Fidelity vs Webull: Which One to Choose

When it comes to investment platforms, understanding which best aligns with your goals is crucial, especially for those interested in long-term investment ideas. The debate between Fidelity vs Webull often centers on which platform offers better resources for achieving these goals. Each provides unique tools and investment options that cater to beginner investors and experienced investors looking for advanced trading tools and options contracts.

At Spartan Trading, we provide online stock and option idea generation services. We understand the importance of tools such as fractional shares, paper trading, and robust desktop platforms. Our platform includes essential trading tools like technical analysis and options contracts to enhance your trading experience and help you trade stocks more effectively.

Given our comprehensive analysis of various platforms’ features, benefits, and drawbacks, we’ve compiled this guide that explores the key aspects of Fidelity vs Webull. These include trading tools and features, customer service, and investment options that make it different. By the end, you’ll understand how these platforms differ, helping you choose the right one for your investment strategy.

Let’s jump in!

Fidelity vs Webull: What’s the Difference?

Fidelity and Webull are popular online brokerage platforms that offer various investment services. While they share common features, they differ in fees, investment offerings, research tools, and user experience. Understanding the difference between Fidelity vs Webull can help investors choose the platform that best suits their investment goals and preferences.

What is Fidelity Investments?

Fidelity Investments is one of the largest investment managers globally, renowned for its vast array of financial products and services, including mutual funds, retirement planning, and brokerage services. Individuals seeking comprehensive portfolio management or just beginning their investment journey can find valuable resources and tools with Fidelity.

Notable Features of Using Fidelity Investments

- Mobile App: Fidelity’s app, available on Google Play and the Apple App Store, offers intuitive mobile features that simplify trading and portfolio management.

- Educational Materials: Fidelity provides extensive educational resources that help investors understand market trends, fundamental analysis, and investment vehicles.

- Active Trader Pro: This platform offers tools for day trading and technical studies, making it ideal for active traders looking for advanced charting and trade execution.

- Zero Expense Ratio Index Funds: Fidelity introduced industry-leading zero expense ratio index funds, allowing investors to gain market exposure without management costs.

- Diverse Investment Options: Fidelity offers a wide range of investment products, from stocks and international stocks to more sophisticated options and futures trading.

Fidelity Investments Pricing Plans

Fidelity promotes transparency with its straightforward pricing model:

- Fidelity Go®: Digital managed accounts with fees starting at $0 for balances under $25,000.

- Fidelity® Wealth Management: Customized planning and investment management with fees ranging from 0.50% to 1.50%, requiring a minimum of $500,000 managed through Fidelity® Wealth Services.

- Fidelity Private Wealth Management®: Tailored planning and investment management with fees ranging from 0.20% to 1.04%, requiring $2 million managed through Fidelity® Wealth Services or Fidelity® Strategic Disciplines and $10 million or more in total investable assets.

What is Webull?

Webull is a robust trading platform offering extensive investment services, including advanced trading options and comprehensive market research tools. Its user-friendly interfaces and a wide array of trading instruments appeal to novice and experienced traders.

