Options Auto Trading: Pros and Cons of Automated Day Trades

Automated trading has surged in popularity across financial markets, reshaping how investors engage with stock and derivatives trading. Options auto trading, a significant part of this trend, leverages algorithms to enhance trading efficiency and precision. The automated systems of this trading can execute trades at speeds and accuracies far beyond human capabilities.

At Spartan Trading, we specialize in generating innovative stock and option strategies catering to seasoned and novice traders. We use our extensive market experience to develop tools and insights that help our subscribers make the most of their brokerage accounts under varying market conditions. We focus on simplifying the trading experience while maximizing the potential for profitable trades.

Utilizing our industry expertise and insights, we’ve crafted a comprehensive guide that delves into the mechanics of options auto trading. We’ll discuss the pros and cons of auto trading and explore the top automated trading software options. Subsequently, you’ll understand how to tailor option trading strategies to your investment goals, navigate different market conditions, and optimize your trading for better results.

Let’s dive in!

What Is Options Auto Trading

Options auto trading is a method where traders use software to execute trades automatically. This software follows a predefined set of rules for buying and selling options. Traders choose their options strategy and set the parameters, and the system operates independently once set up.

Here are the things to consider when using options auto trading:

- Trading Platform Compatibility: Ensure the auto trading software integrates smoothly with your chosen platform. Compatibility reduces issues during live trading.

- Set of Rules Precision: Define your trading rules clearly. The bot uses these rules to make decisions. Precise rules lead to better trading outcomes.

- Third-Party Risks: Third-party services like newsletters or subscription-based signals can enhance auto trading. However, these services’ reliability and track record should be assessed to avoid potential risks.

- Options Strategy Complexity: Select an appropriate options strategy that matches your investment goals. Complex strategies might offer higher returns but come with increased risk.

- Monitoring and Adjustments: Regularly monitor performance and adjust parameters as necessary. Markets evolve, and so should your trading approach to maintain effectiveness.

Options auto trading offers a powerful approach to investing, allowing traders to automate their strategies using bots. It emphasizes the importance of robust rules and a reliable trading platform to ensure successful execution. Effective use of auto trading can act as a hedge against human error in fast-moving markets.

How Does Options Auto Trading Work?

Options auto trading streamlines buying and selling options using automated software. This technology allows traders to execute trades at speeds and accuracies far superior to manual trading. Here’s how it functions and the benefits it provides:

1. Algorithmic Strategies

Options auto trading uses algorithms to make quick decisions based on pre-set trading criteria. These algorithms analyze market data to identify trading opportunities that match the criteria set by the trader. For example, a trader might configure the algorithm to buy options when a specific stock reaches a certain price. This method ensures consistent application of trading strategies, minimizing emotional decisions and improving the trader’s chances of success.

2. Market Scanning

Auto trading software continuously scans the options market for potential trades. This capability allows it to process vast amounts of data much faster than a human trader could. As soon as it detects a trading opportunity that aligns with the predefined rules, it automatically executes the trade. This feature ensures that traders take advantage of valuable trading opportunities due to the limitations of manual monitoring.

3. Risk Management Tools

Options auto trading platforms often include various tools to help manage risk. These tools can automatically set stop-loss orders, take-profit levels, and other protective strategies to guard against significant losses. Traders can adjust these settings to suit their risk tolerance, ensuring the software trades within comfortable limits.

4. Backtesting Capabilities

Before going live, traders can use options auto trading software to backtest their trading strategies against historical market data. This process helps traders understand how their approach would have performed in the past and refine it before risking actual capital. Effective backtesting can improve trading strategies and better preparedness for various market conditions.

5. Time Efficiency

Automating the trading process and options trading bot saves considerable time. Traders don’t need to spend hours monitoring the markets in front of a computer screen. Instead, they can set up their trading parameters, and the software handles the rest. This efficiency frees up traders’ time, allowing them to focus on strategy development, research, or personal pursuits.

