INVESTMENT IDEA – CAPITALIZING ON CRITICAL MINERALS – IBER AMERICAN (OTC: IBRLF)

Disseminated on behalf of

IberAmerican Lithium Corp.

IN DEPTH INVESTMENT ANALYSIS

IberAmerican – $IBRLF

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

As governments and corporations globally push to reduce carbon emissions and fight climate change, the demand for electric vehicles (EV’s) continues to grow exponentially. Strong EV sales in the first quarter of 2024 have already surpassed the annual total from four years ago.1

Lithium plays a crucial role in the production of EV’s, primarily through its use of lithium-ion batteries, which power these vehicles. The majority of EV manufacturers favor using lithium compounds in their batteries due to their high energy density, efficiency and performance (meaning that lithium-ion batteries can store more energy per unit of weight then batteries using other materials, such as nickel or lead).

What most people dont know, is that a typical electric car requires six times the mineral inputs of a conventional car.2 Tin, for example, is one of these minerals that can be used for not only stabilizing lithium-ion batteries but used as a component in PVC stabilizers, bearings, sealants, wiring and fuel tank coatings.

The demand for Tin (primarily used in soldering) has also surged along with the growing global demand and use of semi-conductors. The increasing demand for smart appliances, and their continued path towards miniaturization, has also led to an increased demand for Tantalum (a highly corrosion and temperature resistant transition metal used in capacitors and semiconductors).

Now you are probably thinking, so what?

In the fast-paced world of technology, where materials like Lithium, Tin and Tantalum are increasingly in demand, and their supply security is becoming a top priority for the United States, Asia, and Europe, IberAmerican Lithium Corp (OTCQB: IBRLF; CBOE: IBER; FSE: W2C) presents a unique and strategic investment opportunity.

With the pending acquisition of the Penouta Project in Spain, IberAmerican Lithium Corp. (IberAmerican) is well-positioned to capitalize on the growing demand for critical minerals in the sustainable energy and EV markets.

In this investment thesis I will be covering why I think $IBRLF offers investors the potential for significant value creation and long-term growth, exploring not only their current assets, but their management team, operating environment, overall stock structure and valuation compared to peers.

Spartan’s Technical Analysis

IberAmerican Lithium Corp (OTCQB: IBRLF; CBOE: IBER; FSE: W2C)

- Idea: Long Speculation $IBRLF $0.14 – $0.18 (Starter Position)

- 1st Target Area: $0.24

- 2nd Target Area: $0.31

- Stops: $0.07

- Float: 94.25M

- Shares Outstanding: ~109.5M

- Insider & Institutional Ownership: 44.89%

- Strategic Investors & Management Ownership: ~55.6M

- Free Trading: ~38.5M (less strategic investors & management)

- Market Cap: 15.87M (USD) 22.99M (CAD)

- Warrants: $0.40 (~18.2M)

Note: $0.40 Warrants valid until September 1, 2026. Majority (40M) of founders common shares are locked up until March 1, 2026.

Just started trading on OTCQB in April 2024.

First target is $0.24 – that breaks, room to next target $0.31

As requested by the Spartan Community, here is also the Canadian Chart and my Technical Analysis on the Canadian Ticker of IberAmerican.

Idea: $0.18 – $0.22 (Starter Position)

1st Target Area: $0.28

2nd Target Area: $0.40

Stops: $0.10

Lovely range breakout on the daily alongside the TIN commodity chart with room back to the recent range highs. We break and hold the $0.28 level we have a straight shot back to all time high’s (ATH’s). With this new asset being vended in, IMO we can get there quite quickly as word get’s around and this starts to catch others attention.

