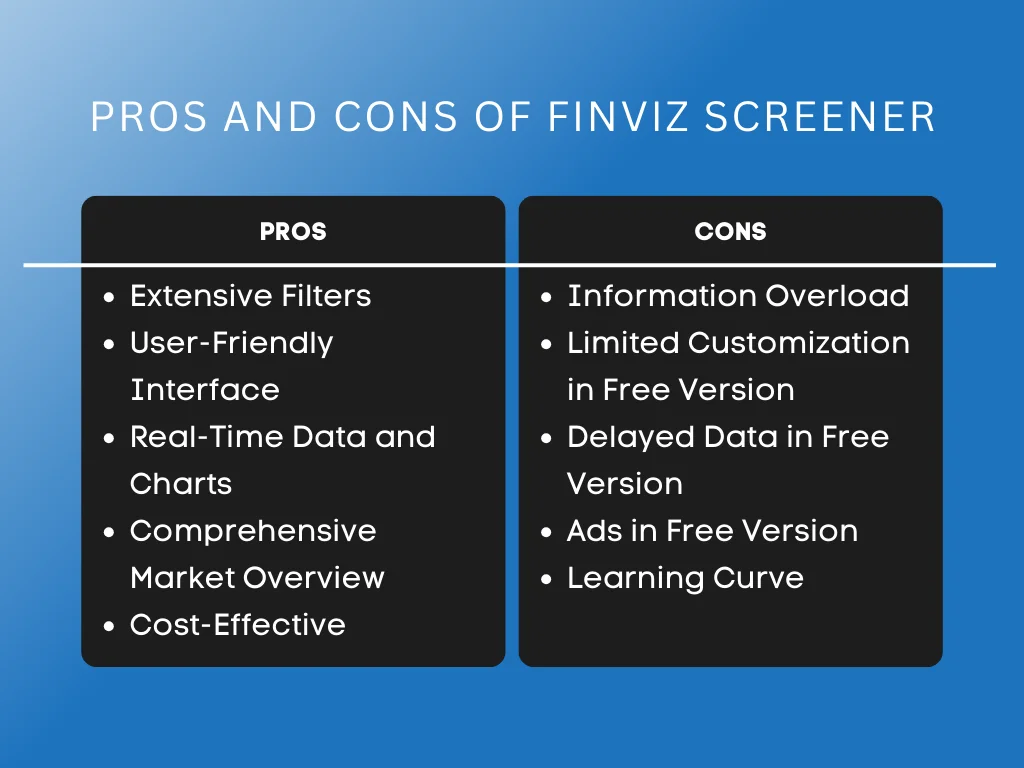

Pros and Cons of FinViz Screener

Investors and traders navigate the complex market landscape using various tools, among which the FinViz Screener stands out for its robust capabilities. This browser-based platform has earned acclaim for its comprehensive market data, financial news, and advanced analytics. However, as with any tool, it has its advantages and limitations.

Pros of Using FinViz Screener

The platform offers numerous benefits to its users:

- Extensive Filters: Users can apply over 60 criteria to pinpoint stocks that match specific investment strategies, including market capitalization, dividend yield, and sector performance.

- User-Friendly Interface: The platform is designed for ease of use, ensuring novice and experienced investors can navigate its features without hassle.

- Real-Time Data and Charts: For subscribers of the Elite version, FinViz provides real-time data, enhancing decision-making with up-to-the-minute information.

- Comprehensive Market Overview: The heat maps and sector analysis tools give users a bird’s-eye view of market trends and sector performances, facilitating informed investment choices.

- Cost-Effective: Most of the screener’s features are free, with the option to upgrade to the Elite version for more advanced tools at a reasonable monthly fee.

Cons of Using FinViz Screener

Despite its strengths, this tool has some drawbacks:

- Information Overload: The sheer volume of data and options can overwhelm new users, potentially complicating the stock selection.

- Limited Customization in Free Version: The free version restricts the ability to save screening criteria and lacks some of the more advanced analytical tools available to Elite subscribers.

- Delayed Data in Free Version: Users of the free version must contend with delayed data, which may impact timely decision-making.

- Ads in Free Version: The presence of ads can disrupt the user experience, pushing some towards the paid subscription.

- Learning Curve: While the platform is user-friendly, fully leveraging its advanced features requires a learning investment, which might deter those looking for quick insights.

FinViz Screener Reviews and Recommendations

The FinViz Screener has garnered acclaim for its comprehensive suite of tools catering to novice and seasoned investors. Its broad range of filters, user-friendly interface, and insightful visualizations make it a go-to resource for stock screening and market analysis. On top of that, its ability to simplify complex data into actionable insights is highly praised, underscoring its importance in making informed investment strategies.

However, some users highlight limitations, such as the delayed data in the free version and the subscription cost for FinViz Elite. Despite these drawbacks, the consensus among many investors is positive, with recommendations often pointing to its effectiveness in identifying market opportunities and optimizing investment portfolios. The blend of advanced features and straightforward usability makes FinViz Screener a valuable asset in the investors’ toolkit.

Key Takeaway

Investors seeking high-potential stocks can leverage FinViz Screener’s user-friendly interface and extensive data filters. This powerful tool offers comprehensive data that helps new and seasoned investors discover opportunities tailored to their investment strategies, whether they focus on aggressive growth or value investing.

Choosing the suitable filters is essential for making the most of the tool. Investors adjust these filters to fit different investment approaches, from aggressive growth to conservative value investing. The platform provides many options, like earnings growth, market size, and debt levels, allowing users to fine-tune their searches and improve their investment results.

Learn more by scanning for stocks in under 3 minutes to boost your strategy. Join the Spartan Trading email list for expert investment tips and resources delivered directly to your inbox. With FinViz Screener and our insights, you can make informed decisions and identify stocks with significant growth potential.