Jigsaw Trading: Pros, Cons & Alternatives

The rise of trading software and educational tools has significantly reshaped the financial markets, making sophisticated trading strategies accessible to a broader audience. Jigsaw Trading stands out in this crowded market with its robust features tailored for real-time market analysis and trade execution. This functionality is crucial for understanding market turning points and managing trade execution effectively.

At Spartan Trading, we emphasize the importance of trading tools and platforms in trade management and market order analysis. We’ve seen firsthand how features like cumulative delta and volume delta bars empower traders by providing efficient trade management and real-time data. Our team extensively uses tools and platforms to help us cater to active and passive traders, enhancing their skills by offering trading activity and education.

Considering our in-depth analysis and extensive industry experience, we’ve put together this guide that delves into the powerful capabilities of the Jigsaw Trading platform. Delving into its tools and features, you’ll discover the benefits and drawbacks of using this platform. By the end of this blog, you’ll gain a comprehensive understanding of how to leverage this tool for future trading success, ensuring future results that could pay huge returns.

Let’s dive in!

What Is Jigsaw Trading?

Jigsaw Trading is a trading platform that equips traders with tools to enhance their trading efficiency. It focuses on order flow and market dynamics. The platform is well-regarded for its in-depth visualization capabilities and the powerful Jigsaw daytradr™ platform, which is essential for active and professional traders.

Use Cases of Jigsaw Trading

- Real-Time Market Depth Visualization: Traders use the platform to view live market depth updates and make informed decisions based on the current market dynamics.

- Order Flow Analysis: The platform’s order flow tools help identify the entry and exit of large volumes, such as iceberg orders and stop orders, which are crucial for day traders.

- Historical Data Review: Tools like Auction Vista allow users to analyze past market data to understand trends and prepare for future trades.

- Simulated Trading Environment: New traders practice strategies in a simulated environment that mimics real trading conditions, an essential step before engaging in actual trading.

- Advanced Trading Education: It provides comprehensive educational resources, including insights into order flow strategies, helping traders advance their skills.

Jigsaw Trading revolutionizes trading by providing essential tools and insights for day traders to make informed decisions. Its real-time data and intuitive visualizations empower traders to navigate the markets with confidence and precision.