SPARTAN’S INVESTMENT THESIS

Company Overview

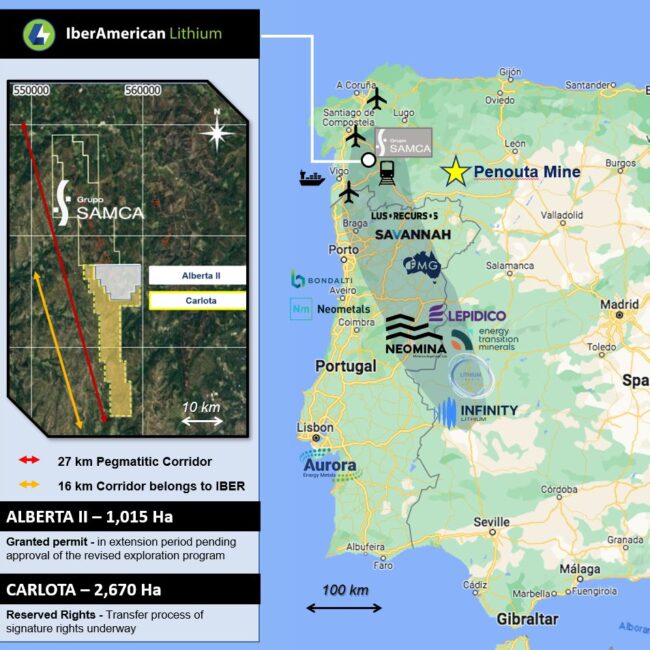

IberAmerican ($IBRLF) is a hard-rock lithium exploration company focused on advancing it’s highly prospective, 100% owned Alberta II & Carlota Properties located in the Galicia region of northwestern Spain, a favorable lithium district with world class infrastructure and a supportive / proactive mining jurisdiction.

Strategic Minerals Europe Corp (Strategic Minerals) wholly owned subsidiary, Strategic Minerals Spain, S.L. (SMS), produces, identifies, explores, and develops mineral resource properties critical to the green economy, predominantly in Spain. SMS holds permits and a production license for the Penouta Project and is the largest producer of Cassiterite concentrate and Tantalite in the European Union (EU). SMS has been recognized within the EU as an exemplary company of good practices in the circular economy and is well-positioned as a major producer of sustainable and conflict-free Tin, Tantalum, and Niobium.

On March 19, 2024, IberAmerican entered into a business combination agreement with Strategic Minerals, in which IberAmerican will acquire all of the issued and outstanding shares in the capital of Strategic Minerals (Proposed Transaction). The closing of the Proposed Transaction is expected to take place on or about June 15, 2024 – upon which IberAmerican intends to resume production at the Penouta Project, representing a rare opportunity to invest in a near-term cash flowing Tin-Tantalum mine in Spain.

You probably didn’t know: “Iber” is the short form of “Iberia” – referring to Spain and Portugal. It’s name derives from its ancient inhabitants whom the Greeks called Iberians.

Strategic Acquisition – Under Valued Distressed Asset

The Penouta Project stands out as a rare opportunity in the European mining landscape. Located in Spain, a first-world country with stringent regulatory standards, the mine offers a near-term cash flow potential that is unmatched by many of its counterparts.

The strategic location of the Penouta Project, coupled with various governmental initiatives aimed at enhancing the battery production capacity in Europe, positions IberAmerican favorably within the integrated Iberian battery value chain. This integration is expected to foster symbiotic relationships with major automotive and energy storage manufacturers, further bolstering the company’s market positioning and operational stability.

The potential acquisition of SMS (and subsequent Penouta Project) at a fraction of its true value presents $IBRLF with a significant value proposition.

This expansion is not merely an extension of quantity but a significant enhancement of the company’s quality and range of extractable minerals. The Penouta Project is renowned for its substantial deposits of Tin and Tantalum—elements essential for the burgeoning semiconductor industry, which is underpinned by an ever-increasing demand for more efficient and smaller electronic devices.

By acquiring the Penouta Project, IberAmerican not only gains exposure to the European Tin-Tantalum market, which is characterized by limited competition and growing demand, but will begin to play a key role in the EU supply chain. There are currently only a few active mines of Tin and Tantalum outside China, Indonesia and other emerging markets.

With supportive government initiatives in Spain aimed at promoting sustainable energy and electric vehicle production, $IBRLF is well-positioned to capitalize on the region’s burgeoning battery value chain. Additionally, geopolitical tensions and supply chain disruptions highlight the importance of stable and secure sources of these minerals, such as those provided by IberAmerican’s mining operations in geopolitically stable regions.

Spain’s Competitive Advantage

Spain’s favorable operating environment provides $IBRLF with a competitive edge in the mining sector. The country’s stable political climate, advanced infrastructure, and skilled labor force contribute to lower operational risks and streamlined production processes.

