GOLD & COPPER TARGETS WITH BILLION-DOLLAR PRECEDENTS

Disseminated on behalf of Questcorp Mining Inc

GOLD & COPPER TARGETS WITH BILLION-DOLLAR PRECEDENTS

QUESTCORP MINING INC – CSE: QQQ.CN | OTC: QQCMF

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

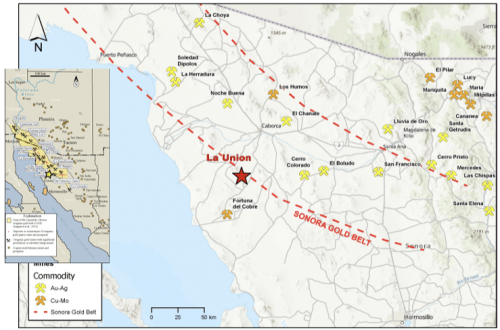

Questcorp Mining Inc. (CSE: QQQ.CN | OTC: QQCMF) is a Canadian junior exploration company focused on high-potential mineral projects, with its flagship La Union Gold Project in the prolific Sonora Gold Belt of northern Mexico and the North Island Copper Property (NICP) in British Columbia, Canada.

This investment thesis emphasizes the tightly held share structure, the de-risked La Union project with its world-class carbonate replacement deposit (CRD) potential, and the strategic partnership with Riverside Resources Inc. (TSXV: RRI).

The Sonora region’s history of major discoveries and acquisitions, combined with the high-grade CRD geology, positions Questcorp for a potentially transformative discovery that could attract significant buyout interest from major mining companies.

Spartan’s Technical Analysis

QUESTCORP MINING INC – CSE: QQQ.CN

- Spartan’s Idea: Long Speculation $0.15 – $0.18

- Spartan’s Stop Loss: $0.10

- First Resistance: $0.27

- Second Resistance: $0.38

OTC: QQCMF

- Spartan’s Idea: Long Speculation $0.10 – $0.13

- Spartan’s Stop Loss: $0.065

- First Resistance: $0.22

- Second Resistance: $0.30

Flagging in the daily, curling back above ema support and room back to the recent range highs in my opinion. Will continue to watch volume to see if spec money flows in before results.

KEY QUESTCORP HIGHLIGHTS

Tightly Held Share Structure Enhances Upside Potential

Share Structure: Questcorp has 72.81 million shares outstanding, a float of 66.09 million, and a market cap of CAD $10.54 million. Post-financing, the fully diluted share count would be 120.44 million, raising approx. an additional $5 million CAD.

Ownership Concentration: The float is tightly controlled, with 58% held by U.S. advisors, 10.1% by management, 9.9% by Riverside Resources, 2% by European investors, and only 20% by retail investors. This concentrated ownership aligns insider and institutional interests with shareholders, reducing selling pressure and amplifying potential share price gains as exploration milestones are achieved.

Implication: The tightly held float positions Questcorp for significant re-rating upon positive exploration results, as limited available shares could drive rapid price appreciation in a discovery scenario. Institutional ownership signals strong confidence in the company’s prospects, particularly for La Union.

La Union Gold Project: De-Risked and Poised for a Major Discovery in the Sonora Gold Belt

Sonora Gold Belt: The Sonora Gold Belt is one of the most prolific mining regions globally, hosting multi-million-ounce gold and silver deposits and world-class CRD and porphyry systems. Notable examples include:

- Fresnillo’s La Herradura: 5.5M oz Au (proven + probable) and 6.7M oz (measured + indicated), one of Mexico’s largest gold mines.

- San Francisco Mine: 1.4M oz Au (measured + indicated), operated by Magna Gold.

- Frisco Mining: One of Mexico’s largest carbonate-hosted mines, exemplifying the region’s CRD potential.

- Alamos Gold’s Mulatos Mine: A multi-million-ounce gold producer, showcasing the region’s scalability. The belt’s history of major discoveries and acquisitions (e.g., South32’s $400M Hermosa project buyout in Arizona, a comparable CRD) underscores its attractiveness to majors. La Union’s location at the edge of this belt positions it ideally for a significant discovery.

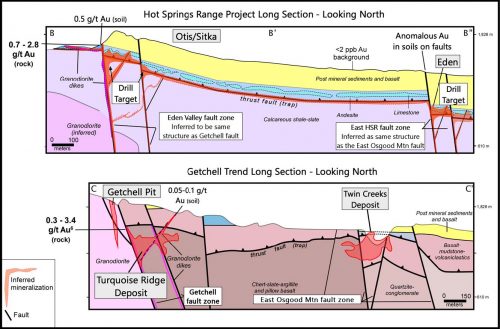

Carbonate Replacement Deposit (CRD) Potential

La Union is a 2,604-hectare, road-accessible, high-grade CRD project targeting gold, silver, zinc, and copper. CRDs are renowned for world-class grades and large-scale deposits, as seen in peers like MAG Silver’s Juanicipio (high-grade silver-gold CRD) and South32’s Hermosa.

Historical production at La Union (1950s) averaged 7-20 g/t Au, 300 g/t Ag, 10-20% Pb, and 5% Zn, with recent grab samples showing exceptional grades (up to 83.2 g/t Au, 4,816 g/t Ag, 30% Zn, and 5.34% Cu).

Geological Advantage: The project’s carbonate host rocks (black and grey limestone units, 150-250m thick) are ideal for high-grade mineralization, forming classic chimney-manto systems. CRDs often overlie larger porphyry copper systems, as seen in nearby Cananea and Hermosa, offering dual discovery potential.

Speculative Upside: The carbonate geology and untested deeper porphyry potential suggest La Union could host a world-class deposit. A significant discovery—particularly of high-grade CRD or underlying porphyry—could mirror the success of MAG Silver or South32’s Hermosa, making Questcorp a prime acquisition target for majors like Fresnillo, Fortuna Mining (3B market cap), or even Northisle Copper and Gold Inc., which is exploring nearby in British Columbia.

De-Risking Efforts: Riverside Resources has invested over $2.5M, consolidating seven properties with past production and conducting extensive surface work, geophysical surveys (gravity and EM), and an upcoming IP survey.

Eight target zones have been identified, with three drill-ready targets:

- Plomito: 83.2 g/t Au, 176 g/t Ag, 19.8% Zn, 5.34% Cu.

- La Famosa: 59.4 g/t Au, 833 g/t Ag, 4.2% Zn.

- La Union: 9.9 g/t Au, 53.6 g/t Ag, 2.5% Zn.

The 2024 Phase I program includes no more than 4-6 drill holes (for approximately a total of 1,500m) to test these targets to hone in on the right stratigraphy, with results expected in Q3/Q4 2025. This systematic approach minimizes wasteful drilling and maximizes discovery potential.

Infrastructure Advantage: La Union benefits from drive-up access on a private ranch, secured permits, and available power and water (trucked from nearby sources). This infrastructure reduces operational costs and eliminates community or regulatory risks, making it cheaper and easier to operate compared to remote projects.

Speculative Buyout Potential: Given the Sonora region’s M&A activity and La Union’s CRD and porphyry potential, a significant discovery could attract immediate interest from majors. The Hermosa project’s $400M buyout is a direct comparable, while Fresnillo, Fortuna, and Alamos Gold’s regional presence increases the likelihood of a competitive bidding process. A discovery of scale could value Questcorp’s assets in the hundreds of millions, far exceeding its current $10.54M market cap.

Strategic Partnership with Riverside Resources

Proven Expertise: Riverside Resources Inc. (TSXV: RRI), holding a 9.9% stake in Questcorp, has operated in Mexico for over 20 years, with a track record of major discoveries, including Alamos Gold ($3.5B market cap) and Ocampo ($2.2B sale). Dr. John-Mark Staude, Riverside’s President, CEO and Founder / Director, brings deep regional knowledge and operational experience.

Operational Continuity: Riverside’s role as program operator leverages its seven years of exploration at La Union, including USD $700,000 spent consolidating properties and identifying targets. This partnership enhances execution efficiency and credibility.

Spinout Rarity: La Union was destined to be one of only two spinout deals Riverside has executed, the other being El Capitan (now ~$100M market cap). This selectivity underscores La Union’s high potential, as Riverside has a history of backing only the most promising projects.

Implication: Riverside’s involvement and stake align interests and increase the likelihood of a successful discovery, making Questcorp an attractive partner or acquisition target for larger players.

Sonora Gold Belt: A Hotbed for Discoveries and M&A

Regional Context: The Sonora Gold Belt’s rich history includes over 15 million ounces of gold and significant silver production across mines like La Herradura, San Francisco, and Mulatos. The region’s carbonate-hosted and porphyry deposits have drawn majors like Fresnillo, Fortuna Mining, and Alamos Gold, as well as recent M&A activity (e.g., South32’s Hermosa).

Acquisition Precedents: The Hermosa project’s $400M buyout by South32 highlights the value of CRD deposits in the region. Similarly, Riverside’s past successes with Alamos and Ocampo demonstrate the belt’s potential for transformative deals.

Speculative M&A Scenario: A significant CRD or porphyry discovery at La Union could position Questcorp as a takeover target for majors seeking to bolster their Sonora portfolios. Nearby players like Fresnillo (world’s largest silver producer) or Fortuna Mining (3B market cap) could view La Union as a strategic fit, especially given its high-grade potential and infrastructure advantages. The tightly held float would further drive premium valuations in a buyout scenario.

