What is a Credit Spread? Options Strategy Guide for 2024

Understanding various strategies in options trading is crucial for success. Knowing what is a credit spread can significantly enhance your decision-making process. A credit spread is a popular options trading strategy where a trader simultaneously buys and sells options of the same class but at different strike prices, aiming to net a credit to their account. This strategy is particularly effective under varying market conditions and can help manage credit risk while targeting maximum profit.

At Spartan Trading, we specialize in online stock and option idea generation. To provide tailored investment strategies, we analyze corporate bond markets, economic conditions, and credit quality. Our focus includes options trading and insights into government bonds and corporate debt to enhance our clients’ understanding of the financial world.

Leveraging our comprehensive analysis, we’ve compiled this guide that explores the strategic deployment of credit spreads in varying economic conditions. We will delve deeper into what is a credit spread, exploring its variations, advantages, and potential pitfalls. Afterward, you will gain insights into using credit spreads effectively, aligning them with your situation for informed investment decisions.

Let’s dive in!

What is a Credit Spread?

A credit spread is a trading strategy primarily used in the options market. It involves simultaneously buying and selling options of the same class and expiration but different strike prices. Understanding what is a credit spread helps traders looking to enhance their portfolio’s risk or reward profile.

A credit spread benefits traders from stable market conditions and predictable security price movements. It requires a nuanced understanding of market dynamics, including expected market volatility and underlying asset behavior. When executed correctly, credit spreads can provide a conservative yet effective means of generating income while offering a defined risk limit.

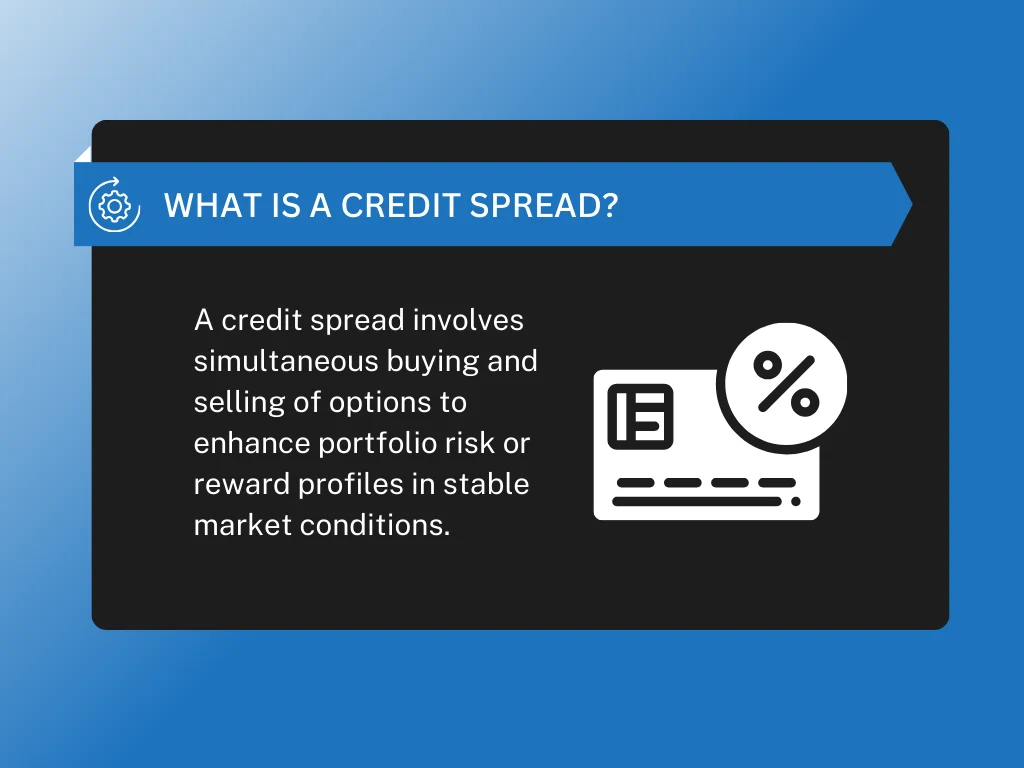

How Do Credit Spreads Work?

Understanding how credit spreads work is essential for anyone looking to diversify their investment strategy through options trading. Here, we will explore the five key components that illustrate how credit spreads function effectively.