IMO, there are 8 key strategic advantages with IberAmerican’s project(s) being located in Spain:

1. Political & Economic Stability: As a member of the European Union, Spain offers a stable political and economic environment, which is crucial for long-term investment. This stability reduces the risks associated with political turmoil or economic volatility that can affect mining operations in other regions.

2. Supportive Regulatory Framework: Spain has a comprehensive legal and regulatory framework that governs mining activities. This framework is designed to ensure that mining operations are conducted safely, responsibly, and sustainably, adhering to high environmental and safety standards. Such regulations provide clarity and predictability for mining companies operating in the country.

3. Strategic Geographic Location: Spain’s location in Europe provides strategic advantages for accessing various markets across the continent. This is particularly important for the distribution of minerals that are critical for the technology and manufacturing sectors in Europe. Spain boasts well-developed infrastructure, including roads, ports, and airports, which facilitates efficient transportation and logistics.

4. Access to Skilled Workforce: Spain has a skilled workforce with expertise in various fields, including mining, engineering, and environmental management. Access to such human resources is vital for the efficient and innovative operation of mining activities.

5. EU Incentives and Initiatives: As part of the European Union, Spain benefits from various EU initiatives aimed at securing supply chains for critical minerals and supporting the development of technologies such as electric vehicles and renewable energy systems. These initiatives can offer financial and logistical support for mining operations.

6. Focus on Renewable Energy & Technological Innovation: Spain has made significant commitments to renewable energy and technological innovation, creating a demand for raw materials like tin and tantalum, which are used in advanced electronics and energy technologies. The alignment of mining operations with these national and European goals can facilitate support and collaboration.

7. Environmental Awareness & Sustainability Practices: The European emphasis on sustainability and environmental protection influences mining practices in Spain, ensuring that operations are conducted with a focus on minimizing environmental impact and enhancing social responsibility. This aligns with global trends towards sustainable development and can enhance the reputation and acceptance of mining projects.

8. Year-Round Operability: Unlike mines in regions subject to seasonal constraints, Penouta Project can operate year-round, maximizing production efficiency and revenue generation. This operational flexibility enhances $IBRLF ability to meet market demand and capitalize on favorable commodity prices.

Macro Outlook

The global macro outlook for Lithium, Tin and Tantalite remain quite positive, reflecting their crucial roles in various advanced technologies such as EV’s and semiconductors.

Known as the ‘spice metal’ because a little of it is found everywhere in ways that are essential to our quality of life, Tin is the best performing base metal on the LME so far this year; showing significant growth with a 20.41% increase since the start of 2024. Looking at the below 2-year Tin chart, Tin is breaking the range to the upside with room back toward $46K.

Despite fluctuations in Lithium prices, the demand for Lithium continues to grow as the global push towards electrification of transport strengthens. Lithium’s role is pivotal in achieving higher energy densities in EV batteries, which is essential for improving the range and performance of electric cars. The market’s need for lithium is expected to expand further as more automotive manufacturers commit to increasing their EV production.

Both minerals are seen as essential in the transition to greener technologies and are likely to remain in high demand. Policies and technological advancements in major economies, such as the continued development of EV infrastructure and increased renewable energy integration, are expected to support this trend.

