What is Ortex and How to Use It?

Investment analytics tools like Ortex have become indispensable in today’s financial industry. They offer a comprehensive range of data sets, including short-interest data. Such tools allow investors to track stock scores and analyze market trends like volatility and interest rates with precision. Users can gain access to essential information on hedge funds, ensuring they are well-equipped to make informed decisions.

At Spartan Trading, we specialize in online stock and option idea generation services. We understand the importance of reliable investment tools and provide a detailed guide on using the tool effectively. We aim to empower our community with insights into various market dynamics, including bitcoin value fluctuations, EPS changes, and the overall market volatility that impacts stocks.

Utilizing insights from our in-depth research and analysis, we’ve compiled this guide that explores key features of Ortex, from how to start using it to understanding its pricing plans and options. We’ll delve into its pros and cons, user reviews, and comparisons with alternatives available. Afterward, you will understand how this tool can enhance your trading strategy for data analysis and ensure you stay ahead in a volatile market.

Let’s dive in!

What is Ortex?

Ortex is a leading platform in financial analytics, delivering comprehensive short-interest data and predictive trading signals. This tool provides investors with real-time insights and historical data across various securities listed on the NYSE and Nasdaq. Its dataset monitors market dynamics and understands stock behaviors through detailed analytics and trading indicators.

Here are the use cases of Ortex:

- Short Interest Tracking: The platform excels at offering up-to-date short interest data, which is crucial for assessing market sentiment and potential short squeeze opportunities.

- Trading Signals: Ortex generates reliable trading signals based on EPS, RSI, MACD, and other metrics to inform trading decisions.

- Market Analysis: Users leverage it for comprehensive analyses of market trends, particularly noting movements on Thursdays when markets can show significant activity.

- Programming Integration: With Python compatibility, it allows advanced data manipulation and customized analytics, making it ideal for tech-savvy traders and developers.

- Subscription Services: The tool offers various subscription plans that cater to different user needs, from casual investors to professional traders in Europe and globally.

Ortex equips users to decide whether to trade on the NYSE or Nasdaq or focus on European markets. A subscription to the platform offers valuable insights that can help you navigate the complexities of today’s financial landscapes.

How to Use Ortex for Advanced Financial Analysis

Understanding how to use Ortex efficiently can significantly enhance your trading strategies through detailed market analytics and data insights. Here’s a step-by-step guide to help you navigate the platform, ensuring you make the most of its extensive features for smarter trading decisions.

Step 1: Set Up Your Ortex Account

Start by creating an account on the platform. Visit the Ortex website and click “Join for free” to register. You must provide basic information such as your name, email address, and a secure password. Once registered, consider upgrading your account to access more detailed features, tools, and resources, which are crucial for deep market analysis.

Step 2: Navigate the Dashboard

After logging in, familiarize yourself with its dashboard. Here, you’ll find quick access to critical features such as Short Interest data, market analytics, and trading signals. The dashboard is designed to provide a comprehensive overview of the market. Explore sections like “Live Pricing” or “Index Rebalance” to understand how they can aid your investment strategies.

Step 3: Utilize Available Resources and Tools

Ortex offers a range of tools for different aspects of market analysis. Use the “Short Interest” section to view detailed reports about the market sentiment toward particular stocks. Utilizing these resources is crucial for identifying potential short-squeeze opportunities. Additionally, explore the “Options” and “Dividend Forecast” tools to plan investments based on upcoming company actions and market conditions.

Step 4: Apply Trading Signals

One of the platform’s standout features is its trading signals based on algorithmic predictions and market indicators such as EPS, RSI, and MACD. These signals guide you on when to buy or sell stocks. To use them effectively, check the “Trading Signals” section daily and analyze the historical success rate and average returns of these signals. This will help you make informed decisions based on past performance and market trends.

Step 5: Monitor and Adjust Your Portfolio

Once you start investing, consistently monitor your portfolio through its portfolio tracker. This tool allows you to see real-time updates and assess the performance of your stocks. It also offers insights into how market changes affect your investments. Adjust your portfolio based on the data and analysis provided, ensuring you stay aligned with your financial goals and market movements.

