INVESTMENT IDEA – BILLION DOLLAR NANOTECHNOLOGY MARKET – FENDX (OTC: FDXTF)

Disseminated on behalf of FendX Technologies Inc. (FendX)

INVESTMENT IDEA:

BILLION DOLLAR NANOTECHNOLOGY MARKET

FendX – $FDXTF

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

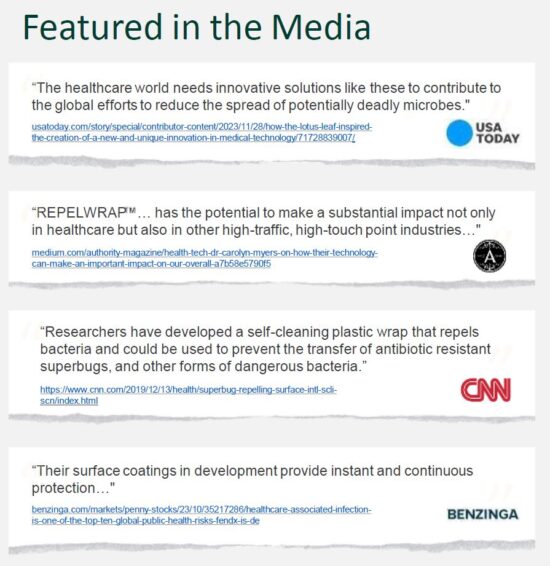

FendX Technologies Inc ($FDXTF) stands at the vanguard of nanotechnology innovation, aiming to revolutionize pathogen control on surfaces. Leveraging groundbreaking research from McMaster University, FendX’s mission is to address the pressing global challenge of pathogen transmission, offering a paradigm shift in surface protection. FendX’s lead product, REPELWRAP™ film, is poised to enter commercial production in late 2024.

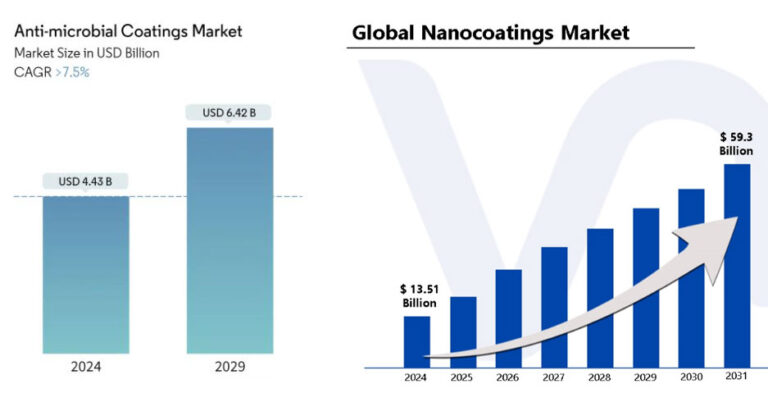

Given the rising concern over healthcare-associated infections and the inadequacies of current disinfecting practices, FendX’s technology may address a critical market need, tapping into a global Anti-Microbial Coating Market that is estimated to be worth $4.43 billion in 2024 and reach $6.42 billion by 2029, growing at a CAGR of over 7.5% between 2024-2029.

Investors seeking exposure to the burgeoning field of nanotechnology-driven pathogen protection control could benefit from FendX’s compelling investment proposition – potentially capitalizing on an early stage company who are positioning themselves for growth and market leadership.

Spartan’s Technical Analysis

Fendex Technologies Inc (OTCQB: FDXTF; CSE: FNDX)

- Float: 59.03M

- Shares Outstanding: ~72.56M

- Strategic Investors & Management Ownership: ~34%

- Market Cap: 24.67M (USD) 30.84 (CAD)

INVESTMENT THESIS

Market Opportunity

The Problem

The rampant spread of pathogens presents a formidable challenge, with conventional disinfection methods falling short in controlling transmission and bacteria increasingly becoming resistant to antibiotics. As a top 10 frequent cause of death in the United States,1 the US Center for Disease Control and Prevention notes that ~1.7 million hospitalized patients acquire health care-associated infections (HCAIs) annually while being treated for other health issues. With more than 1 in 17 patients dying2 from HCAIs, it is estimated to cost the U.S. an astonishing 28 billion per annum.3

Market Size

The global Anti-microbial coatings market size is estimated at $4.43 billion (USD) in 2024 and is expected to reach $6.42 billion (USD) by 2029, growing at a CAGR of more than 7.5% during the forecast period.4

The global nanocoatings market size was estimated at $13.51 billion (USD) in 2024 and is projected to reach 59.3 billion by 2031, growing at a CAGR of 22.4% from 2024-2021.5

In my opinion (IMO) this presents a major market opportunity heading into the future whereas even if $FDXTF is able to capture a small portion of the market share it could still represent a significant amount of revenue and future opportunity.

Innovative Technology:

At the forefront of $FDXTF product portfolio is REPELWRAPTM film, a potential game-changing innovation designed to safeguard high-touch surfaces. Leveraging groundbreaking research rom McMaster University, FendX’s patent pending nanocoating’s have exhibited unparalleled efficacy in repelling pathogens in lab settings, demonstrating a >98% reduction in adhesion of a COVID-19 like virus, E. coli, B. subtilis and MRSA.

Currently in pilot manufacturing runs, the commercial production of REPELWRAPTM film is anticipated to begin in late 2024, with future launches in Canada, followed by expansion into the U.S. and other global markets.