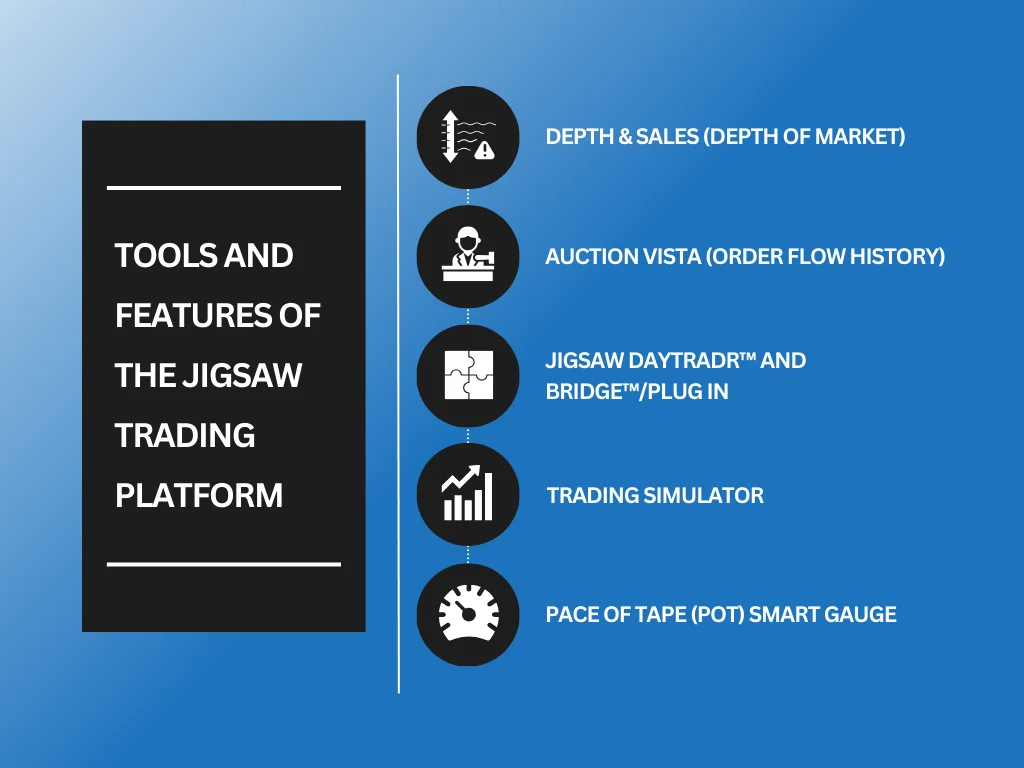

Tools and Features of the Jigsaw Trading Platform

Jigsaw Trading offers a variety of tools that cater to the needs of active and institutional day traders alike. It provides a depth of market view and a real-time data stream that enhances trading decisions. Let’s explore some key features that make the platform stand out.

1. Depth & Sales (Depth of Market)

The Depth & Sales feature, Jigsaw’s interpretation of the Depth of Market (DOM), serves as a cornerstone for proprietary trader decision-making. It offers an intuitive grasp of the market’s pulse by displaying the interaction between passive traders using limit orders and active participants executing market orders. Key insights include:

- Visualization of trading data as trades impact the market.

- Identify potential stop order locations and the dynamics of order cancellation and stacking.

- Balancing trade momentum and adjusting strategies in real-time.

Depth & Sales transforms complex market dynamics into actionable insights, making it indispensable for traders who rely on detailed market analysis to refine their trading strategies.

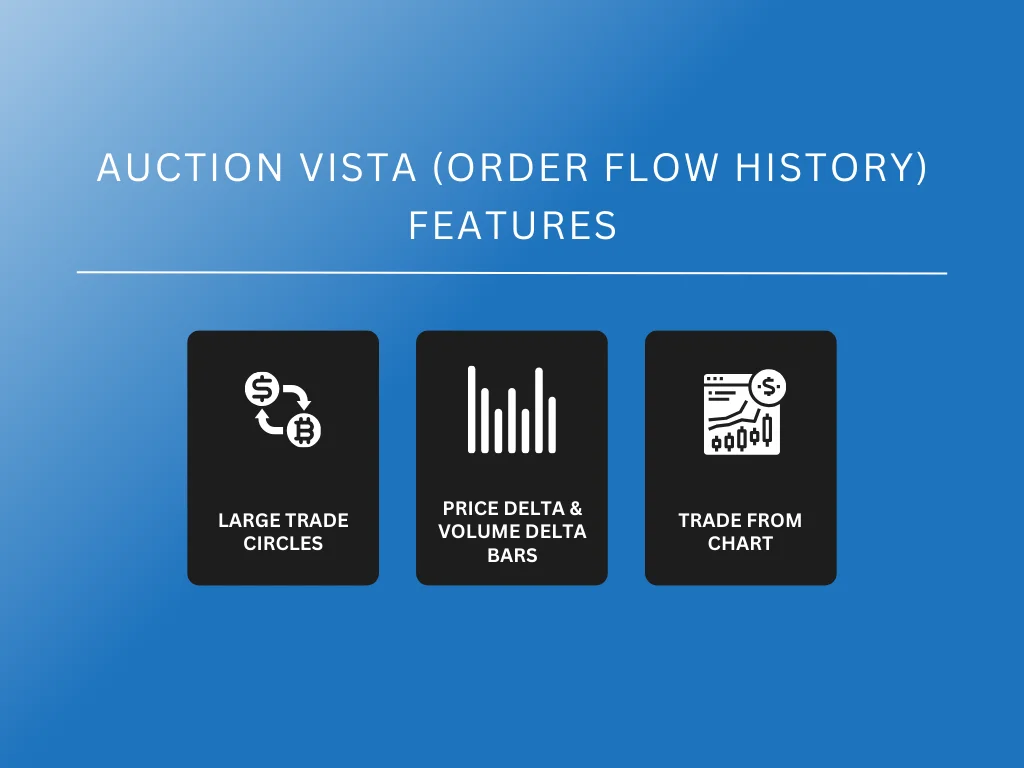

2. Auction Vista (Order Flow History)

Auction Vista enhances market depth visualization by providing a detailed view of real-time and historical order flow. It uses a shaded background where lighter areas indicate liquidity, not guaranteeing market hold but signaling trader interest. Its features include:

- Large Trade Circles: Highlight key areas of high volume, pointing out potential market turning points or iceberg orders.