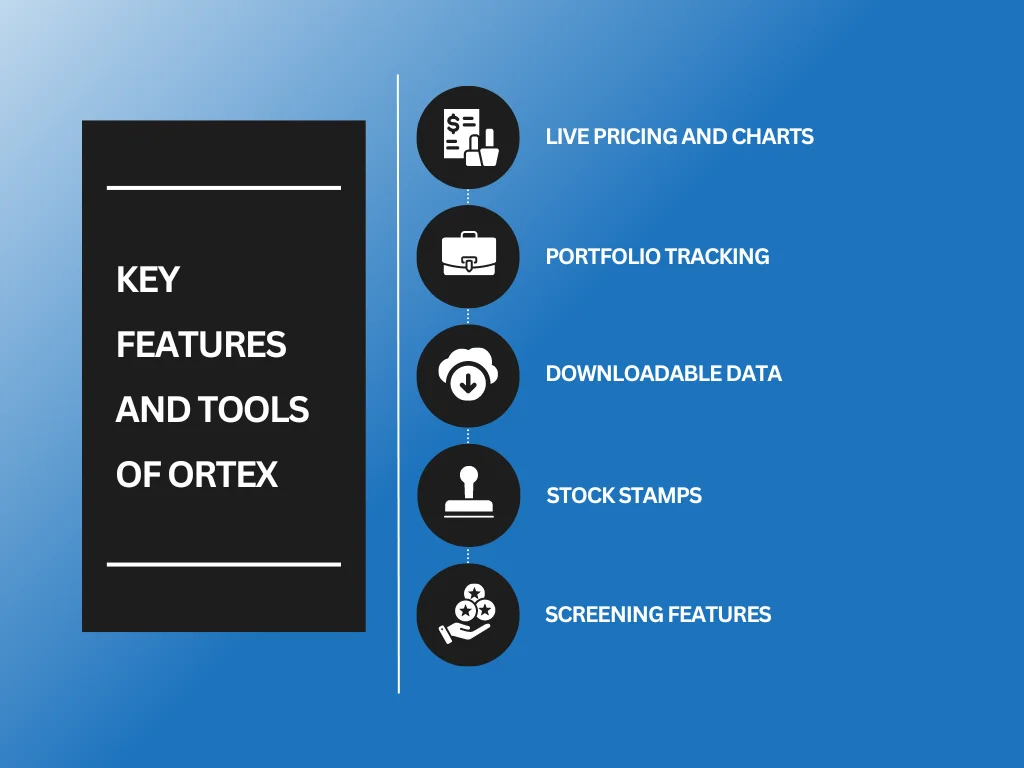

Key Features and Tools of Ortex

Ortex stands out in financial analytics with its comprehensive features and tools for in-depth stock market analysis. This platform supports traders and investors by providing essential data for informed decision-making. Below, we explore some notable functionalities that make it a preferred choice among financial professionals.

Live Pricing and Charts

Ortex offers real-time pricing information across various markets, including global equity prices, indexes, ETFs, commodities, and currencies. Users benefit from up-to-the-minute data, helping them react swiftly to market changes. The platform’s flexible charting tools allow for customized visual data representation, making complex information easier to understand and analyze.

Portfolio Tracking

Investors can monitor their portfolios with its tracking features. The platform tracks portfolio performance and syncs with brokerage accounts, providing a seamless view of investments. This integration helps users manage their assets effectively, offering insights into portfolio health and performance metrics.

Downloadable Data

Its vast data library, which includes information on stock performance, market trends, and other financial metrics, is fully downloadable. This feature ensures that users can access and analyze data offline, tailor reports, and perform personalized data analysis, catering to specific investment strategies or research needs.

Stock Stamps

For a quick overview of financial data, it uses ‘Stock Stamps’—intuitive boxes summarizing key information for each stock. These stamps highlight significant events or changes, enabling users to scan through critical data points without delving into detailed reports. This tool is handy for investors who must make quick, informed decisions based on the latest market developments.

Screening Features

The platform offers flexible screening options on various unique data sets. This feature lets users discover investment opportunities by filtering data according to specific criteria such as geography, sector, size, liquidity, and yield. The screening tool is powerful for identifying stocks that meet precise investment parameters and enhancing strategy-building.