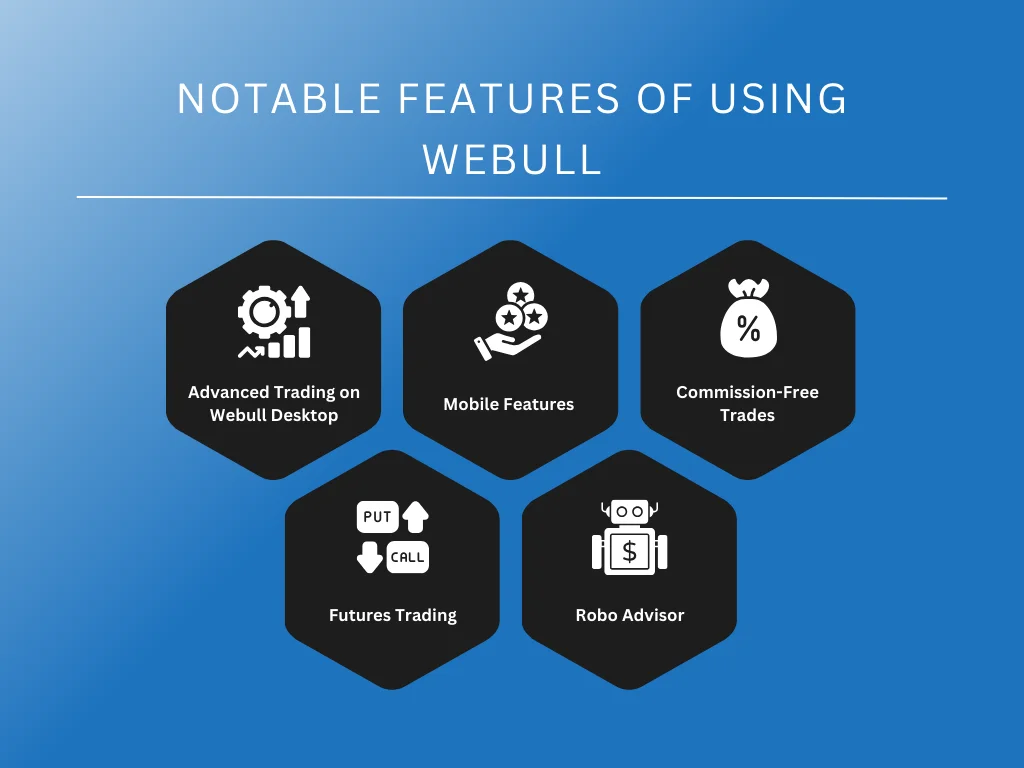

Notable Features of Using Webull

- Advanced Trading on Webull Desktop: Webull offers features like customizable widgets and advanced charting That allow for detailed analysis and trading strategies.

- Mobile Features: Webull offers full trading functionality through apps on Google Play and the Apple App Store, enhancing ease of use for on-the-go trading.

- Commission-Free Trades: Webull allows the trading of stocks, ETFs, and options without commission, making it accessible and cost-effective for all traders.

- Futures Trading: This platform offers low-cost futures trading on various commodities, such as crypto and gold, providing diversity in trading options.

- Robo Advisor: For those preferring automated investment management, Webull’s Robo Advisor offers a convenient option for managing investments effectively.

Webull Pricing Plans

Webull provides an attractive pricing model with no minimum balance requirements and zero commission on most trades, making it a competitive option in the brokerage industry:

- Commission-Free Trading: Webull charges $0 commissions for trading stocks, ETFs, and most options listed on U.S. exchanges, with certain options trades incurring a $0.55 per contract fee.

- Regulatory Fees: Fees applied by regulatory agencies, such as the SEC and FINRA, may apply for certain transactions, but Webull does not profit from these fees.

- Other Potential Fees: Additional fees may apply for trading OTC securities, stock transfers, and margin trading, with details provided in their fee schedule.

Core Differences Between Fidelity and Webull

When choosing an online investment platform, the differences between Fidelity and Webull can significantly influence your decision. This comparison of Fidelity vs Webull focuses on key features that distinguish one another, helping you align your personal finance goals with the right platform.

- Trading Platforms and Tools: Webull and Fidelity offer robust trading platforms and tools. Fidelity provides users with advanced tools like Active Trader Pro and robust research resources for detailed financial analysis and diversified trading strategies. Webull offers a more streamlined, user-friendly interface for beginners and intermediate traders, emphasizing quick stock trades and real-time data accessibility.

- Investment Options: Fidelity offers vast investment options, including stocks, bonds, mutual funds, and ETFs, with access to global stock markets. Webull focuses more on stocks, ETFs, and cryptocurrency, catering to traders interested in a more narrow yet popular range of investment vehicles.

- Fees and Commissions: Fidelity and Webull have various fees and commission plans. Fidelity prides itself on low fees, offering zero expense ratio on select index funds and no commission for stock or ETF trades. Webull also promotes low-cost trading, with no commission fees on stocks and ETFs and low options trading fees.

- Account Types: Fidelity offers a broader variety of account types, including checking accounts, savings accounts, and different types of IRAs (SEP IRAs, traditional IRAs). Webull provides a simpler selection, mainly focusing on brokerage accounts and IRAs, appealing to those who prefer straightforward account management.

- Cryptocurrency Trading: Webull offers cryptocurrency trading that appeals to modern digital currency traders. While traditionally not offering cryptocurrency trading, Fidelity has started incorporating these options to keep up with market trends.

- Educational Resources: Webull and Fidelity differ in their educational offerings. Fidelity offers extensive educational materials and personalized financial advice through its advisors. Webull offers more accessible but less comprehensive educational tools, targeting traders who prefer quick learning.

- Margin Trading: Both platforms offer margin trading, but the margin rate and terms differ. Webull tends to attract more aggressive traders with its competitive margin rates, while Fidelity offers margin trading with more conservative terms, aligning with its long-term investment strategy focus.

- Customer Service: Fidelity vs Webull takes different approaches to customer service. Fidelity has face-to-face consultations at physical branches. Webull, primarily an online platform, provides efficient online support but needs Fidelity’s personalized service.

Fidelity and Webull have unique strengths, and the best choice varies from investor to investor. Whether you prioritize a robust trading platform with a wide range of investment options or a combination, understanding the core differences between Webull and Fidelity will guide you to the right platform.

