Unlocking an Untapped Market Through the World’s First Mine-to-Wallet Ecosystem

Disseminated on behalf of

Blue Gold Limited

UNLOCKING AN UNTAPPED MARKET THROUGH THE WORLD’S FIRST MINE-TO-WALLET ECOSYSTEM

BLUE GOLD LIMITED

NASDAQ: BGL

This communication is not an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance.

Forward: A Structural Shift the Market has not yet Understood

Executive Summary – A Hard Assets with a Fintech Multiple Inside

- MINING: A major physical gold asset with over 5M ounces of M&I resources; Located in Ghana’s Ashanti Gold Belt, the project is supported by $500M+ in legacy infrastructure and a planned 250,000 oz/year production profile.

- TOKEN: A fully redeemable 1:1 gold-backed digital currency; A physically backed, auditable, custody-verified token designed for instant settlement, global transfers, and physical redemption.

- WALLET: A global fintech wallet and payment ecosystem; A multi-asset wallet with a globally accepted debit card, staking, lending, treasury tools, and real-time conversion — enabling gold to function as spendable money.

These verticals form a powerful closed-loop:

- Mining feeds the vault

- Vault feeds the token

- Token feeds the wallet

- Wallet feeds recurring fintech revenue

Together they create a self-reinforcing gold economy unmatched in public markets.

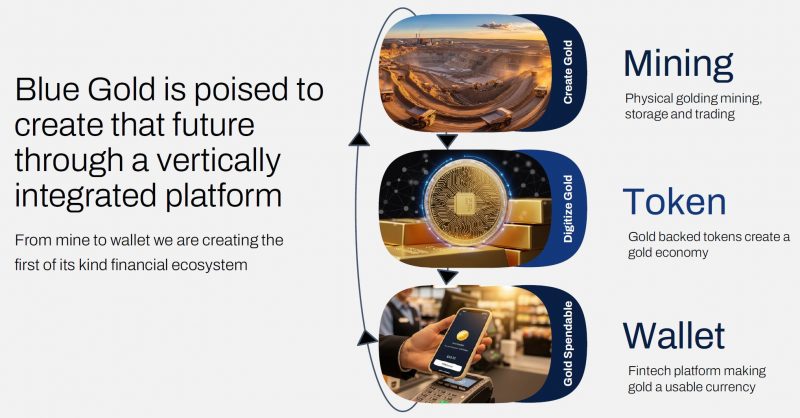

The Three-Pillar Innovation Model: Create → Digitize → Spend Gold.

Blue Gold’s ecosystem is built on a simple but transformative architecture:

- Create Gold – by producing and procuring physical reserves

- Digitize Gold – by tokenizing it into programmable value

- Spend Gold – through a seamless global payment network

This is the world’s first scalable mine-to-wallet platform.

The Macro Setup – Gold’s Quiet Supercycle Meets the Digitization of Real Assets

Gold’s strategic relevance is rising, not falling.

A 50-Year Decline in Fiat Purchasing Power

The U.S. dollar, euro, pound, yen, and virtually every major currency have lost the vast majority of their purchasing power relative to gold over the past half-century. In an environment of persistent inflation and monetary expansion, gold has consistently maintained – and increased – its real value.

Record Central Bank Gold Accumulation

Global central banks are acquiring gold at the fastest rate in over 50 years. This is not speculative behavior – it is strategic diversification away from the political risks of fiat-denominated reserves.

A $12 Trillion Market Sitting Idle

Despite its scale, most of the gold is functionally inert:

- Locked in vaults

- Held in ETFs

- Stored as reserves

- Unavailable for everyday financial utility

Tokenization Is Transforming Real-World Assets

Tokenized assets have already surpassed $100 billion, and forecasts for 2030 place the tokenization market above $10 trillion. Gold is expected to be the flagship asset class of this transition due to its stability, liquidity, and deep global acceptance.

The Rise of Programmable Money

Consumers and institutions are moving toward instant, borderless, 24/7 settlement. Tokenized assets and stablecoins have already proven superior to legacy payment rails in speed, cost, and flexibility.

Gold is the ideal foundation for digital finance — but only if someone can connect physical production to financial utility.

Blue Gold Limited (NASDAQ: BGL) is that connector.

With the macro environment shifting in its favor, the company’s integrated ecosystem becomes increasingly powerful.

A Fully Integrated “Mine → Vault → Token → Wallet” Engine

Blue Gold Limited (NASDAQ: BGL) is building a self-reinforcing economic loop designed to monetize gold at every stage of its lifecycle. This ecosystem consists of four interconnected divisions:

1. Gold Production — The Physical Foundation

Blue Gold owns a significant gold asset in Ghana’s Ashanti Belt featuring:

- 1M ounces of Measured & Indicated resources

- $500M+ of prior infrastructure investment

- A planned production profile of 250,000 ounces per year

Resource quality, location, and existing infrastructure dramatically reduce development risk. This physical asset underpins both the stability and credibility of the digital gold ecosystem.

Because Blue Gold controls its own production pipeline, its tokenized gold supply is not dependent on external vaults or third-party refiners – a structural advantage over existing gold-backed digital assets.

2. Vaulting & Global Sourcing — The Reserve Engine

The vaulting division serves as the bridge between production and tokenization:

- It sources gold from internal mine output.

- It purchases additional gold when token demand exceeds production.

- It supports redemption, custody, and reserve management.

- It captures purchase and trading spreads.

Vault purchases are modeled at a 0.5% discount to spot, enhancing margins during expansion phases. This structure ensures that token supply can scale far beyond the company’s own mining capacity. It also allows Blue Gold to maintain liquidity, redemption capability, and reserve integrity even under rapid token growth.

3. The BlueGold Token – A Redeemable, Gold-Backed Digital Asset

The BlueGold Token is being designed as a physically redeemable 1:1 digital representation of gold. This token unlocks unprecedented capabilities:

- Global real-time settlement

- Borderless transfers

- Physical redemption

- Low-friction trading

- Custody-verified backing

Tokenized gold is uniquely positioned to become the “digital cash equivalent” of the future — fully backed, instantly transferable, and not subject to the control of central banks or commercial banks.

Where traditional stablecoins rely on fiat reserves or debt instruments, Blue Gold’s token is backed by the oldest, most trusted monetary asset in history.

4. BlueGold One – A Global Wallet & Gold-Backed Payment System

BlueGold One evolves gold from a passive store of value into a usable, spendable asset.

The platform includes:

- A multi-asset digital wallet

- A globally accepted debit card

- Rewards tied directly to gold

- Lending and staking functionality

- Business treasury and FX tools

Debit Card Mechanics

Users earn gold on every purchase, creating a direct feedback loop between consumer spending and gold demand.

Interchange fees, FX spreads, and transaction revenues form high-margin recurring revenue streams.

Multiple Revenue Streams – Mining Economics with Fintech Margins

Blue Gold Limited (NASDAQ: BGL) revenue model spans both physical and digital finance sectors:

Mining Revenue

- Spot Sales

- Forward Gold Sales

- Future mine acquisitions

Tokenization Revenue

- On/off-boarding fees (3%)

- Transaction fees (0.02%)

- Custody revenue

Payments & Fintech Revenue

- Debit card interchange

- FX conversion spreads

- Lending and staking income

- Digital asset trading commissions

Vaulting & Trading Revenue

- Gold purchase spreads

- Reserve management

- Market-making income

The result is a hybrid margin profile:

- The stability of mining

- The recurring revenue of FinTech

- The scalability of digital assets

This is one of the most diversified revenue architectures of any emerging public company.

A Rare Blend of Mining, Fintech & Capital Markets Execution

Blue Gold Limited (NASDAQ: BGL) leadership is unusually well-suited for a hybrid mining/fintech/tokenization company.

CEO Andrew Cavaghan

- 15+ years executing major infrastructure and mining projects in Africa

- Extensive private equity and venture capital experience

- Barrister-at-Law with deep legal and commercial structuring expertise

- Co-founded Desert Lion Partners, overseeing mining and infrastructure investments

- Grew Octopus Investments from $30M to $1B AUM

- Holds a significant equity position, strongly aligning interests with shareholders

Executive Team

- Executive Chairman / COO: 30+ years in West African mining leadership positions

- CTO: Multi-exit fintech founder with deep expertise in product launches, crypto infrastructure, and payments architecture

- CFO: Experienced financial operator in public, private, and multinational corporate environments

Advisory Board

Includes executives and innovators with backgrounds in:

- Federal Reserve payments systems

- High-frequency trading

- Digital payments

- Fintech architecture

- Capital markets structure

- Global gold trading

Together, this group provides seasoned leadership across every major pillar of the company’s model.

A Classic Market Mispricing of Binary Risk vs. Structural Upside

Blue Gold Limited (NASDAQ: BGL) current valuation reflects a narrow narrative centered around litigation uncertainty and traditional mining risk. This has obscured the true nature of the company: a multi-division financial ecosystem with several independent valuation drivers.

Mining Valuation (Physical Assets)

Even at steeply discounted resource multiples, the company’s 5.1M oz M&I resource and $500M+ in infrastructure support a valuation far above current levels.

Tokenization Valuation

Token-based businesses frequently command revenue multiples of 10–15X.

Even modest token circulation results in outsized revenue growth given the velocity and compounding nature of digital transactions.

Fintech Valuation (Wallet & Payments)

Fintech platforms with sustained transaction flows are valued at 8–20X revenue multiples. As wallet adoption grows, this segment alone could justify a large portion of Blue Gold’s long-term valuation.

Vaulting & Trading Valuation

Even conservative earnings multiples (8–10X) justify meaningful value for this division due to stable, margin-rich spread capture.

Modeled EV Multiples

- Mining: 50–100% of NPV depending on year

- Vault: 10X earnings

- Token: 12X revenue

- Wallet: 12X revenue

Sum-of-Parts: The Market Is Missing the Whole

The market is valuing Blue Gold as if it were only a mining developer with litigation overhang. It is, instead, a vertically integrated fintech with broad exposure to one of the largest emerging markets in modern finance.

This dislocation between fundamentals and perception is where the multi-bagger opportunity lies.

A Sequential, High-Impact Rerating Path

Blue Gold Limited (NASDAQ: BGL) has several near-term catalysts likely to reshape market perception:

Primary Catalysts

- Arbitration outcome and mine restart

- Token launch and early velocity metrics

- Wallet release and debit card activation

- Exchange listings for the digital gold token

Secondary Catalysts

- Structured finance product rollout

- Additional mine acquisitions and reserve growth

- Scalability of vaulting operations

- Expansion into new markets for digital payments

Long-Term Catalysts

- Token and wallet user growth

- Corporate treasury adoption

- Global expansion of the Blue Gold ecosystem

- Broader integration into payment networks

These catalysts are not speculative — they are structural steps in the company’s roadmap.

Risks

Key risks include:

- Digital asset regulation

- Multi-division execution complexity

- Arbitration timelines

- Gold price volatility

- Emerging market operational risk

However, many of these ‘Risks’ are already heavily discounted into today’s pricing.

Conclusion – A Rare Multi-Sector Asymmetric Opportunity with 5X+ Potential

Blue Gold Limited (NASDAQ: BGL) stands at the nexus of several powerful secular trends:

- The global return to hard-asset wealth preservation

- The explosive rise of tokenized real-world assets

- The modernization of payments and digital wallets

- The increasing demand for asset-backed digital currencies

- The reawakening of gold as a financial instrument

It is uniquely positioned as the only public company executing a vertically integrated “mine-to-wallet” strategy that directly monetizes gold across production, tokenization, payments, and digital finance.

This model blends:

- the scarcity of gold,

- the scale of fintech,

- the velocity of digital assets,

- and the margins of payment infrastructure.

As catalysts unfold – litigation outcomes, token launches, wallet adoption, production visibility -expect a material rerating of the company’s equity.

Execution Roadmap

- Phase 1: 1M gram token issuance

- Phase 2: Wallet and debit card launch

- Phase 3: Production expansion and vault scaling

- Future: Staking, credit, structured finance, and broader financial integration

Growth Assumptions

- Gold price modeled at $3,500/oz

- CAC scaling from $25 to $100 over years 1–5

- Average token holding of 1 gram

- 1% annual token burn

- 3X wallet turnover annually

The asymmetric upside embedded within Blue Gold’s model becomes increasingly clear when mapping its growth trajectory across multiple execution scenarios. In the near term, simply delivering on its first set of milestones – including arbitration clarity, early token velocity, and the activation of its wallet and debit card – positions the company for a 3–5X rerating as the market begins to recognize that Blue Gold is not merely a mining developer but a vertically integrated fintech platform.

As execution compounds and the ecosystem demonstrates real traction through recurring transaction revenue, expanding token circulation, and rising wallet adoption, the valuation potential broadens significantly, supporting an execution-case upside in the range of 6–8X.

The most compelling scenario emerges when both the physical and digital sides of the business scale in tandem: mining provides predictable, collateralized gold flow while tokenization and payments generate high-velocity, high-margin revenue. If token velocity increases as modeled, if global exchange listings accelerate user acquisition, and if the BlueGold One wallet becomes a trusted mechanism for everyday asset-backed payments, then a blue-sky outcome of 10X or more becomes attainable. In this scenario, the market would begin valuing Blue Gold not as a hybrid story, but as a first-mover in a new category — a mine-to-wallet gold fintech leader with global reach and long-term compounding potential.

Gold Limited (NASDAQ: BGL) is not just digitizing gold – it is redefining how gold functions in the global financial system. In our view, this is one of the most compelling asymmetric opportunities in the public markets today.

Stay up to date with Spartan’s Weekly Newsletter

This communication is for informational purposes only and should not be construed as an offer to buy or sell securities nor is it to be construed as personal investment advice. Nothing contained in this communication should be relied upon as a promise or representation as to future performance. An affiliate of Spartan Trading inc. (“Spartan”) has been engaged by Blue Gold Limited (BL) to provide it with consulting, promotional and or marketing services, and the information contained in this communication has been prepared by or on behalf of BL. Spartan’s affiliate may receive compensation in the form of cash or securities from time to time for these services and may sell any such securities as permitted by law.

Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Spartan nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Spartan Trading Inc related properties. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Spartan makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements.

It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources www.spartantrading.com makes no representations, warranties, or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Spartan, nor its affiliates, has no obligation to update any of the information provided. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting.

Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Spartan encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content. Spartan, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Spartan control, endorse, or guarantee any content found in such sites. Spartan does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Spartan, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Spartan, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Spartan uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success and are not responsible for your actions. Spartan Trading Inc an affiliate of Spark Newswire Inc. has been retained by BL (NASDAQ:BGL) to perform consulting, promotional and or advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from BL. Questions regarding this website may be sent to info@spartantrading.com. Spark Newswire Inc and affiliate of Spartan Trading Inc. has a two week agreement with BL (NASDAQ:BGL) for the sum of one hundred thousand dollars. This agreement is for consulting and or marketing of BL (NASDAQ:BGL) which services include the issuance of this release and other opinions that we release concerning of BL (NASDAQ:BGL). Spartan Trading and affiliate Spark Newswire Inc has not investigated the background of BL (NASDAQ:BGL) the hiring party. Anyone viewing this newsletter should assume BL (NASDAQ:BGL) or affiliates of BL (NASDAQ:BGL) own shares of BL (NASDAQ:BGL) which they plan to liquidate, and further understand that the liquidation of those shares may or may not negatively impact the share price. Spartan Trading and affiliate Spark Newswire Inc has received this amount as a consulting and or production budget for advertising efforts and will retain amounts over and above the cost of production, copywriting services, mailing and other distribution expenses as a fee for our services. As such, our opinion is neither unbiased nor independent, and you should consider that when evaluating our statements of BL (NASDAQ:BGL).

PLEASE READ OUR DISCLAIMER STATEMENT BEFORE VIEWING

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE.

Any Spartan Trading Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. Results may not be typical and may vary from person to person. Making money trading stocks takes time, dedication, and hard work. There are inherent risks involved with investing in the stock market, including the loss of your investment.

Past performance in the market is not indicative of future results. Any investment is at your own risk.

Spartan Trading testimonials depicting profitability are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed.

Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment. Becoming an experienced trader takes hard work, dedication and a significant amount of time. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers.

I/we have a beneficial long or Short position in the shares of Any Ticker We speak about on Zoom Streaming or in Discord either through stock ownership, options, or other derivatives

Full Disclaimer, Terms & Conditions:

https://spartantrading.com/terms-conditions/