QUARTERLY IN DEPTH INVESTMENT ANALYSIS – ESE ENTERTAINMENT INC (OTC: ENTEF)

Disseminated on behalf of ESE Entertainment Inc

QUARTERLY IN DEPTH INVESTMENT ANALYSIS

ESE Entertainment Inc – $ENTEF

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

For this Quarterly In Depth Investment Analysis I am going to be focusing on a sector that I do not normally cover – the gaming and esports industry.

I am extremely excited to share this name with the Spartan Community. I have been searching for forgotten companies that have a great business model, strong management team, strong financials and are in a growing sector that have a huge disparity between the price of the stock and the state of the business.

I have met with this companies CEO, looked at the landscape and received great insight into the pipeline going forward and, in my opinion, believe this name should have a 200-300% upside target (medium term) as more people become aware of the name.

So, why the gaming and esports Industry? With the proliferation of online gaming communities and the rise of competitive esport tournaments, the demand for solutions that enhance user engagement, data analytics, and augmented reality experiences is at an all-time high.

These industries have evolved into multi-billion dollar sectors, driven by a surge in digital entertainment consumption and a need from large, established Fortune 500 brands, to find new and innovative ways to gain brand exposure with younger demographics.

ESE Entertainment Inc (ESE) is strategically positioned to capitalize on this burgeoning market by offering leading video game developers, publishers and brands with innovative technology, infrastructure, and fan engagement services on a global scale.

This comprehensive investment thesis delves into ESE’s strategic advantages as a tech related growth name, focusing on it’s market opportunity and growth potential, strategic partnerships, strong financial performance and undervaluation relative to it’s competitors.

As investors seek exposure to high-growth markets and disruptive technologies, $ENTEF stands out as a hidden gem with a promising future ahead.

Spartan’s Technical Analysis

ESE Entertainment Inc (OTCQX: ENTEF; TSXV: ESE)

- Idea: Long $ENTEF $0.04 – $0.06

- Target Area (Short Term): $0.20

- Target Area (1 – 2 Months): $0.40 – $0.58+

- Stops: $0.01 (or treat as a lotto as very minimal down here in my opinion)

- Float: 40.15M

- Shares Outstanding: ~81M

- Insider Ownership: 30.07%

- Strategic Investors & Management Ownership: 20M

- Free Trading: ~20M (less strategic investors & management)

- Market Cap: 4.028M (USD) 5.268 (CAD)

- Warrants: First Level at $0.70

$ENTEF Long Term Idea. Beaten down name with a tight float. Key reclaim will be the short term level of $0.20. I will be looking for a quick move towards the $0.40 – $0.47 level and then a grind higher after some consolidation there.

INVESTMENT THESIS

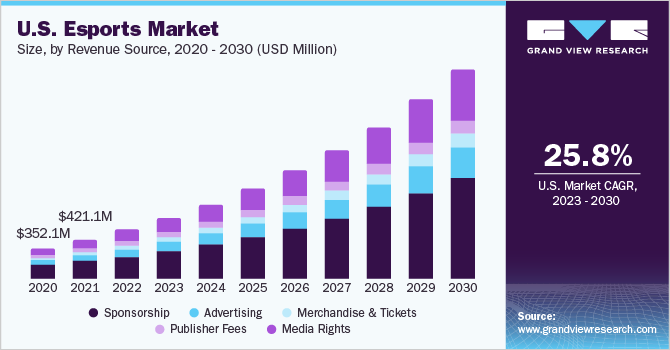

Global Gaming & Esports Market

Global Gaming in High Demand:

The global video game market size was estimated at $217.06B in 2022 and is expected to grow at an annual growth rate (CAGR) of 13.4% from 2023 to 20301. Globally, there are over 3 billion video game players, and by 2030 the global game market is expected to have grown to a value of over $400B USD2. North America is expected to hold the largest market share of the esports global market with an estimated value of $0.5B USD in 20233.

Capitalizing on Global Gaming Growth:

The growing trend of live streaming of games, gaming investments, rising viewership, ticket sales, and demand for league tournament infrastructure are just some factors influencing esports market growth.

