What is Inverse ETF: Check Our Guide

Inverse ETF offers a counterintuitive approach where investors can gain profit from market declines. These ETFs aim to achieve daily investment results that are opposite to their benchmark index’s performance. For active traders seeking to hedge against market volatility or capitalize on short-term downward movements in the stock market, inverse exchange-traded funds present a valuable tool.

At Spartan Trading, we leverage our deep understanding of stock and options markets to offer innovative trading solutions. We’ve seen firsthand how this type of ETF can be crucial in diversified investment strategies. Utilizing tools like Morningstar Direct and platforms like Robinhood, our team navigates the complexities of inverse exposure, swap agreements, and the daily recalibration of net asset values to optimize our strategies.

Grounded in our hands-on experience with managing net assets, adjusting daily target adjustments, and strategically using derivatives, we’ve put together this guide that explores key aspects of an inverse ETF. We’ll also explore advanced trading techniques, such as short selling and utilizing leveraged ETFs to optimize your trading strategies effectively.

Let’s get started!

What is an Inverse ETF?

An inverse ETF is a type of exchange-traded fund constructed to profit from a decline in the value of an underlying index. It aims to deliver the inverse of the index’s daily performance, allowing investors to benefit from market price drops without needing to sell stocks short.

Here are the essential characteristics of inverse exchange-traded funds:

- Daily Basis and Daily Performance: Inverse ETF is intended to achieve its investment objective daily. Their daily return is calculated by aiming to replicate the daily performance of the underlying index inversely.

- Expense Ratio and Returns: These ETFs typically have a higher expense ratio due to the complexity of strategies involved in achieving the index’s daily returns.

- Market Participants and Expert Advice: Ideal for sophisticated investors, these funds require understanding from market participants who can navigate the complexities. Expert advice often guides investment decisions in these ETFs.

- Investing and Price Movements: Investors use these ETFs as part of broader investment strategies, closely watching the market price and NAV. If the underlying index’s market price rises on a given trading day, the inverse or opposite ETF price is expected to decline.

Investors should review the prospectus to understand how the expense ratio affects net returns. It’s crucial to remember that the value of the ETF can fluctuate significantly, even within a single day, making it a more suitable asset class for experienced market participants. Investment decisions should not rely solely on it but consider them part of a broader strategy.

Inverse ETF vs. Short Selling

Inverse ETFs and short selling allow investors to profit from declining market prices but operate differently. Understanding these differences is crucial for making informed investment decisions.

Here is the comparison of the inverse ETF and short selling:

| Feature | Inverse ETF | Short Selling |

| Mechanism | It uses derivatives to replicate the performance of an index inversely. | Involves borrowing stocks to sell at current prices, hoping to buy back cheaper. |

| Complexity | Simple to execute, similar to buying regular stocks. | More complex and requires an understanding of borrowing and margin requirements. |

| Risk Exposure | Limited to the investment amount. | Potentially unlimited losses. |

| Cost | Management fees and expense ratios. | Borrowing fees, interest on margin, and other costs. |

| Market Conditions | Effective in broadly declining markets. | It is best used when specific stocks are expected to decline. |

Investors choose inverse ETFs for their simplicity and lower risk profile than short selling, which requires more expertise and exposes the investor to greater financial risks. Each method suits different strategies and risk tolerances, highlighting the importance of aligning investment choices with personal financial goals.