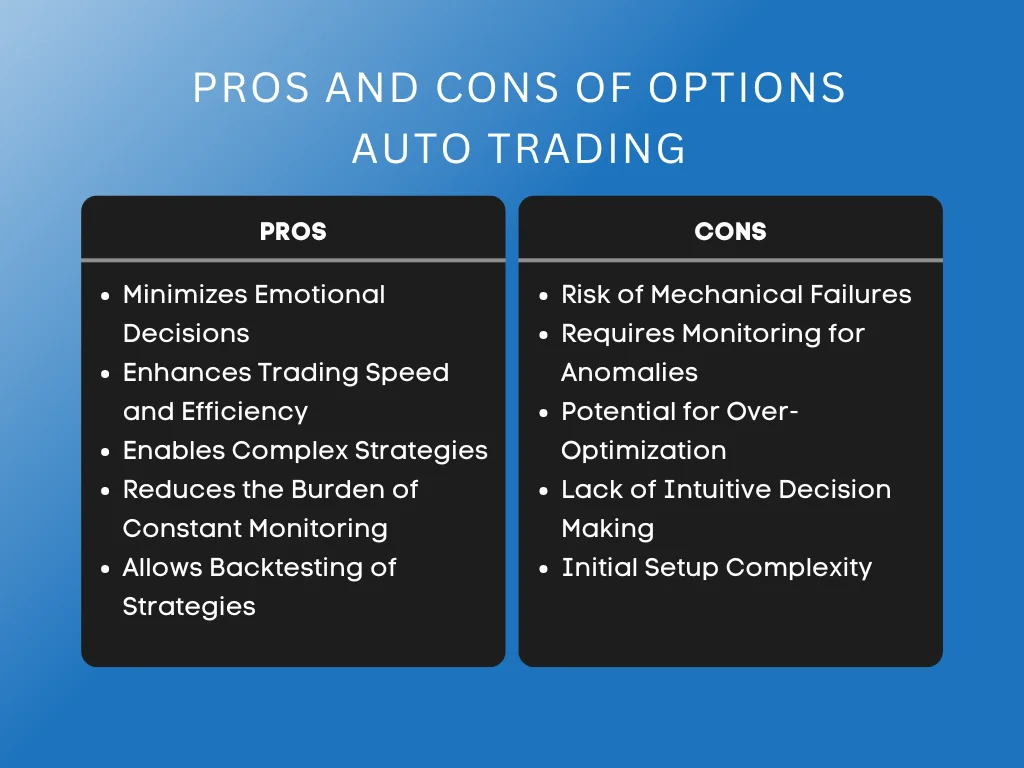

Pros and Cons of Options Auto Trading

Options auto trading has reshaped the financial trading landscape, offering a mechanized approach to market dynamics. This method relies on algorithms to make trade decisions, often improving efficiency and consistency. However, like any system, it has its unique advantages and disadvantages.

Pros of Options Auto Trading

Automated trading systems offer numerous advantages to traders seeking efficiency and consistency in the financial markets. Let’s explore five key benefits of options auto trading and how they can enhance trading strategies.

Minimizes Emotional Decisions

One of the most significant benefits of an options auto trading bot is its ability to reduce the emotional impact on trading decisions. Since the trading system executes trades based on specific criteria, there is no room for fear or greed to influence trade execution. This automation helps maintain trading discipline, particularly during volatile market conditions.

Enhances Trading Speed and Efficiency

Auto trading systems can process vast amounts of data and execute trades at speeds no human trader can match. This quick execution can be crucial in taking advantage of price movements that occur in the blink of an eye, potentially leading to better entry and exit points for trades.

Enables Complex Strategies

Automated systems allow traders to implement complex trading strategies that would be too intricate to execute manually. These systems can monitor multiple markets and make decisions based on changes in market conditions across different assets, all simultaneously.

Reduces the Burden of Constant Monitoring

With options auto trading, traders do not need to monitor the markets constantly throughout trading hours. The system operates independently, scanning for trading opportunities and executing them based on predefined rules. This automation allows traders to focus on strategy development and other tasks.

Allows Backtesting of Strategies

Before applying a strategy in live markets, traders can use historical data to test its viability through backtesting. This testing helps refine the strategy by identifying potential issues and adjusting parameters to improve performance.

Cons of Options Auto Trading

While options auto trading offers enticing advantages, it also presents notable drawbacks. Understanding these cons is vital for traders to make informed decisions. Here, we explore five key drawbacks that traders should consider before adopting automated trading systems.

Risk of Mechanical Failures

Despite the sophisticated nature of auto trading systems, they are not immune to mechanical failures such as connectivity issues, power outages, or computer crashes. Such disruptions can lead to missed or unintended trades, potentially resulting in significant losses.

Requires Monitoring for Anomalies

Although an options trading bot reduces the need for constant market monitoring, it does not eliminate the need for oversight. Traders must check the system regularly to ensure it functions as expected and address any anomalies that could affect trading.

