QUARTERLY IN DEPTH INVESTMENT ANALYSIS UPDATE – CYBIN INC (NYSE: CYBN)

Disseminated on behalf of CYBN Inc (CYBN)

QUARTERLY IN DEPTH ANALYSIS UPDATE

CYBIN INC

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

As I mentioned yesterday during the Live Stream, I want to provide you with an update on a Small Stock Investment Thesis that I presented in June of this year. For those of you that are new to Spartan Trading, or are just receiving our free weekly newsletter for the first time, my goal is to cover one company in detail every quarter that I feel has good investment potential when considering risk / reward.

I have spent a lot of time researching this Biotech space and the different avenues / possibilities this company has ahead of themselves, including extensive due diligence and interviewing members from the executive team (including the CEO, Doug Drysdale).

My previous thesis explored this companies Research Studies, Pipeline Progress, and overall Market Potential and I would recommend checking it out if you want to see my initial entry points and reasoning. That said, based on some recent news and sector updates, I feel this name is still in a good position to gain additional market share and growth in the short and medium term.

Cybin Inc (NYSE: CYBN; NEO: CYBN.NE)

Currently our trade idea on CYBN is up 100% from my initial entry point in June and, in my opinion, feel there is plenty still left on the table.

Below I want to provide a short update on this name and why I feel that an add back at these current levels would make sense, covering 7 key points:

Steve Cohen & Point72 Asset Management’s Recent Investment in $CYBN

Billionaire Steve Cohen’s hedge fund, Point72 Asset Management, has recently acquired an 8.1% stake in Cybin Inc. This investment, revealed in a recent SEC filing, amounts to approximately 18.95 million common shares, valued at around $8.34 million at the market price of $0.44 per share on the Canadian Exchange at the time of acquisition. This move marks Point 72’s first foray into the psychedelic medicine sector (which is significant IMO).

Cohen’s foundation, the Steven & Alexandra Cohen Foundation, had previously donated $5 million to the Multidisciplinary Association for Psychedelic Studies (MAPS) for MDMA-assisted therapy research. Cybin also recently announced its acquisition of DMT drug developer Small Pharma Inc., solidifying its position as a key player in the industry. The company is on track to release conclusive efficacy data on its CYB003 Psilocybin analogue by the end of the year.

Overall, the Steven & Alexandra Cohen Foundation has contributed over $31.3 million to psychedelic research through its Psychedelic Research & Health Initiative.

$CYBN recent acquisition of Small Pharma ($DMTTF)

CYBN has recently announced its acquisition of Small Pharma Inc., a UK based biotechnology company established in 2015 focused on short-duration psychedelic-assisted therapies for mental health conditions. With 8 years of research and $60 million dollars of investment into the company, it is currently anticipated that this transaction will close officially on or about October 23, 2023 after recently obtaining approval from the Supreme Court of British Columbia.

For those that are not familiar with Small Pharma here are some key points as to why I feel this acquisition will establish Cybin Inc as a market leader in Novel Psychedelic Therapeutics:

- Small Pharma Inc. is an international, clinical-stage leader with potential to transform the treatment paradigm for mental health conditions.

- Their two proprietary, advanced clinical programs in development for depression and anxiety disorders with demonstrated safety and efficacy were the industry’s largest, most advanced and well-protected deuterated DMT program.

- Small Pharma’s DMT program is reporting that patients in the program have a 40% remission rate in 6-months off one dose (which is a pretty spectacular result that is unheard of).

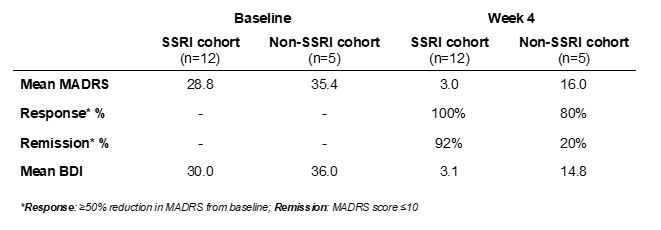

Key Data: Results suggest that SSRIs enhance the efficacy of SPL026 (DMT) when administered to MDD patients on a stable dose of SSRIs versus patients not on SSRIs; At Week 4, 100% of patients in the SSRI cohort responded to SPL026 (DMT) with 92% of patients in remission from depression; No apparent differences in the safety and tolerability profile of SPL026 (DMT) following administration to participants in the SSRI and non-SSRI patient cohorts.