Pros and Cons of Using Ortex

When considering any financial analytics tool, weighing its benefits and drawbacks is crucial. Ortex, a well-known platform in the investment community, offers several advantages and some limitations. Here, we explore these aspects based on user reviews and general functionality.

Pros of Using Ortex

Ortex provides several significant benefits that enhance trading and investment analysis:

- Real-Time Data Access: The tool offers up-to-the-minute data, crucial for making informed trading decisions in a volatile market. Users appreciate the timely updates that help them stay ahead in fast-moving markets.

- Comprehensive Market Analysis Tools: The platform includes various tools for analyzing market trends, short interest, and other vital financial metrics. Users find these tools invaluable for examining market behavior in depth.

- User-Friendly Interface: Many users find the tool interface accessible and easy to navigate. This usability allows novice and experienced traders to extract the needed information without a steep learning curve.

- Supportive Customer Service: Ortex is known for its responsive customer service. Users report quick and helpful responses to inquiries, which enhances their overall experience and satisfaction with the platform.

- Wide Range of Features: From detailed short interest reports to predictive analytics, it offers a broad spectrum of features that cater to diverse trading strategies and preferences, making it a versatile tool for many investors.

Cons of Using Ortex

Despite its strengths, Ortex has several drawbacks that potential users should consider:

- Cost: Some users find it relatively expensive, especially those new to trading or with limited budgets. The cost can be a barrier for individual investors who do not require extensive analytical tools.

- Complexity for Beginners: While the tool offers many features, the sheer amount of data and tools can overwhelm beginners who have yet to familiar with its advanced trading analytics.

- Occasional Data Accuracy Issues: A few users have reported instances where the data provided by Ortex was inaccurate or delayed, which can lead to missed opportunities or misinformed decisions.

- Forced Software Updates: Some users dislike being forced to download new software updates or mobile apps, preferring to use the platform via a straightforward website interface.

- Mixed Reviews on Effectiveness of Trading Signals: The effectiveness of its trading signals receives mixed reviews. Some traders find them valuable, while others consider them unreliable and not worth the investment.

Ortex Alternatives

Ortex is known for comprehensive financial analytics and is a cornerstone for investors seeking data-driven insights. However, exploring some of its alternatives provides diverse perspectives and features:

1. ChartExchange – Best for In-Depth Market Research

ChartExchange is renowned for its detailed market research tools and technical analysis capabilities, catering mainly to professional traders and financial analysts. They provide real-time market data and trend insights, making them ideal for those who depend on up-to-the-minute information to guide their trading decisions.

ChartExchange sets itself apart by integrating a wide range of asset classes and providing a mobile-as-default platform, ensuring optimal functionality across all devices. Their commitment to performance is evident in the fast, seamless access they offer to complex market data. It is particularly beneficial for traders who operate in dynamic, fast-paced market environments.

Notable Features of Using ChartExchange

- Extensive Market Coverage: ChartExchange offers comprehensive coverage of various asset classes, ensuring users can access broad market data.

- Optimized for Speed: The platform is designed for high performance, crucial for trading environments where speed translates to opportunity.

- Mobile Compatibility: Fully optimized for mobile devices, ChartExchange allows traders to conduct research and make decisions on the go.

- User-Friendly Interface: Designed to be intuitive, the platform provides easy navigation through complex data.

ChartExchange Pricing Plans

ChartExchange offers three distinct pricing plans:

- Investor: Priced at $13.70 monthly, this plan offers extended history on web charts and tables.

- Level2View: At $11.65 monthly, it enhances the order book and market depth tool with additional features.

- API: For $18.85 per month, users can access a comprehensive API that includes various data sets and historical options.

ChartExchange is particularly beneficial for day traders, financial analysts, and anyone involved in cryptocurrency and forex markets. The platform’s detailed data and high-speed functionality make it an excellent tool for making quick, informed decisions based on comprehensive market insights.