Potential for Over-Optimization

A common pitfall in options auto trading is the over-optimization of trading strategies. While backtesting helps fine-tune strategies, excessive tweaking based on historical data may result in a strategy that works well in theory but fails in live trading conditions.

Lack of Intuitive Decision Making

Automated trading systems operate based on predefined rules and cannot make intuitive decisions. In situations that require human judgment or adaptation to sudden market changes, an automated system might perform better than an experienced trader.

Initial Setup Complexity

Setting up an automated trading system can be complex and time-consuming. Technical knowledge is required to program the trading rules and ensure the system integrates well with trading platforms. This setup process can be a significant hurdle for traders who need to be tech-savvy.

3+ Automated Trading Software Options

Automated trading software offers investors a hands-off approach to executing trades based on predetermined criteria. With numerous options available, choosing the right software is crucial. Here, we explore three notable choices renowned for their reliability, features, and user-friendliness in navigating the complexities of financial markets.

1. Whispertrades – Best for Brokerage Integration

Whispertrades excels in providing a user-friendly platform for automated options trading. Specializing in seamless integration with your existing brokerage account, Whispertrades allows users to automate their trading strategies without constant monitoring or software programming.

Whispertrades executes trades directly from your brokerage account using automation bots. This feature, rarely offered by other platforms, allows real-time trading without user intervention, ensuring that strategies are executed at optimal speeds and precision.

Notable Features of Using Whispertrades

- Brokerage Integration: Connects directly to brokers like Charles Schwab, tastytrade, and TD Ameritrade.

- Performance Monitoring: Views real-time updates and detailed logs directly through the Whispertrades account.

- No Monthly Fees: Only pay for the bots when they are active, with no long-term commitments.

- High-Fidelity Backtesting: Tests strategies using intraday backtesting to ensure effectiveness before live execution.

Whispertrades Pricing Plans

Whispertrades rates allow for flexible and affordable access to advanced trading automation:

- Automated Trading: $1.10/trading day.

- Backtesting: $0.50/backtest.

2. Option Alpha – Best for Extensive Bot Customization

Option Alpha excels in automated options trading, offering tools that allow users to execute trades without manual intervention. This software utilizes bots to manage trading strategies effectively.

What sets Option Alpha apart is its no-code trading bot platform, a feature that distinguishes it from many competitors. This allows even those without programming skills to automate their trading strategies, leveraging technology to optimize their trading process efficiently.

Notable Features of Using Option Alpha

- Automated Bot Trading: Users can create and run trading bots without programming, simplifying the trading process.

- SmartPricing Technology: This feature optimizes entry and exit points, adjusts bids, and asks dynamically to improve trade execution.

- Extensive Bot Customization: Traders can customize bots using natural language, making complex strategies accessible to all skill levels.

- Community and Support: Option Alpha provides a vibrant community and dedicated support, enhancing the user experience with shared knowledge and assistance.

Option Alpha Pricing Plans

Option Alpha offers transparent pricing models tailored to different trading volumes and needs:

- Standard Plan: $79/month or $69/month with an annual subscription, including ten bots and 100 backtests per month.

- Pro Plan: $99/month or $79/month with an annual plan, offering 20 bots and 250 backtests per month.

- Pro+ Plan: $199/month or $159/month annually, granting 50 bots and 500 backtests per month.

3. PeakBot – Best for Stock Trading Automation

PeakBot is best for investors seeking effortless stock trading automation, especially those new to trading. The platform provides an intuitive, no-code setup that allows anyone to start trading with minimal effort.

PeakBot integrates with top brokerage firms like Tradier and TD Ameritrade, with a setup process that takes less than one minute. This seamless integration ensures users can automate their trading securely without transferring funds or sharing sensitive information.

Notable Features of Using PeakBot

- User-Friendly Automation Setup: Set up trading automation quickly and easily, catering to novice and experienced traders.

- Broker Integration: Works directly with leading brokers, ensuring your money remains secure within your brokerage account while enabling PeakBot to execute trades.

- Transparent Operation: Provides a clear understanding of how trading strategies are implemented, fostering confidence in your investment choices.

- Community and Support: Offers excellent customer service and a community-driven approach, providing a supportive environment for users.

PeakBot Pricing Plans

PeakBot offers three distinct pricing tiers tailored to different levels of trading activity:

- Basic: $49/month, includes access to all bots but limits to one bot at a time, suitable for smaller-scale operations.