- The acquisition of Small Pharma Inc. provides strong synergies across key assets, operating teams, capabilities and IP. Combined with Small Pharma Inc., Cybin now has the largest Intellectual Property (IP) portfolio in the psychedelic drug development sector, with over 30 patents granted and more than 160 patents pending.

- These new multinational operations support scaling to Phase 3 development of CYB003 in early 2004, following planned Phase 2 safety and efficacy data readout in late 2023. CYB003 is going into Phase 3 in Q1 2024, the final stage before approval.

- Cybin’s acquisition of Small Pharma is expected to create the largest DMT dataset in the sector and the most robust clinical-stage DMT program.

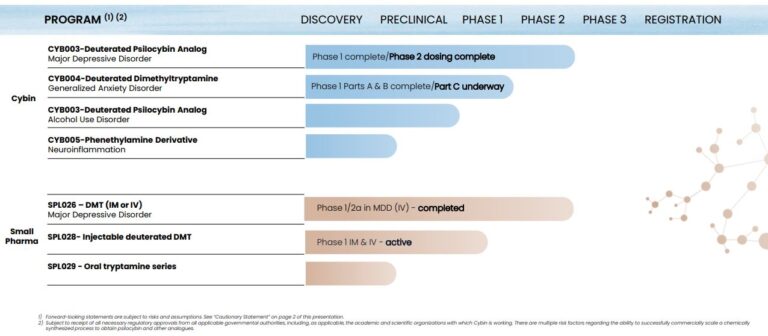

Cybin & Small Pharma’s Combined Pipeline

CYB003 Phase 2 Readout

Cybin expects their Phase 2 Topline efficacy data readout for CYB003 in Q4 2023. This proprietary deuterated psilocybin analog may provide a safe and effective outcome for patients and providers and has IP protection in support of CYB003 until 2041.

Their CYB003 Phase 1 & 2 Summary of data from Cohorts 1-3 has already shown:

- CYB003 was absorbed quickly and reached peak plasma levels within an hour.

- Psychedelic effects were seen within ~15 minutes and average duration of peak effects lasted ~2 hours. This is significant as it may demonstrate their ability to provide a solution that can be administered within a short time frame, allowing for scalability in the future (i.e. doctors would be able to administer dosing to a larger number of patients in a shorter period of time).

- Preparations are underway for a potential Phase 3 pivotal study in early 2024.

CYB004 Phase 1 Readout

Cybin’s CYB004 Deuterated Dimethyltryptamine (dDMT) has potential to overcome existing limitation of DMT in its native form and is a new chemical entity. With a U.S. compositional of matter patent granted through 2041, Cybin is expecting Phase 1 topline data in Q4 of 2023 and to initiate a Phase 2 proof-of-concept study in Q1 2024. If results are positive, this would be a significant step forward for Cybin’s CYB004 program and is worth watching in my opinion.

Recent Financing Activities

On August 4 Cybin announced a closed financing of 8.25 million USD. This was right before Billionaire Steve Cohen’s hedge fund, Point72 Asset Management, acquired an 8.1% stake in Cybin Inc. IMO this is significant as it has expanded their runway for an additional 2.5 months+ on top of the cash they already had on hand.

