The Metal that will Define the Next Decade

Disseminated on behalf of

Super Copper Corp

THE METAL THAT WILL DEFINE THE NEXT DECADE

SUPER COPPER CORP

CSE: CUPR | OTC: CUPPF | FRA: N60

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

FORWARD: A ONCE IN A GENERATION REALIGNMENT OF POWER, TECHNOLOGY, AND RESOURCES

Every era of global economic expansion has been defined by one irreplaceable resource.

Today, as the world races toward AI acceleration, electrification, defense modernization, semiconductor expansion, and sovereign reshoring, that resource is copper – and the world is rapidly waking up to the severity of its scarcity.

The most sophisticated capital in the world has moved in early:

- Peter Thiel, through multiple private and public vehicles, has been accumulating exposure to copper and strategic metals, citing the mismatch between exponential AI demand and constrained physical supply.

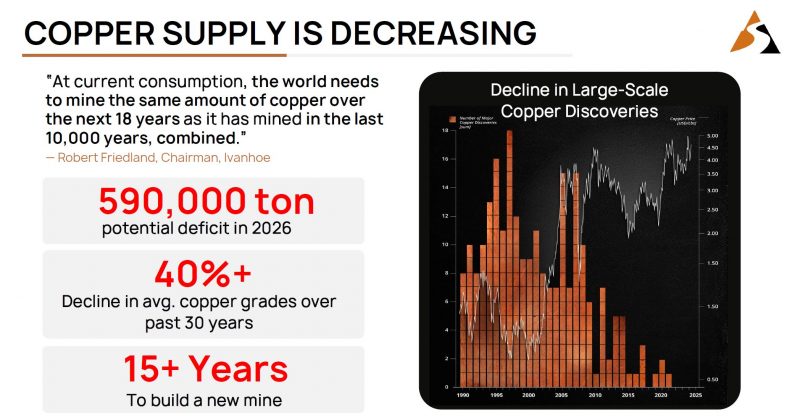

- Robert Friedland has warned that humanity must mine as much copper in the next 18 years as the last 10,000 years combined, an observation now echoed in U.S. Senate energy hearings and global commodity forums.

- BlackRock has called copper a “critical enabler of the next industrial cycle.”

- Apollo Global Management has raised multi-billion-dollar credit for energy-transition metals, explicitly naming copper as a cornerstone input.

- Temasek (Singapore) has dramatically expanded its critical-minerals portfolio, including metals required for AI power buildouts.

- Bill Gates and Jeff Bezos, through climate, energy, and infrastructure vehicles, have invested in metals and advanced-materials companies directly tied to grid and data-center expansion – cycles that depend disproportionately on copper.

These investors are not speculating.

They are positioning ahead of what may become one of the defining supply-demand imbalances of the century – a convergence of technology, geopolitics, and physical constraints that directly impacts global power and economic sovereignty.

And they are positioning early because:

The world is entering a copper deficit at the exact moment it is attempting the largest industrial and technological buildout since World War II.

Super Copper Corp. (CSE: CUPR | OTC: CUPPF | FRA: N60) enters this moment with:

- High-grade copper and gold discoveries,

- Large strategic land packages in Chile’s Atacama,

- A clean, aligned capital structure,

- A technology division built to enhance copper recovery,

- And a geopolitical tailwind as nations fight to secure supply.

This is not a story about price.

This is a story about structural necessity – and the companies that will supply it.

