From Bear Market Land Grab to Bull Market Discovery Quimbaya’s Timing Couldn’t Be Better (CSE: QIM) (OTC: QIMGF)

Disseminated on behalf of

Quimbaya Gold Corp

FROM BEAR MARKET LAND GRAB TO BULL MARKET DISCOVERY

QUIMBAYA GOLD CORP

CSE: QIM | OTC: QIMGF | FRA: KO5

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

FORWARD: GOLD’S SECULAR BULL RUN MEETS QUIMBAYA’S BREAKOUT MOMENT

Gold has reasserted its dominance as the ultimate safe-haven and monetary hedge, posting a 41% YTD surge and touching an all-time high above US$3,700/oz.

The drivers are clear.

Relentless central bank accumulation, persistent inflationary pressures, and rising geopolitical risk premiums as global conflicts and de-dollarization reshape capital flows.

The result is a gold market that is not just cyclical – it is structurally repricing higher, with JP Morgan analysts projecting >US$4,000/oz IN Q2 20261.

This is happening as major producers face a severe reserve crisis. Global discoveries have totaled just 3 Moz in recent years – forcing them to look to the junior sector for growth.

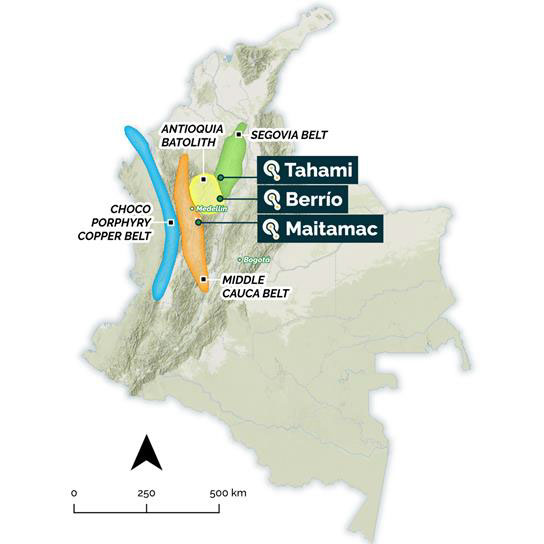

Colombia’s Antioquia district, producing 50% of the nation’s gold, is emerging as one of the most attractive hunting grounds thanks to its rapid permitting timelines (10 months for large projects), new mining approvals, and a pro-mining stance that has attracted majors like AngloGold, Agnico Eagle, B2Gold, and Aris Mining.

Against this backdrop, Quimbaya Gold Corp (CSE: QIM | OTC: QIMGF | FRA: KO5) offers investors a unique combination of high-grade exploration potential and leverage to rising gold prices.

Focused on Colombia’s prolific Middle Cauca Belt – a district known for hosting several multi-million-ounce deposits – Quimbaya is systematically exploring a portfolio of projects with district-scale potential.

This is not a conceptual land bank; it is a portfolio with active artisanal mining, confirmed mineralization, and a clear path to discovery.

WHY QUIMBAYA NOW

Quimbaya Gold Corp (CSE: QIM | OTC: QIMGF | FRA: KO5) stands at the intersection of this macro tailwind and district-scale opportunity. With 59,057 hectares of consolidated land – much of it hosting active artisanal mining – Quimbaya offers de-risked exploration and an entry point into one of the most competitive gold camps on the planet.

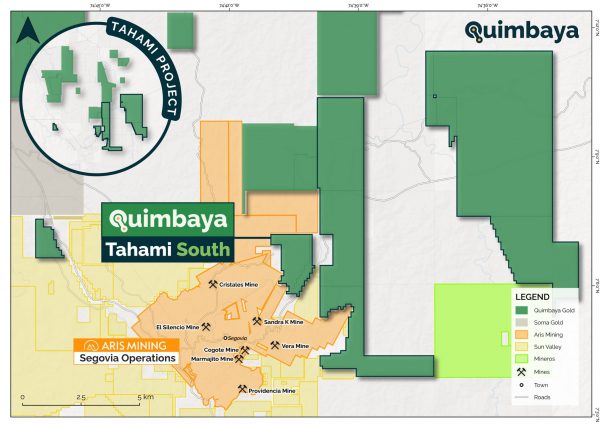

- Flagship Tahami Project: Adjacent to Aris Mining’s Segovia complex (16.1 g/t Au), now drilling its first 4,000m program targeting undrilled vein extensions.

- Elite Management: Built by the team behind billion-dollar Colombian successes (Gran Colombia/Continental), with CEO Alexandre Boivin holding 24% insider ownership — rare conviction in the junior space.

- Tight Structure & Funded Growth: ~18M float, clean cap table, and recent financings ensuring 2025 exploration is fully funded.

- M&A Torque: Strategic adjacencies to producers seeking reserve life extensions, setting up Quimbaya as a natural consolidation candidate.

THE SETUP FOR RE-RATING

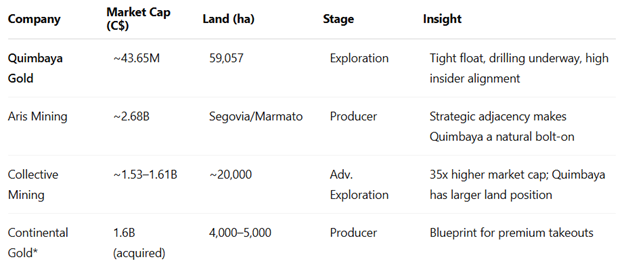

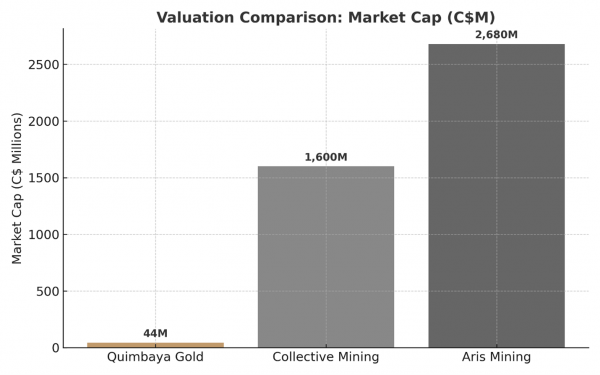

Quimbaya’s C$42.55M market cap (~C$0.73/ha) remains deeply discounted to peers like Aris (C$2.68B) and Collective (C$1.5B+), despite comparable geology and proximity. With drilling underway, assays due in Q4 2025, and a pipeline of additional targets in Maitamac and Berrio, the company is positioned for a potential multi-bagger rerate along the Lassonde Curve as it delivers discovery results.

SPARTAN’S TECHNICAL CHART ANALYSIS:

- CSE: QIM

- Long Idea: $0.75 – $0.85

- Stop Loss: $0.45

- Resistance 1: $1.05

- Resistance 2: $1.18

- Resistance 3: $1.42

- OTC: QIMGF

- Long Idea: $0.58 – $0.63

- Stop Loss: $0.30

- Resistance 1: $0.79

- Resistance 2: $0.94

- Resistance 3: $1.16

MACRO TAILWINDS: GOLD’S HISTORIC BULL MARKET

Gold’s resurgence is not a temporary spike but a structural re-rating driven by multiple global forces:

- Central Bank Demand: Over 1,000 tonnes of gold purchased globally in 2024, the second-highest on record.

- Inflation & Rate Cuts: Persistent inflation and central bank pivots are driving real yields lower, historically bullish for gold.

- Geopolitical Risk: Conflict premiums and de-dollarization efforts continue to create sustained demand for hard assets.

- Supply Crunch: Majors have replaced only a fraction of mined ounces in the past decade, forcing them to look to the junior sector for growth.

With these forces in play, gold’s strength provides a powerful tailwind for juniors with quality assets — precisely where Quimbaya is positioned.

MANAGEMENT & LEADERSHIP’S BILLION DOLLAR TRACK RECORD

Quimbaya Gold Corp (CSE: QIM | OTC: QIMGF | FRA: KO5) leadership draws from the architects of Colombia’s largest gold deals, providing a competitive edge in execution and deal-making. This team’s history with multi-billion-dollar companies like Aris Mining (formerly Gran Colombia Gold) and Continental Gold signals their belief in Quimbaya’s potential to replicate those outcomes.

- Alexandre P. Boivin (CEO & Director): Boivin’s 10+ years in Colombia include pioneering investments in the California-Vetas district, leading to a ~$2 billion buyout. After exiting in 2012, he endured the bear market to identify and consolidate Quimbaya’s assets, growing from 1,000 to 59,057 hectares.

- Sebastian Wahl (VP Business Development & Director): Wahl’s 15+ years in metals trading and capital markets; co-founded Silver X Mining, growing it from exploration to silver production in Peru. Wahl is an integral part of the Quimbaya team, driving strategic partnership.

- Ricardo Sierra (VP Exploration): With 18+ years in South America, Sierra’s tenure at Anglo American/AngloGold Ashanti and Continental Gold included the Apollo deposit discovery, culminating in a $1.6 billion sale. His involvement in billion-dollar projects mirrors Quimbaya’s setup, where he leads data-driven targeting.

- Dr. Stewart Redwood (Senior Technical Advisor): Redwood’s 40+ years include 14 years advising Gran Colombia Gold during its evolution into Aris Mining (C$2.68B market cap). His expertise in Antioquia’s geology is pivotal for Tahami, adjacent to Aris’s Segovia.

- Alexandre P. Boivin (CEO & Director): Boivin’s 10+ years in Colombia include pioneering investments in the California-Vetas district, leading to a ~$2 billion buyout. After exiting in 2012, he endured the bear market to identify and consolidate Quimbaya’s assets, growing from 1,000 to 59,057 hectares.

Additional Expertise: Advisors Nicolas Lopez (discoverer of Colombia’s first Cu-Au porphyry) and Terence Ortslan (40+ years in mining advisory) complement a blend of veterans and “new blood” for innovation.

Collectively, this team has discovered, de-risked, and exited some of Colombia’s most significant gold projects, giving Quimbaya a credibility premium that few juniors possess.

IRREPLICABLE LAND POSITION & GEOLOGICAL POTENTIAL: A DECADE OF RELATIONSHIP BUILDING IN A COMPETITIVE LANDSCAPE

Quimbaya’s land package is not just large – it is rich with evidence of mineralization and existing artisanal mining – forged over 10+ years of trust-building in Colombia’s relationship-driven environment.

In regions where locals distrust outsiders, Boivin’s “massaging” of connections enabled acquisitions during the bear market, when majors exited. Today, with competition from AngloGold and others inflating costs, this moat is non-repeatable.

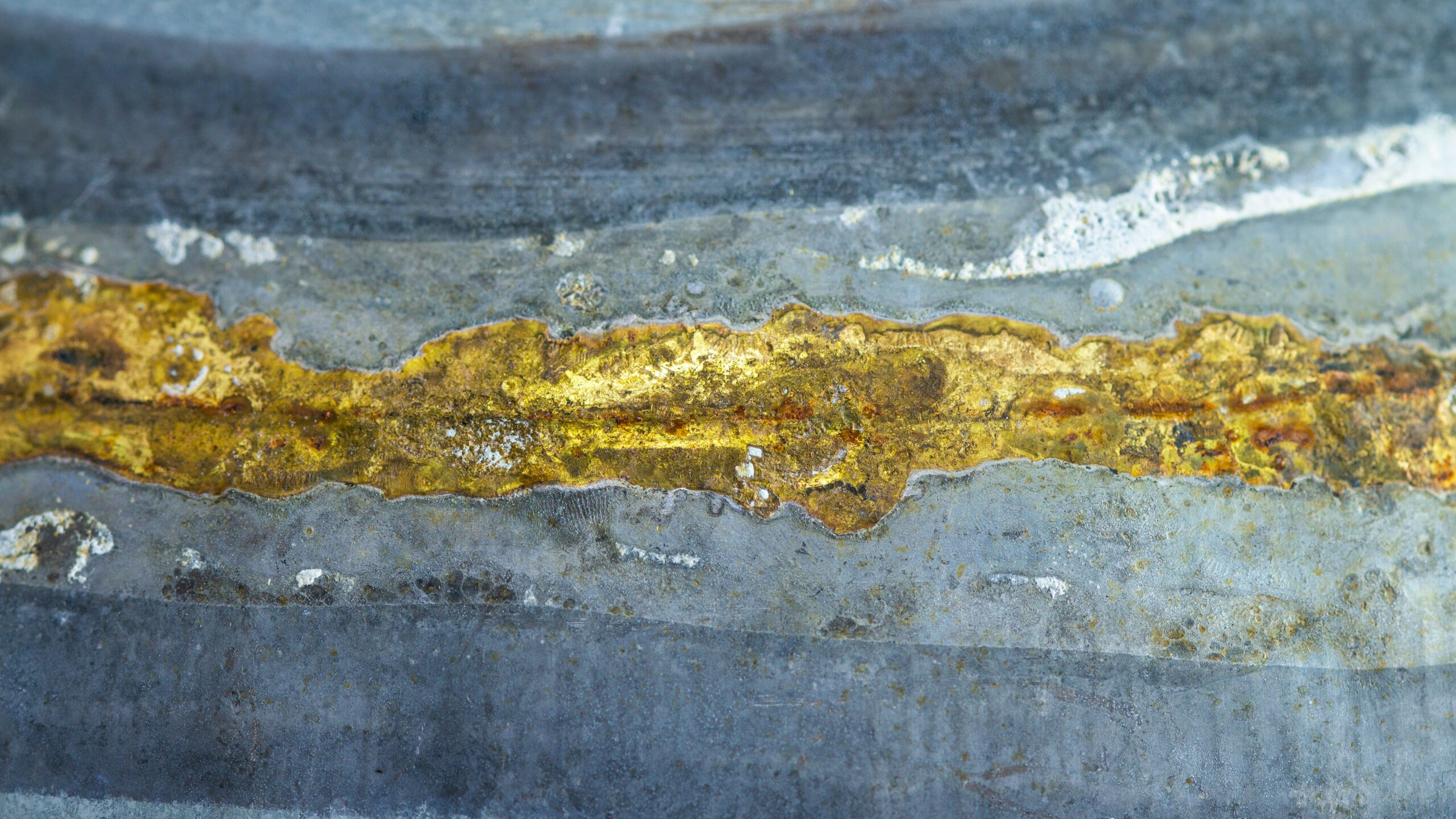

- Tahami (17,087 ha): Tahami, Quimbaya’s flagship, lies on the structural extension of Aris Mining’s Segovia vein system (16.1 g/t Au, expanding to 300,000 oz/year by 2026 with a $18M exploration budget). Over 150 artisanal miners are currently producing from the property, with 25 historical mines and surface samples up to 11.21 g/t Gold and 23.3g/t Silver, with multiple samples exceeding 1 g/t Au confirming potential.

- Maitamac (33,223 ha): Surface sampling up to 2 g/t Au, strategically located in the Middle Cauca Belt responsible for more than 50 Moz of discoveries.

- Berrio (8,746 ha): High-grade shear zone veins with demonstrated production potential.

- Tahami (17,087 ha): Tahami, Quimbaya’s flagship, lies on the structural extension of Aris Mining’s Segovia vein system (16.1 g/t Au, expanding to 300,000 oz/year by 2026 with a $18M exploration budget). Over 150 artisanal miners are currently producing from the property, with 25 historical mines and surface samples up to 11.21 g/t Gold and 23.3g/t Silver, with multiple samples exceeding 1 g/t Au confirming potential.

Excellent infrastructure (roads, power, water) and supportive mining communities further de-risk exploration and pave the way for scalable development.

This position places Quimbaya Gold Corp (CSE: QIM | OTC: QIMGF | FRA: KO5) as the sole exploration-focused player in a producer-dominated district, with untapped corridors ready for first-time drilling.

CURRENT OPERATIONS & CATALYSTS

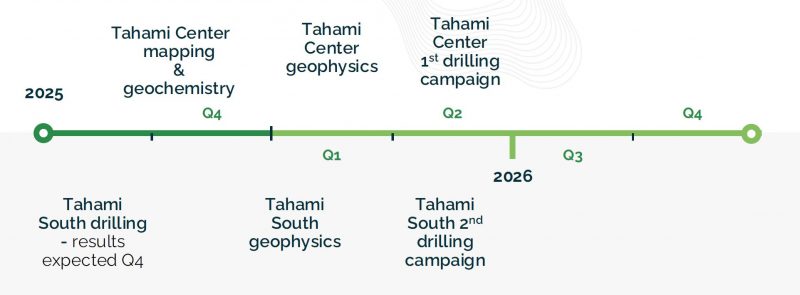

Quimbaya is transitioning from preparation to discovery in 2025:

- Phase 1 Drilling: A 4,000m drill program at Tahami South commenced August 2025 targeting Sandra K and El Silencio veins, testing undrilled gold system beside Aris’ Segovia Mine. Assay results are expected in Q4 2025 with potential near-term share price catalyst.

- Exploration Pipeline: Maitamac and Berrio being advanced for first drill campaigns in 2026.

- Partnerships: Independence Drilling engaged on a 100,000m program, partially share-based, aligning interests and ensuring scalability.

These initiatives mark the beginning of what could be a transformative 12–18 months for Quimbaya.

VALUATION & COMPARABLES

At a market cap of C$42.55M (~C$0.73/ha), Quimbaya trades at a deep discount to peers:

This valuation gap underscores the leverage Quimbaya Gold Corp (CSE: QIM | OTC: QIMGF | FRA: KO5) offers. A single meaningful discovery could unlock significant upside and move the company closer to peer-level valuations.

Investor sentiment on platforms like X is bullish, with analysts noting “stair-stepping” price action and positioning Quimbaya as “the next Aris / Collective.”

That said, every Junior Minor can be subject to risk, including drill disappointments, gold volatility, and Colombia-specific factors (e.g., community relations), though improved stability mitigates these.

Long-term, Quimbaya’s setup of a non-replicable moat, aligned leadership, and prime location positions Quimbaya investors for potential multi-bagger returns in gold’s secular uptrend.

SPARTAN’S TECHNICAL CHART ANALYSIS:

- CSE: QIM

- Long Idea: $0.75 – $0.85

- Stop Loss: $0.45

- Resistance 1: $1.05

- Resistance 2: $1.18

- Resistance 3: $1.42

- OTC: QIMGF

- Long Idea: $0.58 – $0.63

- Stop Loss: $0.30

- Resistance 1: $0.79

- Resistance 2: $0.94

- Resistance 3: $1.16

Stock Structure:

- Outstanding: ~58M

- Float: ~18M

- Market Cap: ~42.55M (CAD) | ~33.28M (USD)

CONCLUSION: POSITIONED FOR DISCOVERY-DRIVEN RERATE

Quimbaya Gold Corp (CSE: QIM | OTC: QIMGF | FRA: KO5) is now at the most value-accretive point on the Lassonde Curve – the discovery stage. Drill rigs are turning at Tahami, assays are expected in Q4 2025, and the company controls 59,057 ha of prime ground in Colombia’s Antioquia district – ground that would be nearly impossible to assemble today.

With a C$42.55M market cap – a fraction of peers like Aris Mining (C$2.68B) and Collective Mining (C$1.5B+) – Quimbaya represents one of the most undervalued exploration stories in the market.

Its clean cap structure, insider alignment (24% CEO ownership), and fully funded drill programs create the perfect setup for a discovery-driven re-rate.

In a gold market defined by record central bank buying, structural supply deficits, and inflationary tailwinds, Quimbaya offers asymmetric exposure: one drill program away from a potential rerate or strategic takeout.

For investors seeking high-torque leverage to gold in a jurisdiction attracting major producers, Quimbaya is positioned to deliver some of the most explosive upside in the sector over the next 12–18 months.

More information on Quimbaya Gold, including their recent corporate updates and project information can be found here.

Stay up to date with Spartan’s Weekly Newsletter

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading Inc. (“Spartan”) has been engaged by Quimbaya Gold Corp (QC) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared on behalf of QC. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements.

It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com and affiliates makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting.

Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by Spark Newswire Inc. to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services Spark Newswire Inc. has received cash compensation from QC (OTCQB:QIMGF). Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc an affiliate of Spartan Trading Inc. has a three month agreement with QC (OTCQB:QIMGF) for the sum of seventy five thousand dollars. This agreement is for consulting and or marketing of QC (OTCQB:QIMGF) which services include the issuance of this release and other opinions that we release concerning of QC (OTCQB:QIMGF) and may be renewed from time to time. Spartan Trading an affiliate Spark Newswire Inc has not investigated the background of QC (OTCQB:QIMGF) the hiring party. Anyone viewing this newsletter should assume Spartan or affiliates own shares QC (OTCQB:QIMGF) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for Spark Newswire Inc’s services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements QC (OTCQB:QIMGF).

PLEASE READ OUR DISCLAIMER STATEMENT BEFORE VIEWING FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Spartan Trading Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Results may not be typical and may vary from person to person. Making money trading stocks takes time, dedication, and hard work. There are inherent risks involved with investing in the stock market, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk. Spartan Trading testimonials depicting profitability are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment. Becoming an experienced trader takes hard work, dedication and a significant amount of time. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers.

I/we have a beneficial long or Short position in the shares of Any Ticker We speak about on Zoom Streaming or in Discord either through stock ownership, options, or other derivatives

Full Disclaimer, Terms & Conditions:

https://spartantrading.com/terms-conditions/