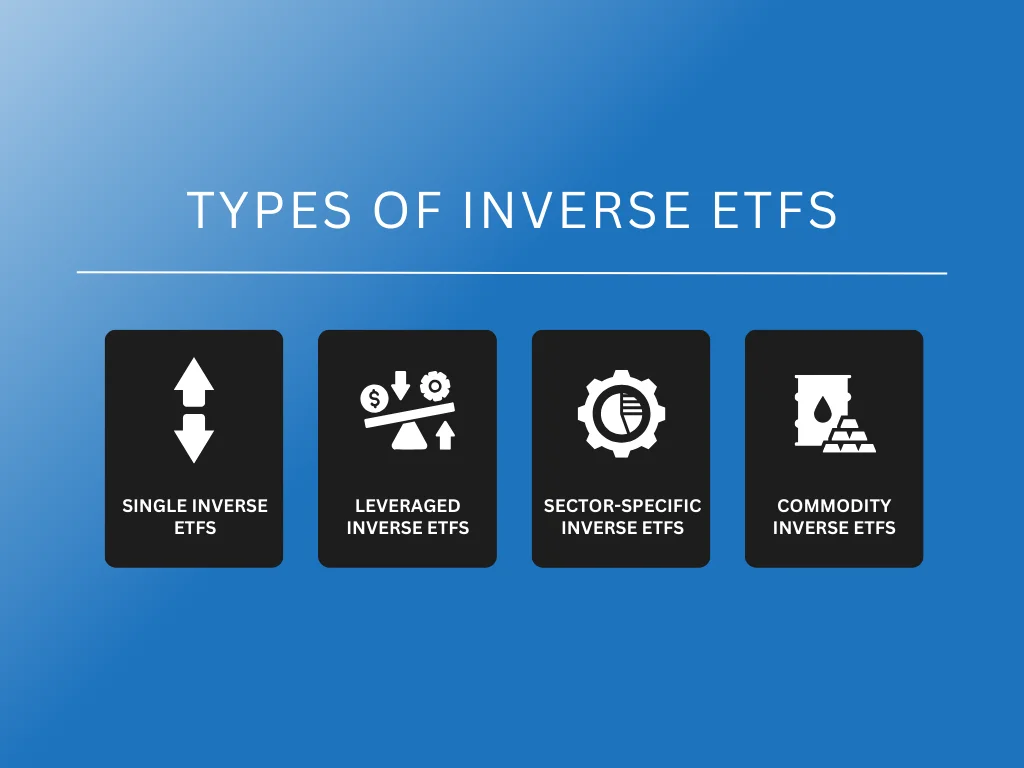

Types of Inverse ETFs

Inverse or short ETFs offer investors a unique way to profit from market downturns or hedge against portfolio losses. Understanding the various types of inverse ETFs can help investors choose the right one to align with their strategy and risk tolerance.

1. Single Inverse ETFs

A single inverse ETF aims to achieve the opposite return of its benchmark index for a single day. This type involves no leverage, meaning they attempt to deliver only the inverse of the index’s performance. For example, if the index falls by 1% on a given day, a single short ETF would seek to rise by approximately 1%. These ETFs are popular among investors who wish to avoid the complexities and increased risk associated with leverage.

2. Leveraged Inverse ETFs

Leveraged inverse ETFs are more aggressive and designed to multiply the inverse return of their underlying index. Typically, these ETFs aim to deliver two or three times the inverse performance. If an index drops by 1%, a 2x leveraged short ETF would target a 2% gain, whereas a 3x leveraged ETF would aim for a 3% gain.

However, it’s crucial to note that the same multiplication factor applies to losses if the market moves against the investor’s position. These ETFs are best suited for experienced investors who can manage the risks associated with high leverage.

3. Sector-Specific Inverse ETFs

These ETFs target specific sectors or industries, allowing investors to bet against particular market areas. Whether it’s technology, healthcare, or financial services, a sector-specific inverse ETF provides an opportunity to capitalize on downturns within specific industries. This type benefits investors anticipating negative performance in a sector due to economic, regulatory, or technological changes.

4. Commodity Inverse ETFs

Investors interested in commodities but expecting price drops might find commodity inverse ETFs appealing. These ETFs aim to inversely mirror the performance of commodity indices, such as those tracking gold, oil, or agricultural products. They offer a way to hedge against or speculate on the decline of commodity prices without holding physical assets.