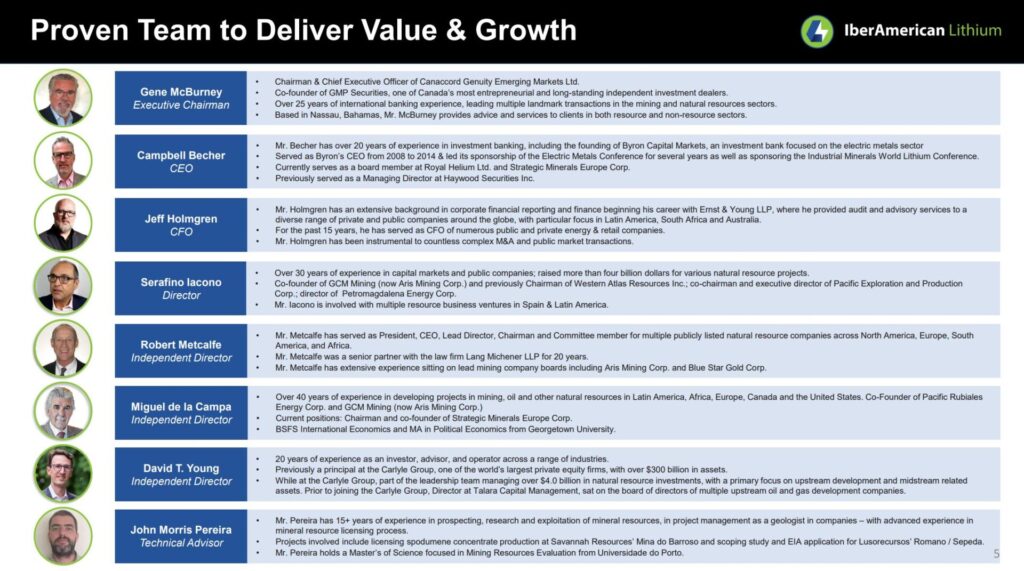

Experienced Management Team

IberAmerican’s management team, led by CEO Campbell Becher and Executive Chairman Gene McBurney, brings decades of experience in investment banking and the mining industry. Their in-depth knowledge of the sector, combined with their track record of successful deal-making, positions $IBRLF for strategic growth and value creation.

The management team’s proactive approach to addressing operational challenges and environmental concerns underscores their commitment to sustainable mining practices. By leveraging top legal and engineering expertise, $IBRLF aims to overcome obstacles and achieve operational excellence at the Penouta Project.