Expanding Market Applications:

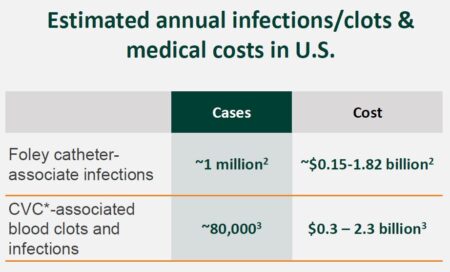

The potential for REPELWRAPTM film and follow-on FendX spray to be used in numerous industries may create a broad market base. IMO, one of the most exciting opportunities for $FDXTF would be its application of nano-coated catheters in development to reduce infections and blood clots. Nano-coated catheters have shown a >96% reduction in the attachment of E. coli after 48 hours of exposure and a >95% reduction in blood / fibrin networks after 24 hours of whole blood flow exposure in McMaster’s lab.

The nanocoated catheter is currently in prototype development, and if successful, $FDXTF could be in a unique position to be able to offer a product that could potentially reduce, for example, Foley catheter-associate infections, affecting an estimated 1 million people a year in the United States.6

Path to Success

Strong Partnerships:

$FDXTF collaborations with well established manufacturers like Dunmore International Corp. and nanoComposix LLC are instrumental in leading to potentially scalable production of the film and spray technologies, respectively. Utilizing these strong alliances with industries leaders will not only help to expediate the advancement of their film and spray technologies but are expected to support a seamless transition from R&D to commercialization. With a clear roadmap and established alliances, FendX is well positioned to deliver its innovative solutions broadly in the future.

Robust Intellectual Property Portfolio:

FendX is building a strong intellectual property portfolio to safeguard its technological advancements in multiple jurisdictions. With pending patents covering nanoparticle and surface formulations for both the film and spray technologies, and catheter coatings, $FDXTF is building a formidable barrier to entry for competitors. This intellectual property fortification bolsters FendX’s market position and underscores its commitment to innovation.

Growth Strategy:

FendX’s growth trajectory is anchored in innovation and expansion, utilizing a capital-light business model by relying on contract manufactures for production, licensing to 3rd parties to sell and market their future products and maximize their capital with non-dilutive funding. The company is poised to explore additional applications of its nanotechnology, potentially unlocking new revenue streams and market opportunities. Furthermore, $FDXTF aims to capitalize on in-licensing and acquisition prospects to augment its product pipeline and intellectual property portfolio. Expansion into global markets, particularly the U.S. and globally, represents a pivotal milestone in FendX’s growth strategy, enabling widespread adoption of its disruptive technology.

Proven Management Team:

$FDXTF is guided by a seasoned management team with a wealth of experience across various facets of the pharmaceutical and biotech industries. Led by Dr. Carolyn Myers, Andrea Mulder, and Rose Zanic, FendX’s leadership brings a potent combination of entrepreneurial acumen, technical expertise, and financial prowess. This formidable team has significant experience in developing and launching product, as well as M&A and licensing positioning them to steer FendX towards success and with the goal of delivering substantial value to investors.

Regulator & Market Acceptance:

As with all early-stage companies there are inherent risks to investors. FendX must navigate regulator approvals which ensuring market acceptance for its products. This may require additional financing to support its operations and product launches. That said, given the potential market opportunity, strong partnerships and robust intellectual property portfolio I feel that FendX has made good strides towards mitigating their risk at this stage.

Conclusion

Potential Disruptor:

$FDXTF represents a compelling investment opportunity in the nanotechnology and healthcare sectors. The company’s innovative products in development are anticipated to address a significant market need for effective pathogen control on surfaces, with broad applications across various industries. Coupled with a solid strategic growth plan and an experienced management team, FendX is well-positioned for substantial growth and potential value creation for investors.

Investors seeking exposure to the burgeoning field of nanotechnology-driven pathogen protection control stand to benefit from FendX’s compelling investment proposition. With a goal to move into commercial production of REPELWRAP™ film by the end of 2024, establishing strategic alliances with manufacturers and building of a robust intellectual property portfolio, $FDXTF has the opportunity to enter into a growing billion dollar anti-microbial market opportunity that innovative surface protection solutions may provide.

As FendX embarks on its journey to disrupt the status quo and develop innovative solutions to pathogen control on surfaces, investors have the opportunity to join forces with a visionary company who’s goal is to positioning themselves for growth and market leadership. Together, we believe we can shape a safer, healthier future for generations to come, while unlocking potentially significant value for shareholders.

Range break setup off the lows here, steady grind higher with room for continuation on the Canadian Side into that all time high area of .52. IMO this can make a move in the short term.

References:

- https://www.futuremarketsinc.com/the-global-market-for-advanced-antimicrobial-coatings-and-technologies-2023-2033/

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6245375/

- https://www.cdc.gov/policy/polaris/healthtopics/hai/index.html

- https://www.mordorintelligence.com/industry-reports/anti-microbial-coatings-market

- https://www.verifiedmarketresearch.com/product/nanocoatings-market/

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8992741/

Stay up to date with Spartan’s Weekly Newsletter

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by FendX Technologies Corp (FT) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared by or on behalf of FT. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by FT (OTCQB:FDXTF) to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from FT. Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc and affiliate of Spartan Trading Inc. has a four month agreement with FT (OTCQB:FDXTF) for the sum of seventy five thousand canadian dollars per month. This agreement is for consulting and or marketing FT (OTCQB:FDXTF) which services include the issuance of this release and other opinions that we release concerning FT (OTCQB:FDXTF). Spartan Trading and affiliate Spark Newswire Inc has not investigated the background of FT (OTCQB:FDXTF) the hiring party. Anyone viewing this newsletter should assume FT (OTCQB:FDXTF) or affiliates of FT (OTCQB:FDXTF) own shares of FT (OTCQB:FDXTF) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading and affiliate Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements of FT (OTCQB:FDXTF).