1. Strike Price

The strike price in an option contract determines when the option is exercised profitably. Selecting the appropriate strike price is fundamental to maximizing the effectiveness of a credit spread strategy. Here are the things to consider in selecting the right strike price:

- Analyze Market Conditions: Understand whether the market is bullish or bearish so that you can choose appropriate strike prices for your credit spread.

- Consider Probability of Success: Higher strike prices for call options or lower strike prices for put options generally increase the probability of successful trades.

- Balance Risk and Returns: Select strike prices that favorably balance risk and potential gains.

- Adjust Based on Volatility: Higher market volatility might require adjusting strike prices to accommodate more significant price swings.

- Use Technical and Fundamental Analysis: Base strike price decisions on thorough analysis to enhance the potential success of the trade.

Choosing the right strike price is crucial for the success of credit spreads. It requires a good understanding of market conditions and a strategic approach to balancing risk and return.

2. Expiration Date

The expiration date of an option is a significant factor in the setup of credit spreads. It affects the options’ time value and their premiums’ decay. Here are considerations in selecting the correct expiration date:

- Define Trading Goals: Short-term or long-term goals will influence the choice of expiration dates.

- Consider Market Conditions: Select an expiration date that aligns with expected market movements.

- Account for Time Decay: Options lose value as they approach expiration, which can be advantageous or disadvantageous based on your position.

- Adjust for Events: Be aware of upcoming events that could impact stock prices and adjust the expiration date accordingly.

- Evaluate Liquidity: Choose expiration dates that offer sufficient market liquidity to ensure smoother entry and exit from positions.

The choice of expiration date is critical in determining the success of credit spreads. It should align with the trader’s goals, market predictions, and the expected time decay of the options involved.

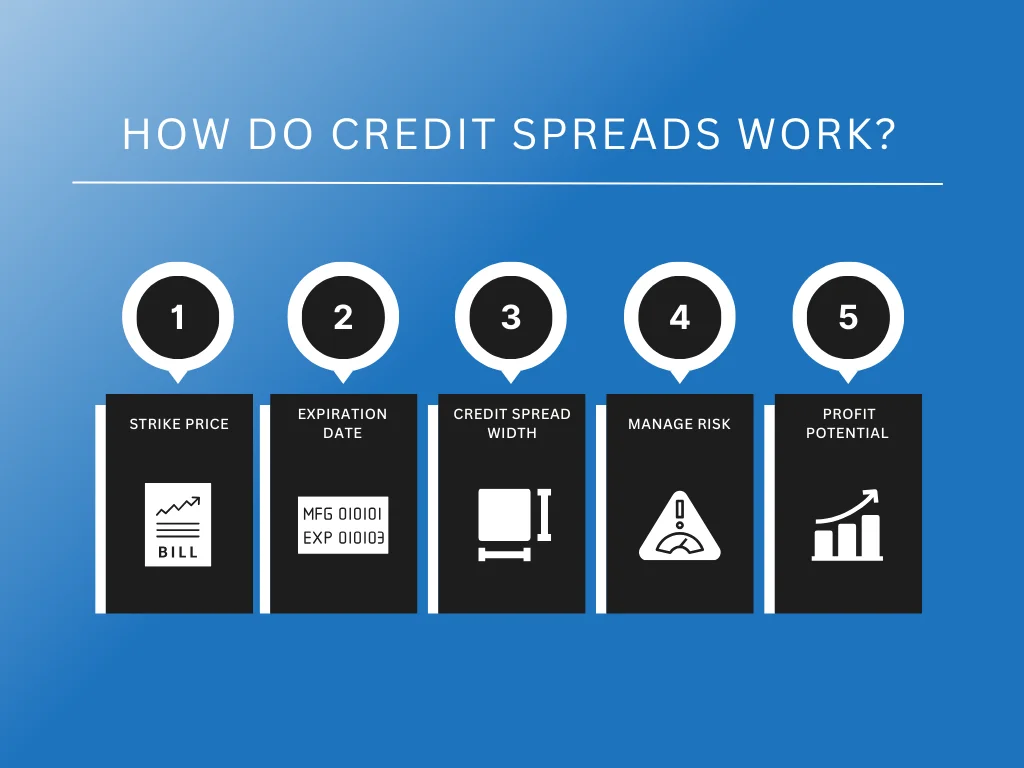

3. Credit Spread Width

Credit spread width refers to the difference in strike prices between the options bought and sold. This width directly impacts the risk and potential return of the spread. Here’s how you manage credit spread width:

- Determine Risk Tolerance: Wider spreads generally involve more risk but can offer higher returns.

