QUARTERLY IN DEPTH INVESTMENT ANALYSIS – AVANTI HELIUM CORP (OTC: ARGYF)

Disseminated on behalf of Avanti Helium Corp (ARGYF)

QUARTERLY IN DEPTH ANALYSIS

AVANTI HELIUM CORP

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

After several weeks of research and due diligence I am finally ready to share another Small Stock Investment Thesis but this time, focusing on what I feel is a significantly undervalued company in a rapidly growing global market.

Similar to my rationale with Cybin Inc., I feel that this company’s particular market sector (in this case, Helium) is poised for explosive growth, especially considering the rise in demand for Helium in the Semiconductor and Healthcare sectors.

After meeting with the executive team, I have come to the conclusion that this company is poised for remarkable growth, especially compared to one of the biggest peers in the industry, North American Helium. As it sits right now, if they are able to execute on some of the agreements that they are aiming to put in place, it is my opinion that this company will be worth 1 – 2 times where it currently sits.

Below I will be breaking down my investment thesis based on my comprehensive due diligence, analysis of competitors in the space and favorable risk-reward potential.

Avanti Helium Corp (OTC: ARGYF; TSXV: AVN.V)

- Idea: Long ARGYF $0.50 – $0.60

- Target Area: $1.10 – $1.30+

- Stop: $0.35

- Time Frame: 3 – 6 Months

As of July 26th, 2023:

- Market Cap: $38.35 Million

- Shares Outstanding: 77,009,000

- Float: 65,447,307

- Insider Owned: 15.1%

- Burn Rate Per Quarter: $1.1 Million

Introduction: Avanti Helium Corp (OTC: ARGYF; TSXV: AVN.V), a promising junior Helium Exploration and Production company, presents an enticing investment opportunity. This thesis aims to shed light on the factors that make Avanti Helium Corp an undervalued gem in the current market. With a strategic Midstream Deal in the pipeline, extensive due diligence on their wells (which are some of the largest in the Northwest), and the potential implication of North American Helium’s NYSE listing (one of the larger Helium providers), Avanti Helium Corp is poised for significant growth in the Helium industry.

Undervalued Gem with a Strategic Midstream Deal: At the core of Avanti Helium Corp’s potential lies a Strategic Midstream Deal. This lucrative agreement, once signed, promises to position Avanti as a major player in the Helium market, allowing them to produce an impressive volume of Helium at a fraction of the cost incurred by their competitors. The Midstream Deal provides an attractive catalyst for potential institutional investors and hedge funds, attracting capital inflow and bolstering the company’s financial position.

Avanti was able to secure two of the largest Helium pools in Canada / Northern United States, giving them potentially better margins then most of their Southern competitors. This is due to the fact that Avanti’s Helium pools are considered “deep, high-pressure wells” which can last 12 – 16 years whereas “shallow wells” (such as those that are controlled by their Southern competitors) may only last 3 – 12 Months.

Once the definitive agreement is signed, it is expected to provide Avanti with a steady flow of funds (roughly $25M USD / Year) and, if approved, would be online by the end of December 2023. As stated above, one of the key competitive advantages is that Avanti will, in theory, be able to have an edge when it comes to pricing due to controlling such a large supply, and can pay back their operating investment is as little as 2 – 3 months. Given their current market cap of $38.35 Million, this would suggest that the stock would be significantly undervalued (in my opinion) on the approval of this deal.

De-Risked Investment with Rigorous Due-Diligence: One of Avanti’s key strengths lies in their comprehensive due diligence process. The company has undertaken extensive research and analysis of their wells, resulting in a well-rounded understanding of the geology and potential yield of their Helium reserves. This meticulous approach mitigates the risk typically associated with junior exploration companies and instills confidence with investors seeking long-term growth opportunities.

Avanti’s management team, led by CEO Chris Bakker, brings over 30 years of experience in the industry. The team’s expertise, coupled with the fact that most members have a background in oil and gas, lends a unique advantage to Avanti Helium’s operations. The management’s dedication to keeping the company relatively small, ensuring practicality and efficiency, further supports Avanti’s position as an attractive investment.

Efficiency & Cost Advantage over Competitors: Avanti Helium’s potential to produce approximately half of the Helium output of North American Helium (one of the Largest Helium Providers in this space), and got to this point at a mere 10% of the cost, is a testament to their operational prowess. Currently, North American Helium produces 350 MCF / Day and Avanti is expected to produce 150 MCF / Day.

Avanti’s deep, high-pressure wells which will, in theory, yield better margins compared to their Southern US counterparts, will eliminate the need for constant well-seeking efforts, reducing overall operational expenses. This cost advantage positions Avanti to capitalize on a growing global Helium demand, especially in the semiconductor industry, where Helium is crucial for manufacturing.

Moreover, Avanti Helium’s strategy to own the entire supply chain from exploration to distribution sets them apart from their competitors. Owning the supply chain provides Avanti with greater pricing power and the ability to capture profits more effectively, enhancing their competitive edge in the Helium market.

Strong Financials Compared to Peers & Strong Investment from Insiders: One of the key metrics I always take a look at when considering an idea is where they sit currently from a financial standpoint, even though I tend to look for names that have huge catalysts coming down the line that will spur large amounts of growth.

Currently, Avanti is holding $1,786,324 in cash as of Q1’ 23 and burning $1.1M per Quarter.

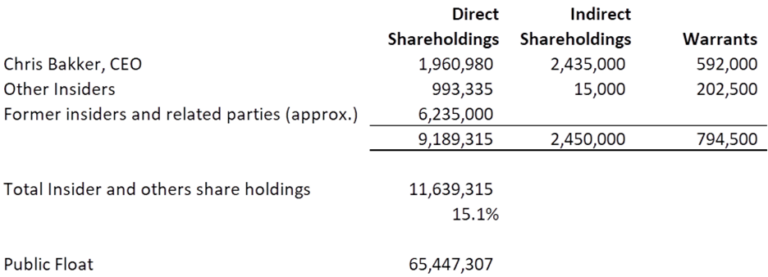

Insiders hold 15% of the stock, with the CEO holding around 5% of the total float himself. The amount the insiders hold are as follows:

In this context, Avanti Helium’s current market cap appears undervalued when considering its comparable production capabilities and strategic positioning. If North American Helium achieves a substantial valuation upon listing it strongly suggests that Avanti Helium is significantly undervalued by comparison. Avanti has the ability to produce 50% of what North American Helium does annually and got this point of production at about 1/10th of the cost.

The implications of such a listing could be substantial for the Helium industry. A successful listing of North American Helium on the NYSE would elevate the industry’s visibility and attract significant investor interest, especially from institutions and hedge funds.

Riding the Helium Market Surge: The global Helium market is witnessing a surge in demand, driven by its essential role in Semiconductor manufacturing, MRI machines, and space exploration technologies.

Russia was expected to produce 25-30% of global supply and meet demand growth over the coming decade. This has not happened due to plant failure and issues related to the Ukraine war (including US sanctions). In a more strategic sense, with the US “re-shoring” semiconductor manufacturing due to geopolitical risk of China threatening Taiwan, Helium to support these plants would logically be sourced from friendly nations, or domestically.

One analogous situation to Helium is critical minerals. China controls a large global supply and with the stroke of a pen could cut the west off from supplies that are important in the manufacturing of everything from renewable energy equipment to semiconductors and many things in between. In the past few weeks China has flexed on this very issue by banning the export of Germanium and Gallium. To ensure security of supply, a strong domestic / regional exploration industry must evolve and Avanti’s unique advantage of looking to develop and own it’s entire supply chain can provide them with just that.

As the market continues to expand, Avanti is poised to capitalize on this rising demand, enhancing shareholder value in this regard.

Conclusion: In conclusion, Avanti Helium stands as an undervalued gem in the Helium industry, with the potential for remarkable growth and profitability. The strategic Midstream Deal, supported by meticulous due diligence, positions Avanti as an attractive investment opportunity for institutions and hedge funds seeking exposure to the Helium market. Moreover, the company’s cost-efficient production capabilities and the potential implication of North American Helium’s NYSE listing suggest that Avanti Helium’s current market cap vastly underestimates its worth.

Investors who recognize the immense potential in the Helium industry and seek a well-positioned, undervalued player should consider Avanti Helium as a compelling addition to their portfolio. As the global demand for Helium continues to soar, Avanti Helium’s strong fundamentals and strategic advantages are likely to reward investors with substantial long-term gains.

Current Idea is a speculation long on ARGYF (3 – 6 months).

Best Regards,

Spartan (aka ‘Chris’)

Stay up to date with Spartan’s Weekly Newsletter