DENISON BACKED & DRILL READY (NASDAQ: FMST)

Disseminated on behalf of

Foremost Clean Energy

DENISON BACKED & DRILL READY

FOREMOST CLEAN ENERGY – NASDAQ: FMST

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

There are moments in every investor’s cycle when macro trends, geopolitical catalysts, and a company’s structure align to create asymmetric upside. Foremost Clean Energy (NASDAQ: FMST) is one of those moments.

As the only Canadian uranium pure play listed on the Nasdaq, Foremost gives investors rare exposure to Tier-1 exploration assets in Saskatchewan’s Athabasca Basin — the world’s highest-grade uranium district.

Backed by Denison Mines (NYSE: DNN), Foremost controls 10 high-potential projects across 330,000+ acres, all within proximity of major discoveries like Cigar Lake and McArthur River. With a fully funded $6.5M drill program underway and historical intercepts up to 2.52% U₃O₈, the company is primed for a catalyst-rich year ahead.

But this isn’t the last uranium cycle — it’s a new chapter powered by AI, SMRs, and global decarbonization. The demand surge is real, and Foremost’s tight float, institutional backing, and peer-relative undervaluation make it one of the best-leveraged vehicles to ride it.

That’s why I’m re-adding $FMST to my long-term investment watchlist.

INVESTMENT THESIS

Company Overview

Foremost Clean Energy Ltd. (NASDAQ: FMST | CSE: FAT) is a rapidly growing North American uranium and lithium exploration company focused on advancing critical mineral assets in premier Canadian jurisdictions.

The company holds an option to earn up to a 70% interest in 10 prospective uranium properties—except for Hatchet Lake, where it can earn up to 51%—spanning over 330,000 acres in the prolific Athabasca Basin of northern Saskatchewan. These projects range from grassroots exploration to drill-ready targets with confirmed historical mineralization, all located near some of the highest-grade uranium deposits ever discovered.

Foremost’s uranium portfolio is being advanced in collaboration with Denison Mines, a strategic partner and 20% shareholder, under a fully funded $6.5M exploration program for 2025.

Complementing its uranium portfolio, Foremost also owns a suite of lithium projects in Manitoba and Quebec, covering over 50,000 acres, positioning the company for long-term growth in the clean energy sector.

As the global shift toward carbon-free baseload energy accelerates, Foremost offers investors rare exposure to a high-leverage, drill-ready explorer backed by institutional capital and operating in Tier-1 jurisdictions.

$FMST coming off the lows with volume, gap extension filled with room for continuation short term back into the upper end range of resistance here. In my opinion, highly skewed risk/reward setup.

Macro Tailwinds: Uranium at the Center of the Next Energy Supercycle

The International Energy Agency forecasts electricity demand to grow by 4.3% in 2024 — nearly double the rate seen in 2023 — and that trajectory is only accelerating as generative AI workloads and hyperscale data centers reshape energy consumption patterns.

AI servers alone are projected to consume up to 50 times more power than traditional systems, creating insatiable demand for stable, high-capacity baseload energy.

This has placed nuclear power — long sidelined in favor of intermittent renewables — back in the global spotlight. With a 92% capacity factor (versus 35% for wind and solar), nuclear energy is uniquely positioned to meet always-on, zero-emission power needs.

After a decade of underinvestment, uranium supply is critically short. Major mines have closed, exploration budgets were slashed, and stockpiles are dwindling. The World Nuclear Association now projects a widening supply gap that cannot be met without a dramatic increase in exploration success and mine development.

This confluence of rising demand and limited supply sets the stage for a sustained, multi-year bull market in uranium — and places $FMST in an ideal position to capitalize.

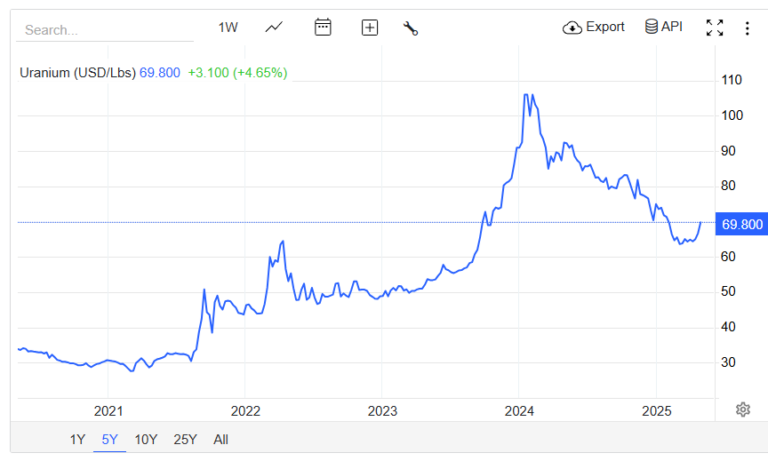

Global Price of Uranium

Uranium finally coming off the lows, all ema support reclaimed, downtrend broken and plenty of room for continuation to the upside short to long term here. Bodes well for all Uranium names especially $FMST.