- Analyze Reward Potential: Assess the potential profit against the risk taken.

- Use Market Analysis: Base the width on current market volatility and potential directional moves.

- Adjust According to Strategy: Wider or narrower spreads can be used depending on whether the strategy is aggressive or conservative.

- Monitor and Adjust: Regularly review the spread to adjust the width as market conditions change.

Effectively managing the width of a credit spread is vital to optimizing its performance. However, it requires a careful balance of risk, reward, and ongoing market analysis. Understanding and implementing these steps significantly enhance the effectiveness of a credit spread strategy in options trading.

4. Manage Risk

Risk management is a pivotal aspect of trading credit spreads. As you receive the premium upfront, your maximum gain is limited to the credit received. Conversely, your losses can exceed this amount if the market moves unfavorably. Effective risk management involves choosing the right strike prices and expiration dates, continuously monitoring market conditions, and adjusting your positions as necessary.

Additionally, setting stop-loss orders or deciding in advance when to close a position help limit potential losses. Understanding technical and fundamental market indicators can aid in making informed decisions about when to enter or exit a trade.

5. Profit Potential

The primary function of a credit spread is the ability to generate income through the premiums received. Your profit from a credit spread is the initial credit obtained after setting up the positions. This profit is realized if the options expire worthless or the spread narrows, allowing you to buy back the spread for less than the initial credit received.

Maximizing profit involves correctly predicting the market direction and actively managing the trade to mitigate losses. Savvy investors closely monitor market trends and adjust their strategies to align with current conditions.

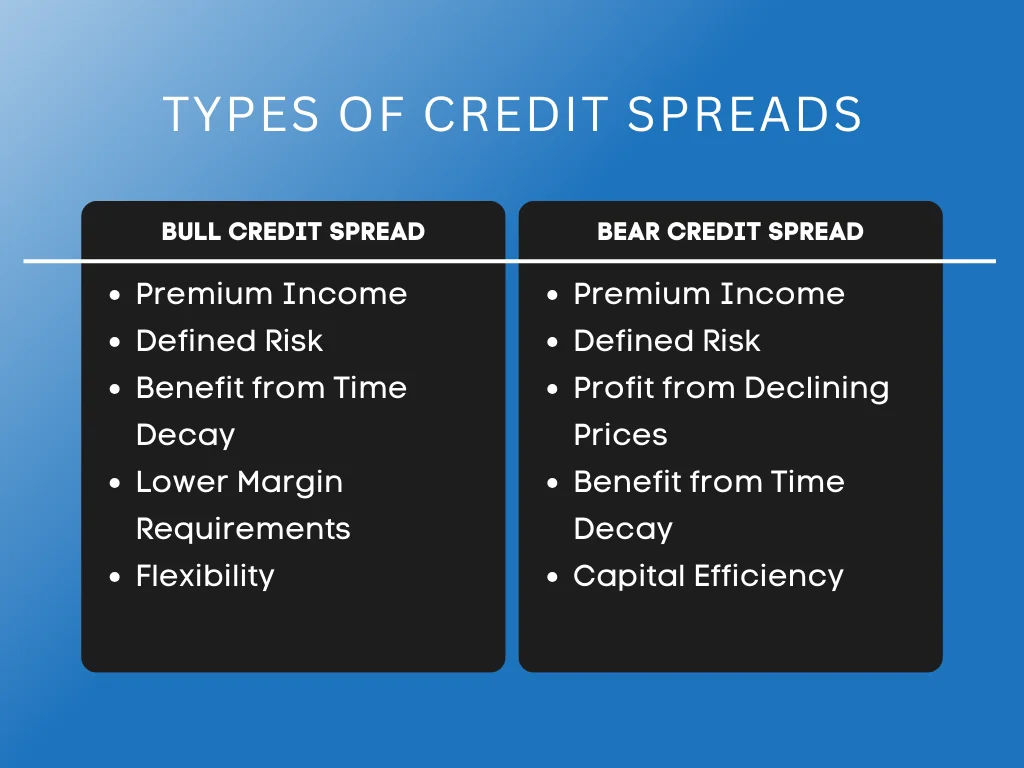

Types of Credit Spreads

Several types of credit spreads are employed in options trading. Credit spreads involve simultaneously buying and selling options of the same type (either calls or puts) but with different strike prices and the same expiration date. The goal is to limit potential losses while maximizing possible gains. Two types include:

Bull Credit Spread

A bull credit spread is an optimistic trading strategy used when a trader expects a moderate increase in the price of the underlying asset. This strategy typically involves selling a put option at a higher strike price and buying another put at a lower strike price, both with the same expiration date.

