THE GOLD STREAMING PLAY – NEVADA CANYON GOLD CORP (OTCQX: NGLD)

Disseminated on behalf of Nevada Canyon Gold

THE GOLD STREAMING PLAY

NEVADA CANYON GOLD CORP – OTCQX: NGLD

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

Gold has officially shattered the $3,000/oz milestone, solidifying its status as the ultimate safe-have asset in times of economic uncertainty. As inflation concerns mount and geopolitical tensions escalate, investors are flocking to gold-backed opportunities – but not all gold exposure is created equal.

Enter Nevada Canyon Gold Corp. (OTCQX: NGLD) – a company with a different approach to Gold Mining investsing.

Instead of the high-risk, capital intensive world of mining, $NGLD operates in the royalty and streaming sector, securing revenue from active gold projects without the operational burdens. With Nevada ranked among the world’s premier gold jurisdictions, Nevada Canyon Gold Corp. is strategically positioned to capitalize on the gold market’s historic rally while mitigating the risks faced by traditional miners.

As gold soars to new heights, investor focus is shifting towards companies primed to benefit from this momentum – and $NGLD is emerging as a standout player in this evolving landscape.

Why have I added Nevada Canyon Gold Corp. to my long-term investment watchlist?

With a strong management team, a well-positioned portfolio of high-potential assets, and an increasingly favorable macroeconomic environment for gold, $NGLD offers a compelling alternative to direct gold mining investments, with positive potential.

Spartan’s Technical Analysis

NEVADA CANYON GOLD CORP – OTCQX: NGLD

- Spartan’s Idea: Long Speculation $NGLD $1.05 – $1.30 (Starter Position)

- Spartan’s 1st Position Add Area: $1.32

- Spartan’s 1st Technical Resistance: $2.01

- Spartan’s 2nd Technical Resistance: $2.58

Share Structure Overview:

- Float: ~16M

- Shares Outstanding: ~27M

- Insider Ownership: ~30.86%

- Market Cap: $32.4M – as of March 18, 2025

Watching $NGLD for the downtrend break and 50EMA reclaim. With gold at all-time-highs (ATH) this name is lagging behind.

INVESTMENT THESIS

Company Overview

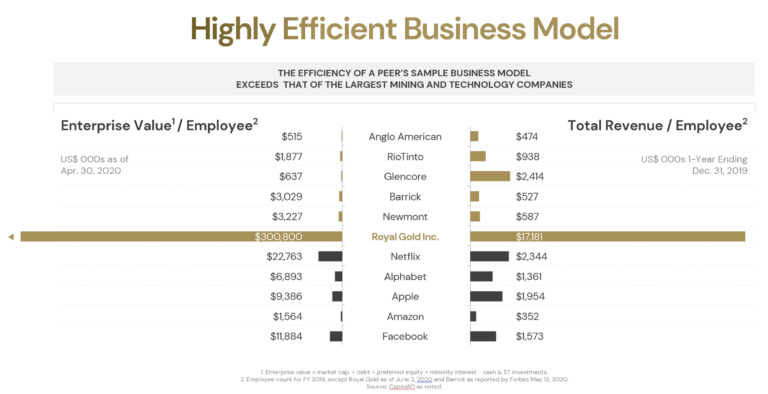

Nevada Canyon Gold Corp (OTCQX: NGLD) leverages a precious metal streaming business model, providing upfront capital to mining operators in exchange for a portion of their future precious metal production. This enables mining companies to fund exploration, development, and expansion without diluting their share structure or incurring debt.

What is a Precious Metal Stream? A precious metal stream is a purchase agreement where an investor provides upfront capital for the right to purchase a percentage of their gold production at a fixed, below-market price (often 80% below the market price). This model provides predictable cash flow and significant profit margins when gold prices rise.

For example, Nevada-based streaming companies have an average cash cost of $400 per gold equivalent ounce (GEO), netting cash operating margins exceeding ~$2,000 per ounce.

Why Nevada? The Premier Mining Jurisdiction

- Stable & Pro-Mining Regulatory Environment – Unlike mining operations in politically unstable regions, Nevada provides regulatory certainty and a streamlined permitting process.

- Infrastructure & Skilled Workforce – Nevada has well-developed mining infrastructure, from roads to processing facilities, as well as a deep talent pool of experienced mining professionals.

- High-Quality Geology – The state is home to multiple world-class gold districts, including the prolific Carlin Trend, which has produced over 255 million ounces of gold to date.

- Stable & Pro-Mining Regulatory Environment – Unlike mining operations in politically unstable regions, Nevada provides regulatory certainty and a streamlined permitting process.

By focusing on royalty and streaming assets in Nevada, $NGLD ensures its portfolio is positioned in a tier-one mining jurisdiction with long-term production potential.

Nevada Canyon Gold’s Asset Portfolio: Strong Upside Potential

Exploration Accelerator Projects

Nevada Canyon Gold’s “Exploration Accelerator Model” focuses on acquiring undervalued or underdeveloped mineral properties, investing in exploration, and ultimately monetizing them through partnerships, joint ventures, or royalty retention. These projects are located in high-potential, historically productive gold districts.

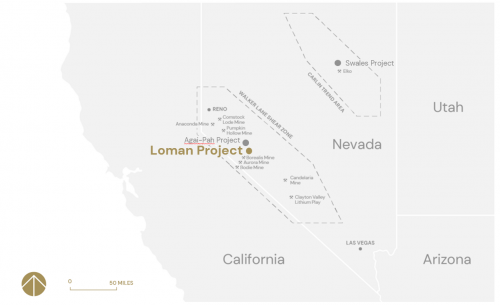

1. Loman Project (Mineral County, Nevada)

- Location: Walker Lane Shear Zone, Nevada

- Size: 600-acre past-producing gold and copper project

- Highlights: Located near the Pamlico Project and multiple historic gold mines, this property has strong geological indicators of high-grade mineralization. Phase I exploration has been completed, including reconnaissance prospecting, geological mapping, and surface sampling.

2. Swales Property (Elko County, Nevada)

- Location: Carlin Trend, Nevada—one of the world’s most prolific gold-producing regions

- Size: 40 unpatented mining claims covering 800 acres

- Highlights:

- Located near Nevada Gold Mines’ Goldstrike Mine (~100M ounces produced)

- Geological setting highly favorable for Carlin-type gold deposits

- Phase I exploration included prospecting, mapping, and surface sampling, with Phase II planned for geophysical surveys

3. Agai-Pah Property (Mineral County, Nevada)

- Location: Walker Lane Shear Zone, Nevada

- Size: 400 acres of unpatented mining claims

- Historical Significance: Property has a history of high-grade silver, copper, gold, lead, and zinc mining

- Current Exploration: Initial programs included geological mapping and surface sampling, with potential for expansion

4. Belshazzar Property (Boise County, Idaho)

- Location: Quartzburg Mining District, Idaho

- Historical Significance: A past-producing high-grade gold deposit with extensive underground workings

- Potential: Features multiple past-producing veins with modern exploration potential, with room for resource expansion

Royalties & Streaming Portfolio

In addition to its exploration projects, $NGLD holds a diverse royalty and streaming portfolio in high-value gold districts, ensuring long-term revenue potential while avoiding the capital expenditures of direct mining.

1. Lapon Canyon Royalty (Walker Lane, Nevada)

- Operator: Walker River Resources Corp.

- Royalty: 3% NSR (Net Smelter Return) royalty

- Project Highlights:

- High-grade epithermal gold system

- Drill results include 77 g/t Au over 4.5m and 122m at 1.89 g/t Au, showing both high-grade veins and bulk-tonnage potential.

2. Palmetto Royalty (Walker Lane, Nevada)

- Operator: Smooth Rock Ventures Corp.

- Royalty: 2% NSR

- Project Highlights:

- Existing Inferred Resource of ~353,000 oz AuEq (1.0 g/t Au)

- Potential for expansion to 1M oz with further drilling

3. Pikes Peak Royalty (Walker Lane, Nevada)

- Operator: Walker River Resources Corp.