Strategic Advantage: The Only Nasdaq-Listed Canadian Uranium Explorer

Foremost is uniquely positioned as the only Canadian uranium pure-play trading on the Nasdaq. This offers three distinct advantages that most junior explorers lack:

- Greater liquidity,

- Broader institutional access,

- Increased visibility among ESG-focused and U.S.-based investors.

Canada, and in particular the Athabasca Basin, is a politically stable, mining-friendly jurisdiction that produces approximately 15% of the world’s uranium. The region is globally recognized for its geological abundance, hosting deposits with grades that are 10 to 100 times higher than the global average.

Simply put, the Athabasca Basin is to uranium what Nevada is to gold — and Foremost Clean Energy Ltd. (NASDAQ: FMST | CSE: FAT) owns one of the largest unexplored portfolios in the area.

The company’s valuation remains disconnected from its strategic positioning.

While peers such as Atha Energy, CanAlaska Uranium, NexGen, and Fission Uranium trade at significantly higher market capitalizations, Foremost maintains comparable or better project diversification, exposure to high-grade corridors, and now, institutional credibility through its Denison partnership.

With only ~10.3 million shares outstanding and major insider and institutional backing, the company’s lean capital structure offers maximum leverage to positive exploration results and market re-rating.

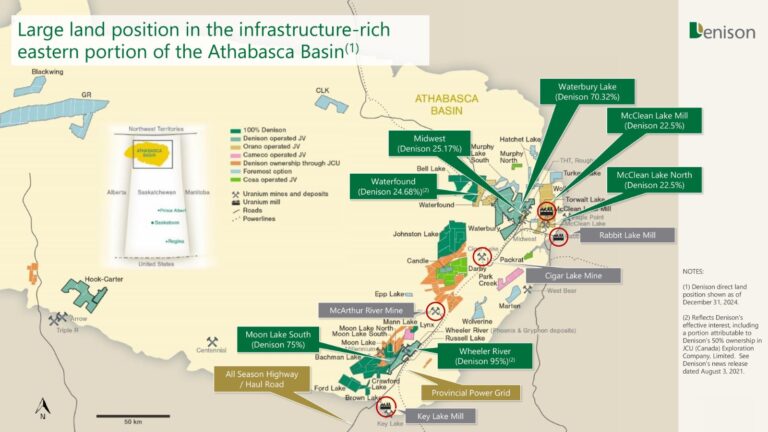

Tier-1 Partnership: Denison Mines as Strategic Anchor Investor

One of the most significant and underappreciated aspects of the Foremost story is its partnership with Denison Mines — a ~$1.3 billion market cap uranium developer with decades of operational experience in the Athabasca Basin. Denison is not just a passive investor; it led Foremost’s recent $10.5 million CAD financing and now owns approximately 20% of the company. Furthermore, Denison’s CEO, David Cates, has joined Foremost’s board of directors, lending both technical credibility and strategic alignment.

This relationship provides Foremost with far more than capital.

Denison brings deep technical bench strength, exploration expertise, and a proven discovery track record, including its success at the Wheeler River Project — one of the world’s highest-grade uranium deposits. Denison’s involvement significantly de-risks Foremost’s exploration efforts while adding validation that few junior companies can claim.

In a sector where credibility is critical and project execution can make or break value, the “Denison factor” is a clear differentiator.