Here are the advantages of a bull credit spread:

- Premium Income: Traders earn upfront premiums from the options sold, which can provide a steady income stream.

- Defined Risk: The maximum possible loss is limited to the difference between strike prices minus the net premium received.

- Benefit from Time Decay: As expiration approaches, the value of the options decays, potentially increasing the profit if the stock price remains stable or rises.

- Lower Margin Requirements: Unlike other trading strategies, bull credit spreads often require lower margin investments.

- Flexibility: Traders can choose strike prices and expirations that match their market expectations and risk tolerance.

Overall, bull credit spreads offer an excellent way for traders to capitalize on slight upward movements in the underlying asset. With defined risks and the potential to earn premiums, this strategy suits traders looking to enhance their portfolio’s income potential.

Bear Credit Spread

A bear credit spread, or bear call spread, is a bearish trading strategy used when a trader believes that the price of the underlying asset will decline. It involves selling a call option at a lower strike price and buying another call option at a higher strike price, both with the same expiration.

Here are the benefits of a bear credit spread:

- Premium Income: Like bull spreads, bear spreads generate immediate income from the premiums of the sold options.

- Defined Risk: The risk is confined to the spread between the strike prices minus the credit received.

- Profit from Declining Prices: Ideally used when expecting a slight decrease in the underlying asset’s price.

- Benefit from Time Decay: Option values decrease as they near expiration, which is advantageous if the stock declines or moves sideways.

- Capital Efficiency: Uses less capital than owning stocks outright while allowing for strategic bets on stock price movements.

Generally, bear credit spreads are an effective strategy for traders anticipating a downturn in the market. Bare spreads can be essential to a diversified trading strategy by providing premium income and controlled risk, especially in volatile markets.

Benefits of a Credit Spread

Credit spreads are a popular options trading strategy, particularly for investors looking to generate income from their portfolios. This approach involves a combination of buying and selling options that results in net credit to the trader. Here, we explore the key advantages of using a credit spread.

Consistent Income Generation

A primary benefit of a credit spread is the ability to generate consistent income. When establishing a credit spread, you receive a net credit, which is the difference between the premiums of the sold and bought options. This strategy works well in various market conditions, especially when the underlying security price remains stable or moves as predicted.

Lower Risk Compared to Other Strategies

Credit spreads typically involve less risk than other types of options strategies like the naked call or put options. Since you’re buying one option and selling another, the potential loss is limited to the difference between the strike prices minus the net credit received. This predefined risk makes managing easier than strategies with unlimited risk potential.

Capital Efficiency

Credit spreads allow for efficient capital use. Since the trader receives a net credit upfront, the capital requirement is often lower compared to strategies like the debit spread, where you pay upfront. This efficiency is beneficial in scenarios where maintaining cash flow is crucial.

Flexibility in Market Conditions

Credit spreads can be tailored to benefit from various market scenarios. You can set up a bull put spread if you expect the market to rise or a bear call spread if you anticipate a downturn. This flexibility allows traders to leverage market predictions more effectively and react to changes with different credit spread options.

Protection Against Volatility

Credit spreads offer a buffer against market volatility. By choosing options with similar maturity but different credit quality or strike prices, traders can hedge against excessive movements in the underlying security’s price. This can protect the investment from significant losses during a financial crisis or high volatility.

