What are Credit Spreads? 3 Information to Know in 2024

Understanding credit spreads and their significance is crucial in 2024, primarily for investment and finance strategies. Credit spreads offer insights into credit risk, interest rates, and the risk of default across various financial instruments. Grasping the nuances of credit spreads can significantly enhance your strategy and decision-making processes. Knowing what are credit spreads helps assess market conditions and the credit quality of corporate and government bonds.

At Spartan Trading, we specialize in offering insights into stocks and options trading. We focus on simplifying complex financial concepts like credit spreads, making them accessible and actionable. Our services provide tailored advice that aligns with current market conditions and individual investment strategies. We aim to empower you to make informed decisions that optimize your financial performance.

Drawing from our extensive market experience, we’ve compiled this comprehensive guide that delves into the mechanics of credit spreads, their risks and rewards, and crucial factors such as economic conditions and credit rating changes. By the end of this blog, you’ll understand what are credit spreads and how they can influence your investment decisions, providing a foundation for better handling corporate debt, bond market dynamics, and options strategies.

Let’s dive in!

What Are Credit Spreads?

Credit spreads are financial metrics that compare the yield of bonds with different credit qualities to those of treasury bonds or similar maturity. Understanding what are credit spreads helps investors gauge the relative risk and return on bonds issued by corporations versus the US government.

Formula for Credit Spread

The standard formula for a credit spread is:

- Credit Spread = Corporate Bond Yield − Treasury Bond Yield

However, it’s common for investors to substitute the treasury bond yield with a benchmark bond yield of their choice, enhancing the formula’s flexibility. Therefore, the adjusted formula can be represented as:

- Credit Spread = Corporate Bond Yield − Benchmark Bond Yield

For example, an investor might calculate the credit spread using the yield from an AAA-rated corporate bond versus a chosen benchmark bond yield. This adjustment allows investors to tailor their analysis to more specific investment scenarios, providing a clearer view of the relative value and risk associated with different bond credit qualities.

Understanding credit spreads is crucial for anyone involved in the financial markets, whether they assess government debt, corporate bonds, or broader investment strategies. By comparing yields between different types of bonds, investors gauge the expected return and the inherent risk, making credit spreads a fundamental concept in investment finance.

How Useful Are Credit Spreads?

Credit spreads are vital tools in the financial world, influencing decisions from valuation to strategy development. Understanding credit spreads and how they function can significantly enhance an investor’s ability to assess and manage risks associated with bond investments.

Here, we explore the top 5 ways in which credit spreads are advantageous:

Valuation Purposes

Credit spreads play a vital role in showing the additional yield bondholders expect to receive for taking higher risk relative to US Treasuries. An expansion of these spreads, which is measured in basis points, indicates that investors are increasing the perceived risk level and the required compensation above risk-free rates. This recalibration of value is important for those who want their investment portfolios to align with their risk tolerance and return objectives.

Investment Purposes

Investors use credit spreads to gauge the attractiveness of different credit ratings and the potential return on various bonds. A wider credit spread indicates a higher yield but signals higher default risk, guiding investors when selecting bonds that fit their particular situation. This method helps craft a balanced portfolio that maximizes returns while managing exposure to potential losses.

Risk Assessment

Credit spreads are vital when evaluating bond issuers’ default risk. A small spread shows less likelihood of default, making it suitable for risk-averse investors. On the other hand, a widespread spread signifies high risks, which would require the investor to think twice or else look for extra yield to compensate for the additional uncertainty. This dynamic plays a crucial role in investment decisions and risk management strategies.

Market Prediction

Credit spread analysis can help forecast what is next in the financial markets. Investors and financial specialists monitor credit spread trends to foresee economic outlooks. When credit spreads widen, there may be a looming recession, which indicates heightened investor worries about default.

Strategy Development

The credit spread strategy involves using options trading to capitalize on the difference in credit quality between two entities. Establishing a position that gains value as the credit spread between investment-grade bonds and high-yield bonds changes. Traders can profit from movements in the spread without investing directly in bond markets. Options such as put options or strategies involving different strike prices allow flexibility and creativity in approaching credit markets.

The ability to interpret and react to changes in credit spreads provides a strategic advantage in navigating the complexities of investment and risk management. For those looking to leverage credit spreads in day trading or seeking advanced trading strategies, Spartan Day Trading Rooms offers a robust platform where new and experienced traders can thrive.

3 Important Things to Know About Credit Spreads

Credit spreads are a key financial metric, indicating the risk premium investors demand over safer investments. They provide essential insights into market sentiment, economic conditions, and investment risks. Understanding these spreads is crucial for anyone investing, trading, or managing financial portfolios.

Here are three essential aspects to know about credit spreads.

1. Movements in Credit Spreads

Anyone involved in the financial markets must recognize how credit spreads fluctuate. Credit spreads measure the difference in yield between bonds of varying credit qualities but similar maturities, reflecting the risk premium that investors require to hold riskier securities.

Several factors contribute to the movements of credit spreads, affecting the risk and return on bonds.

- Economic Indicators: Economic health directly influences credit spreads. Strong economic growth, low unemployment, and controlled inflation typically result in narrower spreads, indicating lower perceived risk. Conversely, economic downturns often cause spreads to widen as uncertainty and risk of default for borrowers increase.

- Market Sentiment: Investors’ general moods can cause fluctuations in credit spreads. Optimism can narrow spreads, while pessimism due to economic or geopolitical uncertainties can widen them.

- Credit Quality Changes: Any changes in bond issuers’ credit ratings can lead to immediate adjustments in credit spreads. Rating upgrades generally narrow spreads, reflecting improved issuer stability, while downgrades widen them due to increased risk perceptions.

Impact of Wider Credit Spreads

Wider credit spreads indicate increasing concern about bond issuers’ financial stability and a greater risk of default, which impacts the market and economy in several ways, including:

- Increased Borrowing Costs: When credit spreads widen, companies face higher capital costs as investors demand higher returns for increased risks.

- Indicator of Economic Downturn: A widening of spreads often signals investor concern about future economic stability, acting as a leading indicator of potential economic recession or downturn.

- Investment Strategy Adjustments: Investors might shift their strategies towards safer assets, reducing exposure to high-yield bonds with widening spreads.

Recognizing these impacts allows investors and policymakers to respond appropriately to changes in market conditions.

Impact of Narrower Credit Spreads

Narrower credit spreads suggest a positive outlook on the economy and the financial health of bond issuers. This situation also brings several impacts:

- Decreased Borrowing Costs: As spreads narrow, borrowing costs for companies decrease, facilitating cheaper access to capital and potentially spurring economic growth.

- Indicator of Economic Stability: Narrowing spreads generally indicate confidence in the economic future and the stability of bond issuers, suggesting a stable or growing economy.

- Opportunities for Investors: A narrowing spread can allow investors to buy into higher-yielding assets before spreads tighten further, potentially securing better returns.

Capitalizing on these conditions can lead to significant gains for proactive investors. Movements in credit spreads provide valuable insights into market conditions, the economic outlook, and risk perception. Investors and analysts closely monitor these changes to guide investment decisions and strategies. Credit spreads and their implications allow for proactive management of investment portfolios and can lead to more informed financial decisions in both stable and volatile market conditions.

2. Credit Spreads as an Options Strategy

Credit spreads are a fundamental strategy in options auto trading that allows investors to take a position on the direction of market prices while managing risk. This strategy involves simultaneously buying and selling options of the same class but with different strike prices. Traders use credit spreads to generate net credit, the maximum gain they can achieve if the spread works in their favor.

Types of Credit Spread Strategies

Credit spread strategies include various setups, but two popular ones are the bull put spread and the bear call spread.

- Bull Put Spread: Involves selling a put option at a higher strike price and buying another one at a lower strike price. Investors employ this approach when anticipating moderate increases in the underlying asset’s price. The credit received from the sale of the higher strike put helps offset the cost of the lower strike put, reducing overall risk.

- Bear Call Spread: It is used when investors expect a slight decline in the underlying asset’s price. It involves selling a call option at a lower strike price and buying another one at a higher strike price. The premium received from the sold call option covers part of the cost of the bought call, limiting potential losses.

Understanding these credit spread strategies can help traders make informed decisions, leveraging their market predictions while controlling potential risks.

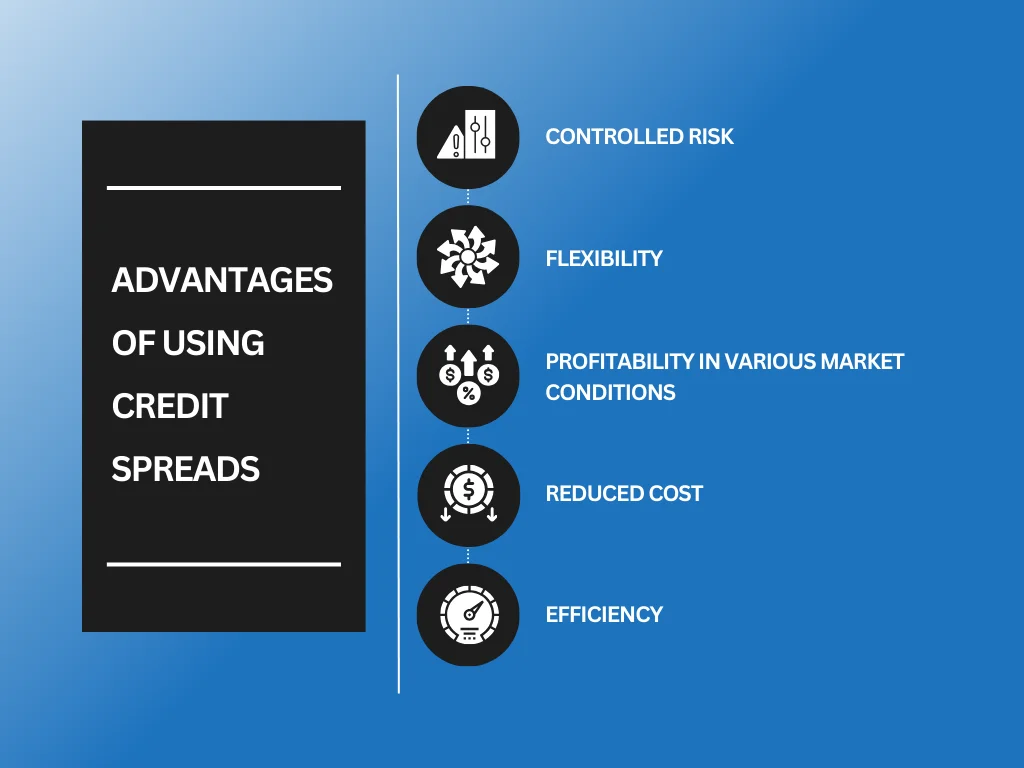

Advantages of Using Credit Spreads

Credit spreads offer several advantages in options trading:

- Controlled Risk: Investors know their maximum potential loss upfront, equal to the difference between the strike prices minus the net credit received.

- Flexibility: Traders can adjust credit spreads based on risk tolerance and market outlook.

- Profitability in Various Market Conditions: Depending on the chosen strategy, credit spreads can be profitable in rising, falling, or sideways markets.

- Reduced Cost: The net credit received reduces the overall cost of entering a trade.

- Efficiency: Credit spreads require less capital compared to buying individual options, making them an efficient use of trading capital.

These benefits make credit spreads attractive for traders looking to enhance their portfolios through strategies offering protection and potential profit.

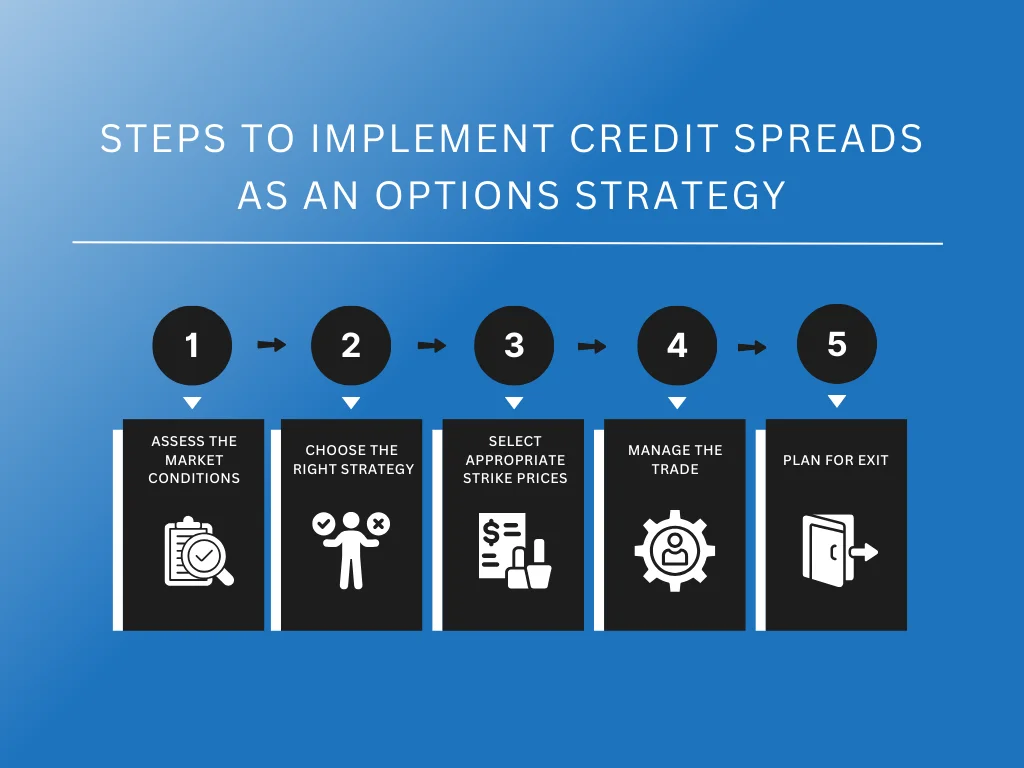

Steps to Implement Credit Spreads as an Options Strategy

Implementing credit spreads requires careful planning and attention to detail. Here are five steps to guide you:

- Assess the Market Conditions: Analyze the market to determine if it is stable, bullish, or bearish. This assessment helps you choose the right credit spread strategy.

- Choose the Right Strategy: Select either a bull put spread for a bullish outlook or a bear call spread for a bearish or neutral outlook.

- Select Appropriate Strike Prices: Choose strike prices that reflect your risk tolerance and market analysis. Ensure the premium collected is worth the risk you are taking.

- Manage the Trade: Monitor the market and the trade positions. If the market moves against your initial predictions, be prepared to adjust the trade.

- Plan for Exit: Decide in advance under what conditions you will close the trade, whether it is reaching a profit target or cutting a loss.

Credit spreads can enhance an investment strategy by offering protection and potential profit in stable market conditions. Understanding the steps to implement these strategies is crucial for any trader leveraging the benefits of options trading. Following these guidelines, traders can effectively use credit spreads to navigate various market scenarios.

3. Risk Indicator

Credit spreads serve as crucial indicators of financial risk. Investors consider the difference between yields on government bonds and corporate bonds, known as credit spreads, to gauge the market risk level. A wider credit spread suggests higher risk and potential economic uncertainty, making these measures essential for market analysis.

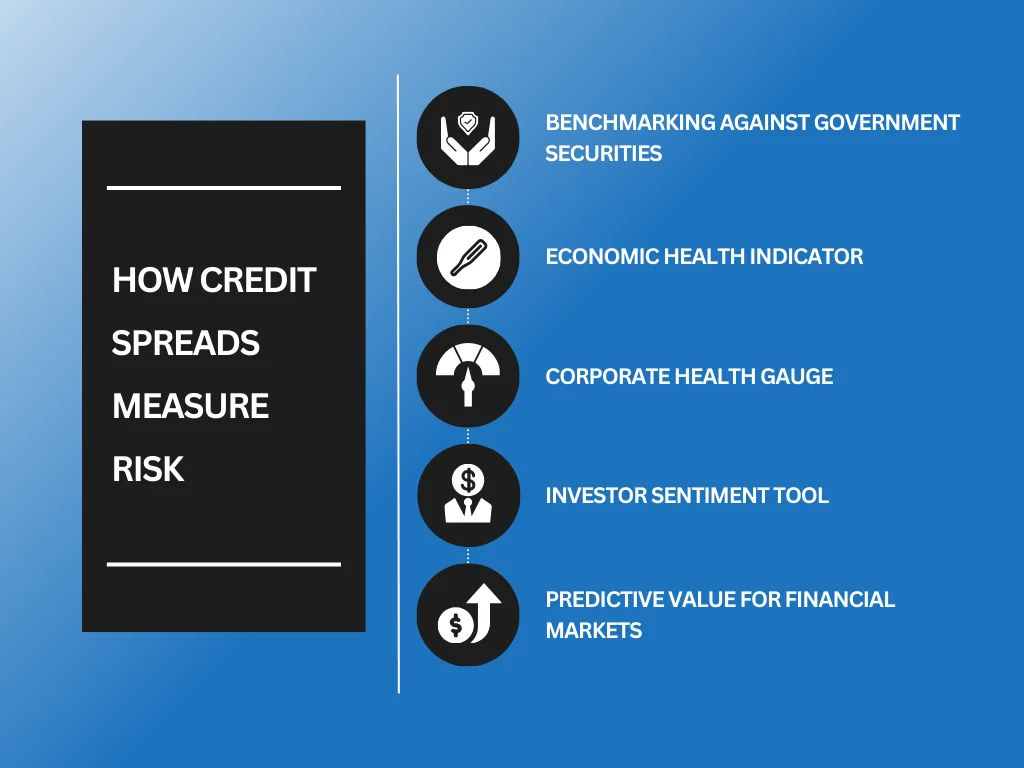

How Credit Spreads Measure Risk

Credit spreads reveal insights about investment risk levels. They function as a thermometer for an entity’s financial health. Here are the key ways credit spreads measure risk:

- Benchmarking Against Government Securities: Credit spreads compare corporate bond yields to risk-free government bonds. A wider spread indicates investors demand higher returns for increased risk.

- Economic Health Indicator: These spreads reflect economic conditions. Widening spreads often signal economic downturns as investors seek safer assets.

- Corporate Health Gauge: The size of a credit spread can indicate a company’s financial stability. Wider spreads imply greater investor concern over a company’s ability to meet its debt obligations.

- Investor Sentiment Tool: Spreads are a barometer for overall investor sentiment toward the corporate bond market. Narrow spreads suggest confidence; wider ones indicate caution.

- Predictive Value for Financial Markets: Historically, significant changes in credit spreads have preceded shifts in market directions, providing predictive value for investors.

Credit spreads offer vital information on risk levels across various markets, serving as a critical tool for investors to make informed decisions. They reflect current economic and corporate health and help predict future market trends. Credit spreads and their function can significantly aid risk assessment and investment strategy formulation.

Key Takeaway

Credit spreads serve as crucial indicators in the financial markets, showing the difference in yield between bonds of varying credit qualities but similar maturities. Investors often monitor credit spreads to assess the risk level of different bonds. Understanding what are credit spreads helps in making informed decisions on bond investments.

When implementing strategies that involve credit spreads, investors should consider several factors. These include the current economic environment, bond issuers’ creditworthiness, and expected interest rate changes. Maintaining a trading journal can help track the success of strategies involving credit spreads and refine them over time.

Have you explored how options auto trading can be optimized with insights from what are credit spreads? Spartan Trading‘s expert guidance can elevate your trading to new heights. We will show you how to master credit spreads to boost your trading outcomes.