Westbridge: The $63M Solar Giant in Disguise (TSXV: WEB) (OTC: WEGYF)

Disseminated on behalf of

Westbridge Renewable Energy Corp

THE $63M SOLAR GIANT IN DISGUISE

WESTBRIDGE RENEWABLE ENERGY CORP

TSXV: WEB | OTC: WEGYF | FRA: PUQ

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

FORWARD: MACRO TAILWINDS COLLIDE WITH WESTBRIDGE’S MOMENT

The energy transition is no longer a slow-burn narrative – it’s a full-scale arms race.

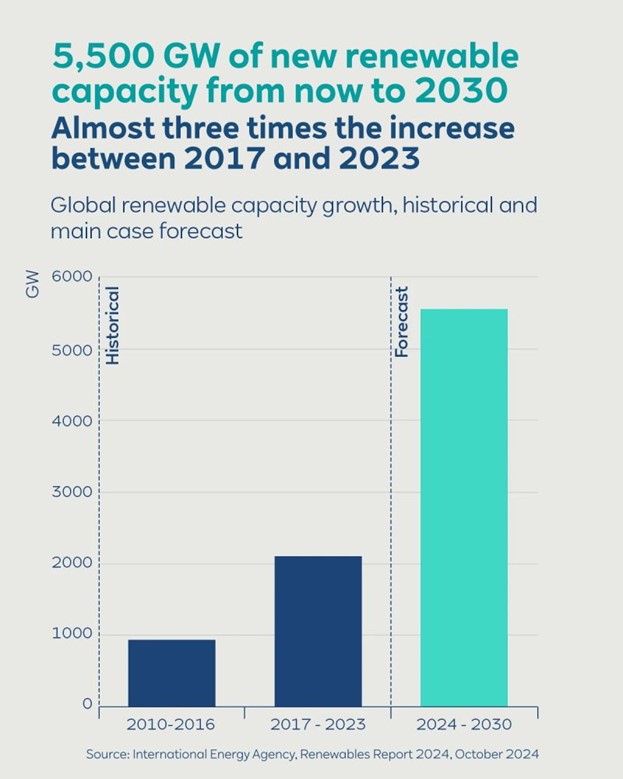

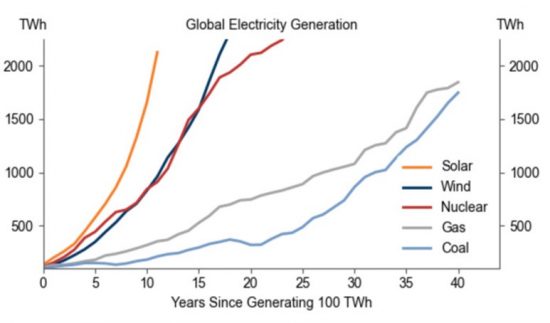

The International Energy Agency projects renewable capacity will nearly triple by 20301 with solar leading the charge at over 80% of that buildout. This is happening against a backdrop of soaring electricity demand – from AI data centers, EV adoption, and the re-shoring of industrial production – pushing grids to the brink and forcing governments and utilities to fast-track capacity procurement.

In North America, the U.S. is entering its most aggressive build cycle in decades, with >5,000 TWh of demand forecast by 20502, Texas and Ontario leading record-size procurements, and federal ITCs incentivizing clean energy deployment at scale3.

Canada, under Mark Carney’s post-election agenda, is targeting 30% renewable penetration in Alberta by 20304, green-lighting permitting reform and funneling capital toward solar and storage.

Meanwhile, Europe is doubling down on energy security with >€8B allocated to battery storage5 and permitting pipelines accelerated to de-risk projects.

This perfect storm of policy support, demand pull, and capital urgency has created a unique window where well-capitalized, nimble developers can capture exponential value – but only if they can move fast, originate projects in-house, and monetize before the field gets crowded.

Enter Westbridge Renewable Energy Corp (TSXV: WEB | OTC: WEGYF | FRA: PUQ) – a capital-light, developer-first solar and BESS powerhouse with a 10+ GW pipeline, a zero-debt balance sheet, and a proven model of monetizing projects at 5-10x ROIC without dilution.

Westbridge is not just keeping pace with the energy transition – it’s positioned to arbitrage it, pivoting between project sales, royalties, and build-and-hold IPP strategies to capture maximum upside.

With Ontario’s 7,500 MW LT2 program6 on deck, a 380MW AI-focused data center hub under development in Colorado, and C$50M in contracted milestone payments already locked in, Westbridge is set up for a potential 2-3x rerate as 2025 catalysts hit.

This is not just a play on renewables – it’s a levered call option on electrification itself, with asymmetric risk/reward, strong downside protection (C$37M cash, no debt), and management with a flawless execution record.

In a market where the winners will be those who can both originate and exit projects with precision, Westbridge is the disciplined sniper — not the spray-and-pray developer.

As macro tailwinds intensify, patient investors have an opportunity to step in before the rerating wave hits.

EXECUTIVE SUMMARY

Westbridge Renewable Energy Corp (TSXV: WEB | OTC: WEGYF | FRA: PUQ) is a capital-light, utility-scale solar and battery energy storage system (BESS) developer positioned to capitalize on the global surge in clean energy demand, particularly in Canada and the US where massive energy needs from AI data centers and tech farms are driving unprecedented growth.

-

- Diversified 10+ GW Pipeline: Projects span Canada, US, UK, and Europe, including 2 GW late-stage assets with clear near-term monetization potential.

- Proven Monetization Model: Westbridge has already sold two Alberta projects (Georgetown and Sunnynook) for C$99M with C$50M in additional milestone payments to come, demonstrating 5–10x ROIC with zero dilution.

- Strong Balance Sheet: C$37M cash, no long-term debt, C$10M returned to shareholders via dividend and buyback in FY24.

- Strategic Pivot: Transitioning to a hybrid Developer-IPP model — combining exceptional ROIC from project sales with recurring operating revenue streams.

- Scenario-Resilient Growth: Whether facing adverse U.S. rhetoric (competitor bankruptcies creating cheap acquisition opportunities) or favorable policy tailwinds (smooth expansion), Westbridge is positioned to win. Its nimble model, prime land positions, and ability to pivot between project sales, distressed-asset bids, and Ontario project development mitigate forecasting challenges and create asymmetric upside.

- Market Valuation: At a ~C$54M market cap, with C$37M cash, no debt, and C$50M in contracted milestones, the company trades at a steep discount to its pipeline value — offering significant rerating potential as catalysts are unlocked.

SPARTAN’S TECHNICAL CHART ANALYSIS:

- TSXV: WEB

- Long Idea: $2.20

- Stop Loss: $1.40

- Resistance 1: $3.63

- Resistance 2: $4.31

- Resistance 3: $5.04

- OTC: WEGYF

- Long Idea: $1.58

- Stop Loss: $1.00

- Resistance 1: $2.66

- Resistance 2: $3.23

- Resistance 3: $3.86

COMPANY OVERVIEW

Westbridge Renewable Energy Corp (TSXV: WEB | OTC: WEGYF | FRA: PUQ) is a fast-growing energy developer specializing in utility-scale solar PV, BESS, and data-centre projects, with a primary focus on the origination and pre-construction phases to deliver exceptional ROIC (targeting 5–10x).

This capital-light strategy allows Westbridge to generate significant value by de-risking projects and monetizing them at the ready-to-build stage.

Westbridge is actively driving a strategic transition into a vertically integrated, hybrid ‘Developer-IPP’ model.

By leveraging its cash-generative project pipeline, the company can selectively cherry-pick and fund projects for construction and operation, combining high ROIC project sales with long-term recurring revenues — a powerful combination designed to compound shareholder value.

Founded by a management team with expertise from over 40 projects totaling >3 GW, Westbridge has scaled its portfolio from just 0.3 GW in Q1 2021 to >10 GW within four years, accomplishing this growth with zero share dilution.

Its monetization track record includes the successful sale of Georgetown and Sunnynook projects in Alberta for C$99M, with an additional C$50M expected from future milestone payments.

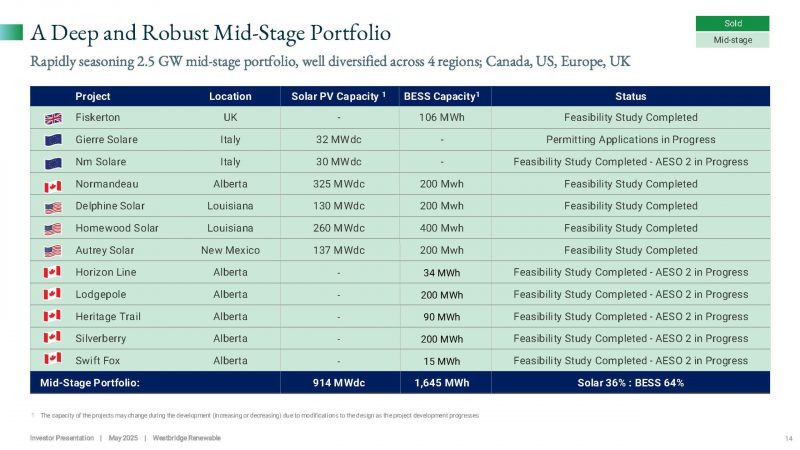

Westbridge’s portfolio is diversified across four countries:

- Canada: Dolcy, Eastervale, Red Willow (total 1,800 MW late-stage) and five new standalone BESS projects announced in January 2025.

- United States: Accalia Point (Texas) and the recently launched Fontus Data Centre (Colorado, 380 MW) targeting AI-driven demand.

- UK: Fiskerton BESS project.

- Italy: Gierre Solare solar PV project.

Management, led by CEO Stefano Romanin and COO Margaret McKenna, boasts a world-class track record in >$2B of renewable energy deals.

Strategic partnerships, such as with Metlen for Alberta project sales, provide ongoing non-dilutive capital recycling.

Additional 2025 highlights include a share consolidation (August 19, 2025), reducing shares outstanding from ~101M to ~25M, streamlining the capital structure and positioning the company for institutional visibility.

The business model emphasizes flexible monetization: selling ready-to-build projects, retaining royalties, or partnering for construction/operation.

This diversified approach across geographies and technologies reduces risk, with solar comprising ~67% and BESS ~33% of the portfolio.

Westbridge Renewable Energy Corp (TSXV: WEB | OTC: WEGYF | FRA: PUQ) growth has been smart and efficient, originating projects in-house and leveraging expertise to navigate approvals (e.g., major Alberta project approved despite policy changes).

MARKET OPPORTUNITY

The renewable energy sector is booming, driven by surging clean power demand. The IEA forecasts renewable capacity to grow 2.7x to 5,500 GW by 2030, with solar leading at 80%.

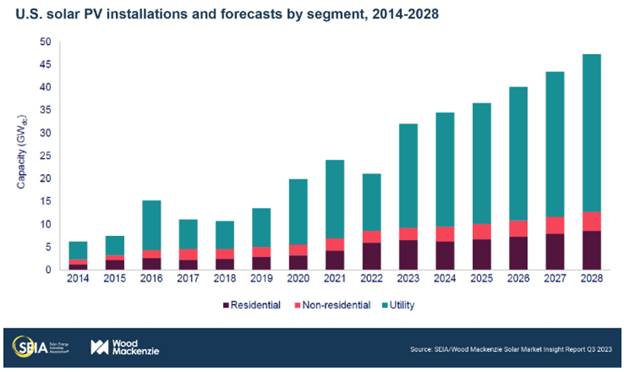

In the U.S. (Westbridge’s primary long-term focus) electricity demand is projected to rise sharply (EIA: from ~4,000 TWh in 2020 to >5,000 TWh by 20507), fueled by AI data centers, tech farms, EVs, and industrial electrification.

The U.S. ranks #1 on EY’s Renewable Energy Attractiveness Index, with solar capacity expected to hit 375 GW by 2028. Texas alone will lead utility-scale installations.

Geopolitical tailwinds in the U.S. further enhance efficiency for developers like Westbridge: streamlined processes, energy security priorities, and retiring coal capacity (22.3 GW past two years, 16 GW more by 2025) create new market openings.

Massive U.S. energy demand for AI/tech (e.g., data centers) aligns with Westbridge’s recent Fontus project, a 380 MW hub in Colorado, designed to capture this demand surge. China remains “on the map” for supply chains, but Westbridge’s ability to fully develop projects independently reduces reliance and risk.

Westbridge Renewable Energy Corp (TSXV: WEB | OTC: WEGYF | FRA: PUQ) U.S. projects (e.g., in Texas, Louisiana, New Mexico) position it as a major solar developer with minimal IRA exposure, allowing flexibility to adapt to new bills or incentives, and providing strong optionality for future returns.

In Canada, federal ITC support remains very strong, aligning with Prime Minister Mark Carney’s aggressive clean energy agenda post-2025 election. Carney’s policies aim to make Canada a “leading energy superpower” through investments in critical minerals, clean supply chains, and accelerated permitting for renewables (e.g., 30% renewable power in Alberta by 2030).

Ontario’s historic 7,500 MW procurement by 2034 and BC Hydro’s 3,000 GWh RFP open doors for Westbridge’s bids on three major projects this fall, promising strong cash flows.

Europe mirrors this policy support: Italy targets 50 GW solar by 20308 with centralized permitting, while the UK pushes BESS (>9 GW financed) via funds like Great British Energy (£8B launched in 2024).

This policy alignment across geographies creates an unprecedented runway for Westbridge’s multi-market pipeline.

STRATEGIC POSITIONING & SCENARIOS

Westbridge Renewable Energy Corp (TSXV: WEB | OTC: WEGYF | FRA: PUQ) cash-rich, capital-light model gives it an edge in volatile markets. With big land leases secured on favorable terms and a light burn rate, it can weather adverse scenarios and seize opportunities.

- Adverse Scenario: Protectionist policies or subsidy reductions could bankrupt over-leveraged competitors. Westbridge could acquire distressed assets cheaply, consolidating market share.

- Favorable Scenario: Smooth expansion with continued incentives allows Westbridge to accelerate growth organically, leveraging its pipeline to secure more long-term contracts.

Either path offers upside.

COMPETITIVE ADVANTAGES

- Execution Track Record: Two Alberta projects monetized with >10x ROIC.

- Diversified Pipeline: 10+ GW across four countries and three technologies (solar, BESS, data centers).

- Financial Strength: No long-term debt, C$37M cash, milestone payments secured.

- Flexibility: Ability to pivot between project sales and long-term ownership.

- Elite Management: CEO Stefano Romanin and COO Margaret McKenna bring >40 project track record.

FINANCIAL ANALYSIS & VALUATION

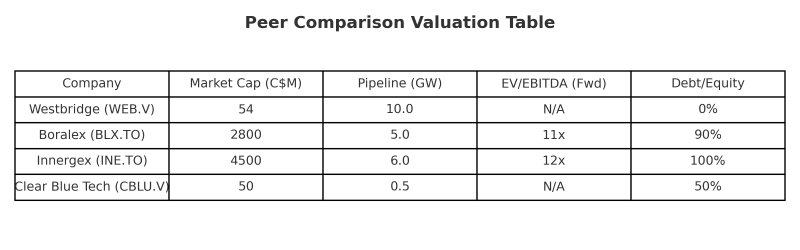

At C$2.15/share (market cap ~C$54M as of September 16, 2025), Westbridge Renewable Energy Corp (TSXV: WEB | OTC: WEGYF | FRA: PUQ) trades at a steep discount relative to peers such as Boralex, Innergex, and Clear Blue Tech.

With zero debt and C$37M in cash, its enterprise value is minimal relative to its 10+ GW pipeline.

Valuation Upside:

- Ontario LT2 win could re-rate shares significantly.

- Milestone payments (C$50M) provide near-term cash flow visibility.

- Transition to Developer-IPP model could command higher multiples (8–12x IRR typical for IPPs).

Westbridge Renewable Energy Corp (TSXV: WEB | OTC: WEGYF | FRA: PUQ) trades at 91% below estimated fair value (Simply Wall St), undervalued vs. peers due to its developer-only model and early-stage risks.

Comparables like small solar devs (e.g., via Seeking Alpha) show Westbridge’s discount to growth potential; analysts note its “low price tags big pipeline” for patient investors.

Upside from milestones (e.g., Dolcy approval, Fontus progress) and its transition to a hybrid developer-IPP (recurring revenues) could drive rerating.

SPARTAN’S TECHNICAL CHART ANALYSIS:

- TSXV: WEB

- Long Idea: $2.20

- Stop Loss: $1.40

- Resistance 1: $3.63

- Resistance 2: $4.31

- Resistance 3: $5.04

- OTC: WEGYF

- Long Idea: $1.58

- Stop Loss: $1.00

- Resistance 1: $2.66

- Resistance 2: $3.23

- Resistance 3: $3.86

Stock Structure:

- Outstanding: ~25M

- Float: ~17M

- Market Cap: ~54.37M (CAD) | ~40.5M (USD)

RISKS & MITIGANTS

- Project Delays & Permitting Risk: Navigated successfully in Alberta; management’s experience mitigates.

- Lumpy Revenues: Project sales create non-linear earnings, but diversified pipeline smooths volatility.

- Market Volatility: Low capex holding costs provide downside protection.

CONCLUSION – A PROVEN PLATFORM FOR SCALABLE GROWTH IN CLEAN ENERGY DEVELOPMENT

Westbridge Renewable Energy Corp (TSXV: WEB | OTC: WEGYF | FRA: PUQ) is positioned at the center of the global renewable energy buildout – with a diversified 10+ GW pipeline, U.S. projects aligned with surging AI / tech demand, and Canadian / European policy support providing additional tailwinds.

The company’s capital-light model, seasoned management team, and proven ability to generate high ROIC through project sales have created significant value to date and set the stage for further growth.

Upcoming catalysts – including Ontario LT2 awards, milestone payments from previously sold projects, and U.S. construction progress – have the potential to significantly re-rate the stock.

Based on current pipeline value and milestone visibility, a scenario-based target of C$3.50+ within 12–18 months reflects the upside potential if major project milestones are achieved.

More information on Westbridge, including its recent news releases, project overview and investor information package can be found here.

Stay up to date with Spartan’s Weekly Newsletter

References

- https://www.iea.org/news/massive-global-growth-of-renewables-to-2030-is-set-to-match-entire-power-capacity-of-major-economies-today-moving-world-closer-to-tripling-goal

- https://www.eia.gov/outlooks/aeo/

- https://www.energy.gov/eere/solar/articles/investment-tax-credit-itc

- https://natural-resources.canada.ca/energy-sources/renewable-energy/about-renewable-energy-canada

- https://energy.ec.europa.eu/index_en

- https://www.ieso.ca/Sector-Participants/Resource-Acquisition-and-Contracts/Contract-Data-and-Reports

- https://www.iea.org/reports/net-zero-by-2050

- https://informedinfrastructure.com/102382/italy-poised-to-increase-renewables-share-in-power-generation-mix-to-over-55-by-2035-says-globaldata/

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading Inc. (“Spartan”) has been engaged by Westbridge Renewable Energy Corp (WE) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared on behalf of WE. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements.

It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com and affiliates makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting.

Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by Spark Newswire Inc. to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services Spark Newswire Inc. has received cash compensation from WE (OTCQX:WEGYD). Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc an affiliate of Spartan Trading Inc. has a two month agreement with WE (OTCQX:WEGYD) for the sum of one hundred thousand dollars. This agreement is for consulting and or marketing of WE (OTCQX:WEGYD) which services include the issuance of this release and other opinions that we release concerning of WE (OTCQX:WEGYD) and may be renewed from time to time. Spartan Trading an affiliate Spark Newswire Inc has not investigated the background of WE (OTCQX:WEGYD) the hiring party. Anyone viewing this newsletter should assume Spartan or affiliates own shares WE (OTCQX:WEGYD) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for Spark Newswire Inc’s services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements WE (OTCQX:WEGYD).

PLEASE READ OUR DISCLAIMER STATEMENT BEFORE VIEWING FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Spartan Trading Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Results may not be typical and may vary from person to person. Making money trading stocks takes time, dedication, and hard work. There are inherent risks involved with investing in the stock market, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk. Spartan Trading testimonials depicting profitability are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment. Becoming an experienced trader takes hard work, dedication and a significant amount of time. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers.

I/we have a beneficial long or Short position in the shares of Any Ticker We speak about on Zoom Streaming or in Discord either through stock ownership, options, or other derivatives

Full Disclaimer, Terms & Conditions:

https://spartantrading.com/terms-conditions/