- Price Delta and Volume Delta Bars: Offer a depth histogram that helps traders understand price movements and make more informed decisions.

- Trade From Chart: This option allows direct trade management from the chart, integrating depth and sales data for comprehensive analysis.

Auction Vista offers a comprehensive view of market activity, equipping traders with the tools to anticipate and react to market movements effectively. As such, it is a critical asset in the trader’s toolkit.

3. Jigsaw Daytradr™ and Bridge™/Plug in

Jigsaw provides two versions of its tools to suit different trader needs:

- Daytradr Trading Platform™: A robust platform designed for day traders, connecting directly to significant data feeds like CQG, Rithmic, and GAIN Futures. It includes all necessary out of the box features to deliver a seamless trading experience.

- Jigsaw Bridge™/Plug-in: This tool allows integration with existing trading platforms like NinjaTrader and MetaTrader, enhancing them with Jigsaw’s advanced order flow capabilities.

Whether opting for the comprehensive Daytradr platform or enhancing an existing setup with the Jigsaw Bridge, traders gain access to top-tier trading tools that support a range of trading activities from day trading to complex strategy execution.

4. Trading Simulator

The Jigsaw Trading Simulator is crucial for traders learning new strategies or refining their techniques. It simulates a realistic trading environment where realistic fills on limit orders and appropriate slippage on the market and stop orders are modeled, and traders can test strategies in a risk-free environment to gauge potential real-world outcomes.

The Trading Simulator is a valuable educational tool that helps traders refine their approach and practice strategies. It is crucial for both beginners and experienced traders who want to hone their skills.

5. Pace of Tape (PoT) Smart Gauge

This innovative tool provides a dynamic view of the pace of trade, comparing current market activity against historical averages. It helps identify the strength of market movements at critical points like support or resistance levels and slightly different use cases like monitoring correlated markets to predict movement sustainability.

Additionally, the PoT Smart Gauge is an innovative tool that provides immediate insights into the market’s tempo. It assists traders in making informed decisions about entry and exit points and overall trade management.

Jigsaw Trading Pricing Plans

Jigsaw Trading offers various pricing plans tailored to different trader needs. Each plan provides access to the unique Daytradr platform and comprehensive support and training options.

- Independent Plan ($579): This one-time payment grants full access to the Daytradr platform. It includes Journalytix trade history analysis, trade calendar, leaderboard, live chat room access, realistic trade simulator, and basic training materials.

- Professional Plan ($879): This plan is ideal for traders seeking deeper insights and community interaction. It builds on the Independent plan with additional training packs and monthly group therapy sessions to enhance trading strategies.

- Institutional Plan ($1979): This is the most comprehensive package for high-volume traders or institutional clients. It includes advanced training modules and one-on-one support to optimize trading strategies.

Pros and Cons of Jigsaw Trading

Jigsaw Trading offers a comprehensive suite of features to help traders understand market movements. However, like any trading platform, it has its strengths and weaknesses. Let’s explore the pros and cons of using this trading platform.