Strategic Asset Portfolio: 10 High-Potential Uranium Projects

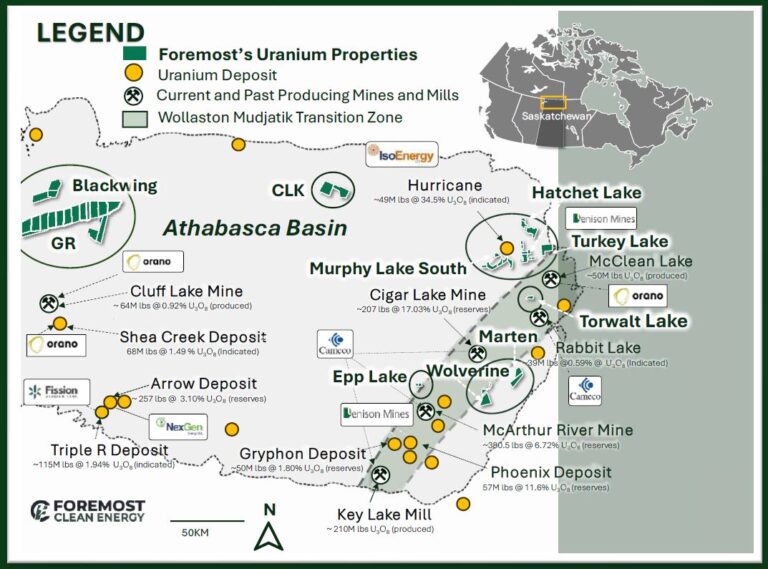

Foremost Clean Energy Ltd. (NASDAQ: FMST | CSE: FAT) asset base comprises 10 uranium exploration properties totaling over 330,000 acres in Saskatchewan’s Athabasca Basin, the world’s premier uranium district. These assets are strategically divided into two clusters: the Eastern Athabasca Uranium Properties and the Blue Sky Uranium Properties.

Eastern Athabasca Uranium Properties

This cluster includes seven properties: Hatchet Lake, Murphy Lake South, Turkey Lake, Torwalt, Marten, Wolverine, and Epp Lake. These projects are situated along the Wollaston-Mudjatik Transition Zone (WMTZ), a structural corridor hosting all of the Basin’s current uranium production. The proximity to existing infrastructure, including mills, power lines, and highways, enhances their development potential.

- Hatchet Lake: Foremost’s flagship project, Hatchet Lake, has demonstrated significant exploration potential. The 2024 drill program identified uranium mineralization at the Richardson and Tuning Fork target areas, with notable intercepts such as 0.11% U₃O₈ over 0.2 meters. These findings have set the stage for an expanded 2025 drill program aimed at testing extensions of known mineralization and new targets based on geophysical anomalies and geochemical signatures.

- Murphy Lake South: Comprising six mineral claims over 17,676 acres, Murphy Lake South is located approximately 30 kilometers northwest of the McClean Lake mill. The property lies near the La Rocque Lake Conductive Corridor, which hosts significant uranium deposits like Hurricane and Alligator. A two-phase drilling program totaling 1,500 meters is planned for 2025, targeting uranium mineralization along this corridor.

- Wolverine: The Wolverine property is scheduled for a geochemical survey in the summer of 2025. The survey aims to identify anomalies indicative of uranium mineralization, guiding future drilling efforts.

- Hatchet Lake: Foremost’s flagship project, Hatchet Lake, has demonstrated significant exploration potential. The 2024 drill program identified uranium mineralization at the Richardson and Tuning Fork target areas, with notable intercepts such as 0.11% U₃O₈ over 0.2 meters. These findings have set the stage for an expanded 2025 drill program aimed at testing extensions of known mineralization and new targets based on geophysical anomalies and geochemical signatures.

Blue Sky Uranium Properties

The Blue Sky cluster includes the GR, Blackwing, and CLK properties, located on the northern edge of the Athabasca Basin. These properties were staked in late 2023 and are situated along regional structures such as the Black Bay Fault and the Grease River Shear, known for hosting Beaverlodge-style uranium deposits.

- GR and Blackwing: These properties are undergoing airborne electromagnetic and magnetic surveys to identify conductive zones and structural features that may host uranium mineralization. The surveys will inform the design of future drilling programs.

- CLK: The CLK property, covering over 25,753 acres, is set for an airborne EM and magnetic survey, followed by a 2,000-meter diamond drilling program. The property is located near the Snowbird Tectonic Zone, a significant structural feature associated with uranium mineralization.

- GR and Blackwing: These properties are undergoing airborne electromagnetic and magnetic surveys to identify conductive zones and structural features that may host uranium mineralization. The surveys will inform the design of future drilling programs.

2025 Exploration Program: A Catalyst-Rich Campaign

Foremost Clean Energy Ltd. (NASDAQ: FMST | CSE: FAT) 2025 exploration program is a comprehensive, fully funded $6.5 million initiative targeting multiple properties across its portfolio. The program includes:

- Hatchet Lake: A 2,000-meter helicopter-supported diamond drill program commenced in early 2025, focusing on the Tuning Fork and Richardson target areas. The program aims to evaluate extensions of known mineralization and test new targets identified through geophysical and geochemical data.

- Murphy Lake South: A two-phase drilling program totaling 1,500 meters is planned, targeting uranium mineralization along the La Rocque Lake Conductive Corridor.

- CLK: An airborne EM and magnetic survey will precede a 2,000-meter diamond drilling program, aiming to test structural features associated with uranium mineralization.

- Wolverine: A geochemical survey is scheduled for the summer of 2025 to identify anomalies for future drilling.

- GR and Blackwing: Airborne electromagnetic and magnetic surveys are planned to delineate conductive zones and structural features for subsequent exploration.

- Hatchet Lake: A 2,000-meter helicopter-supported diamond drill program commenced in early 2025, focusing on the Tuning Fork and Richardson target areas. The program aims to evaluate extensions of known mineralization and test new targets identified through geophysical and geochemical data.