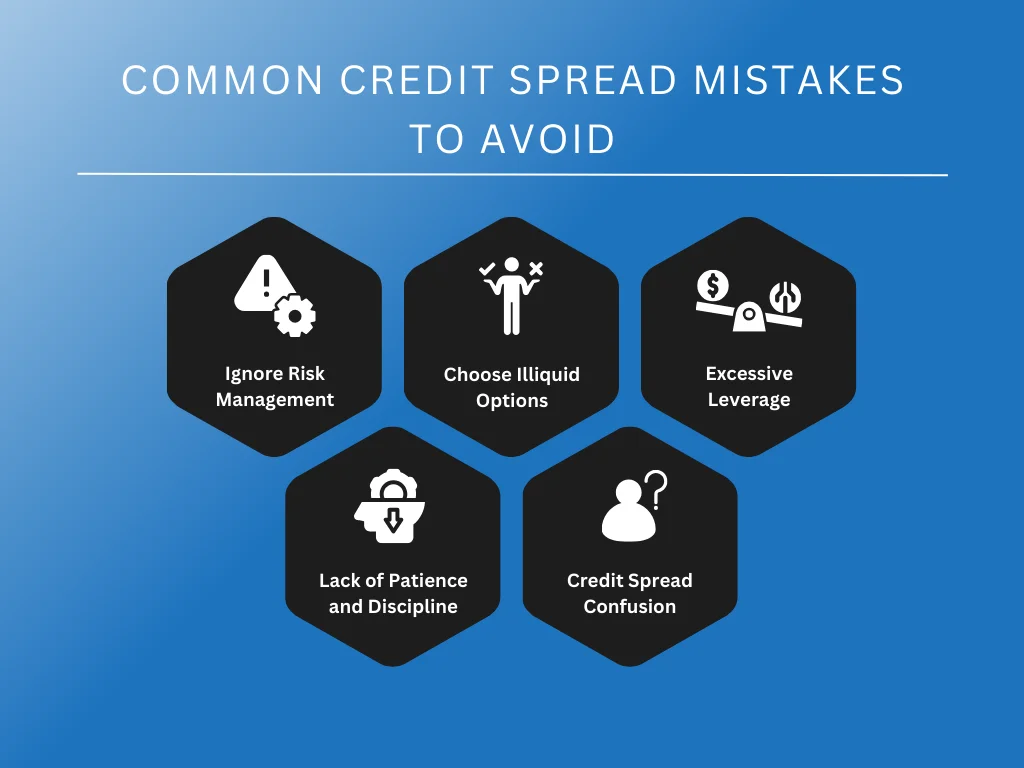

Common Credit Spread Mistakes to Avoid

Trading credit spreads involves selling and buying options to take profit from the premium difference, but even experienced traders can make critical errors. This strategy often appeals because it limits risk while providing an income opportunity. However, understanding common mistakes can significantly enhance your trading effectiveness.

Ignore Risk Management

One of the most crucial aspects of any trading strategy, especially credit spreads, involves managing potential losses. Traders should always set stop-loss orders or have a solid exit strategy. Losses can quickly escalate without these measures, potentially outweighing the gains from successful trades.

Choose Illiquid Options

Liquidity is vital in trading credit spreads. Options with low liquidity might have wider bid-ask spreads, making it hard to execute trades at favorable prices. Selecting options with sufficient trading volume is essential to avoid the pitfalls of poor liquidity, which can complicate entering and exiting positions.

Excessive Leverage

Using too much leverage is a frequent mistake in options trading. Traders often overestimate their capacity to handle risk and take on too many positions or allocate too much capital to a single trade. This can magnify losses and lead to a precarious financial situation. Maintaining a balanced portfolio is crucial to managing risk effectively.

Lack of Patience and Discipline

Successful trading demands a high degree of patience and discipline. Impulsive decisions, often triggered by short-term market movements, can derail a well-planned trading strategy. Traders must adhere to their trading plans, exercise patience, and avoid emotional decisions to achieve long-term success.

Misunderstanding Credit Spread Mechanics

A fundamental understanding of how credit spreads work is essential, yet some traders need a thorough grasp of the strategy. This includes knowing the significance of strike prices, from lower strike price options to higher strike price ones, and how they influence the risk and outcome of the trade. Traders should familiarize themselves with all aspects of credit spreads, from basis points to yield difference and credit ratings, to make informed decisions.

Key Takeaway

Credit spreads are a versatile tool in market environments with significant notable benefits. Understanding what is a credit spread helps traders manage risks while potentially increasing profits through well-planned option spreads. This strategy involves selling a high-premium option and buying a lower-premium one, aiming to profit from the premium differential. The strategic use of a credit spread can stabilize returns even in fluctuating markets.

With proper consideration and application of a credit spread, traders can incorporate this tactic into long-term investment strategies. Essential trading resources and continuous learning can improve one’s proficiency in using credit spreads effectively. Hence, knowing what is a credit spread is vital in providing a reliable method to strengthen your trading portfolios.

Why not take the next step in mastering your trading skills today? Contact Spartan Trading for expert guidance to deepen your trading knowledge or refine your strategies with credit spreads. Join our day trading chatroom for live discussions or explore our offerings to find online stock trading courses that align with your trading goals.