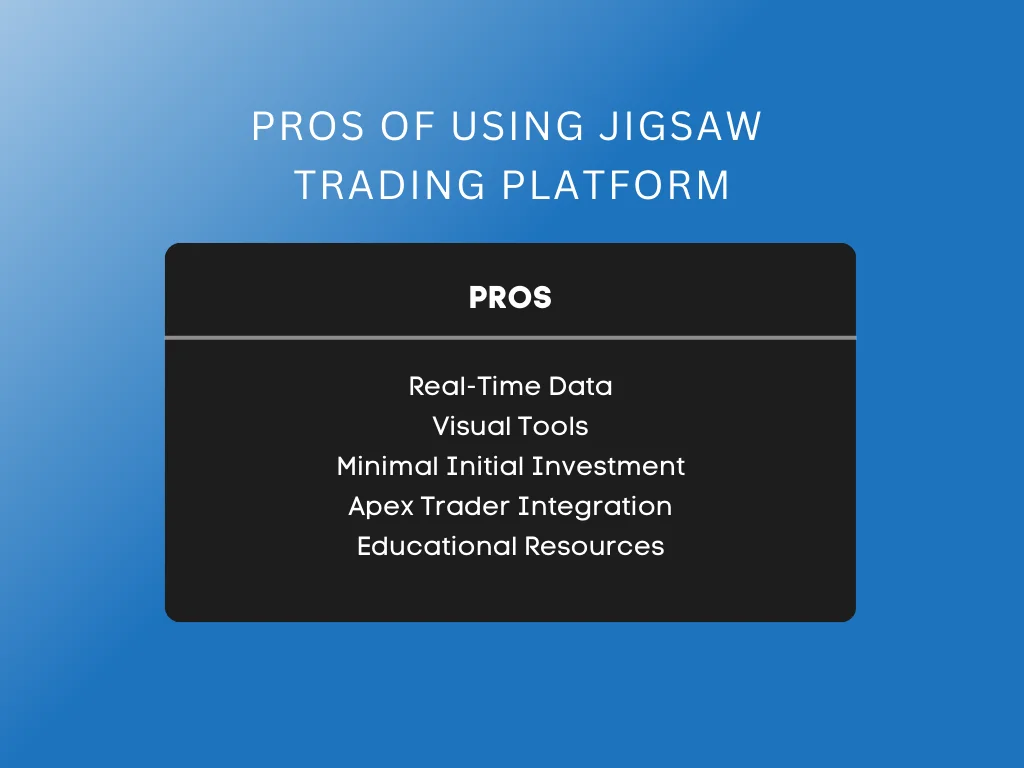

Pros of Using Jigsaw Trading

Jigsaw Trading provides several benefits that enhance the trading experience, particularly for those focused on order flow and market depth. Here are five benefits:

- Real-Time Data: Jigsaw Trading offers real-time data through its Depth of Market (DOM) tool and order book heatmap. This real-time information is crucial for traders who rely on quick decision-making based on current market conditions.

- Visual Tools: The platform includes visual tools that make it easier to interpret market data. These tools help traders understand the pace of trade and identify patterns that might take time to be noticeable.

- Minimal Initial Investment: While some trading platforms require significant upfront costs, their initial investment is relatively low, making it accessible to traders at various levels.

- Apex Trader Integration: Integrating seamlessly with Apex Trader, the platform allows users to use both platforms’ features. This integration enhances the trading experience and provides additional tools for market analysis.

- Educational Resources: It offers extensive educational resources, including courses and tutorials. These resources help traders understand the terms of your market understanding and improve their trading skills.