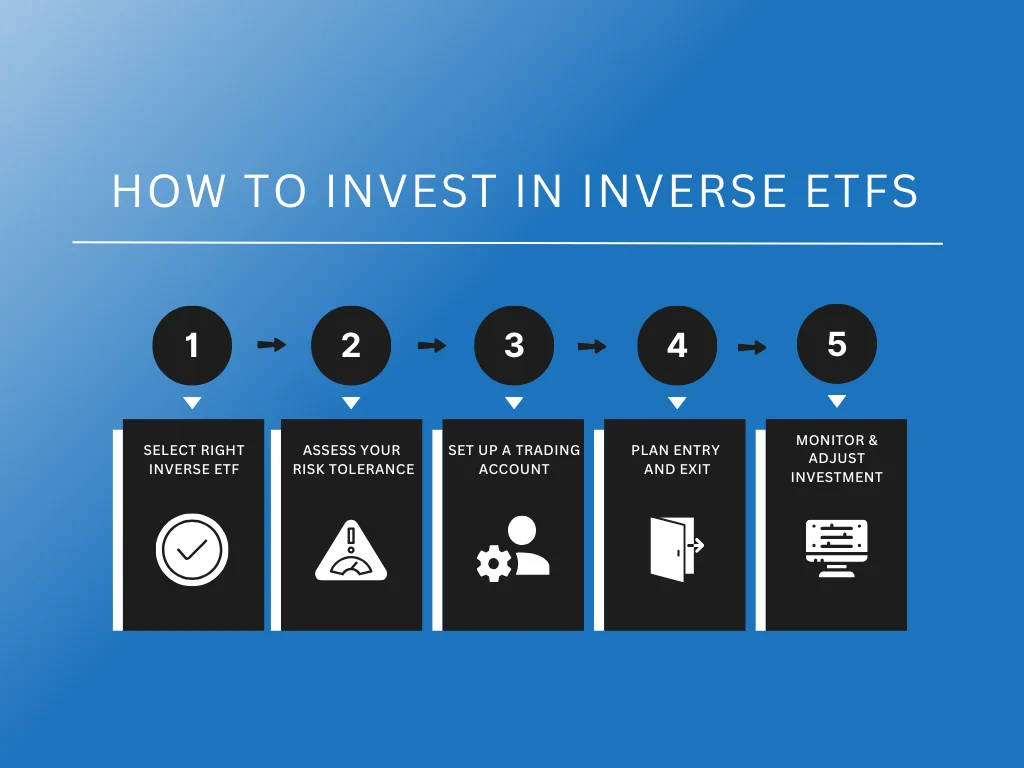

How to Invest in Inverse ETFs

Investing in inverse ETFs, also known as short ETFs, involves a strategy where the investor seeks to profit from a decline in the market or a specific sector. To ensure effective investment, following a clear and structured approach is crucial.

Here are five essential steps to guide you in buying inverse ETFs:

Step 1: Research and Select the Right Inverse ETF

Start your investment journey by properly researching different inverse ETFs in the market. Concentrate on those focusing on sectors or indices you foresee going down. Be sure to understand the goals, underlying assets, and the specific index each ETF plans to track in the opposite direction.

The performance history, management fees, and liquidity of the ETF should be considered. The prospectus contains detailed information about the ETF’s work, including the method used to achieve opposite results and any risks involved. It’s important because your choice must reflect what will happen in the markets and how much risk is acceptable.

Step 2: Assess Your Risk Tolerance

Since an inverse ETF must be rebalanced daily, they are usually better for short-term investments. However, this feature also makes them volatile and potentially dangerous if kept for long periods. You may assess the risk you can take, knowing you may suffer from substantial losses.

If you are still determining your risk tolerance, consider talking to a financial advisor about your investment strategy. An advisor can explain where bear ETFs fit in among the other assets that comprise your investment portfolio. It’s essential to ensure that your risk tolerance aligns with the potentially stressful and financially impactful nature of bear ETFs.

Step 3: Set Up a Trading Account

To trade an inverse ETF, you must have a brokerage account. It’s important to choose a trusted broker that provides access to the stock exchanges where these funds are traded. Furthermore, you should also ensure the brokerage’s trading platform is reliable and easy to use.

Opening an account often requires personal details and choosing how to finance it. Nowadays, many brokers provide internet services that enable you to oversee your stocks and obtain live financial information. These might come with additional features, such as educational resources for enhancing decision-making while trading.

Step 4: Plan Your Entry and Exit Strategy

Before purchasing an inverse ETF, plan your entry and exit points. This strategy is vital due to the ETFs’ short-term nature. Decide the price you intend to buy the ETF and set a target for when you plan to sell it.

To avoid further losses, you can set a stop-loss order to sell your ETF at a specific price if the market does not move in your expected direction. Failure to closely monitor market conditions is a primary reason many fail when investing in leveraged ETFs, among other inverse, exchange-traded funds.

Step 5: Monitor and Adjust Your Investment

To keep your inverse or bear ETF investment on track, you must know what’s happening in the market and monitor the economic factors that affect it. You can quickly respond to changes in the market that affect your investment by checking it regularly.

Be prepared to adjust your investment strategy based on market performance. This may include selling your ETF to realize gains or cut losses. Continuous assessment and flexibility can significantly enhance your ability to manage investments in this type of ETF effectively.

Pros and Cons of Inverse ETF

Investing in inverse exchange-traded funds presents unique opportunities and risks. Understanding these can help investors make informed decisions. Let’s delve into its advantages and disadvantages, equipping you with the necessary knowledge to navigate this complex investment tool.

Pros of Inverse ETF

An inverse ETF offers several advantages that can appeal to investors. These include:

- Profit from Market Declines: Unlike traditional ETFs, an inverse exchange-traded fund increases in value as the underlying index declines. This feature allows investors to profit during bear markets without selling securities short.

- Hedging Opportunities: Investors use inverse ETFs to hedge against downturns in their portfolios. If you anticipate a drop in the market sector represented by your holdings, adding an inverse exchange-traded fund can help offset potential losses.

- No Need for a Margin Account: Trading the ETF does not require a margin account, which is necessary for short selling. This makes the ETFs accessible to more investors, including those who prefer not to engage in margin trading due to its risks.

- Simplicity and Accessibility: Buying and selling inverse exchange-traded funds is as easy as trading. They are available on major exchanges, and you can trade them through any brokerage account, simplifying access to inverse market exposures.

- Daily Reset: A bear ETF typically resets daily to achieve its objectives. This reset feature allows for reflecting daily market changes but requires understanding and active management from the investor.

Cons of Inverse ETF

Despite their benefits, an inverse ETF also carries significant risks and drawbacks, including:

- Compounding Losses: The daily reset of the ETF can lead to compounding losses in volatile markets. If the market swings widely, the effects of daily rebalancing can diminish long-term returns, potentially leading to significant losses.

- Short-Term Focus: Due to their daily rebalancing, ETFs are generally suitable for short-term trading strategies. Holding these ETFs for long periods can be risky, as their performance can deviate significantly from the long-term performance of the underlying index.

- Cost Implications: Due to their complex strategies, inverse exchange-traded funds often charge higher fees than standard ETFs. These costs can reduce profits if the ETF is held longer.

- Market Timing Challenges: Successfully investing in this type of ETF often requires accurate market timing, a skill that even experienced investors find challenging. Incorrect timing can lead to losses, particularly in unpredictable market conditions.

- Regulatory and Operational Risks: Inverse ETFs face various regulatory and operational challenges, including the risk of closure if the fund does not perform as expected or if regulatory changes affect its operations. This adds an element of uncertainty to their use.

Key Takeaway

An inverse ETF offers a strategic advantage in investment portfolios, allowing investors to gain profit from market declines. These financial instruments, designed to increase in value as the market decreases, are crucial for hedging against losses. Investors use them effectively in both day trading and swing trading. Maintaining a disciplined approach through a well-maintained trading journal is essential to maximize the benefits.

More notably, investing in this type of ETF requires careful thought and ongoing education. Beginners and experienced traders should continually update their knowledge base. Resources such as the best day trading books can provide valuable insights and improve trading acumen. Regularly engaging with educational materials sharpens decision-making skills and bolsters understanding of market dynamics.

Are you considering strategically integrating inverse exchange-traded funds into your investment portfolio? Let Spartan Trading guide you through this complex landscape. With expert advice and a wealth of resources, we can help you navigate the intricacies of an inverse ETF to optimize your trading outcomes. Explore more with us today.