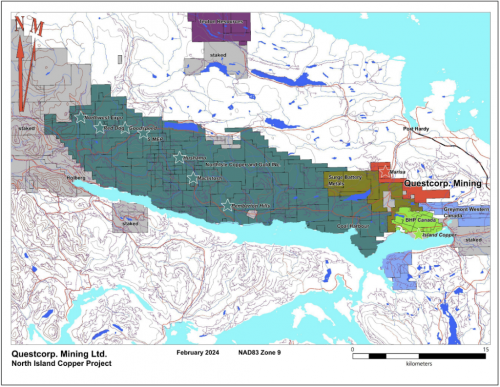

North Island Copper Property (NICP): Complementary Upside

Location and Potential: NICP, located near the past-producing BHP Island Copper Mine (1.2B kg Cu, 35,268 kg Au), targets copper-silver skarn and porphyry copper mineralization. Historic drilling intersected 0.078% Cu over 56.39m, with grades increasing at depth, and a planned 3D IP survey will guide further drilling.

Regional Interest: Northisle Copper and Gold Inc., exploring 15-31km away, could view NICP as a strategic acquisition target due to its proximity and complementary polymetallic potential.

Infrastructure: The property benefits from highways, logging roads, and a hydro line, supporting cost-efficient exploration.

Implication: While La Union is the primary value driver, NICP adds diversification and potential for additional discoveries, enhancing Questcorp’s overall appeal to investors and acquirers.

Experienced Management Team

Leadership: Founding Director, President & CEO Saf Dhillon has over 20 years of experience in public company development, including U.S. Geothermal’s growth from USD $2M to a $200M sale. Advisor Paul Larkin, with 42 years in corporate finance, has guided multiple resource startups including being a Founder of U.S. Geothermal Inc. to success.

Technical Expertise: Director R. Tim Henneberry (P.Geo) brings 43 years of international exploration experience, ensuring robust project execution.

Implication: The team’s track record in exploration and M&A enhances Questcorp’s ability to deliver on La Union’s potential and navigate acquisition discussions.

Valuation & Market Opportunity

Current Valuation: Questcorp Mining Inc. (CSE: QQQ.CN | OTC: QQCMF) $10.54M market cap is significantly undervalued relative to peers like El Capitan ($100M) and Fortuna Mining ($3B). The tightly held float and low market cap create a low base for substantial re-rating upon exploration success.

Comparable Valuations: South32’s $400M Hermosa acquisition and MAG Silver’s Juanicipio success highlight the premium valuations for CRD discoveries. A major discovery at La Union could value Questcorp’s assets in the $200-500M range, based on regional precedents.

Catalysts:

- IP survey results (expected within weeks) to refine drill targets.

- Phase I drilling at La Union (1,500m, Q3/Q4 2025) targeting high-grade CRD zones.

- NICP 3D IP survey and follow-up drilling.

- Potential M&A interest following a discovery, driven by Sonora’s active deal environment.

Speculative Buyout Scenario: A significant CRD or porphyry discovery could catalyze a buyout, with valuations potentially exceeding $400M, as seen with Hermosa. Majors like Fresnillo, Fortuna, or even Northisle (for NICP synergy) could compete for Questcorp’s assets, leveraging the tightly held float to drive a premium offer.

Conclusion

QUESTCORP MINING INC – CSE: QQQ.CN

- Spartan’s Idea: Long Speculation $0.15 – $0.18

- Spartan’s Stop Loss: $0.10

- First Resistance: $0.27

- Second Resistance: $0.38

OTC: QQCMF

- Spartan’s Idea: Long Speculation $0.10 – $0.13

- Spartan’s Stop Loss: $0.065

- First Resistance: $0.22

- Second Resistance: $0.30

Flagging in the daily, curling back above ema support and room back to the recent range highs in my opinion. Will continue to watch volume to see if spec money flows in before results.

Spartan (aka ‘Chris’)

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by Questcorp Mining Inc (QM) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared by or on behalf of QM. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com and affiliates make no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by QM (OTC:QQCMF) to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from QM. Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc and affiliate of Spartan Trading Inc. has a twelve month agreement with QM (OTC:QQCMF) for the sum of twenty five thousand dollars per month. This agreement is for consulting and or marketing of QM (OTC:QQCMF) which services include the issuance of this release and other opinions that we release concerning of QM (OTC:QQCMF). Spartan Trading and affiliate Spark Newswire Inc has not investigated the background of QM (OTC:QQCMF) the hiring party, QM (OTC:QQCMF). Anyone viewing this newsletter should assume QM (OTC:QQCMF) or affiliates QM (OTC:QQCMF) own shares QM (OTC:QQCMF) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading and affiliate Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements QM (OTC:QQCMF).