Use Cases For Fidelity Investments

Fidelity Investments stands out as a robust platform for various investors, offering tailored solutions that cater to different financial needs and objectives. Here, we explore five distinct use cases:

Comprehensive Retirement Planning

Fidelity can be the best option for those who intend to prepare for old age and the golden years. Many retirement resources, including retirement accounts such as IRAs and 401ks, and tools enable retirement savings and expense prediction. Fidelity retirement calculators and easy-to-follow planning guidance guarantee that it is possible to build a retirement plan aligned with long-term financial objectives.

Extensive Research and Market Insights

Fidelity is best for investors willing to gain more market insights and research. The platform offers more in-depth markets, real-time data, and more than 20 independent research presentations. Making accurate investment decisions and keeping up-to-date with the current dynamically changing market is beneficial.

No-Fee Index Investing

Investors concerned about costs and wanting broad market exposure can use Fidelity’s zero-expense ratio index funds. Passive investment and lack of performance fees allow investors to increase their portfolio’s long-term value without incurring additional fees.

Advanced Trading Tools

Fidelity is a trading platform suited for experienced traders, mainly because of platforms such as Active Trader Pro®. This platform provides sophisticated charting tools, real-time analytics, fully customizable trading, and all the features traders need to have detailed control over their trades.

Personalized Wealth Management

Fidelity’s wealth management service is designed to offer highly customized investment solutions to high-net-worth individuals seeking a holistic approach to wealth management. Specifically, the investor is assigned a financial advisor who guides their investments and assists in planning for their financial future. This type of service is best for active investors.

Use Cases For Webull

Webull presents a dynamic platform tailored for the modern trader who values cutting-edge technology and comprehensive market access. This segment explores why various traders might choose Webull, focusing on its distinctive features and user benefits.

In-Depth Market Analysis

Webull provides traders with vast market data and analytics, a gateway to the complex world of market trends and behavioral psychology in assets. It is a must-have for traders who plan to conclude based on what is happening in the market. Moreover, Webull’s integrated high-level charting tools and back-testing analytics allow users to conduct advanced technical analysis and are an indispensable source for discerning market participants.

Extended Trading Hours

One of Webull’s compelling features is the ability to trade during extended hours, including pre-market and after-hours sessions. This is particularly advantageous for traders who react swiftly to news and events outside standard market hours. It offers flexibility that can lead to potential gains from price movements during these times.

Diverse Account Options

Webull serves a wide range of investors by offering various account types, including IRAs and margin accounts. This variety allows users from all financial backgrounds to find an account that best fits their investment strategy and financial goals. Whether saving for retirement or leveraging investments, Webull provides the options to support these needs.

High Yield on Uninvested Cash

Webull’s cash management feature offers a high yield on uninvested cash balances. This attractive yield provides a valuable avenue for investors to earn passive income from their uninvested funds. The absence of minimum balance requirements and additional fees makes this feature investor accessible, enhancing the value of their investment capital.

Community and Educational Resources

Webull platforms offer a lively community for traders to interact and exchange trading strategies, market insights, and shared lessons. The ability to learn in the community, coupled with robust in-app trading, demystifies the trading experience and makes Webull a fantastic option for beginner traders. These resources contain articles and video tutorials that explain trading and investments from the simplest form to the most complicated procedures.