THE WORLD IS NOW BUILT ON COPPER

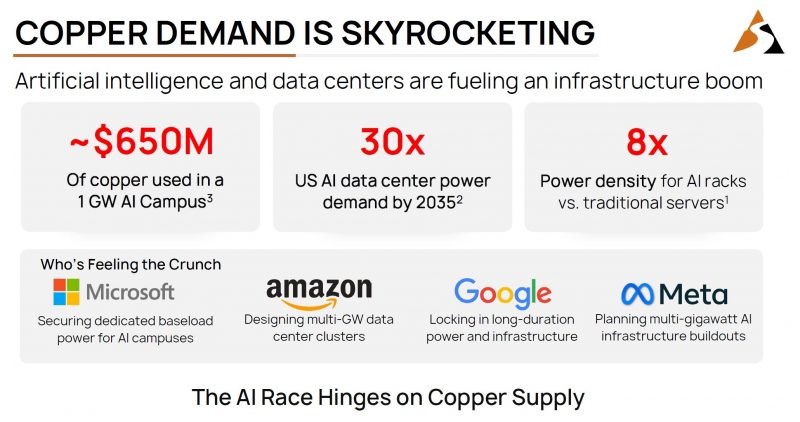

- AI Infrastructure Has Become a Copper-Consumption Machine

The global AI race is creating the fastest electricity-consumption expansion in modern history.

- AI server racks require 8× more power than traditional cloud compute.

- U.S. data-center power demand is projected to rise 30× by 2035.

- Each 1-GW hyperscale AI campus requires ~50,000+ tons of copper.

- Microsoft, Google, Amazon, and Meta are now securing long-duration power agreements, grid access, and transmission upgrades — all copper intensive.

This is no longer a Silicon Valley story.

It is a global industrial story.

Every step from the substation to the server depends on copper.

AI’s physical footprint is now becoming as real – and as resource-intensive – as the steel and oil booms of the 20th century.

- Defense, National Security, and Copper Stockpiles

Defense modernization depends heavily on copper:

- Missile systems

- Radar and sensor arrays

- Submarine propulsion

- Satellite power systems

- Directed-energy weapons

- Battlefield electrification

- Redundant grid infrastructure protecting military bases

The U.S. Department of Defense has formally classified copper as “strategic and essential” for national security infrastructure.

Countries are preparing for long-term tension, not short-term cycles – and copper is now embedded in that planning.

- Energy Transition: A Multi-Decade Copper Sink

The global transition to electrification is copper intensive in every dimension:

- EVs require 4× more copper per unit.

- Solar, wind, and hydrogen plants require extensive copper wiring.

- Grid-scale batteries and transmission lines cannot function without copper.

- Grid modernization is currently one of the largest unfunded infrastructure challenges in the West.

The electrification era is not additive – it is exponential. And exponential curves collide violently with constrained supply.

- Semiconductor Expansion and Manufacturing Reshoring

Chip foundries require copper everywhere:

- High-capacity electrical redundancy

- HVAC systems

- Chemical-processing equipment

- Thousands of miles of copper cabling

- Specialized copper alloys inside wafer equipment

TSMC’s Phoenix campus alone requires enough copper to wire a mid-sized city.

The resource bottleneck is beginning to show — and countries know it.

THE SUPPLY CRISIS – THE WORLD IS NOT READY FOR WHAT IS COMING

- Copper Grades Have Declined 40% Over 30 Years

Ore grades have fallen continuously, driving costs higher even as demand explodes.

- Discoveries Have Collapsed

Global copper discoveries have dropped to multi-decade lows.

Exploration budgets have been insufficient for the task.

- It Takes 15+ Years to Build a New Mine

By the time the world “reacts,” it will be too late.

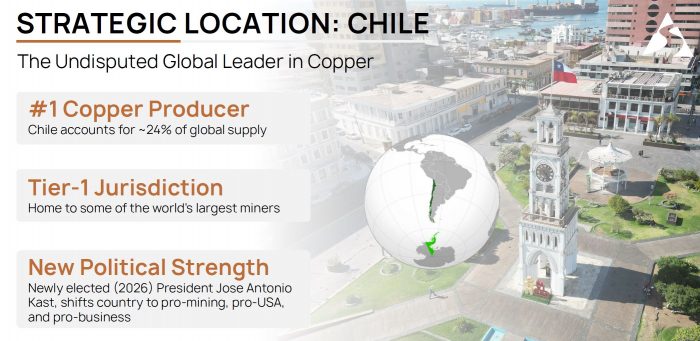

- Supply Is Concentrated – and It’s Shifting

Current supply dominance:

- Chile: ~24%

- Peru: ~10%

- China: ~8%

- DRC + Zambia: increasing influence

Future demand dominance:

- United States

- India

- Southeast Asia

- Middle East

- Europe

This is one of the most dangerous imbalances in the global economy:

The countries that need copper the most produce almost none of it.

And that imbalance is driving a global geopolitical resource war.

THE GLOBAL GEOPOLITICAL RESOURCE WAR – WHY THIS MATTERS

In the last two years, the U.S., China, India, the EU, Japan, and the Middle East have moved aggressively to secure copper supply through:

- Long-term offtake agreements

- Strategic-metal stockpiles

- Direct sovereign investments in mining companies

- Critical-mineral partnerships

- Diplomatic corridors and infrastructure loans in Africa and South America

- Defense-related supply chain diversification

- National subsidies for domestic processing and smelting

Copper is now treated the same way countries historically treated oil:

A foundational input to economic growth and geopolitical influence.

Here’s what makes this moment so significant:

- China has spent 20+ years consolidating global processing capacity, controlling ~40–45% of refined copper supply through smelters and refiners.

- The United States is now openly strategizing to counter this dependency, creating new tax incentives, DoD-backed supply programs, and federal critical mineral initiatives.

- India is beginning its first true industrial supercycle, requiring copper for manufacturing, infrastructure, satellites, solar, and defense.

- Gulf states (Saudi Arabia, UAE, Qatar) are investing billions into global mining portfolios to secure long-term metals for mega-industrial projects and AI data-center corridors.

- Europe’s Green Deal demands copper that Europe does not produce, forcing it to compete directly with the U.S., China, and India.

This is not a theoretical future.

This is unfolding now – and history shows that in moments of resource scarcity, high-grade, jurisdictionally secure copper assets appreciate disproportionately.

WHY SUPER COPPER MATTERS — A STRATEGIC POSITION IN THE HEART OF THE COPPER CAPITAL

Super Copper’s dual-asset portfolio – Castilla and Cordillera – sits in Chile’s Atacama region, one of the most productive copper belts on Earth.

- Chile is the Epicenter of Global Copper Production

Chile produces nearly one-quarter of global supply.

Its Atacama corridor has delivered many of the world’s largest and highest-value deposits.

- This Region Attracts the Largest Miners and Highest Valuations

Around Super Copper’s projects are multi-billion-dollar companies operating on the same geological trends.

- High-Grade Results Provide Early Indications of Scale

Castilla:

- Up to 17.7% copper

- Up to 53.8 g/t gold

- 10 samples exceeding 50% iron

- Widespread IOCG signatures

Cordillera:

- Up to 10.3% copper

- 46 samples above 1% copper

- Silver grades up to 296 g/t

These are not promotional anomalies – they indicate robust, high-grade mineral systems consistent with major IOCG and oxide deposits in the region.

- Permanent Mining Rights on 6,858 Hectares

Cordillera’s exploitation concessions grant full, enduring mining rights – a major advantage compared to typical early-stage concessions.

- Why It Matters Now

The world’s most powerful countries are competing for copper supply while the world’s highest-grade discoveries are increasingly rare.

Super Copper Corp. (CSE: CUPR | OTC: CUPPF | FRA: N60) controls two large land packages with:

- Early high-grade results

- Proximity to infrastructure

- Geological signatures aligned with major regional deposits

- Political stability

- Favorable Chilean policy shifts toward pro-mining governance

At a time of global copper scarcity, location + grade + jurisdiction is the clearest investment filter.

Super Copper meets all three.

VALUATION – A DISCONNECT IN PLAIN SIGHT

Comparables Within the Atacama & Similar Districts

Company | Approx. Market Cap | Stage | Region |

NGEx Minerals | ~$5.9B | Advanced Exploration | Atacama |

Filo Mining | ~$4.0B | Advanced Exploration | Atacama/Argentina |

Marimaca Copper | ~$1.4B | Development | Antofagasta |

Hot Chili | ~$298M | Development | Atacama |

Fitzroy Minerals | ~$147M | Early Exploration | Atacama |

Super Copper | ~$31M | Early Exploration | Atacama |

This comparison is striking.

Narrative: Why This Matters

Valuation in mining does not only reflect resources — it reflects:

- Jurisdictional risk

- Capital structure

- Access to infrastructure

- Grade profile

- Strategic positioning

- Potential for discovery scale

- Relative scarcity of comparables

- Geopolitical timing

- Institutional alignment

- Market awareness

In the Atacama, where majors have consolidated most of the prime assets, opportunities with:

- Large land positions,

- Documented high-grade mineralization,

- Mining rights,

- Proximity to producing mines,

- Clean share structures, and

- Strategic investors

are rare – and typically valued significantly higher.

Super Copper Corp. (CSE: CUPR | OTC: CUPPF | FRA: N60) trades at a fraction of its regional peers, not because of inferior geology, but because the company is still in the very early phase of market recognition.

This is precisely the window where structural mispricing’s emerge.

CONCLUSION – WHY THE TIME IS NOW

Copper is no longer a cyclical metal.

It is becoming one of the most strategically important resources of the 21st century.

The world is accelerating into an era defined by:

- Artificial intelligence and multi-gigawatt compute campuses

- National defense modernization

- Manufacturing reshoring

- Energy transition and grid expansion

- Semiconductor megaprojects

- Sovereign competition for resource security

- Long-term scarcity in new copper supply

The most sophisticated investors – Peter Thiel, Robert Friedland, BlackRock, Apollo, Temasek, and the climate-infrastructure vehicles backed by Gates and Bezos — are positioning in anticipation of this shift.

Super Copper sits at the intersection of these trends with:

- High-grade early discoveries

- Strategic land in the Atacama

- Permanent mining rights

- Clean capital structure

- Technology aimed at increasing copper recovery

- A catalyst-rich 2026–2027 roadmap

- A valuation that reflects none of the above

The timing is notable because copper’s importance is rising faster than global supply can respond – and the geopolitical competition for reliable jurisdictions is intensifying.

Super Copper Corp. (CSE: CUPR | OTC: CUPPF | FRA: N60) is early, strategically located, and aligned with the macro forces reshaping resource markets.

And at today’s valuation, the market continues to treat the company as if the world were not entering a copper-constrained era defined by AI, electrification, and geopolitical resource realignment.

This thesis does not suggest outcomes – it highlights conditions:

Copper is becoming the defining bottleneck of global progress.

Super Copper Corp. (CSE: CUPR | OTC: CUPPF | FRA: N60) is positioned in the right metal, the right region, at the right geopolitical moment.

More information on Super Copper Corp, including its recent news releases, project overview and investor information package can be found here.

Stay up to date with Spartan’s Weekly Newsletter

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by SPC (Super Copper Corp) Public Limited Company (SC) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared by or on behalf of SC. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law.

Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements.

It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time-to-time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the microcap or penny stock market that we are highlighting.

Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrongdoing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by SC (OTC:CUPPF) to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from SC. Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc and affiliate of Spartan Trading Inc. has a one month agreement with SC (OTC:CUPPF) for the sum of fifty thousand dollars. This agreement is for consulting and or marketing of SC (OTC:CUPPF) which services include the issuance of this release and other opinions that we release concerning of SC (OTC:CUPPF). Spartan Trading and affiliate Spark Newswire Inc has not investigated the background of SC (OTC:CUPPF) the hiring party. Anyone viewing this newsletter should assume SC (OTC:CUPPF) or affiliates of SC (OTC:CUPPF) own shares of SC (OTC:CUPPF) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading and affiliate Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements SC (OTC:CUPPF).

PLEASE READ OUR DISCLAIMER STATEMENT BEFORE VIEWING

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE.

Any Spartan Trading Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Results may not be typical and may vary from person to person. Making money trading stocks takes time, dedication, and hard work. There are inherent risks involved with investing in the stock market, including the loss of your investment.

Past performance in the market is not indicative of future results. Any investment is at your own risk.

Spartan Trading testimonials depicting profitability are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed.

Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment. Becoming an experienced trader takes hard work, dedication and a significant amount of time. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers.

I/we have a beneficial long or Short position in the shares of Any Ticker We speak about on Zoom Streaming or in Discord either through stock ownership, options, or other derivatives

Full Disclaimer, Terms & Conditions:

https://spartantrading.com/terms-conditions/