- Standard: PeakBot’s most popular plan; priced at $99/month, allowing for more extensive use of bots in volume and variety.

- Pro: Designed for accounts over $25k, providing extensive access and higher limits for professional traders.

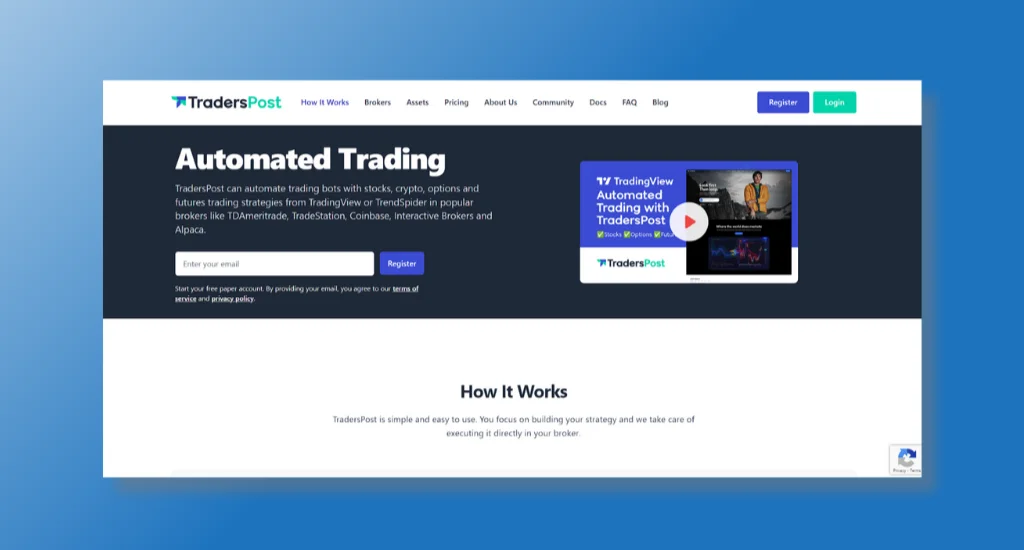

4. TradersPost – Best for Multi-Asset Automated Trading

TradersPost excels in multi-asset automated trading, offering seamless integration with leading brokers and platforms. They specialize in connecting traders’ strategies from TrendSpider or utilizing TradingView stock heatmap to execute real-time trades across various asset classes.

TradersPost supports multiple asset classes, including stocks, options, and futures. This unique feature allows traders to diversify and manage their strategies from a single interface, significantly enhancing trading efficiency and effectiveness.

Notable Features of Using TradersPost

- Broad Broker Compatibility: TradersPost supports integration with major brokers like TD Ameritrade, Coinbase, and Interactive Brokers, ensuring broad market access.

- Advanced Strategy Implementation: Users can automate complex trading strategies without writing code thanks to user-friendly webhooks and strategy alerts.

- Unified Trading Interface: A single dashboard allows users to manage trades and portfolios across multiple accounts and asset classes, simplifying the trading process.

- Comprehensive Asset Class Coverage: Traders can automate strategies not just in stocks but also in options, futures, and cryptocurrencies, offering a versatile trading solution.

TradersPost Pricing Plans

TradersPost provides a range of pricing plans tailored to various trading needs and volumes:

- Basic Plan: $99 monthly, featuring one live broker connection, six paper brokers, and up to 5 strategy subscriptions.

- Pro Plan: $199 monthly, including three live brokers, eight paper brokers, and ten strategy subscriptions.

- Premium Plan: $299 monthly, offering extensive access with six live brokers, ten paper brokers, and unlimited strategy subscriptions.

Key Takeaway

Traders increasingly consider options auto trading as a significant tool for various investment strategies, from long-term investment ideas to more dynamic day trading approaches. This technology enables traders to automate their options trading strategies, thus optimizing their time and potentially increasing their profit margins. It helps them execute trades at the best possible prices without constant market monitoring.

As markets evolve, the importance of continuing education in trading cannot be overstated. Engaging with a day trading chatroom or enrolling in a stock trading course can significantly enhance a trader’s ability to stay ahead. Options auto trading tools integrate with these educational platforms, providing traders with practical trading capabilities and insights from real-time data and analytics.

Looking to boost your trading game with a strategy that aligns with your goals and resources? Subscribe to our newsletter and gain free access to exclusive event access, promotions, weekly stock picks, and market outlook. This will empower your trading journey, allowing you to make more informed decisions and potentially increase your profitability.