2. Chaikin Analytics – Best for Predictive Stock Ratings

Chaikin Analytics excels in providing predictive analytics and stock ratings, helping traders and investors anticipate market movements. They specialize in the Chaikin Power Gauge, a tool that evaluates the potential performance of stocks over the next three to six months, making it highly valuable for strategic decision-making.

Chaikin Analytics sets itself apart with its proprietary Power Gauge rating, developed by Wall Street veteran Marc Chaikin. This system uniquely combines 20 factors to predict stock performance, offering insights not readily available on other platforms. Additionally, their integration of the Chaikin Money Flow Indicator into the platform allows users to visualize buying and selling pressure, enhancing their trading strategies.

Notable Features of Using Chaikin Analytics

- Power Gauge Rating: Provides a comprehensive assessment of stock potential, helping users make informed investment decisions.

- Chaikin Money Flow: An indicator that helps users identify the strength of buying and selling pressures on stocks.

- PowerFeed Newsletter: This newsletter delivers daily market insights and stock tips to users’ emails, offering actionable trading ideas.

- Educational Resources: Offers a range of articles and tools to help users understand market dynamics and improve their trading skills.

Chaikin Analytics Pricing Plans

Chaikin Analytics provides detailed information on their pricing plans, which include:

- Power Gauge Investor: This plan, priced at $5,000 annually, includes access to the Power Gauge system and monthly stock picks.

- PowerTactics: Also at $5,000 annually, this subscription focuses on tactical trades and market strategies.

- Market Insights: For $999 per year, users receive Marc Chaikin’s analysis and perspectives on the market.

Chaikin Analytics is beneficial for investors and traders who rely on thorough research and predictive analytics to guide their stock selections. Utilizing this platform leads to an edge in the stock market by using advanced analytics to forecast stock movements and trends.

3. Opensee – Best for Risk Data Aggregation

Opensee excels in aggregating and analyzing risk data, earning accolades as the best Risk Data Aggregation initiative for three consecutive years. They specialize in real-time analytics and data management tailored for financial institutions, distinguishing themselves with a platform that integrates these elements seamlessly at scale.

Opensee stands out for its dedicated focus on financial institutions, combining advanced real-time analytics with scalable data management. This unique blend allows users to access and explain all their ESG data effectively, which is a capability that few other platforms offer. Opensee is also recognized for its comprehensive approach to managing various financial risks, including market, credit, and liquidity.

Notable Features of Using Opensee

- Integrated Data Management: Opensee provides a holistic environment where data ingestion, quality monitoring, storage, and analysis occur seamlessly.

- Real-Time Analytics: The platform ensures up-to-date data analysis, enabling timely and informed decision-making.

- Advanced Simulation Capabilities: Users can run detailed simulations on their P&L, enhancing their understanding of potential financial exposures.

- ESG Data Handling: Opensee excels in managing and analyzing ESG-related data, helping institutions stay ahead of regulatory changes.

Opensee Pricing Plans

Opensee offers tailored pricing plans based on financial institution’s specific needs and scale. These details are typically customized, so potential clients are encouraged to contact Opensee directly for the most accurate and relevant pricing information.

Opensee is ideal for financial institutions involved in extensive risk management operations. Its platform serves risk managers, traders, and IT professionals who require detailed risk assessment and management tools. Opensee helps these professionals navigate complex financial landscapes more effectively by providing comprehensive and integrated solutions for risk data aggregation.

Key Takeaway

Choosing the right financial analytics tool can significantly enhance your trading outcomes. Whether logging activities in an option trade journal or developing long-term investment ideas, tools like Ortex equip you with the necessary analytics to make informed decisions. Each feature of Ortex supports different facets of financial analysis, enabling novices and seasoned investors to thrive in complex markets.

For more holistic trading outcomes, investors and beginners should consider enrolling in stock trading courses. These courses cover many topics, including what to look for in financial analytics tools. Engaging in a stock trading course can refine your strategy and expand your understanding of the market, ensuring you make the most of tools like Ortex.

Is your trading strategy as robust as it could be? Spartan Trading will guide you through the complexities of market analysis to expand your trading expertise. Subscribe to our newsletter for insights and updates on the best tools and courses to enhance your trading skills today.