- Royalty: 2% NSR

- Project Highlights:

- Early-stage gold-copper project with high-grade rock samples (up to 9 g/t Au and 2.2% Cu)

- Potential for large-scale porphyry system

4. Olinghouse Royalty (Washoe County, Nevada)

- Operator: Lake Mountain Mining LLC

- Royalty: 1% production royalty

- Project Highlights:

- Past-producing mine with a historic resource of ~695,000 oz gold

- Located 30 miles from Reno, with potential for resource expansion and future production restart

5. Lapon Canyon Stream Exploration Earn-in (Walker Lane, Nevada)

- Operator: Walker River Resources Corp.

- Structure: Up to 50% earn-in agreement through $5M in funding over three years

- Project Highlights:

- $NGLD gains exploration control to advance the project, define resources, and conduct economic assessments

- Includes an exclusive royalty agreement for long-term revenue upside

Valuation & Exit Strategy: Unlocking True Shareholder Value

As Nevada Canyon Gold Corp’s assets continue to mature, one can only assume that $NGLD plans to package its portfolio for acquisition by industry leaders like Franco-Nevada (NYSE: FNV), Wheaton Precious Metals (NYSE: WPM), and Royal Gold (NASDAQ: RGLD) or through individual asset sales to miners expanding production.

Major royalty firms seek established or near-production royalties, making Nevada Canyon Gold Corp’s growing portfolio a potential acquisition target. This may provide a high-return potential for early investors as the company’s value is driven by asset appreciation rather than costly mine development, providing a lower risk exist strategy compared to traditional mining investments.

Additionally, by retaining select royalties, Nevada Canyon Gold Corp has the potential to generate sustainable long-term cash flow and even future dividend payouts, offering investors both near-term upside and lasting value creation in a rising gold market.

By maximizing royalty value and targeting strategic buyouts, $NGLD is positioning itself as a premier growth opportunity in the gold royalty sector.

Technicals

Watching $NGLD for the downtrend break and 50EMA reclaim. With gold at all-time-highs (ATH) this name is lagging behind.

Conclusion

Nevada Canyon Gold Corp (OTCQX: NGLD) offers a lower risk exit strategy compared to traditional mining investments. By focusing on royalty and streaming acquisitions, $NGLD avoids the high costs and operational risks of mining while benefiting from the gold sector’s continued growth.

As a growth-stage royalty and streaming company, Nevada Canyon Gold has the potential to deliver value creation as its assets mature. Investors looking for high-margin exposure to gold without the operational risks of mining should consider $NGLD as a strategic play on the ongoing $3,000/oz gold bull market.

NEVADA CANYON GOLD CORP – OTCQX: NGLD

- Spartan’s Idea: Long Speculation $NGLD $1.05 – $1.30 (Starter Position)

- Spartan’s 1st Position Add Area: $1.32

- Spartan’s 1st Technical Resistance: $2.01

- Spartan’s 2nd Technical Resistance: $2.58

Share Structure Overview:

- Float: ~16M

- Shares Outstanding: ~27M

- Insider Ownership: ~30.86%

- Market Cap: $32.4M – as of March 18, 2025

Spartan (aka ‘Chris’)

Stay up to date with Spartan’s Weekly Newsletter

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by Nevada Canyon Gold Corp (NC) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared by or on behalf of NC. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com and affiliates www.ace-digital.ca makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by NC (OTCQX:NGLD) to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from NC. Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc an affiliate of Spartan Trading Inc. has a six month agreement with NC (OTCQX:NGLD) for the sum of three hundred thousand dollars. This agreement is for consulting and or marketing of NC (OTCQX:NGLD) which services include the issuance of this release and other opinions that we release concerning of NC (OTCQX:NGLD). Spartan Trading an affiliate of Spark Newswire Inc has not investigated the background of NC (OTCQX:NGLD) the hiring party. Anyone viewing this newsletter should assume NC (OTCQX:NGLD) or affiliates of NC (OTCQX:NGLD) own shares of NC (OTCQX:NGLD) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading an affiliate of Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements.