QUARTERLY IN DEPTH INVESTMENT ANALYSIS – ATHA ENERGY CORP (OTC: SASKF)

Disseminated for ATHA Energy Corp (SASKF)

QUARTERLY IN DEPTH ANALYSIS

ATHA ENERGY CORP

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

In lieu of today’s “Spartan’s Weekly Picks” Newsletter, this week I am going to be focusing on what I feel is an extremely undervalued energy / mining play within a sector that’s setting up to explode.

For those of you that are new to Spartan Trading, or are just receiving our free weekly newsletter for the first time, my goal is to cover one company in detail every quarter that I feel has good investment potential when considering risk / reward.

Over the past several months I have been researching the Uranium sector as a whole and have selected one company that I feel is an undervalued gem that has the potential to double its valuation in the medium term.

The global energy landscape is undergoing a radical transformation and, potentially at the forefront of this evolution, is ATHA Energy Corp (ATHA). As the world shifts towards achieving net-zero emissions, ATHA finds itself in a unique position to contribute significantly to the global imperative.

I had the pleasure of speaking with ATHA’s CEO and Executive Management Team on numerous occasions, exploring the different avenues and possibilities the company has ahead of itself.

This comprehensive investment thesis delves into ATHA’s strategic advantages in the Uranium sector, focusing on the impeding global supply deficit, the company’s undervaluation relative to it’s competitors, it’s potential for groundbreaking discoveries and the remarkable team steering ATHA’s towards industry prominence.

Spartan’s $SASKF idea outlook:

ATHA Energy Corp (OTCQB: SASKF; TSXV: SASK.V; FRA: X5U)

- Idea: Long SASKF $0.75+

- Target Area (Short Term): $1.07

- Target Area (2 – 6 Months): $1.37 – $1.50+

- Risk: $0.20

- Float: 80M

- Shares Outstanding: 135.9M

- Insider Ownership: 46% (Tightly Held)

- Institutional Ownership: 25%

$SASKF Long Term Idea

Curling off the lows, yet to see volume come in from recent news and feel this is the perfect spot to start to build a base off the lows. Currently lagging behind the Uranium chart. IMO expect to see continuation as pipeline, news and sector progresses.

INVESTMENT THESIS

Macro-Economic Landscape: Monumental Global Market Opportunity

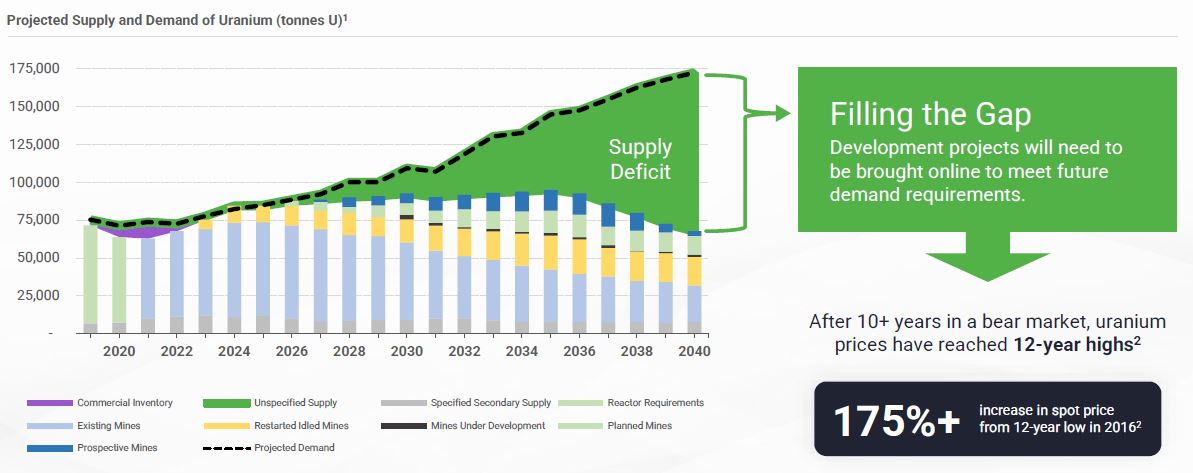

Uranium Supply Deficit:

The uranium market is currently in a 26% production deficit and expected to increase significantly by 2040, with over 50% of global production embedded with significant geopolitical risk. The structural gap in the uranium market is not merely a challenge; it’s a monumental opportunity that ATHA is uniquely positioned to address. With a strategic focus on the impending supply deficit, ATHA’s operations align perfectly with the burgeoning demand for nuclear energy.

Net-Zero Energy Emission Strategy:

Changes to energy policy have increased support for nuclear energy, leading to an increasing number of announcements for new, restarted, and extended reactors. The global push towards net-zero emissions establishes nuclear energy as a linchpin. ATHA, entrenched in the uranium sector, stands as a potential key player in the impending surge in demand for clean, efficient energy.

Global Nuclear Growth:

ATHA’s significance in the nuclear energy narrative is emphasized by the industry’s staggering global growth. With substantial environmental, social, and governance (ESG) advantages over alternative sources, ATHA is well-positioned to capitalize on this upward trajectory.

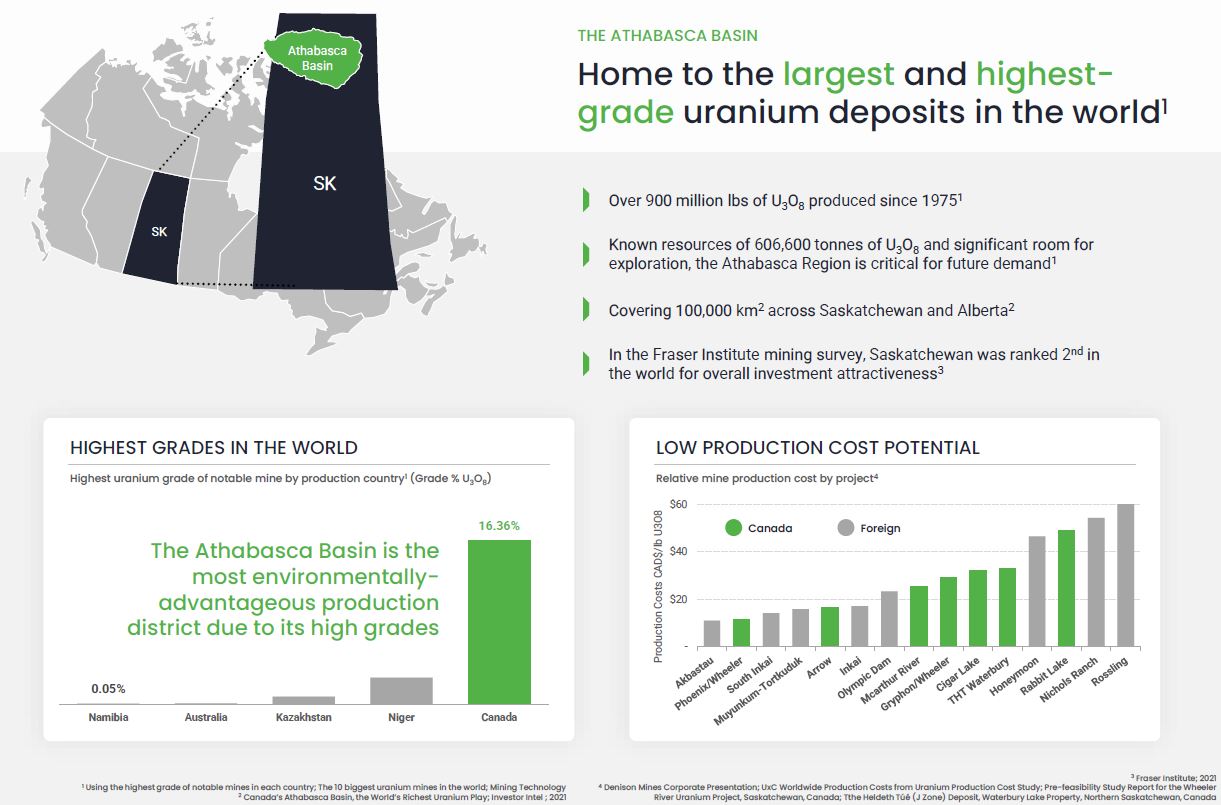

Operational Strengths: World’s Largest, Highest-Grade Uranium Deposits & Mines

Athabasca Basin:

ATHA’s operational strength lies in the Athabasca Basin, home to the world’s largest and highest-grade uranium deposits and mines. ATHA’s strategic positioning in this resource-rich basin provides a solid foundation for sustainable growth.

Jurisdictional Support:

Canada as a whole, but more specifically the Province of Saskatchewan, where ATHA’s projects are situated, is ranked number three on Fraser Institute’s list of top mining-investment jurisdictions globally. Saskatchewan has a long history of uranium exploration and mining, going back more than 70 years. Both the federal and provincial governments are focused on supporting the uranium exploration and mining sectors, as both levels of government continue to announce plans to expand and advance Canada’s nuclear energy sector. ATHA Energy is the largest land holder of prospective uranium exploration mineral claims in Canada, and thusly has the support of all levels of government.

Exploration Potential:

ATHA distinguishes itself by operating in an exploration-rich environment. While competitors often limit their focus to one project in maturing or matured districts, ATHA’s approach is to explore numerous projects across the entire Athabasca Basin. Their projects encompass all current, past, and developing uranium mining camps, focusing on areas that are underexplored, applying a systematic geoscience approach to exploration. This approach truly positions ATHA as a leader in the exploration and discovery of new, substantial uranium deposits.

Management Proficiency: Track Record of Value Creation

ATHA Foundation:

The foundation laid by ATHA’s founders reflects not just financial backing but a shared vision for success. Their ability to raise substantial capital showcases the market’s confidence in ATHA’s potential. ATHA’s land is sourced by the same group which provided NexGen Energy’s foundational assets and were involved in Hathor Exploration’s Roughrider deposit (C$650MM sale to Rio Tinto).

Technical Expertise:

ATHA’s CEO is Troy Boisjoli, a geologist with two decades of experience in exploration and production of uranium in the Athabasca Basin. Troy most recently held the position of Chief Geologist at Cameco’s Eagle Point Uranium Mine, and Vice-President of Exploration and Development at NexGen Energy. The technical team is further bolstered by Doug Engdahl, Managing Director at ATHA, and Doug Adams, Vice-President of Exploration. Both are veteran uranium geologists with decades of experience in the Athabasca Basin, holding senior roles in exploration and production at Cameco.

Strategic Assets and Financial Flexibility:

ATHA’s possession of 3.4 million acres across four exploration districts, coupled with financial flexibility, positions the company to leverage modern technology and pursue strategic opportunities, including farm-outs and mergers and acquisitions (M&A).

Desirable Carried Interest:

ATHA’s assets include 10% carried interests on key exploration blocks owned and operated by two of the most successful development teams in the Basin: NexGen Energy & IsoEnergy.

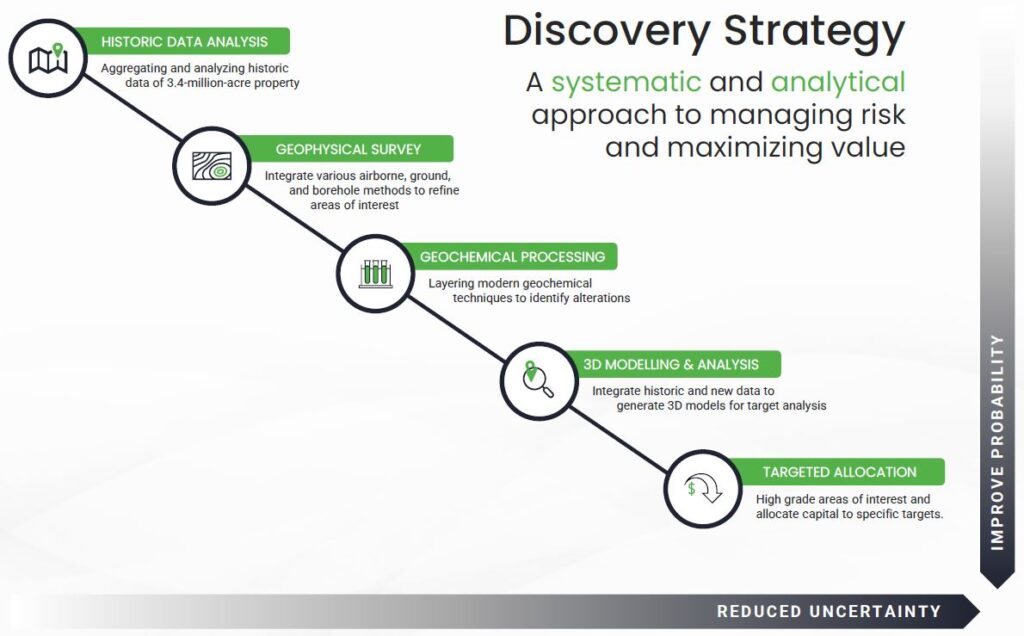

Exploration & Discovery Strategy: Pioneering the Future

ATHA’s commitment to a systematic, data-driven approach to exploration sets it apart. By focusing on exploration at scale and tier-one targets, ATHA maximizes the probability of success in a field where precision is paramount.

Discovery Strategy:

ATHA’s meticulous discovery strategy involves an array of techniques, including historic data analysis, geophysical surveys, geochemical processing, 3D modeling, and targeted allocation. This approach underscores ATHA’s commitment to methodical exploration and groundbreaking discoveries.

Financial Landscape: Valuation & Market Dynamics

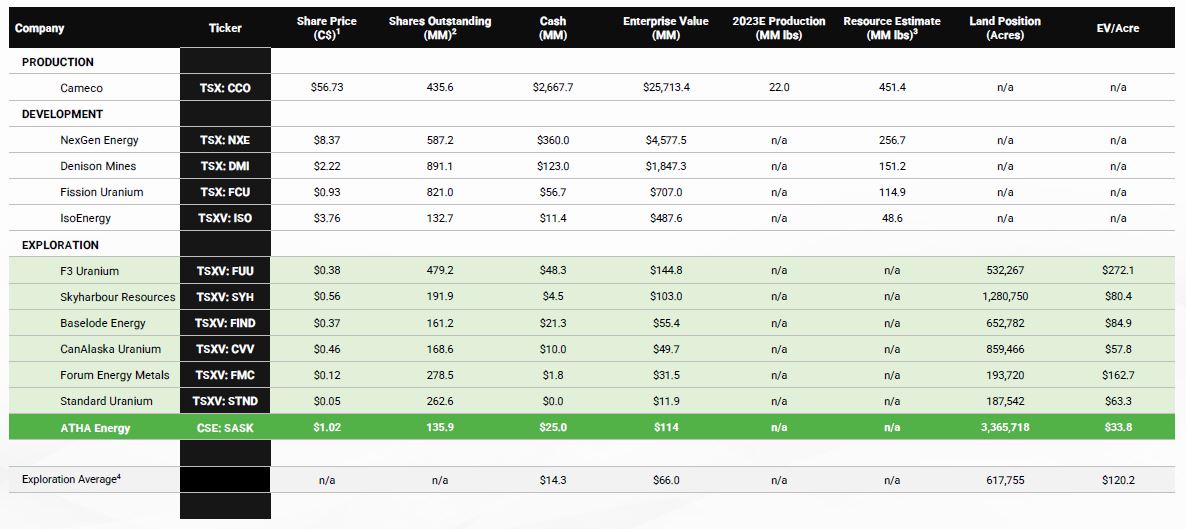

Valuation Disparity:

ATHA’s market cap of $92 million is indicative of an undervaluation in the market. This sets the stage for an opportune entry point for investors, especially when compared to competitors such as Cameco (NYSE: CCJ) and NexGen (NYSE: NXE).

Capital Structure Strength:

The tightly held shares, insider ownership at 46%, and institutional ownership at 25% highlight the market’s confidence in ATHA’s financial stability and potential for growth.

Competitive Analysis: ATHA’s Standout Position

Comparative Valuation:

In a landscape dominated by competitors like Cameco and Nexgen, ATHA stands out as an undervalued gem. The comparative valuation underscores the potential for substantial returns, making ATHA an attractive investment opportunity. Compared to its peers we can see below that their market cap is significantly lower even given the recent developments with their projects, the surveys, cash position vs. burn and the strategic site locations near their competitors where favorable survey results have been published. As I mentioned earlier, ATHA’s assets also include 10% carried interests on key exploration blocks owned and operated by two of the most successful development teams in the Basin: NexGen Energy & IsoEnergy.

Recent Acquisition & Financing News

ATHA Energy Announces Proposed Acquisition of 92 Energy & Latitude Uranium and Concurrent $14M Financing – December 7, 2023

This will be a massive development strategically for this company as it not only strengthens their balance sheet but will create an attractive opportunity for institutional ownership to increase. Because of the larger market cap institutions will be more likely to participate in owning the company going forward. This Transaction also will position ATHA to now have the largest exploration portfolio in Canada. The combined company is expected to provide shareholders with exposure to 7.1 million acres of exploration acreage spread across Canada’s top three uranium jurisdictions, representing the largest exploration portfolios in some of the highest-grade uranium districts in the world.

Conclusion

In conclusion, ATHA’s strategic advantages form a robust foundation for the company’s ascent in the uranium sector. The convergence of imminent supply deficits, operational strengths, a proficient management team, exploration prowess, and an undervaluation relative to competitors positions ATHA on a trajectory towards unparalleled success in the nuclear renaissance.

ATHA Energy Corp (OTCQB: SASKF; TSXV: SASK.V; FRA: X5U)

- Idea: Long SASKF $0.75+

- Target Area (Short Term): $1.07

- Target Area (2 – 6 Months): $1.37 – $1.50+

- Risk: $0.20

Current Idea is a speculation long on SASKF (2 – 6 months).

More information on ATHA Energy Corp, including their most recent presentation highlighting their recent transaction announcement can be found here.

Best Regards,

Spartan (aka ‘Chris’)

Stay up to date with Spartan’s Weekly Newsletter

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by Atha Energy Corp (AE). to provide it with promotional or marketing services, and the information contained in this communication has been prepared by or on behalf of AE. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services, and may sell any such securities as permitted by law. Disclaimer: We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com and affiliates www.sparknewswire.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success, and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc has been retained by AE (OTCQB: SASKF) to perform promotional and advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from AE. Questions regarding this website may be sent to info@spartantrading.com Spark Newswire Inc. and affiliate of Spartan Trading Inc. has a two month agreement with AE (OTCQB: SASKF) for the total sum of ninety nine thousand nine hundred and ninety nine CAD This agreement is for the marketing of AE (OTCQB: SASKF) which services include the issuance of this release and other opinions that we release concerning of AE (OTCQB: SASKF). Spartan Trading and affiliates Spark Newswire Inc. has not investigated the background of AE (OTCQB: SASKF) the hiring party, or AE (OTCQB: SASKF) Anyone viewing this newsletter should assume AE (OTCQB: SASKF) or affiliates of AE (OTCQB: SASKF) own shares of AE (OTCQB: SASKF) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading and affiliates Spark Newswire Inc. has received this amount as a production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements regarding AE (OTCQB: SASKF)