INVESTMENT IDEA – STRATEGIC ASSETS WITH HIGH GROWTH POTENTIAL (NASDAQ: FMST)

Disseminated on behalf of Foremost Lithium Resource & Technology (Foremost)

IN DEPTH INVESTMENT ANALYSIS

Foremost – $FMST

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

This week I want to focus on an asset-rich, low-float exploration company that is strategically positioned to play a critical role in the North American clean energy economy.

Considering President Biden’s recent direction to increase tariffs on $18 billion of imports from China (targeting batteries, critical metals, semiconductors, steel and other essential goods) I thought it would be good timing to focus on a name that will not only benefit from North American supply chain protection, but also the wide range of tax credits and grants available.

Yes, there are inherent risks investing in an exploration company.

The resources may be valuable now but may not be economically viable to mine in the future given demand. Or there may not be significant resources even available that are worth mining on the property.

With an aim at understanding the significance of the exploration results, growth opportunities and favorable market dynamics, not only have I had discussions with senior management but I have reviewed the technical reports and have decided that I will be adding this name to my long-term investment portfolio.

As the global shift towards electrification continues, Foremost’s ($FMST) significant resource claims and exploration results indicate a promising future. With potentially undervalued assets and unexplored gold deposits ready for spin-off, any positive developments could significantly boost the company’s valuation.

Foremost’s robust financial management, strong insider and institutional ownership, low-float and undervalued market position make it an attractive investment. With strategic positioning, promising exploration results, and a proactive growth strategy, Foremost is likely poised for substantial value creation and long-term success.

This forward-looking analysis provides a detailed insight into why $FMST stands out as a compelling investment opportunity in the evolving energy landscape.

Spartan’s Technical Analysis

Foremost Lithium Resource & Technology Ltd. (NASDAQ: FMST; CSE: FAT)

- Idea: Long Speculation $FMST $2.40 – $2.70 (Starter Position)

- Spartan’s 1st Target Area: $3.52

- Spartan’s 2nd Target Area: $4.25

- Spartan’s 3rd Target Area: $4.93

- Stops: $1.50

- Float: 4.31M

- Shares Outstanding: ~5.5M

- Insider Ownership: ~17.8%

- Strategic Investors & Management Ownership: ~3M

- Free Trading: ~1.2M (less strategic investors & management)

- Market Cap: 13.75M (USD) 18.44 (CAD)

Wedge breakout off the lows with room to the upside.

50 EMA breaks, given the small float and the environment in small caps, I would expect a solid squeeze to occur.

INVESTMENT THESIS

Company Overview

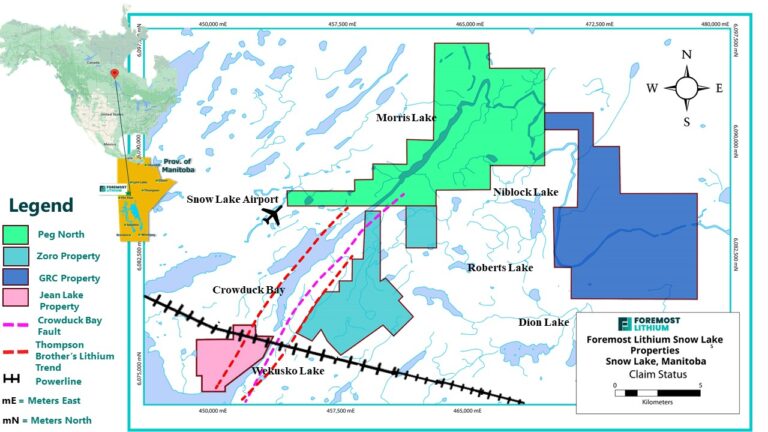

$FMST is a hard-rock, low-float, asset rich company with a diversified portfolio in critical minerals including Gold, Silver and Lithium. Capitalizing on emerging market trends, Foremost is focused on playing a critical role in the North American clean energy economy and either 100% owns or has to option to own 100% interest in their “Lithium Lane” projects in the Snow Lake region of Manitoba, which include the Zoro, Jean Lake, Grass River, and Peg North Projects, totaling 43,276 acres (17,513 hectares).

Additionally, $FMST holds the Lac Simard South property in Quebec (11,842 acres) and the Winston Gold / Silver property in New Mexico, a 3,000 acre (1,214 hectare) drill ready property with promising geology (and potential lucrative spin-out which would result in divided shares to shareholders).

Not only does Foremost’s exploration approach include the most modern, scientific technology available to develop drill targets with minimal environmental impact, its forward thinking ability to potentially employ strategies such as Direct Shipping Ore (DSO) as a viable way to fast-track cash flow could lead it to be one of the fastest growing exploration resource companies in North America.

Major Market Advantages & Opportunities

NAFTA “Superhighway”:

Foremost has strategically acquired significant resource assets in key locations, the majority of which are lithium-based assets at the tip of the NAFTA “Superhighway.” This Superhighway will provide Foremost with easy, incomparable access to North American battery and Electric Vehicle (EV) manufacturing sites to supply it’s lithium concentrate product for future feedstock.

$FMST sites are also accessible via the Arctic Gateway Railway that runs North to the Port of Churchill and South (via Winnipeg) to the U.S. Rail Network and U.S. Major Highways, making it a very geographically attractive bundle of high-value and asset rich properties.

Government Policy:

With the on-shoring of critical mineral supply chains becoming a growing national security concern, governments are increasingly incentivizing domestic production of key minerals, including lithium supply.

The Inflation Reduction Act (IRA), has intensified the need for automakers to secure their future lithium supply. The IRA requires that battery minerals in EV’s be extracted or processed in the United States (or by a Free-Trade Partner country such as Canada).

In response to China’s unfair trade practices, on May 14th, 2024 the US Government announced further Tariff’s under Section 301 of the Trade Act of 1974 on $18 billion of imports from China, to protect American workers and businesses. This includes a 2024 tariff rate increase on lithium-ion EV batteries from 7.5% to 25% and certain other critical minerals from 0 to 25%.

“Despite rapid and recent progress in U.S. onshoring, China currently controls over 80 percent of certain segments of the EV battery supply chain, particularly upstream nodes such as critical minerals mining, processing, and refining. Concentration of critical minerals mining and refining capacity in China leaves our supply chains vulnerable and our national security and clean energy goals at risk.” 1

This puts Foremost in a privileged position as EV manufacturers and other suppliers scramble to source and secure their critical minerals with a Free-Trade Partner, leading to potentially significant new revenue opportunities (or acquisition potentials).

Favorable Market Outlook:

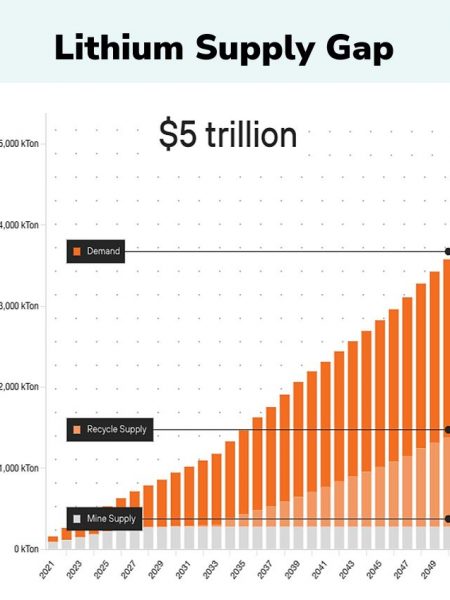

Driven by the electrification of the global economy, lithium demand is expected to structurally outstrip supply. Despite a temporary downturn in lithium prices, indicators suggest a potential bottoming out with stabilization on the horizon.

Both public policy (lead by global decarbonatization efforts) and the subsequent investments being made by OEMs into vehicle electrification have supported an increased demand for Lithium.

A study conducted by the Fraser Institute projects that 50 new lithium mines will be required to meet the 2030 targets for governmental EV mandates that require the phase out of traditional combustion engine passenger vehicles in North America.

In addition, the increased energy transition into mobile electrification increases the need for grid-scale battery storage, with the global grid-scale battery market expecting to grow at a 26.1% CAGR to $55.3B in 2031 according to Transparency Market Research.

Seeing the increasing future demand, battery and EV manufactures have begun securing their raw materials directly with miners and junior explorers, presenting a lucrative opportunity for $FMST to capitalize on their potential large resource claims.

In 2022, both Mercedes Benz and Volkswagen announced agreements to secure battery raw materials in Canada, with LG Energy Solutions also signing an MOU with $FMST‘s neighbor in Snow Lake, Manitoba.

Direct Shipping Ore – Fast Tracking Cash Flow:

Direct Shipping Ore (DSO) is where bulk ore blasted from the ground is shipped directly to a mine and then transformed to concentrate prior to shipping.

Foremost has recently applied to the Government of Canada Critical Mineral Infrastructure Fund for $10M to assist with the upgrade of roads to complete this strategy.

Foremost’s metallurgy work on Zoro Project was successful, demonstrating that it’s ore is amenable to 6% battery grade lithium, which is the necessary grade for EV cars, and off-take agreements.

This is significant as it provides $FMST with the potential ability to fast-track their cash flow while still being able to drill off reserves on other parts of the property and continue exploration efforts without having to wait years to become a viable mine.

Although DSO is currently projected to begin in the first half of 2026, it is important to note that Foremost’s Zoro Project is located 400 miles NW of the Tanco Mine, one of the only fully producing lithium spodumene concentrate mines in North America – signaling great potential for a future revenue stream opportunity.

Unlocking Shareholder Value – Exploration to Discovery

Lithium Lane Properties:

Foremost’s Lithium Lane properties in the Snow Lake region of Manitoba include the Zoro, Jean Lake, Grass River, and Peg North Projects, totaling 43,276 acres (17,513 hectares).

These Lithium Lane Properties are 100% owned or optioned by Foremost and include over 78 claims, hosting 100’s of pegmatite dykes. Each project has its own separate planned future drill program, with the potential to independently reach significant tonnage.

To date $FMST has invested over $16M to acquire, develop and or explore these properties.

High Level Lithium Lane Properties Overview:

Zoro Property (8,377 acres)

Resource: Lithium

- Over $8M invested into this project by Foremost to Date (this is their flagship property), including a $600,000 government grant from the Manitoba Mineral Development Fund (“MMDF”).

- This Property runs alongside the Crowduck Bay Fault which is a significant regional focus for the development of lithium-enriched pegmatite cluster.

- Metallurgical studies on a blended bulk sample collected from ‘Dyke 1’ were amenable to produce near battery-grade 6% Li2O. This will allow Foremost to market the lithium potential on this site to potential partners even before full drilling and extraction operations commence.

- Foremost also plans to monetize ore through DSO in order to fast-track cash flow. Foremost’s Zoho Project is located 400 miles NW of the Tanco Mine, one of the only fully producing lithium spodumene concentrate mines in North America – potentially signaling significant future revenue stream opportunities.

- Currently drilling at ‘Dyke 1’ which hosts the Company’s maiden inferred resource of 1,074,567 tons at a grade of 0.91% Li20, with a cut-off grade of 0.3%, as outlined in the Company’s filed Regulation SK-1300 Technical Report Summary (2023) and NI-43-101 Technical Report (2018).

- There are fifteen additional lithium-bearing dykes on the property which are yet to be fully explored which means that Foremost could be sitting on a very large and valuable resource reserve.

Jean Lake Property (2,476 acres)

Resource: Gold & Lithium

- Area is known for hosting world-class gold, and gold-rich base-metal deposits and for the development of lithium resources.

- Both Lithium and Gold have been discovered on the property.

- Jean Lake remained unexplored for lithium since 1942 until Foremost began exploration efforts in the late summer of 2021.

- The Manitoba Mineral Development Fund (“MMDF”) provided funding by way of a $300,000 grant, stimulating exploration on the property.

- Following a successful June 2023 drill program, Foremost is preparing for future drill programs to further explore the potential size of the Gold and Lithium reserves on the property.

Grass River (15,664 acres)

Resource: Lithium

- Located 4 miles east of the Zoro Property, Glass River consists of 29 claims and 7 spodumene-bearing pegmatite dykes discovered by past drilling, with 10 exposed pegmatite targets at surface.

- Pegmatites show similar trends to those of the Thompson Brothers Lithium Trend and the regionally extensive Crowduck Bay Fault, known to be associated with lithium-enriched pegmatite dyke clusters.

- Future drilling programs are planned to identify the potential size of the Lithium reserves on the property, with the assumption that they will be similar to their flagship project (Zoro Property) given the close proximity and location across the Crowduck Bay Fault.

Peg North (16,697 acres)

Resource: Lithium

- Largest property, and newest property acquisition of all of the Lithium Lane projects, consisting of 28 claims and five pegmatite dykes which were first mapped and reported in 1949.

- Property straddles the northeastern extension of the Crowduck Bay Fault, which, similar to Foremost’s other Lithium Lane properties, is a focal point for the development of lithium-enriched pegmatite dyke clusters.

- This property has had limited exploration due to the summer 2023 forest fires, inhibiting access to large portions of the property. Future plans include extensive prospecting and exploration to enable effective future drill targeting.

Additional Canadian Property:

In May 2023, $FMST acquired the Lac Simard South Property consisting of 60 mineral claims located in Quebec, Canada. In addition to those 60 claims, FMST staked an additional 20 mineral claims, contiguous to the property, increasing the project to an aggregate size of 11,482 acres (4,647 hectors).

Located within a well-developed mining region with readily available support facilities and services, $FMST intends to begin a work program to validate the identified pegmatites associated in this active lithium, mining, and refining region of Quebec. Once targets are determined a project drilling program will follow, potentially validating Foremost’s assumptions that they are sitting on an additional high-value resource.

Anticipated Lucrative Spin-Out – Gold & Silver Project:

In my opinion, one of the most exciting aspects of $FMST (other than their large property claims and promising exploration results validating the thesis that they are sitting on large amounts of valuable resources), is the anticipated spin-out of their Winston Gold / Silver Project.

The Winston Gold / Silver project is a 3,000 acre drill-ready property located in the Black Range of Sierra County, New Mexico. It is home to three historic mines; Ivanhoe, Emporia, and Little Granite consisting of 147 unpatented Bureau of Land Management mining claims and 2 patented Ivanhoe and Emporia lode mining claims.

Each historic mine had produced high-grade Gold and Silver during full-time operations over a century ago, with historic drilling in early 1980s suggesting potential for high-grade ore shoots within larger mineralized envelopes.

With the price of Gold reaching an all time high in 2024, should Foremost be successful in spinning out this drill ready property, shareholders can anticipate dividend shares which would add significant value to the company while strengthening the balance sheet.

Note: The Winston Gold / Silver project is currently held in a Foremost subsidiary, Sierra Gold & Silver Ltd. (Sierra). Should the spinout occur, $FMST would apply this list this separate entity on a major North American exchange where Foremost shareholders would retain their respective interest in both $FMST and Sierra. The amount of shares Foremost shareholders would get in Sierra is still to be determined.

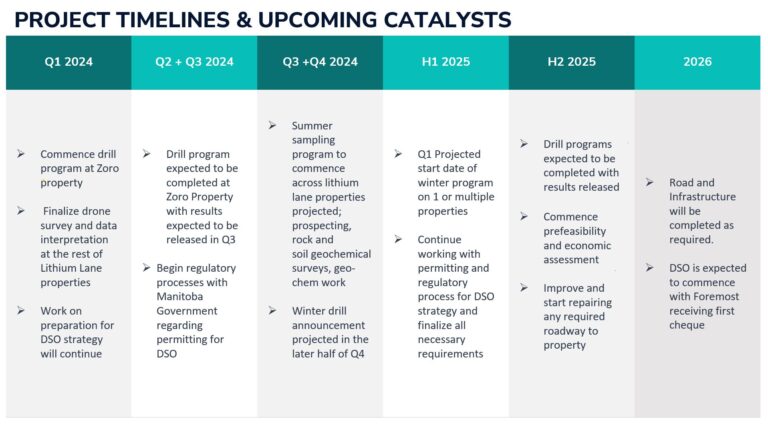

Operations & Growth Strategy

Foremost’s operational and growth strategy revolves around aggressive exploration and efficient resource utilization. Utilizing the most modern, scientific technology available such as drone magnetic surveys, soil geochemistry and data integration allows $FMST to develop drill targets with minimal environmental impact and increased efficiency.

These operational efficiencies, combined with their ability to tap into grant funding opportunities (having already received $900,000 from the Manitoba Government with a potential additional $10 Million from the Government of Canada to support their DSO strategy) allows Foremost to continue their resource discovery programs on a less dilutive basis when compared to other companies in the space.

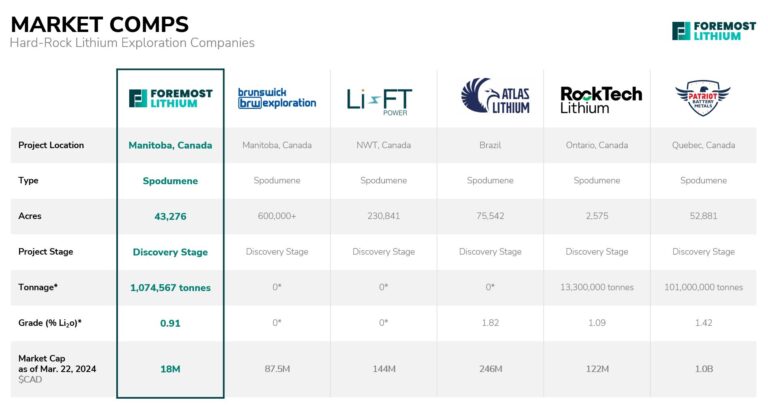

Furthermore, operating independently without joint venture partners, $FMST distinguishes itself within the competitive landscape. Competitors such as Brunswick Exploration (Canada) or Atlas Lithium (Brazil) may present larger market capitalizations but lack reserves, providing Foremost with a competitive edge.

Share Appreciation – Growth in Discovery

As with most things, those that are first to discover it typically get rewarded. Comparing Foremost to its competitors it is clear that $FMST is significantly undervalued when compared to other Hard-Rock Lithium Exploration Companies.

A Foremost Market Cap of 13.75M (USD) | 18.44M (CAD) represents a compelling valuation opportunity for investors. IMO as additional Foremost properties continue to be explored, and results of the resource amounts and grades are shared, $FMST market capitalization has the potential to appreciate significantly, reflecting the true value of its assets.

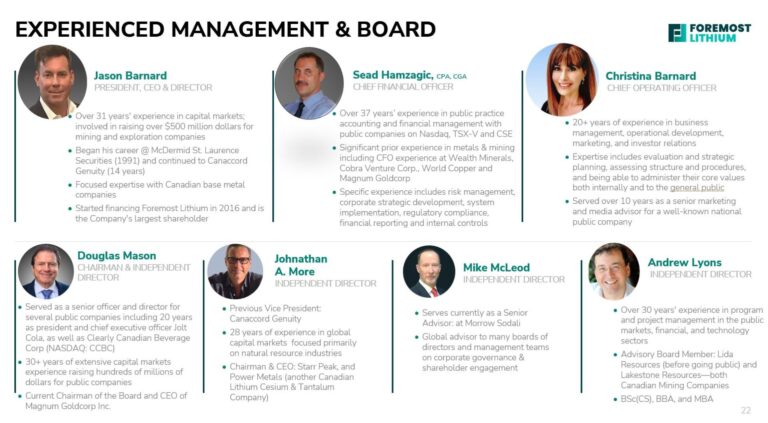

Largest Shareholders = Management Team

$FMST boasts a management team with a proven track record of success in capital markets, operational management and geological expertise, with Jason Barnard assuming the role of CEO in December 2022.

Jason’s extensive background in financing Canadian based exploration companies, coupled with Christina Barnard’s (COO) operational prowess and experience working with major, well known public companies, ensures effective strategic planning and execution. Combined, Jason and Christina Barnard are the largest shareholders in $FMST and have been financing Foremost since 2016.

Dahrouge Geological Consulting lead the company’s exploration program with a strong proven track record of finding monster discoveries, including being the original vendor of PMET’s Corvette property, further strengthen Foremost’s exploration capabilities, instilling shareholder confidence in the company’s leadership and ability to delivery results.

Financial Overview

Since its inception, $FMST has strategically invested over $16 million into its projects, allocating approximately $3.4 million towards property acquisitions and $12.6 million towards exploration efforts.

With a controlled burn rate and a recently completed private placement of $3,084.397, Foremost showcases strong financial stewardship. Their operational efficiencies, combined with access to grant funding—including $900,000 already received from the Manitoba Government and the potential for an additional $10 million from the Government of Canada—enable Foremost to pursue resource discovery programs with minimal dilution compared to peers.

Equity resource reports, valuing the company between $6.1 and $8 per share, highlight $FMST significant upside potential, driven by strategic positioning and promising drilling results to date.

Share Structure:

- Float: 4.31M

- Shares Outstanding: ~5.5M

- Insider Ownership: ~17.8%

- Strategic Investors & Management Ownership: ~3M

- Free Trading: ~1.2M (less strategic investors & management)

- Market Cap: 13.75M (USD) 18.44 (CAD)

Poised for Substantial Appreciation

In conclusion, Foremost ($FMST) presents an exceptional investment opportunity in the lithium exploration sector, with a significant upside potential from its unexplored gold and other deposits.

With a resilient management team, promising drilling results, and favorable market dynamics, $FMST is well-positioned for substantial growth and value creation. As global demand for both gold and lithium continues to rise, driven by the electrification of transportation and grid-scale energy storage, $FMST is primed to seize emerging opportunities. This makes it an attractive prospect for investors seeking exposure to the evolving energy landscape.

In my opinion, the company is undervalued based on its assets, including the promising gold deposits that area ready for potential spin-off. Any positive developments in this area could dramatically boost the company’s valuation.

Foremost Lithium Resource & Technology Ltd. (NASDAQ: FMST; CSE: FAT)

- Idea: Long Speculation $FMST $2.40 – $2.70 (Starter Position)

- Spartan’s 1st Target Area: $3.52

- Spartan’s 2nd Target Area: $4.25

- Spartan’s 3rd Target Area: $4.93

- Stops: $1.50

Current Idea is a Long Speculation on $FMST

More information on Foremost Lithium Resource & Technology Ltd,, including their most recent corporate presentation and materials can be found here.

Best Regards,

Spartan (aka ‘Chris’)

Stay up to date with Spartan’s Weekly Newsletter

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by Foremost Lithium (FL) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared by or on behalf of FL. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by FL (NASDAQ:FMST) to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from FL. Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc and affiliate of Spartan Trading Inc. has a twelve month agreement with FL (NASDAQ:FMST) for the sum of eight hundred and ten thousand canadian dollars. This agreement is for consulting and or marketing of FL (NASDAQ:FMST) which services include the issuance of this release and other opinions that we release concerning of FL (NASDAQ:FMST). Spartan Trading and affiliate Spark Newswire Inc has not investigated the background of FL (NASDAQ:FMST) the hiring party. Anyone viewing this newsletter should assume FL (NASDAQ:FMST) or affiliates of FL (NASDAQ:FMST) own shares of FL (NASDAQ:FMST) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading and affiliate Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements of FL (NASDAQ:FMST).