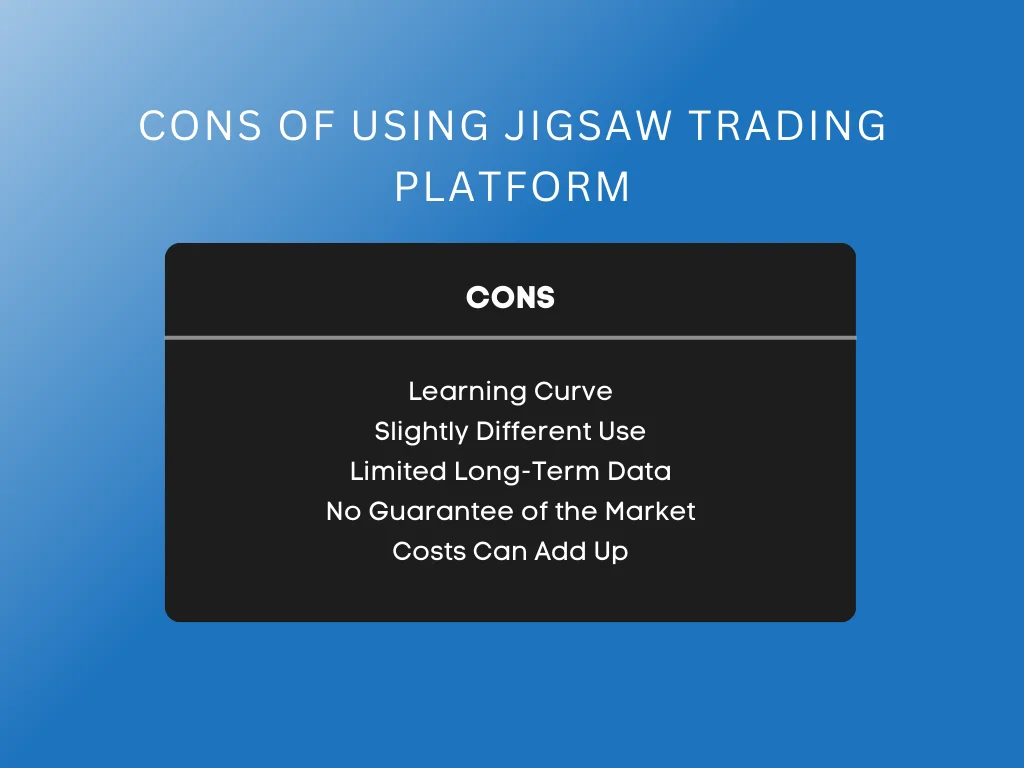

Cons of Using Jigsaw Trading

Despite its advantages, Jigsaw Trading has some drawbacks that potential users should consider. Here are its five notable cons:

- Learning Curve: The platform’s depth and range of tools can overwhelm beginners. New traders might find the learning curve steep, as the uses of the pace of trade and other features require some time to master.

- Slightly Different Use: While it excels in order flow and market depth analysis, its tools might be used differently than other trading platforms. This difference can be a disadvantage for traders accustomed to more conventional methods.

- Limited Long-Term Data: The platform focuses primarily on short-term trading. Traders looking for longer-term data might find the platform needs more in this aspect, as it doesn’t provide extensive historical data.

- No Guarantee of the Market: The platform cannot guarantee market success like any trading tool. Users must understand that while the platform provides valuable insights, there is no foolproof method for accurately predicting market movements.

- Costs Can Add Up: Although the initial investment is low, ongoing costs for data feeds, such as Gain Feed and subscriptions, can add up. Traders need to consider these expenses when deciding whether to use it.

Jigsaw Trading Reviews and Recommendations

Jigsaw Trading garners positive feedback across various platforms, with a strong focus on customer service and effective trading tools. Reviews often highlight the platform’s ability to enhance trading strategies, citing the platform as a cornerstone of the proprietary trader’s toolkit. Users from diverse regions appreciate the platform’s robust features, like the Index Trade Launcher and Global Zen Trader.

Despite its numerous advantages, some users encounter challenges with Jigsaw Trading. A minority of reviews suggest discrepancies in expectations, particularly concerning cancellation policies and customer support responsiveness. However, most feedback remains highly favorable, with traders achieving significant success over longer-term engagements.

Jigsaw Trading Alternatives

While Jigsaw offers powerful tools for traders, several alternatives provide similar features and functionalities. Exploring these alternatives can help traders find the best fit for their needs and strategies.

1. FlowTrade – Best for Real-Time Market Analysis

FlowTrade specializes in providing traders with advanced tools for real-time market analysis. They excel in integrating unique indicators like the Flow Index, which offers traders a deeper understanding of market movements and price approaches.

FlowTrade stands out with its Dark Pool Index, a rare feature that gives insights directly from the dark exchanges. This allows traders to see the underlying market sentiments that are not visible through ordinary trading platforms. This unique offering helps traders anticipate major market moves by understanding the actions of large institutional players.

Notable Features of Using FlowTrade

- Flow Index: This flagship indicator lets traders see beneath the market’s surface. It reveals when and where big money is moving, facilitating more informed trading decisions.

- Dark Pool Index: Provides real-time data on dark pool activities, giving traders insight into the actions of major market players.

- Various Brokers, Exchanges, and Feeds: FlowTrade offers extensive market coverage, ensuring traders can access diverse market data and execute trades across multiple asset classes.

- DOM/Chart Trading: Customizable DOM and chart trading features allow traders to tailor their trading environment to their specific needs, enhancing their trading efficiency.

FlowTrade Pricing Plans

FlowTrade does not explicitly list pricing details on its website. Interested traders should contact them directly to discuss pricing plans and find the option that best suits their trading needs.