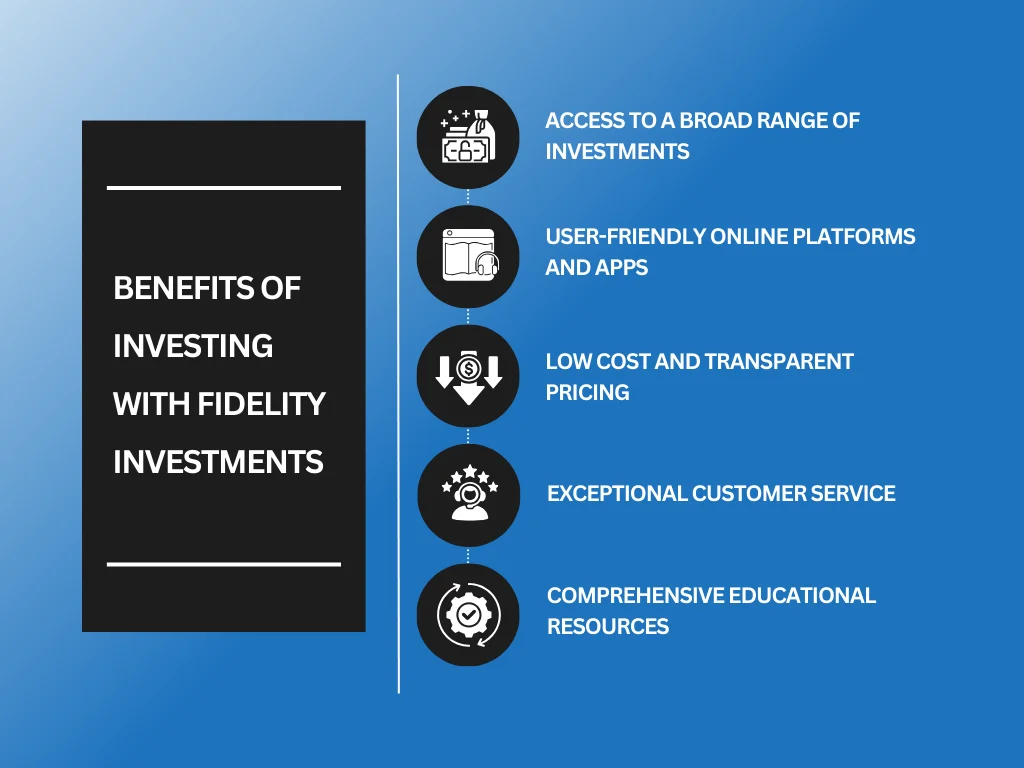

Benefits of Investing with Fidelity Investments

Fidelity Investments offers a range of benefits that cater to diverse investor needs. Here are five key advantages of using Fidelity:

Access to a Broad Range of Investments

Fidelity gives users optimal options for stocks, bonds, ETFs, mutual funds, etc. This enables investors to spread their investments across different asset classes, sectors, and geographies. A broad range of investments enables them to hedge their risks and achieve the optimal return on their investments.

User-Friendly Online Platforms and Apps

Fidelity’s online platform and mobile applications are friendly and easy to use. They aid users in accessing and managing their investments, checking their account balances, and efficiently trading their shares from anywhere. Its user-friendly interface greatly serves a beginner or experienced investor with a high preference for convenience and easy access.

Low Cost and Transparent Pricing

Traders benefit from the platform’s no commissions on online US stock, ETF, and options trades. Opening a retail brokerage account also has no account fees or minimums. This means that the cost of the platform is relatively small and accessible to all investors, which is convenient for beginners and active traders.

Exceptional Customer Service

Fidelity is known for its top-notch customer service, which includes 24/7 phone, live chat, and email support. This implies that users are always provided with support, whether for account configuration and troubleshooting or for complex investment queries.

Comprehensive Educational Resources

Fidelity provides a wealth of educational content for both novices and seasoned investors. This includes articles, webinars, and interactive tools covering various topics, from basic investment concepts to advanced strategies. These resources help users understand and navigate the market more effectively, making informed investment decisions.

Benefits of Webull for Active Traders

Webull greatly benefits active traders who prioritize zero-commission trades and advanced trading tools. The platform’s support for algorithmic trading appeals to tech-savvy investors who want to implement their automated strategies.

Here are five key benefits of Webull:

Zero Commission Trading

Webull offers zero-commission trading on stocks, ETFs, and options. This feature is particularly beneficial for active traders who perform multiple transactions daily. This helps to minimize trading costs and maximize potential returns. The absence of commission fees makes it easier for new traders to enter the market without a significant financial burden.

Advanced Technical Analysis Tools

Webull provides advanced technical analysis tools that are essential for detailed market analysis. These tools include various chart types, technical indicators, and graphical objects that help traders identify trends, patterns, and potential entry and exit points. This suite of tools is designed to cater to the needs of technical traders who require precise and flexible trading strategies.

Paper Trading Capability

Webull offers a paper trading feature for traders who wish to practice their trading strategies without financial risk. This virtual trading environment allows users to experiment with different trading approaches using real-time market data. This feature is invaluable for beginners and experienced traders looking to refine their techniques before applying them in the market.

Full Mobile Integration

Webull’s platform is fully integrated across mobile devices, providing a seamless trading experience. The mobile app offers comprehensive functionality, allowing traders to execute trades, analyze charts, and receive market updates in real-time. This mobility is crucial for traders who need to manage their portfolios from anywhere.

Real-Time Market Data and News

Webull provides real-time market data and financial news updates directly through its platform. This access helps traders stay informed about the latest market developments and economic events that could impact their trading decisions. The integration of this data ensures that Webull users can react promptly to market changes, maintaining a competitive edge.

Key Takeaway

Investors must weigh the choice between Fidelity vs Webull, focusing on their financial goals and preferences. Their features offer robust options for auto trading, catering to those seeking efficiency in their investment strategies. However, when evaluating these platforms, investors should carefully consider how Fidelity and Webull align with their risk tolerance and investment horizon.

Moreover, both platforms serve well for long-term investment ideas and more dynamic strategies like swing trading and day trading. This versatility allows Fidelity vs Webull users to adapt their trading tactics as their financial landscapes evolve and market conditions change. Furthermore, knowing which one to choose ensures that your chosen platform supports your overall trading approach.

Looking to enhance your trading skills or refine your investment strategy? Spartan Trading offers expert insights and support. Subscribe to our newsletter and gain free access to exclusive events, promotions, weekly stock picks, and market outlooks.