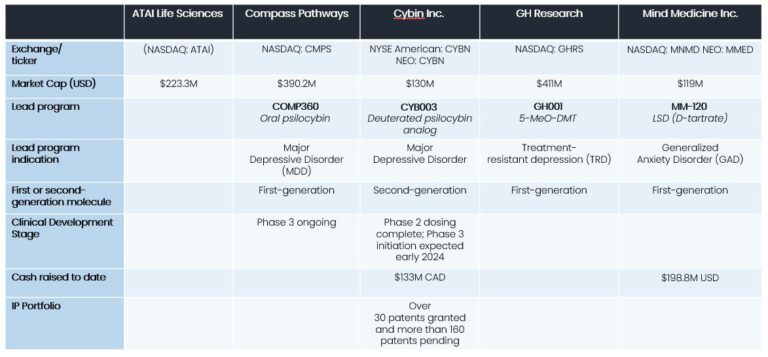

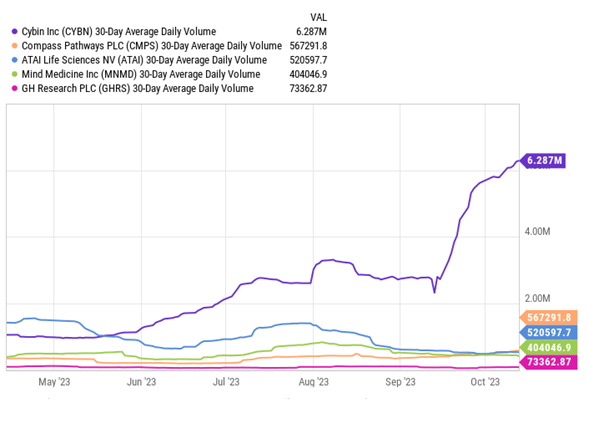

Internal Sector Comparison

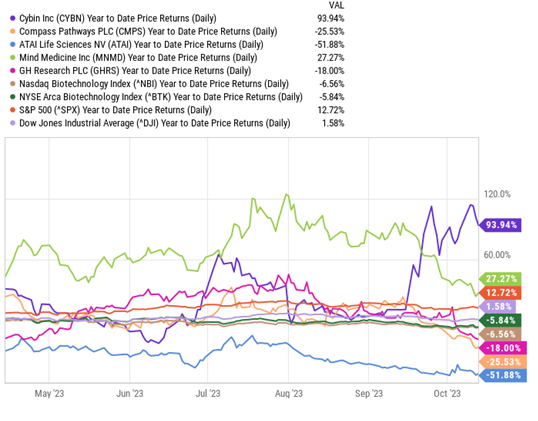

$CYBN is a leader in the space and is the only company in the space that is still above their go-public price. What is even more impressive is that they are up more than all their competitors combined from a percentage standpoint. Below I have included a graph showing their Year-to-Date Returns (Daily) as well as their 30 Day Average Volume.

Year-to-Date Returns (Daily)

30-Day Average Daily Volume

New Targets given the Recent Changes

My new target on $CYBN going forward, if we do get positive readout data, will be a push through the recent range resistance levels of $0.72 and $0.87 into the $1.14 – $1.30 range on the upside.

Cybin Inc (NYSE: CYBN; NEO: CYBN.NE)

- Idea: Long CYBN $0.50 – $0.60

- Target Area: $1.14 – $1.30+

- Risk: $0.30

- Time Frame: 2 – 6 Months

Current Idea is a speculation long on CYBN (2 – 6 months).

Best Regards,

Spartan (aka ‘Chris’)

Stay up to date with Spartan’s Weekly Newsletter

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by CYBN Inc. to provide it with promotional or marketing services, and the information contained in this communication has been prepared by or on behalf of CYBN Inc. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services, and may sell any such securities as permitted by law. Disclaimer: We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com and affiliates www.sparknewswire.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success, and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc has been retained by CYBN Inc. (NYSE: CYBN) to perform promotional and advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from CYBN. Questions regarding this website may be sent to info@spartantrading.com Spark Newswire Inc. and affiliate of Spartan Trading Inc. has a 1 month agreement with CYBN Inc (NYSE: CYBN) for the total sum of one hundred thousand dollars. This agreement is for the marketing of CYBN Inc. (NYSE: CYBN) which services include the issuance of this release and other opinions that we release concerning of CYBN Inc. (NYSE: CYBN). Spartan Trading and affiliates Spark Newswire Inc. has not investigated the background of CYBN Inc. (NYSE: CYBN) the hiring party, or CYBN Inc. (NYSE: CYBN) Anyone viewing this newsletter should assume CYBN Inc. (NYSE: CYBN) or affiliates of CYBN Inc. (NYSE: CYBN) own shares of the CYBN Inc. (NYSE: CYBN) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading and affiliates Spark Newswire Inc. has received this amount as a production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements regarding CYBN Inc. (NYSE: CYBN)