A First Commercial Psychedelic Manufacturer — Positioned to Dominate a Multi-Billion Dollar Market?

POSITIONED TO DOMINATE A MULTI-BILLION DOLLAR MARKET?

OPTIMI HEALTH CORP

CSE: OPTI | OTC: OPTHF | FSE: 8BN

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

FORWARD: PROOF, PRODUCT, AND PROFITABILITY IN A MARKET OF PROMISES

Every generational shift in healthcare follows the same arc: ridicule, resistance, breakthrough, and eventual acceptance.

Psychedelics are no exception.

Once dismissed as counterculture experiments, they are now re-emerging as some of the most promising treatments for mental health disorders — a sector in crisis.

Global depression and PTSD rates have exploded post-COVID, driving trillions in lost productivity and sparking unprecedented urgency among regulators and policymakers.

Australia has already legalized MDMA and psilocybin prescriptions for PTSD and treatment-resistant depression1. In the U.S., the DEA has formally requested psilocybin rescheduling to Schedule II, while Health Secretary RFK Jr. has gone on record pledging reform within 12 months2. Meanwhile, the FDA has granted multiple “Breakthrough Therapy” designations for psychedelic-assisted treatments, slashing review times3.

While most competitors chase billion-dollar valuations on little more than trial pipelines, Optimi Health Corp. (CSE: OPTI | OTC: OPTHF | FSE: 8BN) is playing an entirely different game.

Optimi is not a speculative science project. It is a commercial pharmaceutical manufacturer with GMP-certified MDMA and psilocybin capsules already reaching patients today. With active revenues, real-world evidence, and two fully licensed facilities in Canada4, Optimi represents the next phase of psychedelic investing: moving from “what if” to “when.”

EXECUTIVE SUMMARY

Optimi Health Corp. (CSE: OPTI | OTC: OPTHF | FSE: 8BN) value proposition is simple yet profound: it is one of the only GMP-certified company in the world producing both psilocybin and MDMA capsules at scale and selling them into regulated markets right now.

In Australia, psychiatrists are already prescribing Optimi’s capsules under the Authorized Prescriber Scheme, and — critically — these prescriptions are eligible for government insurance reimbursement. This milestone cannot be overstated.

Insurance reimbursement is the gateway to mainstream adoption, and Optimi is the first mover capturing it.

In Canada, Optimi supplies patients through the Special Access Program, delivering treatments for severe, otherwise untreatable cases. These channels create not only near-term revenue but also generate a trove of real-world patient data — evidence that becomes a strategic moat in regulatory dialogues globally.

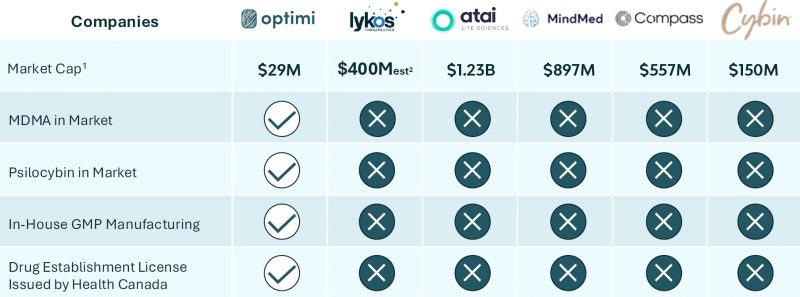

With a current market cap of just ~US$29M, Optimi trades at a tiny fraction of peers like COMPASS Pathways (~US$557M) and MindMed (~US$897M), none of which have commercialized drugs.

Optimi has also filed to uplist on the Nasdaq (September 2025), an inflection point that could bring a surge of institutional capital and liquidity.

For investors, the opportunity is clear.

Optimi is undervalued, under-the-radar, and structurally positioned for a multi-bagger rerating as psychedelic rescheduling sweeps across developed markets which is why I am adding it to my Biotech Investment Watchlist.