FlowTrade is ideal for active traders and proprietary trading firms who require deep market insights and real-time data to make quick, informed trading decisions. Their tools are particularly beneficial for those involved in high-frequency trading and those who need to understand the subtle shifts in market dynamics to stay ahead.

2. Binomo – Best for Beginner Traders

Binomo offers an accessible and user-friendly platform for new traders. Specializing in real-time market data and user-centric features, it is designed to support those beginning their trading journey. Trades start from $1, ensuring a minimal initial investment risk.

What sets Binomo apart is its commitment to training and accessibility. The platform offers a comprehensive demo account with $10,000 in virtual funds, allowing users to practice without financial risk. This is paired with the unique feature of non-stop trading, which lets traders open multiple positions simultaneously without restrictions, enhancing their trading flexibility.

Notable Features of Using Binomo

- Demo Account: Binomo provides a risk-free demo account where traders can practice strategies using virtual funds before committing real money, ensuring they are well-prepared.

- Non-Stop Trading: The platform allows multiple trades at once, offering continuous trading without limitations on the number of open positions, which is ideal for dynamic trading strategies.

- Weekend Trading: Binomo enables weekend trading, providing flexibility for those who cannot trade during traditional market hours.

- Mobile Trading: The Binomo app, available for iOS and Android, allows traders to execute trades from anywhere and stay updated with real-time information on trades, promotions, and tournaments.

Binomo Pricing Plans

Binomo’s minimum account balance starts at $10, making it accessible for traders with minimal initial investment. Trade amounts begin at just $1, significantly lowering the entry barrier for new traders and reducing the risk of substantial financial loss while learning.

Binomo is ideally suited for individual traders new to the financial markets, looking for a straightforward platform offering educational resources and tools to foster a deeper understanding of trading strategies. Its low-cost entry and supportive features appeal to those cautious about initial investments.

3. Seasonax – Best for Seasonal Trading Strategies

Seasonax excels in identifying and capitalizing on seasonal trading patterns. They specialize in providing traders with tools to detect high-probability seasonal trades, optimize trade timing, and increase potential returns based on historical data.

Seasonax’s proprietary Seasonality Screener filters thousands of instruments to pinpoint the best seasonal trading opportunities. This tool is unique in its ability to offer quick access to high-probability trades with a proven track record of success, supported by over 30 years of market data.

Notable Features of Using Seasonax

- Seasonality Screener: This feature quickly screens over 25,000 instruments, identifying those with the most promising seasonal patterns

- Event Studies: Allows traders to analyze price trends around significant events, enhancing the timing and accuracy of trades based on historical data.

- Detailed Statistics: Provides extensive statistical analysis of seasonal patterns, deepening into year-by-year performance for better strategy formulation.

- Watchlists and Alerts: This enables traders to track their preferred instruments and receive notifications about upcoming seasonal patterns, ensuring they never miss a profitable opportunity.

Seasonax Pricing Plans

Seasonax offers several pricing tiers:

- Basic Plan: Priced at $41.66 per month or $499.95 per year, this plan provides access to all instruments, up to 100 years of historical data, and basic features of the Seasonality Screener.

- Professional Plan: At $80.00 per month or $960.00 per year, it includes all the benefits of the Basic plan plus additional features.

Ideal for portfolio managers and individual traders focusing on market timing and seasonal trends, Seasonax is the go-to choice. Its tools are precious for trading commodities, stocks, and forex, where seasonal patterns significantly influence price movements.

Key Takeaway

Jigsaw Trading is a significant tool and platform for traders aiming to elevate their market strategies. It integrates seamlessly into your trading journal, enhancing your ability to track and analyze trades effectively. You gain access to comprehensive trading resources and education, equipping you with the knowledge to make informed decisions. This tool is invaluable for novice and seasoned traders seeking to refine their approaches.

Jigsaw Trading provides strategies and tips crucial for real-time market decision-making. Additionally, It supports long-term investment ideas, helping traders diversify their portfolios and enhance their understanding of market dynamics. This platform ensures users have a robust foundation in day trading and long-term investment strategies.

Are you ready to optimize your day trading strategy? Spartan Trading can guide you through the complexities of choosing the right tools and resources to expand your trading capabilities. Start transforming your trading journey today!