Large brands and Fortune 500 companies are also looking for new and innovative ways to capture the attention, viewership and gain brand recognition among younger demographics.

$ENTEF capitalizes on this by providing a specialized range of services to leading video game developers, publishers and brands by owning, operating, and monetizing their own ecommerce channels, sports teams, and gaming leagues.

360 Marketing Solution – Chosen by Fortune 500 Brands:

ESE’s 360 marketing solution has helped to not only attract tier one customers, but retain then. Their unique 360 marketing solution enables ESE to be paid directly from the publisher (i.e. EA Sports, Ubisoft, Google etc) and assist the publishers in not only marketing the product through online / offline events, but by bringing in new users and connecting sponsors to the communities and ecosystems ESE creates.

The unique marketing solution between developers, brands and audiences has enabled $ENTEF to continue to grow its revenue quarter-over-quarter while creating multiple additional business growth and expansion opportunities.

It is clear that in working with many larger and recognizable names this presents an opportunity for significant growth going forward. Contracts with Fortune 500 companies are extremely impressive for such an organization with such a low market cap. This is almost never seen in any industry.

Market Opportunities: Partnership & Middle East Expansion

Metapro Partnership – Tapping into Crypto & Blockchain Markets:

ESE’s partnership with Metrapro and its subsequent expansion into the Crypto and Blockchain Markets further amplifies its executive teams forward-thinking approach. The integration of cryptocurrency wallets into gaming platforms not only diversifies ESE’s revenue streams but also opens doors to new monetization models and digital asset exchanges within virtual ecosystems. Leveraging blockchain technology to empower gamers and creators while tapping into the growing decentralized finance (DeFi) space will assist ESE in standing out within the ESports sector.

ESE Middle East Expansion:

ESE is extending its footprint in the Middle East with the planned opening of a Dubai office, emphasizing ESE’s commitment to tapping into gaming’s fastest-growing region in the world. The Middle East has seen investments from the Savvy Games Group, a company which is owned by Saudi Arabia’s Public Investment Fund (PIF), totally nearly $40B, and ESE wants to leverage its expertise and services to increase sales in this region.

ESE Ownership in GameAddik:

$ENTEF is a 30% owner in the technology asset GameAddik, and a partner with BlackPines Capital, the family office of Darren Huston. Mr. Huston was the past CEO of Booking.com (NASDAQ: BKNG) and the current Chairman of Skyscanner. ESE earns revenue directly from GameAddik and is compensated for acquiring new users (paid per user) in addition to earning money for marketing efforts around Game Addik. This strategic partnership enables ESE to earn additional revenue without the full overhead of managing and directly operating GameAddik (a previously divested asset, sold for $9M in 2023).

Comparative Analysis: Significant Upside

When comparing $ENTEF to its closest competitor, Over Active Media (OAM), several key metrics highlight ESE’s superior positioning and growth prospects.

Revenue & Profitability:

OAM reported revenue of ~$15.0M CAD (TTM), with a net loss of -$41.5M CAD, While ESE boasts audited revenues of $58M (TTM) and a net break-even position. This significant disparity underscores $ENTEF stronger financial performance and path to profitability.

Market Capitalization:

Despite $ENTEF robust financials and strategic partnerships, its market capitalization stands at $4.028M USD, significantly lower than OAM’s market cap of $43.5M USD. This valuation disconnect presents an attractive investment opportunity for discerning investors, considering ESE’s revenue-generating capabilities and growth trajectory relative to its market value.

Growth Potential:

ESE’s expansion into high-growth markets such as Crypto and Blockchain, coupled with its strategic partnerships and diversified revenue streams, positions the company for exponential growth. In contrast, OAM’s narrower focus and weaker financial performance limits its scalability and market competitiveness.

Risk Reward Profile:

$ENTEF offers investors a favorable risk-reward proposition, with strong fundamentals, a robust pipeline of partnerships and a clear path to profitability. In contrast, OAM’s higher market capitalization relative to its revenue and profitability metrics may present greater downside risk, particularly in volatile market conditions.