Valuation & Growth Potential

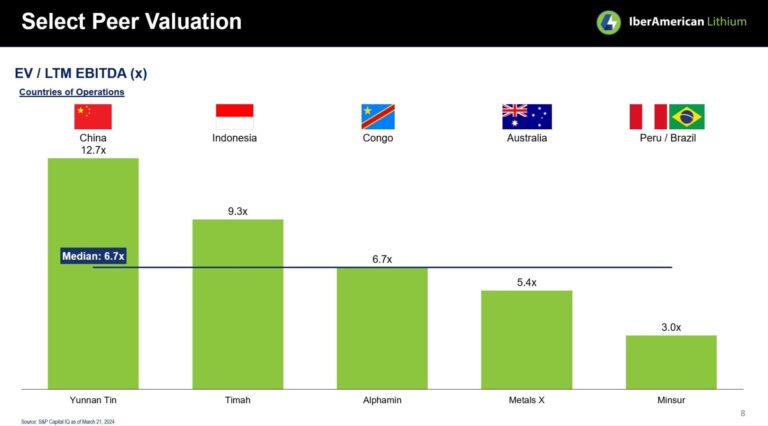

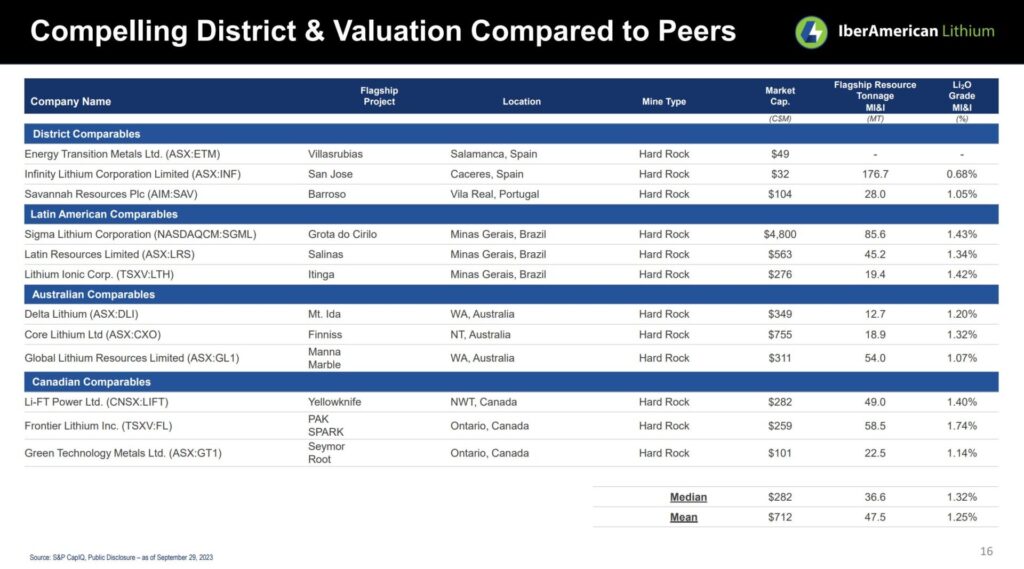

$IBRLF is currently significantly undervalued when compared to it’s peers. With a current Market Cap of 15.87M (USD) | 22.99M (CAD) – the acquisition of SMS (and its Penouta Project) below a 1x EBITDA represents a compelling valuation opportunity for investors. As production resumes and operational efficiencies are realized, $IBRLF market capitalization has the potential to appreciate significantly, reflecting the true value of its assets.

Comparing IberAmerican’s assets to its peers, operating in arguably less predictable countries / environments, IMO it’s most comparable valuation (based on the proposed 8M annual production figures leading to a 6.7X EBITDA) $IBRLF market cap could experience substantial growth, potentially doubling or tripling from current levels. This significant upside underscores the attractiveness of investing in $IBRLF at its current valuation. The below chart shows a direct comparison (and assumed undervaluation) of IberAmerican to its peer’s.

Financial Overview

IberAmerican has outlined a clear timeline for the acquisition and restart of operations at the Penouta Project. With shareholder approval scheduled for late May and operational restart targeted for on or about June 15, 2024, investors can expect near-term catalysts to drive value appreciation.

While $IBRLF current cash reserves and burn rate indicate the need for additional financing, the company’s previous successful IPO and availability of warrants at an attractive price provide avenues for capital raising. With prudent financial management and strategic allocation of resources, $IBRLF aims to fund its growth initiatives while minimizing dilution for shareholders.

Share Structure:

- Float: 94.25M

- Shares Outstanding: ~109.5M

- Insider & Institutional Ownership: 44.89%

- Strategic Investors & Management Ownership: ~55.6M

- Free Trading: ~38.5M (less strategic investors & management)

- Market Cap: 15.87M (USD) 22.99M (CAD)

- Warrants: $0.40 (~18.2M)

Note: $0.40 Warrants valid until September 1, 2026. Majority (40M) of founders common shares are locked up until March 1, 2026.

Conclusion – Capitalizing on Growing Demand

IberAmerican represents a compelling investment opportunity in the European Tin-Tantalum mining sector. With the pending acquisition of SMS and it’s Penouta Project, $IBRLF is well-positioned to capitalize on the growing demand for critical minerals in the sustainable energy and electric vehicle markets. Backed by an experienced management team, favorable operating conditions, and a clear execution plan, $IBRLF offers investors the potential for significant value creation and long-term growth. As the company progresses towards operational restart and production ramp-up, investors have the opportunity to participate in $IBRLF journey towards unlocking the full potential of its strategic assets.

IberAmerican Lithium Corp (OTCQB: IBRLF; CBOE: IBER; FSE: W2C)

- Idea: Long Speculation $IBRLF $0.14 – $0.18 (Starter Position)

- 1st Target Area: $0.24

- 2nd Target Area: $0.31

- Stops: $0.07

Spartan (aka ‘Chris’)

Stay up to date with Spartan’s Weekly Newsletter

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by IberAmerican Lithium Corp (IC) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared by or on behalf of IC. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by IC (OTCQB:IBRLF) to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from IC. Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc an affiliate of Spartan Trading Inc. has a three month agreement with IC (OTCQB:IBRLF) for the sum of two hundred and fifty thousand united states dollars. This agreement is for consulting and or marketing of IC (OTCQB:IBRLF) which services include the issuance of this release and other opinions that we release concerning of IC (OTCQB:IBRLF). Spartan Trading and affiliate Spark Newswire Inc has not investigated the background of IC (OTCQB:IBRLF) the hiring party. Anyone viewing this newsletter should assume IC (OTCQB:IBRLF) or affiliates of IC (OTCQB:IBRLF) own shares of IC (OTCQB:IBRLF) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading and affiliate Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements of IC (OTCQB:IBRLF).