INVESTMENT IDEA – SPECULATIVE BUYOUT OPPORTUNITY – CYBEATS TECHNOLOGIES CORP (OTC: CYBCF)

Disseminated on behalf of Cybeats Technologies Corp

IN DEPTH INVESTMENT ANALYSIS – SPECULATIVE BUYOUT OPPORTUNITY

Cybeats Technologies Corp – $CYBCF

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

As traders, we are always on the lookout for investment opportunities in rapidly growing sectors. As these sectors evolve and mature there are typically acquisitions that start to occur as larger companies are always searching for undervalued companies that have great assets, solid contracted relationships, and strong leadership teams that they can vend in.

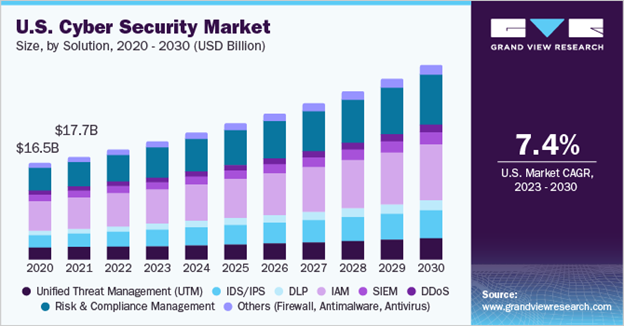

One of these rapidly growing sectors is Cybersecurity.

The proliferation of software across all aspects of modern life has created a significant challenge for governments and businesses alike. With software impacting critical infrastructure and everyday devices, ensuring its safety has become paramount.

Governments are now recognizing the necessity of regulating software to protect citizens and vital systems. The escalating threat of international cyber warfare highlights the critical importance of cybersecurity for organizations and nations alike. Malicious actors, including state-sponsored entities, pose significant risks to sensitive data, infrastructure, and national security.

In this investment thesis I will be covering a rapidly expanding cybersecurity company, one that I feel, after countless hours of research, is significantly undervalued yet is at the forefront of this movement, including directly influencing U.S. Cybersecurity Policy at the White House Level.

Positioned as the ‘seatbelt’ for software security, not only does this company offer innovative solutions to assess and certify software safety, they have already secured contracts with 8 of the worlds top 10 medical device and industrial controls companies —a testament to its industry reputation and growth trajectory.

The company? Cybeats Technologies Corp (OTCQB: CYBCF; CSE: CYBT)

Cybeats Technologies Corp (Cybeats) is one of the few publicly traded entities in this space and provides Software as a Service (SaaS) security solutions to major U.S. infrastructure companies and Fortune 500 giants like Schneider Electric, a $100 billion market cap infrastructure giant.

I had the pleasure of sitting down with the Cybeats executive team to learn more about their business and the vital role that companies like Cybeats play in safeguarding against emerging global threats.

With a strategic focus on SBOM Management and emerging threats like AI-enabled cyber warfare, $CYBCF is poised for continued growth and leadership in safeguarding digital infrastructure worldwide.

Based on my discussions and comparative research, I believe that they represent an enticing buyout speculation opportunity due to its undervalued status, overlooked position in a high-growth sector, and potential attractiveness to larger players seeking to bolster their presence in the cybersecurity market.

Spartan’s Technical Analysis

Cybeats Technologies Corp (OTCQB: CYBCF; CSE: CYBT)

- Idea: Long Speculation $CYBCF $0.12 – $0.20 (Starter Position)

- 1st Target Area: $0.39 – $0.51

- 2nd Target Area: $0.60 – $0.78

- Stops: $0.07

- Float: 41M

- Shares Outstanding: ~117.5M

- Insider Ownership: 56.58%

- Strategic Investors & Management Ownership: 20M

- Free Trading: ~22.4M (less strategic investors & management)

- Market Cap: 16.13M (USD) 18.73M (CAD)

- Warrants: First Level at $0.40 (6M)

Note: Half warrants at $0.20 from last financing but are subject to a lock up period. Majority of all other outstanding warrants are sitting at $0.60. Parent company Scryb Inc. holds 60M shares, of which 51.3M are held in escrow / lock-up.

$CYBCF Long Speculation

Beaten down name with a tight float. Key reclaim will be the short term level of $0.39. I will be looking for a quick move towards the $0.60 – $0.78 level and then a grind higher after some consolidation there.

As requested by the Spartan Community, here is also the Canadian Chart and my TA on the Canadian Ticker of Cybeats.

$CYBT.CN Long Speculation

Idea: $0.16 – $0.25 (Starter Position)

1st Target Area: $0.42 – $0.54

2nd Target Area: $0.69 – $0.80

Stops: $0.10

Spartan’s Investment Thesis Highlights

- Over 50% of $CYBCF shares locked up in escrow – tight stock, limited public float.

- Amid escalating conflicts in the Middle East and heightened threats of cyber warfare, defense and cybersecurity stocks stand out as strategic investments.

- Government-mandated SBOMs have started, and market is set to soar.

- Cybeats team has over 100 years of combined cybersecurity experience and expertise in multiple domains, including three members of the US Government framing group that created the SBOM standard.

- Client base has a collective market cap exceeding $1 trillion and a 100% client retention rate.

- Monthly recurring revenue growth of 237% with an average enterprise contract size of $700,000+

- $CYBCF has secured contracts with 8 of the world’s top 10 medical device and industrial controls companies (four in medical devices & four in the industrial controls) including names like Schneider Electric and Becton Dickinson.

- Comparable companies to $CYBCF have been acquired for $350M (Crowstrike bought Bionic) to $600M (Palo Alto bought Talon Ventures) – IMO Cybeats is a desirable acquisition target.

Detailed Investment Thesis

Company Overview

$CYBCF operates in a critical niche of the cybersecurity market, providing solutions for managing growing regulatory oversight related to software, particularly in industries prone to cyber threats.

Led by a seasoned management team with deep industry connections and a history of successful contracts, Cybeats has secured partnerships with Fortune 500 companies, top-tier medical device providers, and key players in industrial automation, positioning itself as a trusted solution provider in the cybersecurity landscape.

Core Product Offering – SBOM Studio

Open-source software makes up over 80% of the software use in modern applications. Cybeats’ flagship product – SBOM Studio – is an enterprise class solution that helps organizations understand the security risks stemming from their software, including the third party and open-source components. SBOM studio documents what the organization has in order to plan for maintenance that will prevent security posture degradation over the life of the software.

Following a pivot in 2020, Cybeats SBOM Studio was first launched in Q2’ 2022 and has shown impressive market traction with 12 large enterprises currently using this flagship product.

How SBOM Studio Works:

- Automatically scans software showing all vulnerabilities and threats.

- Allows for sharing of SBOM with government agencies, such as the FDA for regulatory compliance.

- Offers organizations one, centralized tool for efficiently managing SBOMs and cyber risk

- Enables massive cost reductions for software security teams, who can react faster to cyber threats.

On the Brink of Explosive Growth

The SBOM market is on the brink of explosive growth. Cyber threats linked to software vulnerabilities have surged by 742% annually, prompting governments worldwide to take action. Software regulation is now a reality, with SBOMs becoming mandatory to combat these risks, transforming a once niche security measure into a global imperative.

Currently, only 5% of organizations utilize SBOMs. By 2025, this adoption rate is expected to skyrocket to 88%. With the global market projected to exceed $100 billion, $CYBCF is the leading solution for software safety and compliance, strategically positioned to capitalize on the imminent surge in demand.

From a global market perspective, the global cyber security market size was estimated at $222.66B in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.3% from 2023 to 2023.1

Team & Advisors – Depth of Operational Experience

Comprised of several ranking individuals within the Department of Homeland Security, White House and Canadian Department of Defense, the depth of the Cybeats team is unmatched in the sector.

With over 100 years of combined cybersecurity experience and expertise in multiple domains, the $CYBCF team has led multiple standardization efforts across the industry including the framing group that created the SBOM standard. Having close ties to the White House cyber policy team showcases Cybeats deep understanding of software transparency and security regulations.

Which is exactly the type of team that larger companies look for when selecting organizations as target acquisitions.

Valuation & Financial Highlights

Despite its robust revenue growth, a year-over-year increase of 322% and a net revenue retention rate of 142%, Cybeats remains significantly undervalued. With a market cap of $16.13M and substantial room for expansion, especially considering recent acquisitions in the cybersecurity space, Cybeats presents an attractive opportunity for both investors as well as organizations looking for target acquisitions.

Fiscal 2023 Financial Highlights:

- Cash on Hand: $1.05M

- New Burn: $330K

- Annual Recurring Revenue (ARR): $2M

- Year-over-Year (YOY) Growth: 322%

- Net Revenue Retention (NRR): 142% (demonstrating organic contract usage / growth & 100% client retention).

Share Structure:

- Float: 41M

- Shares Outstanding: ~117.5M

- Insider Ownership: 56.58%

- Strategic Investors & Management Ownership: 20M

- Free Trading: ~22.4M (less strategic investors & management)

- Market Cap: 16.13M (USD) 18.73M (CAD)

- Warrants: First Level at $0.40 (6M)

Note: Half warrants at $0.20 from last financing but are subject to a lock up period. Majority of all other outstanding warrants are sitting at $0.60. Parent company Scryb Inc. holds 60M shares, of which 51.3M are held in escrow / lock-up.

The company had previously completed two equity financings, one priced at $0.50 (with large insider participation) and the other at $1.00. Their most recent financing was for an oversubscribed placement with gross proceeds exceeding $2.4M, placing Cybeats in a strong cash position to continue operations for the foreseeable future.

With over 50% of Cybeats shares locked up in escrow, $CYBCF represents a very tight stock with a limited public float, in a balanced cash position.

Competitive Landscape – Ripe for Acquisition

Cybeats faces competition from players like Cybellum, MedCrypt, and Manifest Cyber, some of whom have already been acquired by larger entities.

Recent acquisitions in the cybersecurity sector highlight the appetite for consolidation in the market. For instance, Cybellum, a direct competitor, was acquired by LG for $240M USD.

Cybeats’ subsector of cyber is arguably the hottest sector worldwide right now for M&A.

The tech giants are on a buying spree.

Below are 7 of these transactions in the last few months:

- Crowdstrike acquires Bionic for $350M USD

- LG acquires Cybellum for $240M USD (Direct Competitor)

- Palo Alto networks acquires Talon ventures for $625M USD

- Cisco acquires Splunk security for $28B USD

- SAP acquires application security company, LeanIX for ~$1B USD

- Crowdstrike buys Flow Security for $200M USD

- Wiz acquires Gem security for $350M USD

- Zscaler acquires Avalor for $350M USD

These acquisitions highlight the appetite for consolidation in the market, with companies seeking to strengthen their portfolios through strategic acquisitions.

Pipeline & Partnerships

$CYBCF robust pipeline, encompassing partnerships with industry leaders, expansion into new sectors such as automotive, telecom, and financial services, and its innovative product development initiatives, underscore its potential for rapid growth and market dominance.

Regulatory changes, such as Executive Order 14028 and the European Union’s Cyber Resilience Act, further bolster Cybeats’ value proposition as a critical player in compliance management.

In addition, the rapid advancement of artificial intelligence (AI) introduces new complexities and challenges to cybersecurity. AI can be leveraged by both defenders and attackers, with the potential to automate sophisticated attacks or enhance defense mechanisms. $CYBCF is well-positioned to harness AI technology for proactive threat detection and response, bolstering its capabilities in an evolving cybersecurity landscape and providing it with a virtually limitless future pipeline.

Future Projections

Currently, over 80% of Cybeats customers are Fortune 500 Companies, including top tier brands such as Schneider Electric and Becton Dickinson.

Due to the confidential and secure nature of their work, $CYBCF cannot publicly name all of their clients but they also include 4 of the top 5 industrial automation companies in the world as well as one of the largest Crypto Exchanges in the world.

Conclusion – A Speculative Buyout Opportunity

Housing a client base with a collective market cap exceeding $1 trillion, $CYBCF presents a compelling investment opportunity within the cybersecurity sector, uniquely positioned to capitalize on the increasing demand for secure software solutions.

Given Cybeats’ impressive client roster, revenue growth, strategic partnerships, and the burgeoning demand for cybersecurity solutions globally, it is also primed for acquisition. With competitors being snapped up by larger entities, $CYBCF comparatively low valuation presents an attractive proposition for potential acquirers seeking to capitalize on the booming cybersecurity market.

In conclusion, Cybeats’ combination of strong fundamentals, strategic positioning, and potential for exponential growth make it a compelling buyout speculation target. As the cybersecurity landscape continues to evolve and consolidate, $CYBCF stands out as a prime candidate for acquisition, offering substantial upside potential for investors.

Cybeats Technologies Corp (OTCQB: CYBCF; CSE: CYBT)

- Idea: Long Speculation $CYBCF $0.12 – $0.20 (Starter Position)

- 1st Target Area: $0.39 – $0.51

- 2nd Target Area: $0.60 – $0.78

- Stops: $0.07

Spartan (aka ‘Chris’)

Stay up to date with Spartan’s Weekly Newsletter

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by Cybeats Technologies Corp (CT) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared by or on behalf of CT. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by CT (OTCQB:CYBCF) to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from CT. Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc and affiliate of Spartan Trading Inc. has a two month agreement with CT (OTCQB:CYBCF) for the sum of two hundred thousand united states dollars. This agreement is for investor relations, consulting and or marketing of CT (OTCQB:CYBCF) which services include the issuance of this release and other opinions that we release concerning of CT (OTCQB:CYBCF). Spartan Trading and affiliate Spark Newswire Inc has not investigated the background of CT (OTCQB:CYBCF) the hiring party. Anyone viewing this newsletter should assume CT (OTCQB:CYBCF) or affiliates of CT (OTCQB:CYBCF) own shares of CT (OTCQB:CYBCF) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading and affiliate Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements of CT (OTCQB:CYBCF).