SPARTAN’S TECHNICAL CHART ANALYSIS:

- CSE: OPTI.CN

- Long Idea: >$0.40

- Resistance 1: $0.58

- Resistance 2: $0.72

- OTC: OPTHF

- Long Idea: $0.28

- Resistance 1: $0.45

- Resistance 2: $0.71

COMPANY OVERVIEW

Optimi Health Corp. (CSE: OPTI | OTC: OPTHF | FSE: 8BN) is headquartered in British Columbia, Canada, and operates two 10,000 sq ft GMP-certified pharmaceutical facilities under a Health Canada Drug Establishment License (DEL)5. This infrastructure advantage allows Optimi to control the entire supply chain – from cultivation and extraction to formulation, encapsulation, and global export.

Its core products are standardized, pharmaceutical-grade capsules:

- Psilocybin (5mg): Naturally derived, GMP-standardized extracts for depression and anxiety disorders.

- MDMA (40mg/60mg): Synthetic capsules with >99% purity, designed for PTSD, addiction, and mood disorders.

Unlike peers that outsource or rely on contract manufacturers, Optimi’s in-house GMP capacity ensures cost efficiency, scalability, and compliance with global standards — a key advantage as regulators demand industrial-grade controls.

Optimi’s commercial reach is expanding quickly:

- Australia: Prescriptions under the Authorized Prescriber Scheme since October 2024, with insurance reimbursement already in place – setting a precedent for OECD adoption.

- Canada: Approved supplier under the Special Access Program.

- International: Health Canada permits have already enabled exports to Israel, New Zealand, and pending approvals in European jurisdictions preparing for legalization6.

Optimi forecasts support for over 5,000 patients in 2025, a figure likely to accelerate as new countries adopt frameworks modeled after Australia.

With a Nasdaq IPO filed in September 2025, Optimi Health Corp. (CSE: OPTI | OTC: OPTHF | FSE: 8BN) is entering a phase where infrastructure, regulatory readiness, and commercial traction converge into exponential growth potential.

MARKET OPPORTUNITY: RIDING THE RESCHEDULING WAVE

Mental health is not just a medical crisis — it is an economic one. Depression and PTSD affect more than 650 million people globally, contributing to over $1 trillion annually in lost productivity7. Existing treatments like SSRIs, benzodiazepines, and talk therapy fail up to 30% of patients, leaving tens of millions without effective solutions.

This gap is driving demand for psychedelic therapies — treatments that work via neuroplasticity and can deliver long-lasting remission in a fraction of the time. The global anxiety disorders treatment market is projected to grow from $11.9B in 2024 to $17B by 2034.

And the regulatory environment is moving fast:

- Australia: Became the first country to legalize prescriptions of MDMA and psilocybin in July 2023. Insurance reimbursement followed shortly after — a game-changer for adoption.

- United States: The DEA requested psilocybin rescheduling in August 2025. Health Secretary RFK Jr. declared in July 2025 that psychedelic rescheduling would be prioritized “within 12 months.” The FDA has also shortened review times for psychedelic approvals from years to as little as 30 days.

- Europe: The Czech Republic is legalizing psilocybin for psychiatric hospitals starting 2026. The Netherlands is forming a commission to reschedule MDMA. Germany launched the EU’s first compassionate-use psilocybin program in 2025.

The precedent is clear: what happened with cannabis legalization is now playing out in psychedelics — but at a faster pace, with broader political support and immediate medical demand.

COMPETITIVE ADVANTAGE

Optimi Health Corp. (CSE: OPTI | OTC: OPTHF | FSE: 8BN) edge lies in being commercial today. Where peers like COMPASS Pathways and MindMed burn hundreds of millions pursuing risky Phase II/III trials (where historically 9/10 drugs fail), Optimi is generating revenue and building evidence now.

Key differentiators include:

- Dual Product Advantage: The only company with both psilocybin and MDMA capsules available commercially.

- In-House GMP Facilities: Ensures cost efficiency, scalability, and regulatory compliance.

- Evidence Moat: Insurance-reimbursed patient data from Australia is a unique strategic asset that accelerates acceptance in other jurisdictions.

- Generic Pathway: Like ketamine — where J&J’s Spravato does $1B annually while generics thrive in parallel — Optimi will capture market share immediately upon rescheduling without NDA bottlenecks.

This combination makes Optimi less a biotech gamble and more a commercial rollout story, akin to generics capturing explosive share as regulatory gates open.

FINANCIAL SNAPSHOT & VALUATION DISCONNECT

Optimi’s financial position is robust for a company at this stage:

- Market Cap: ~US$29M (Sept 2025).

- Cash: CA$3.5M (raised Aug 2025).

- Debt: CA$2.9M (36.8% D/E).

- Runway: >12 months, minimizing dilution pressure.

Meanwhile, peers command valuations many multiples higher — despite having no commercial products:

- COMPASS Pathways: ~US$557M

- MindMed: ~US$897M

- ATAI Life Sciences: ~US$1.23B

- Cybin: ~US$150M

- Lykos: ~US$400M (est.)

Key Takeaway: Optimi Health Corp. (CSE: OPTI | OTC: OPTHF | FSE: 8BN) trades at ~5% of COMPASS’s valuation despite being years ahead in commercialization. The disconnect is staggering, and potential uplisting + rescheduling are catalysts that could rapidly close it.

RISKS & MITIGANTS

- Regulatory Delays: Timelines can slip. Mitigant: Ongoing revenues in Australia/Canada sustain operations.

- Competitive Threats: Branded drugs could dominate post-approval. Mitigant: Generics always capture share, as proven with ketamine.

- Execution Risk: Scaling production and distribution globally. Mitigant: Two GMP facilities operational, export licenses in hand.

- Market Volatility: Psychedelics remain sentiment-driven. Mitigant: Real-world sales + reimbursement provide fundamentals to support valuation.

SPARTAN’S TECHNICAL CHART ANALYSIS:

- CSE: OPTI.CN

- Long Idea: >$0.40

- Resistance 1: $0.58

- Resistance 2: $0.72

- OTC: OPTHF

- Long Idea: $0.28

- Resistance 1: $0.45

- Resistance 2: $0.71

Stock Structure:

- Outstanding: ~96.6M

- Float: ~75M

- Market Cap: ~37.20M (CAD) | ~29.19M (USD)

CONCLUSION – THE CALL

Optimi Health Corp. (CSE: OPTI | OTC: OPTHF | FSE: 8BN) is a rare asymmetry in the psychedelics sector. It is not a binary biotech bet — it is a commercial manufacturer with GMP infrastructure, insurance reimbursement, and patients today. With a Nasdaq uplisting filed and global regulatory momentum accelerating, Optimi is poised to dominate the transition of psychedelics from experimental to mainstream medicine.

At just ~US$29M market cap, the market has failed to price in Optimi’s leadership position. The upside is measured in multiples, not percentages. For investors, this is the moment to enter before uplisting and U.S. rescheduling — when the system inevitably catches up to Optimi’s head start.

More information on Optimi, including its recent news releases, project overview and investor information package can be found here.

Stay up to date with Spartan’s Weekly Newsletter

References

- https://www.biospace.com/press-releases/optimi-health-announces-launch-of-psilocybin-capsules-in-australia-for-treatment-resistant-depression

- https://www.pbs.org/newshour/health/rfk-jr-suggests-administration-support-for-psychedelic-therapy-for-depression-trauma

- https://www.marijuanamoment.net/dea-advances-psilocybin-rescheduling-petition-to-federal-health-officials-following-years-long-legal-challenge

- https://synapse.patsnap.com/article/optimi-health-receives-drug-establishment-licence-from-health-canada

- https://www.prnewswire.com/news-releases/optimi-health-awarded-drug-establishment-licence-from-health-canada-302162122.html

- https://www.biospace.com/press-releases/optimi-health-reports-first-patients-dosed-in-landmark-natural-psilocybin-study-in-new-zealand

- https://www.who.int/news-room/fact-sheets/detail/depression

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements.

It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com and affiliates makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting.

Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Questions regarding this website may be sent to info@spartantrading.com. Anyone viewing this newsletter should assume Spartan or affiliates own shares of (OTC:OPTHF) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price.

PLEASE READ OUR DISCLAIMER STATEMENT BEFORE VIEWING FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any Spartan Trading Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Results may not be typical and may vary from person to person. Making money trading stocks takes time, dedication, and hard work. There are inherent risks involved with investing in the stock market, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk. Spartan Trading testimonials depicting profitability are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment. Becoming an experienced trader takes hard work, dedication and a significant amount of time. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers.

I/we have a beneficial long or Short position in the shares of Any Ticker We speak about on Zoom Streaming or in Discord either through stock ownership, options, or other derivatives

Full Disclaimer, Terms & Conditions:

https://spartantrading.com/terms-conditions/