$OAM.V (a direct competitor) in a worse financial position than ESE (lower revenues and profitability)

and recently ran up 550% from lows at the peak in 2024 (in just two and a half months).

Significant Upside – Aggressive Growth for Takeout

With the esports market continuing to grow each year, not only do I feel that $ENTEF is significantly undervalued, with ESE’s aggressive growth aspirations I see additional upside as they begin to chip away at their competitors market share (and/or acquire or be acquired by competitors in the space).

Examples of competitor valuations:

- Playmaker Capital:~$110M

- ESL Faceit Group: ~$1.5B

- Keywords Studios: ~$2.1B

- Score Media & Gaming: ~$2.5B

Financial Landscape: Valuation & Structure Summary

Valuation Disparity:

$ENTEF market cap of $4.028 million is indicative of an undervaluation in the market. This sets the stage for an opportune entry point for investors, especially when compared to the competitors identified above.

Capital Structure Strength:

The tightly held shares, insider ownership at 30.07%, with strategic investors and management ownership sitting around ~20M Shares, highlight insiders confidence in $ENTEF and it’s potential for growth.

2023 Financial Highlights:

- Overall Revenue of $19.10M CAD

- GameAddik asset reported $19.47M CAD in Revenue and $5.38M CAD Gross Profit, affirming the strategic value of ESE’s ongoing 30% ownership position.

- Significant improvement in Q4 2023 operations, with earnings per share of $0.00 (compared to Q4 2022 earnings per share of -$0.23).

- Cash on hand: $2,125,251 CAD (compared to $812,220 Fiscal 2022).

This is a significant improvement in earnings and all the signs are pointing that they will be heading towards profitability sooner rather then later. These financial improvements have yet to be reflected in ESE’s market cap. As noted above, ESE competitors, who are loosing +$40M a year, dwarf ESE’s market cap despite being in a much worse financial position. That said, I feel that it is only a matter of time before the market adjusts accordingly.

Conclusion

ESE Entertainment Inc. represents a compelling investment opportunity in the dynamic gaming and technology sector. With its innovative solutions, strategic partnerships, and solid financial performance, $ENTEF is poised to capitalize on the rapid growth of the Gaming, Esports, and Blockchain industries. As investors seek exposure to high-growth markets and disruptive technologies, $ENTEF stands out as a hidden gem with significant upside potential and a promising future ahead.

ESE Entertainment Inc (OTCQX: ENTEF; TSXV: ESE)

- Idea: Long $ENTEF $0.04 – $0.06

- Target Area (Short Term): $0.20

- Target Area (1 – 2 Months): $0.40 – $0.58+

- Stops: $0.01 (or treat as a lotto as very minimal down here in my opinion)

Spartan (aka ‘Chris’)

References:

1. https://www.grandviewresearch.com/industry-analysis/video-game-market

2. https://eit-culture-creativity.eu/european-game-industry-latest-study-shows-potential-of-e40-billion-turnover-by-2030/

3. https://www.fortunebusinessinsights.com/esports-market-106820

4. https://www.grandviewresearch.com/industry-analysis/esports-market

Stay up to date with Spartan’s Weekly Newsletter

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by ESE Entertainment Inc (EI) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared by or on behalf of EI. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by EI (OTCQX:ENTEF) to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from EI. Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc and affiliate of Spartan Trading Inc. has a three month agreement with EI (OTCQX:ENTEF) for the sum of three hundred thousand canadian dollars. This agreement is for consulting and or marketing of EI (OTCQX:ENTEF) which services include the issuance of this release and other opinions that we release concerning of EI (OTCQX:ENTEF). Spartan Trading and affiliate Spark Newswire Inc has not investigated the background of EI (OTCQX:ENTEF) the hiring party. Anyone viewing this newsletter should assume EI (OTCQX:ENTEF) or affiliates of EI (OTCQX:ENTEF) own shares of EI (OTCQX:ENTEF) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading and affiliate Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements of EI (OTCQX:ENTEF).