This aggressive exploration strategy, supported by Denison Mines’ technical expertise and financial backing, positions Foremost for potential discovery success and significant value creation in the near term.

Dual Commodity Exposure: Lithium Projects Provide Bonus Upside

In addition to its core uranium portfolio, $FMST also holds significant lithium assets in Manitoba under the “Lithium Lane” banner. These include the Zoro and Jean Lake properties — both of which have shown strong potential through historical sampling and recent drill intercepts.

With an inferred maiden resource, the Zoro property has returned excellent grades and drill-indicated widths up to 1.4% Li₂O over 49.8 meters, while Jean Lake has returned assays indicating both lithium and gold mineralization. These assets provide added optionality and clean energy leverage as lithium demand remains robust amid ongoing EV and battery growth.

Importantly, Manitoba offers a clean energy advantage of its own: the province is powered by 98% renewable energy. That makes lithium production from this region highly ESG-compliant — a valuable trait as automakers and battery manufacturers push toward traceable, low-carbon supply chains.

While uranium remains the primary focus, these lithium assets represent a valuable, low-cost call option for investors.

Geopolitical and Policy Tailwinds: Canada’s Clean Energy Advantage

Recent geopolitical developments have created a new strategic imperative for domestic critical mineral supply. In April 2025, the U.S. imposed sweeping tariffs on Chinese imports — prompting Beijing to retaliate by restricting the export of critical minerals, including uranium and rare earths. This escalating trade war has exposed serious vulnerabilities in Western supply chains and elevated the urgency of sourcing uranium from secure jurisdictions like Canada.

Canadian policy is also evolving to support this shift. The federal Critical Minerals Strategy, combined with intergovernmental efforts such as the Canada-U.S. Joint Action Plan, prioritizes the development of domestic uranium and lithium resources.

Ontario’s “One Project, One Process” legislation is aimed at cutting red tape by 50% for mining approvals. Meanwhile, the re-election of a Liberal government in 2025 has ensured continuity of pro-clean energy and pro-mining policies. In a world where energy and supply chain security are top priorities, Foremost’s Canadian footprint provides a strategic hedge and policy-aligned growth platform.

Valuation and Upside Potential

Foremost Clean Energy Ltd. (NASDAQ: FMST | CSE: FAT) trades at a deep discount to its intrinsic and peer-based valuation. Zacks Small-Cap Research recently issued a $5.45 USD price target on $FMST — implying more than 500% upside from current levels. With drilling already underway at Hatchet Lake, additional programs scheduled across multiple properties, and lithium exploration advancing in parallel, the company is entering a catalyst-rich period with the wind at its back.

This is a classic case of asymmetric risk-reward. Foremost’s lean share structure, strategic partner backing, high-grade targets, and near-term catalysts position it for significant re-rating as results come in.

As the world transitions into a nuclear-powered AI era, and as uranium becomes increasingly indispensable to energy security and decarbonization, Foremost Clean Energy Ltd. (NASDAQ: FMST | CSE: FAT) stands out as one of the best-leveraged early-stage opportunities in the market.

$FMST coming off the lows with volume, gap extension filled with room for continuation short term back into the upper end range of resistance here. In my opinion, highly skewed risk/reward setup.

Conclusion

Foremost Clean Energy Ltd. (NASDAQ: FMST | CSE: FAT) is a high-conviction investment in the uranium bull market, offering leveraged exposure to the clean energy transition.

Its unique Nasdaq listing, diversified Athabasca Basin portfolio, and Denison partnership position it as a standout among junior uranium explorers. With a fully funded 2025 exploration program, near-term catalysts, and geopolitical tailwinds, $FMST is poised for significant growth and re-rating.

Investors seeking exposure to nuclear energy’s pivotal role in powering AI, SMRs, and decarbonization should consider Foremost as a core portfolio holding.

Spartan (aka ‘Chris’)

Stay up to date with Spartan’s Weekly Newsletter

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by Foremost Clean Energy Ltd (FL) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared by or on behalf of FL. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com and affiliates www.ace-digital.ca makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by FL (NASDAQ:FMST) to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from FL. Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc an affiliate of Spartan Trading Inc. has a six week agreement with FL (NASDAQ:FMST) for the sum of seventy five thousand canadian dollars. This agreement is for consulting and or marketing of FL (NASDAQ:FMST) which services include the issuance of this release and other opinions that we release concerning of FL (NASDAQ:FMST). Spartan Trading an affiliate of Spark Newswire Inc has not investigated the background of FL (NASDAQ:FMST) the hiring party. Anyone viewing this newsletter should assume FL (NASDAQ:FMST) or affiliates of FL (NASDAQ:FMST) own shares of FL (NASDAQ:FMST) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading an affiliate of Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements.